Lower costs spark surge in battery storage projects | Asian Power

In 2024, lithium-ion battery pack prices dropped to the lowest in eight years. Significantly lower raw material costs and more affordable battery technologies are driving

Get Price

Lithium Prices Crash Below $10K, Hitting a 4-Year

The lithium market is experiencing a major price decline due to rising supply and weaker demand. In February 2025, the lithium carbonate

Get Price

Asia Pacific (APAC) grid-scale energy storage pricing 2024

This report analyses the cost of lithium-ion battery energy storage systems (BESS) within the APAC grid-scale energy storage segment, providing a 10-year price forecast by both

Get Price

Analysts predict 30% reduction in Asia-Pacific

The Asia-Pacific region will continue to be the world''s leading centre of lithium-ion cell manufacturing for the next decade, but it won''t just be price reductions in batteries that will

Get Price

Trends in electric vehicle batteries – Global EV

In 2023, the supply of cobalt and nickel exceeded demand by 6.5% and 8%, and supply of lithium by over 10%, thereby bringing down critical mineral prices

Get Price

The State Of The US Energy Storage Market

Despite tariffs and interconnection issues in the supply chain, the US energy storage market is still seeing record-breaking growth.

Get Price

Exploring The Rise Of Lithium-Ion Batteries In Asia''s Solar

Explore the growing impact of lithium-ion batteries in Asia''s solar energy sector, focusing on pricing trends and performance insights.

Get Price

What is the appropriate price for lithium energy storage power

The price of lithium energy storage systems fluctuates in response to supply and demand, technological breakthroughs that enhance efficiency and lower costs, economic

Get Price

Lower costs spark surge in battery storage projects

In 2024, lithium-ion battery pack prices dropped to the lowest in eight years. Significantly lower raw material costs and more affordable battery

Get Price

Commercial And Industrial Energy Storage Market Size, Share

9 hours ago· Lithium-ion retained an 80.2% share of the commercial industrial energy storage market in 2024, but sodium-ion is forecast to expand at a 37.8% CAGR to 2030 as buyers

Get Price

Analysts predict 30% reduction in Asia-Pacific

The Asia-Pacific region will continue to be the world''s leading centre of lithium-ion cell manufacturing for the next decade, but it won''t just be

Get Price

Lithium-ion battery pack prices fall 20% in 2024

Lithium-ion battery prices have fallen 20% to US$115 per kWh this year, going below US$100 for electric vehicles (EVs), BloombergNEF said.

Get Price

What is the market price of energy storage power supply?

The market price of energy storage power supplies fluctuates based on several key factors, including 1. technology type, 2. market demand, 3. policy and regulatory

Get Price

How much is the price of Jiangsu lithium energy storage power supply

In response to the inquiry regarding Jiangsu lithium energy storage power supply, it is essential to highlight several fundamental aspects. 1. Prices can vary significantly based on

Get Price

China''s EV Subsidies Set to Fuel Lithium Price Recovery in 2025

Lithium prices are expected to stabilize in 2025 as strong electric vehicle sales growth, particularly in China, and mine closures help to reduce the global supply glut. China''s

Get Price

THE GLOBAL BATTERY ARMS RACE: LITHIUM-ION

Simon Moores The coronavirus pandemic has turbocharged the lithium-ion-battery-to-electric-vehicle (EV) supply chain and accentuated a global battery ''arms race'' between China, the

Get Price

Lithium-Ion Battery Market | Global Market Analysis Report

2 days ago· Renewable energy storage systems utilize lithium-ion batteries for load balancing, peak shaving, and uninterrupted power supply. Advancements in battery management

Get Price

Southeast Asia Battery Market

Southeast Asia Battery Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Southeast Asia Battery Market report

Get Price

Lithium price jump exposes China''s chokehold on supply

Global lithium prices rose significantly after China''s Contemporary Amperex Technology Co. Limited (CATL), the world''s largest electric vehicle

Get Price

Lithium prices to stabilise in 2025 as mine closures, China EV

Lithium prices are expected to stabilise in 2025 after two years of steep declines as shuttered mines and robust electric vehicle sales in China soak up an oversupply, although the

