$479M Boost for Egypt''s First 1GW Solar-Battery

In a monumental step towards a cleaner and more resilient energy future, a coalition of international development finance institutions has

Get Price

African green hydrogen uptake from the lens of African development

In addition, it identifies gaps concerning the economic and geopolitical risks associated with green hydrogen uptake in Africa, in particular in terms of its implications for

Get Price

North Africa''s Power Shift: Renewable Energy Development and Energy

Download the full PDF of this edited volume to explore in-depth analyses, case studies, and actionable insights on renewable energy, energy security, and regional cooperation across

Get Price

The role of energy storage in supporting Africa''s infrastructure

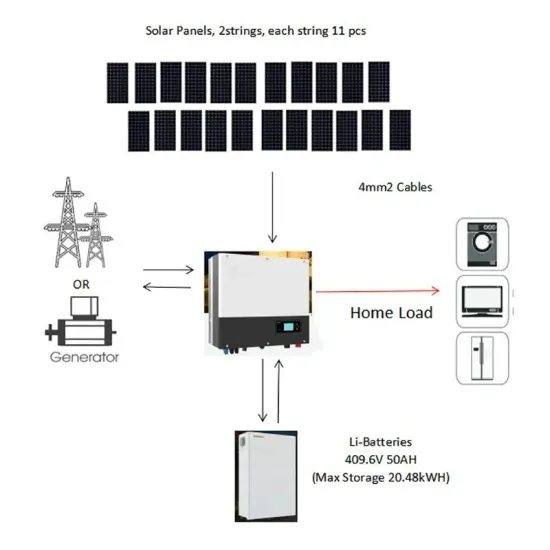

Energy storage plays a pivotal role in bolstering Africa ''s infrastructure projects by addressing key challenges in energy supply, enhancing resilience, and facilitating sustainable

Get Price

North Africa''s Energy Renaissance: A Hub of Potential and Progress

The energy sector in North Africa is not just about megawatts and barrels; it''s a catalyst for economic growth and stability. The development of energy resources has the potential to

Get Price

Top 5 largest energy storage projects in Africa

The Noor I CSP plant features a full-load molten salt storage capacity of three hours, while the Noor II and III CSP plants are able to store

Get Price

EE23_076 North Africa Energy Report_V1 dd

The African Development Bank (AfDB) announced that it would commit $379.6 million over the next seven years to provide funding for 500 MW of solar energy and storage for the Desert to

Get Price

Middle East and North Africa

The revenues that flow from that are the mainstay of the region''s economic activity, funding state spending in the public sector-dominated economies of the Gulf and North Africa and also

Get Price

Top 5 largest energy storage projects in Africa

The Noor I CSP plant features a full-load molten salt storage capacity of three hours, while the Noor II and III CSP plants are able to store energy for up to seven hours each, thus

Get Price

In Scramble for Clean Energy, Europe Is Turning to

In its quest for green energy, Europe is looking to North Africa, where vast solar and wind farms are proliferating and plans call for submarine

Get Price

Africa''s energy trilemma: Security, equity, sustainability

Africa''s energy sector must balance security, equity and environmental sustainability. Improving one of these components can weaken

Get Price

Africa set to kickstart 41 Green Hydrogen Projects by

Africa is on the brink of a transformative energy revolution, with 41 green hydrogen projects slated for construction by 2030. According to the

Get Price

North Africa''s Power Shift: Renewable Energy

Download the full PDF of this edited volume to explore in-depth analyses, case studies, and actionable insights on renewable energy, energy security, and

Get Price

African Development Bank Group (AfDB) / Press release | African

Source: African Development Bank Group (AfDB) | Jun 16, 2025 African Development Bank, British International Investment and European Bank of Reconstruction and

Get Price

African states give nod to battery energy storage system project

The Battery Energy Storage Systems (BESS) Consortium, was launched during COP28 in Dubai and received the backing from African states.

