US solar tariffs and the shadow of larger trade measures

The Biden administration has imposed a series of tariffs on hardware imported from China. In the case of the solar module business,

Get Price

Sun Tax In Australia Explained | Canstar Blue

KEY POINTS The sun tax is a rooftop solar tariff in Australia, designed to encourage solar users to export excess solar to the electricity grid

Get Price

Understanding the Sun Tax: Solar Export Tariffs in

Learn about Australia''s new ''Sun Tax'' on solar exports, who it affects, and how it impacts the future of solar energy.

Get Price

Australia''s minimum flat feed-in tariff for solar PV faces 195% drop

Australia''s ESC proposes dropping the minimum flat feed-in tariff for solar PV to AU$0.04/kWh from 1 July 2025-26.

Get Price

To understand why Biden extended tariffs on solar

President Joe Biden extended tariffs on imported solar panels in February 2022 in a bid to protect domestic manufacturing. These tariffs add a

Get Price

Reconfiguring Globali sation: A Review of Tariffs, Industrial

Executive Summary The trade war of the early 2010s on solar PV initiated by the US and European Union (EU) triggered a major wave of bankruptcies in China that proved to be a

Get Price

Unpacking the Sun Tax: Solar Export Tariffs Explained | Voltx

Discover how Ausgrid''s new solar export charges, dubbed the "sun tax," will impact Australian solar energy consumers starting in July 2024. Learn more! Unpacking the Sun Tax:

Get Price

Here comes the sun tax: The export tariffs proposed

Endeavour Energy has lagged behind the other NSW networks in developing its future tariff strategy. It has not yet made public its proposed export tariff prices,

Get Price

Global Solar Tariffs and Supply Chain: Report

The report "Reconfiguring Globalisation: A Review of Tariffs, Industrial Policies, and the Global Solar PV Supply Chain" by The Oxford Institute For Energy Studies summarises: •

Get Price

The Sun Tax

Talks of a "Sun Tax" have been ongoing since August 2021, when the Australian Energy Market Commission (AEMC) accepted a proposal to consider a two-way pricing structure for solar

Get Price

Here comes the sun tax: The export tariffs proposed for

Endeavour Energy has lagged behind the other NSW networks in developing its future tariff strategy. It has not yet made public its proposed export tariff prices, so what follows relates

Get Price

The Solar Tax has Arrived

The Australian Energy Regulator has stated that solar export tariffs in NSW, ACT, NT and Tasmania cannot be mandatory until 2025. They have not applied any similar

Get Price

QB 22-507 Solar Cells and Modules 2022

On February 4, 2022, the President signed a Proclamation "To Continue Facilitating Positive Adjustment to Competition from Imports of Certain Crystalline Silicon Photovoltaic Cells

Get Price

What will the "sun tax" cost households? Solar tariffs

Networks in NSW have been able to charge for solar exports to grid since July last year, but only for customers who opted in, and only for

Get Price

Understanding the Sun Tax: Solar Export Tariffs in Australia and

Learn about Australia''s new ''Sun Tax'' on solar exports, who it affects, and how it impacts the future of solar energy.

Get Price

Export Tariff Guidelines | Australian Energy Regulator (AER)

The Export Tariff Guidelines provide information and guidance to distributors and other stakeholders about how distributors propose and justify two-way pricing

Get Price

Sun Tax In Australia Explained | Canstar Blue

Talks of a "Sun Tax" have been ongoing since August 2021, when the Australian Energy Market Commission (AEMC) accepted a proposal to consider a two

Get Price

Suspension of tariffs on SEA PV modules spurred import in 2022

The amount of imports has started gaining traction since August. In November 2022, the US imported US$1.17 billion of PV modules, increasing from US$422 million or by

Get Price

US Government Finalizes Tariffs on Southeast Asian Solar Imports

The U.S. government has finalized severe tariffs on imports of solar panels from four Southeast Asian countries, in connection with a complaint filed last year by major U.S.