Get Price

Emerging Energy Storage Markets Analysis in

1. Southeast Asia: abundant light resources, low proportion of new energy, large space for development (1) Southeast Asia has an advantage in

Get Price

Asia Pacific Lithium-Ion Stationary Battery Storage Market,

The Asia Pacific lithium-ion stationary battery storage market size exceeded USD 82.3 billion in 2024 and is expected to grow at a CAGR of 30.3% from 2025 to 2034, driven by the need to

Get Price

What is the appropriate price for lithium energy storage power supply

The price of lithium energy storage systems fluctuates in response to supply and demand, technological breakthroughs that enhance efficiency and lower costs, economic

Get Price

Lithium price jump exposes China''s chokehold on supply

Global lithium prices rose significantly after China''s Contemporary Amperex Technology Co. Limited (CATL), the world''s largest electric vehicle (EV) battery manufacturer,

Get Price

Asia Pacific Lithium-Ion Stationary Battery Storage

The Asia Pacific lithium-ion stationary battery storage market size exceeded USD 82.3 billion in 2024 and is expected to grow at a CAGR of 30.3% from 2025 to

Get Price

The battery industry has entered a new phase –

Cheaper battery minerals have been an important driver. Lithium prices, in particular, have dropped by more than 85% from their peak in 2022.

Get Price

North Asia Energy Storage Lithium Battery Prices 2025: Trends,

Why Are Lithium Battery Prices Hitting Historic Lows in North Asia? You''ve probably noticed the headlines: lithium battery prices for energy storage systems in North Asia have plummeted to

Get Price

Exploring The Rise Of Lithium-Ion Batteries In Asia''s Solar Energy

Explore the growing impact of lithium-ion batteries in Asia''s solar energy sector, focusing on pricing trends and performance insights.

Get Price

Asia-Pacific Energy Storage System Price Trends: What You

Let''s face it – the Asia-Pacific energy storage system price trends are hotter than a lithium battery on a summer day. From solar farms in Australia to EV factories in China, everyone''s asking:

Get Price

Lithium Prices Crash Below $10K, Hitting a 4-Year

Lithium prices plunged below $10K per ton, hitting a 4-year low. Oversupply, weak China demand, and more fuel the slump. What''s next?

Get Price

Lithium Prices Crash Below $10K, Hitting a 4-Year Low: Will the

Lithium prices plunged below $10K per ton, hitting a 4-year low. Oversupply, weak China demand, and more fuel the slump. What''s next?

Get Price

6 FAQs about [What is the price of lithium energy storage power supply in Asia]

How big is the Southeast Asia lithium-ion battery market?

The market size and forecasts for the Southeast Asia lithium-ion battery market in revenue (USD Billion) for all the above segments. The Southeast Asia Lithium-ion Battery Market is expected to register a CAGR of 15% during the forecast period.

What is the largest lithium-ion battery storage system in the world?

Vistra says the facility, which uses technology from LG Energy Solution, is the largest lithium-ion battery storage system in the world. Burns & McDonnell provided engineering, procurement, and construction expertise for the expansion, which was completed in less than a year.

How much does lithium cost in China?

Benchmark Mineral Intelligence ("BMI") as of late June reported China lithium carbonate prices of RMB 469,000 (US$69,875) (battery grade), and for lithium hydroxide RMB 472,500 (US$70,400). Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 33,761 (~USD 4,996/mt), as of July 22, 2022.

How big is lithium energy storage battery shipment volume in China?

According to data, the shipment volume of lithium energy storage batteries in China in 2020 was 12GWh, with a year-on-year growth of 56%. It is expected that the shipment volume will reach 98.6GWh by 2025, an increase of 721% compared to 2020.

What is the expected average price of lithium in North Asia in 2023?

According to the latest Platts' Battery Metals Outlook Survey, more than half of the 26 companies expected North Asian lithium prices to average below $70,000/mt in 2023. A survey of Asian market participants presented a more conservative view of lithium prices.

Why did Lithium prices rise in China in 2022?