Get Price

North Africa''s Renewable Potential and Strategic Location

North Africa – Algeria, Egypt, Libya, Morocco, Tunisia, and Sudan – faces significant challenges due to climate change, which increasingly disrupts the region''s

Get Price

North Africa Energy Storage Study: Powering the Future of

Welcome to North Africa, where the energy storage study isn''t just academic—it''s the missing puzzle piece for unlocking solar and wind potential. With countries like Morocco

Get Price

Projects Transforming North Africa''s Energy Landscape

The project secured $170 million in funding from the African Development Bank in December 2024. Developed by clean energy firm ACWA Power, the $1.1 billion project will

Get Price

North africa energy storage project

A Battery Energy Storage Systems (BESS) initiative has the backing of several African countries - it commits members to participate in efforts to reach energy storage commitments of 5GW

Get Price

Major Energy Infrastructure Projects: Top 10 in Africa

Discover the top 10 major energy infrastructure projects in Africa as the continent tackles its energy deficit and drives economic progress.

Get Price

The role of energy storage in supporting Africa''s infrastructure

By championing a holistic strategy combining financial, regulatory, and educational measures, governments can effectively promote the broader application of energy

Get Price

Africa''s green hydrogen and energy opportunities

We look at how Africa''s transition towards green energy and hydrogen presents a significant opportunity for investors and development in

Get Price

North Africa''s Growing Energy Influence – Key Projects and

At this year''s African Energy Week: Invest in African Energies conference in Cape Town, North African nations will showcase their growing contributions to Africa''s energy future,

Get Price

Projects Transforming North Africa''s Energy Landscape

The project secured $170 million in funding from the African Development Bank in December 2024. Developed by clean energy firm

Get Price

North Africa''s Power Shift: Renewable Energy

Advancing renewable energy in North Africa requires not only governance and regulatory reforms, financial resources and administrative capacities, but also

Get Price

North Africa Energy Storage Battery Construction: Powering

With strategic battery storage deployment, North Africa might just become the world''s first renewable energy superpower – turning golden sunlight into 24/7 golden opportunities.

Get Price

North Africa: Policies and finance for renewable energy

Newsletter North Africa – Algeria, Egypt, Libya, Morocco, Tunisia and Sudan – is the African continent''s largest energy market. The region boasts relatively high rates of socio-economic

Get Price

6 FAQs about [North Africa Economic Development Energy Storage Project]

Where does North Africa Invest in renewables?

So far, most of the investments are concentrated in Morocco and Egypt. Contrary to the global trend in the period of 2013-2020 which shows private sector financing as the primary source of funding for renewables development, North Africa sees public finance play a far more important role.

Should North Africa export clean electricity to Europe?

North Africa has enormous renewable energy potential, particularly in solar and wind power, whose surplus could be easily exported to Europe. Clean electricity from North Africa would be an important medium-term option to help diversify Europe’s energy mix and reduce reliance on imported fossil fuels in the long term.

Why does North Africa need a backup power system?

The industry needs hardware, software and international standards – and on top of all this, there is an increasing requirement for power to come from renewable sources. North Africa is witnessing a rising number of refinery green- and brownfield projects, which will warrant an increase in backup power requirements.

Will North Africa's power sector be impacted by Green- and brownfield projects?

North Africa is witnessing a rising number of refinery green- and brownfield projects, which will warrant an increase in backup power requirements. But, as with every sector, the critical power sector must be mindful of environmental reforms and stringent emission regulations.

Can North Africa produce green hydrogen?

future production of green hydrogen and is a home to critical raw materials (CRMs) necessary for the energy transition. The International Renewable Energy Agency (IRENA) outlined North Africa to have some of the highest technical potential for green hydrogen production based on renewable potential and the cost of electricity.

Could North Africa become a partner in Europe's energy transition?

North Africa could become an important partner in Europe’s energy transition. North Africa is also a good place for the future production of green hydrogen, an energy source that is likely to be essential for the EU to fulfil its climate goals in hard-to-decarbonise sectors.