Get Price

Solar panel import tariffs are affecting the industry by

Clean Energy Associates released a summary of the seven solar module trade policies and solar panel import tariffs currently in place, including

Get Price

Export charges are coming! What does it mean and

When you export excess energy (from your solar or a battery) to the grid, you are paid a feed-in tariff by your energy retailer because you are saving them the

Get Price

Solar Tariffs Guide

What a solar tariff is, the pros and cons of solar tariffs, a timeline of recent solar tariffs, and why tariffs matter to homeowners when going solar.

Get Price

Unpacking the Sun Tax: Solar Export Tariffs

Discover how Ausgrid''s new solar export charges, dubbed the "sun tax," will impact Australian solar energy consumers starting in July 2024.

Get Price

Understanding Solar Export Charges: What They Mean for Your

Traditionally, homeowners with solar systems have been paid a feed‑in tariff (FiT) for every kilowatt-hour (kWh) of excess energy they export. However, with the rapid growth of

Get Price

Sun Tax In Australia Explained | Canstar Blue

The sun tax, or two-way tariff, was introduced to lessen grid congestion by imposing a cost on households exporting solar electricity when it isn''t needed. The sun tax affects

Get Price

What will the "sun tax" cost households? Solar tariffs hold steady

Networks in NSW have been able to charge for solar exports to grid since July last year, but only for customers who opted in, and only for Ausgrid customers. From July this

Get Price

Chinese module exports up 5% MoM despite declines in the

Despite imposing a 10% tariff on imported modules in June, the country still relies on imports due to limited local production, with recent demand driven by local ground-mounted

Get Price

Export charges are coming! What does it mean and

When you export excess energy (from your solar or a battery) to the grid, you are paid a feed-in tariff by your energy retailer because you are saving them the cost of buying that energy from

Get Price

6 FAQs about [Australia s export tariffs on photovoltaic modules]

Are solar export tariffs mandatory in Australia?

The Australian Energy Regulator has stated that solar export tariffs in NSW, ACT, NT and Tasmania cannot be mandatory until 2025. They have not applied any similar restriction to SA, QLD or Victoria in their guidelines to electricity companies. What can solar panel owners do about it?

How will Ausgrid's new solar export tariffs affect you?

Ausgrid, the largest distributor on the East Coast, has set to roll out their new solar export tariffs in July 2024, stirring quite a buzz. Often referred to as the “sun tax,” these changes could impact how you use and manage your solar energy. In fact, radio station 2GB even warned listeners of an imminent “solar shock” due to this new policy.

Will Australia's New solar tariffs change the landscape of solar energy adoption?

For those considering investing in solar panels, the new tariffs might extend the payback period slightly, which will significantly change the landscape of solar energy adoption in Australia.

Will solar tariffs Hold Steady as export charges kick in?

Solar tariffs hold steady as export charges kick in - One Step Off The Grid What will the “sun tax” cost households? Solar tariffs hold steady as export charges kick in February 24, 2025 by Sophie Vorrath Leave a Comment

How much do Solar Tariffs cost in 2025?

Solar tariffs hold steady as export charges kick in February 24, 2025 by Sophie Vorrath Leave a Comment New South Wales solar households on the Ausgrid network can expect to pay an average of $3.50 a year in rooftop PV export tariffs starting in July, as the poles and wires company forges ahead with the roll out of the so-called “sun tax.”

Are solar exports worth more than all-day feed-in tariffs?

Exports in the late afternoon and evening are also likely to be worth significantly more than the all-day solar feed-in tariff benchmark – higher than 20 c/kWh in some cases (see above table).