Benchmark Mineral Intelligence said lithium prices soared to $81,375 per tonne in China by December 2022. This spike pushed consumers to look for alternatives, such as LFP batteries. The future of North America’s lithium supply chain is unclear, adding to the market pressure.

More related information

-

What is the price of lithium energy storage power supply in Bahrain

What is the price of lithium energy storage power supply in Bahrain

-

What is the price of lithium energy storage power supply in Sierra Leone

What is the price of lithium energy storage power supply in Sierra Leone

-

Estonia lithium energy storage power supply price

Estonia lithium energy storage power supply price

-

Lithium energy storage power supply price in India

Lithium energy storage power supply price in India

-

Türkiye lithium energy storage power supply price

Türkiye lithium energy storage power supply price

-

Cyprus lithium energy storage power supply price

Cyprus lithium energy storage power supply price

-

How much is the price of lithium energy storage power supply in Malawi

How much is the price of lithium energy storage power supply in Malawi

-

China s lithium energy storage power supply retail price

China s lithium energy storage power supply retail price

Commercial & Industrial Solar Storage Market Growth

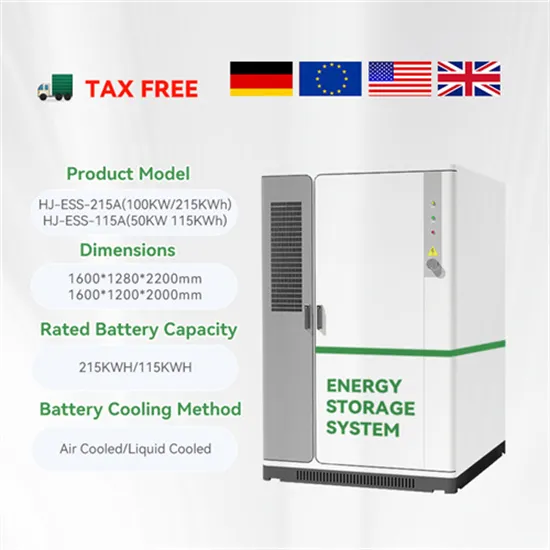

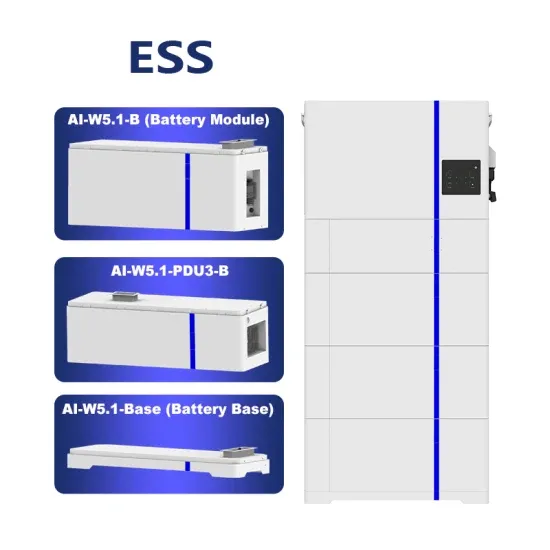

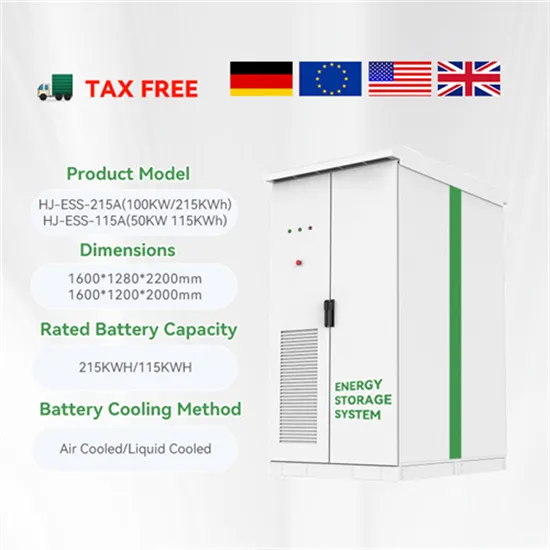

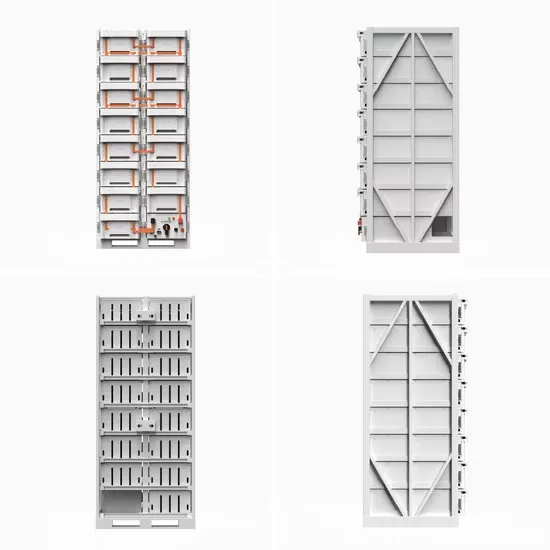

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

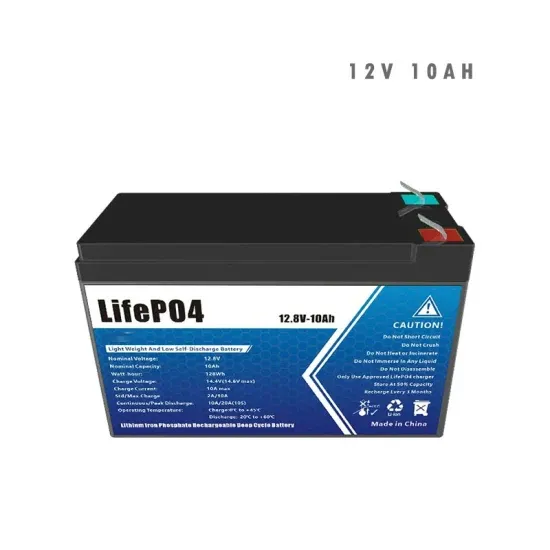

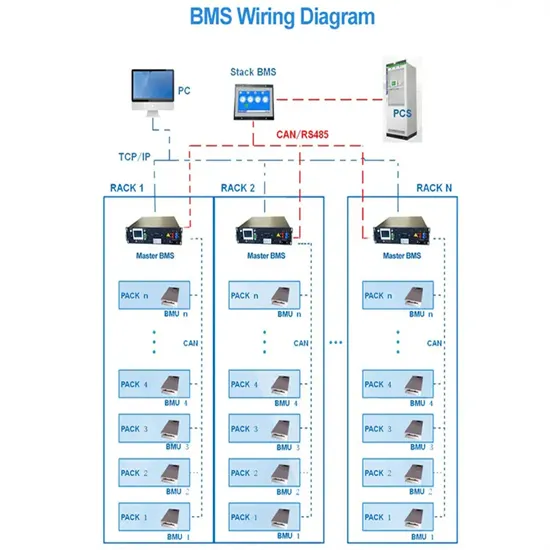

Solar Battery Innovations & Industrial Cost Benefits

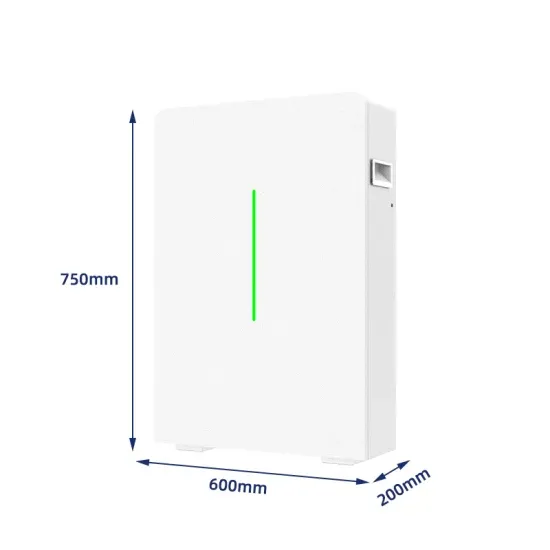

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.