More related information

-

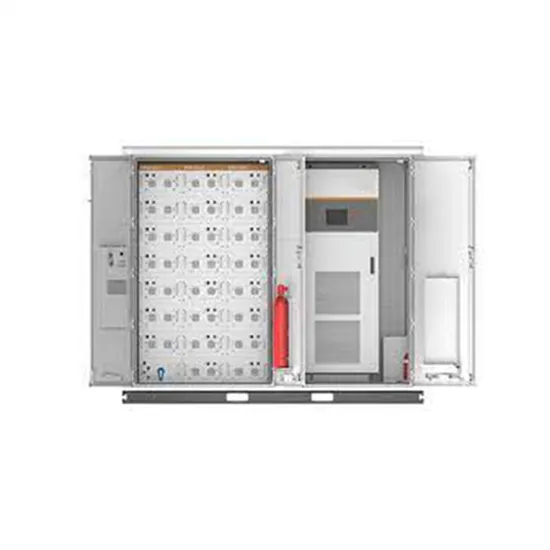

Huawei North Africa Energy Storage Box Company Project

Huawei North Africa Energy Storage Box Company Project

-

Energy Storage Battery Purchase in North Africa

Energy Storage Battery Purchase in North Africa

-

North Macedonia Electricity Supply Bureau Energy Storage Battery Project

North Macedonia Electricity Supply Bureau Energy Storage Battery Project

-

Economic Half-Hour Gravity Energy Storage Project

Economic Half-Hour Gravity Energy Storage Project

-

North Asia 200MW hybrid energy storage project

North Asia 200MW hybrid energy storage project

-

What is the price of new energy storage cabinets in North Africa

What is the price of new energy storage cabinets in North Africa

-

Enterprise Energy Storage Project Development

Enterprise Energy Storage Project Development

-

Huawei s New Energy Storage Policy in North Africa

Huawei s New Energy Storage Policy in North Africa

Commercial & Industrial Solar Storage Market Growth

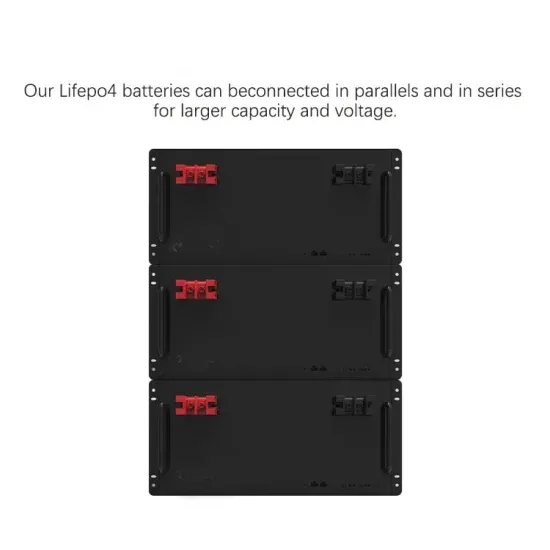

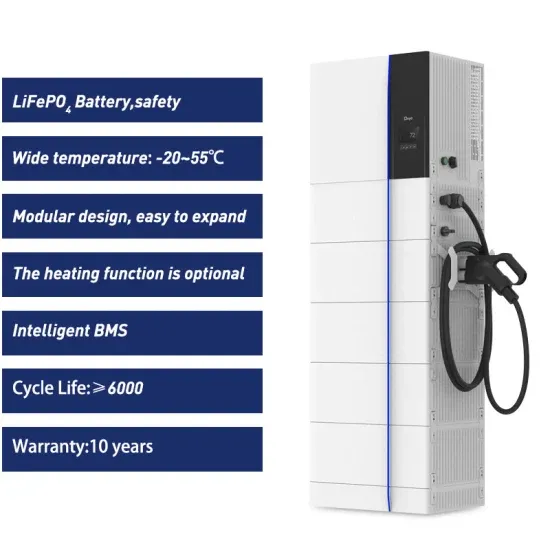

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.