More related information

-

Norway s main photovoltaic modules for export

Norway s main photovoltaic modules for export

-

ASEAN photovoltaic module mainland export tariffs

ASEAN photovoltaic module mainland export tariffs

-

Is it easy to export Tajikistan photovoltaic modules

Is it easy to export Tajikistan photovoltaic modules

-

Photovoltaic double-glass modules and bifacial modules

Photovoltaic double-glass modules and bifacial modules

-

Madagascar photovoltaic module export tax rate

Madagascar photovoltaic module export tax rate

-

Thailand photovoltaic cell modules

Thailand photovoltaic cell modules

-

The composition of solar panel photovoltaic modules

The composition of solar panel photovoltaic modules

-

Smart defrosting of solar photovoltaic modules

Smart defrosting of solar photovoltaic modules

Commercial & Industrial Solar Storage Market Growth

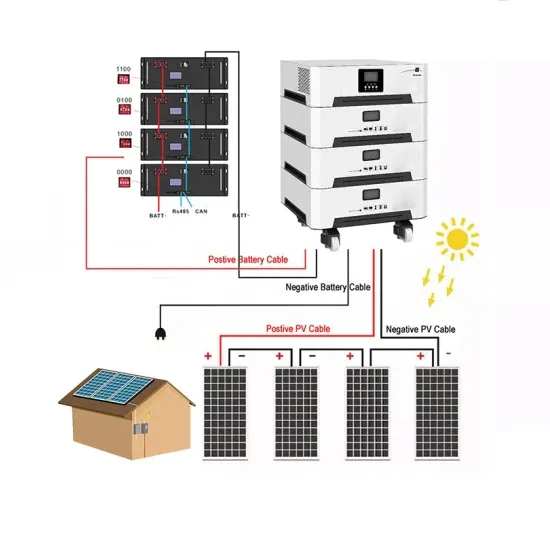

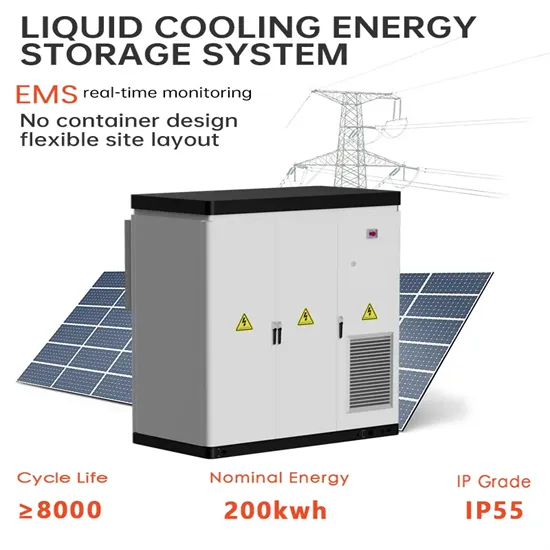

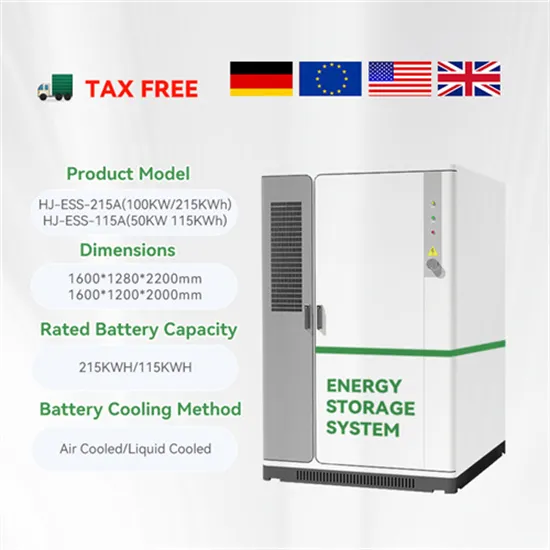

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

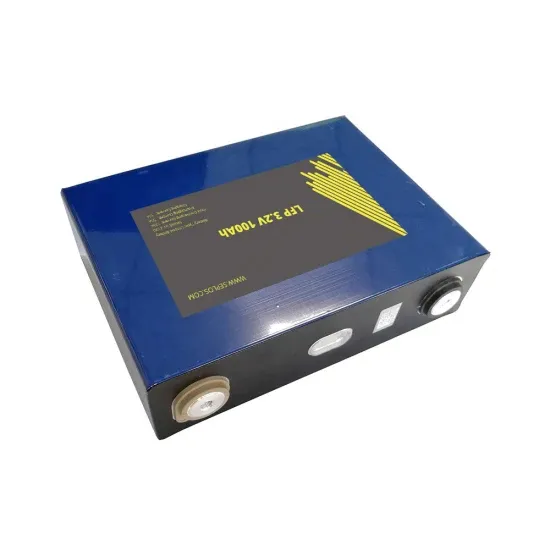

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.