energy storage industry czech republic

Find the top Solar Energy suppliers and manufacturers in Czech Republic from a list including Soluzione Solare S.r.l., S.W.H. GROUP SE and Concentrating Systems Ltd.

Get Price

Top 52 Energy Storage Companies in Czechia (2025) | ensun

Discover all relevant Energy Storage Companies in Czechia, including MND Energy Storage and EnergyCloud

Get Price

Czech Republic Energy Storage Market (2025-2031) | Industry

6Wresearch actively monitors the Czech Republic Energy Storage Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Get Price

Energy Storage Solutions & Companies for the Power Industry

Discover the leading Energy Storage Solutions & Companies in the Power Industry. Download the free Buyer''s Guide today for full details.

Get Price

Top 100 Energy Companies in Czechia (2025) | ensun

EnergyCloud is a manufacturer of energy storage systems, specifically home batteries, that integrate decentralized energy producers and consumers. The company''s focus on creating

Get Price

Thermal Energy Storage Suppliers Serving Czech Republic

Find the top Thermal Energy Storage suppliers & manufacturers serving Czech Republic from a list including Greendur, Axiom Cloud & Kraftblock GmbH

Get Price

Top 52 Energy Storage Companies in Czechia (2025) | ensun

The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers Supplier discovery Energy & Sustainability Renewable

Get Price

Czech thermal energy storage supplier

Energy-Storage.news also reported today on a partnership between thermal energy storage technology developer Azelio and Mexico-based industrial equipment supplier and turnkey

Get Price

Five Energy Storage Companies Revolutionizing

Check out the five energy storage companies using lithium-ion, flow, and thermal storage solutions to propel us towards a carbon-free future.

Get Price

Czech Energy Storage System Integration Co Ltd

Cnte Battery Energy Storage Systems Manufacturer CNTE is proud to provide the ESS for the largest energy storage project in the Czech Republic – 37.95MW/41.7MWh installation using

Get Price

Czechia: Energy Country Profile

Czechia: Many of us want an overview of how much energy our country consumes, where it comes from, and if we''re making progress on

Get Price

Czech Power Energy Storage Equipment Price

Electricity law and regulation in the Czech Republic 2.5.2 Due to cross-border integration and the liberalisation of power prices, the Czech and German markets are integrated. The primary

Get Price

Energy Storage in the Booming Czech Market

How can Czech organisations make the most of their renewable generation assets? Here''s a review of energy storage in the Czech market.

Get Price

Czech company to provide cathode material to U.S.

Prussian blue material manufactured by Draslovka will become part of Natron''s sodium-ion battery supply chain. The Czech company plans to

Get Price

Energy Storage Tech Sector in Czech Republic

The Energy Storage Tech sector in Czech Republic comprises 29 companies, including 5 funded companies having collectively raised $3.79M in venture capital money and

Get Price

Czech Republic Energy Storage

Leading Czech manufacturers of advanced Li-Ion batteries (OIG Power, Fitcraft, GWL Power, A123 Systems, EV Battery, HE3DA /Magna Energy Storage) successfully

Get Price

Nábor skupiny Czech Mobile Energy Storage Equipment

In terms of cost effectiveness, the gross margin of mobile energy storage vehicles as a new type of mobile energy storage equipment is expected to exceed 40%. Especially for military or

Get Price

The House-sized Battery Will Help Stabilise the Czech Energy Grid*The battery storage capacity is 10 MW and it exceeds the current largest battery in the Czech Republic by more than 40%.

Get Price

Energy Storage Startups in Czech Republic

There are 12 Energy Storage startups in Czech Republic which include EVSELECT, Nimble Energy, Divetta, Atom Safe, Powerorbital . Out of these, 1 startup is funded and

Get Price

Energy Storage Tech in Prague, Czech Republic

The Energy Storage Tech sector in Prague, Czech Republic comprises 15 companies, including 5 funded companies having collectively raised $3.79M in venture capital

Get Price

EN O nás |

Magna Energy Storage a.s. The company Magna Energy Storage a.s. was established in May, 2017 with the aim of building a new manufacturing plant for the production of high-capacity

Get Price

ENERGY STORAGE COMPANIES AND SUPPLIERS IN CZECH

As the top battery energy storage system manufacturer, The company is renowned for its comprehensive energy solutions, supported by advanced industrial facilities in Shenzhen,

Get Price

Energy Storage Suppliers & Manufacturers

Established in 2007, Beijing SinoHy Energy Co., Ltd. is a distinguished national high-tech enterprise specializing in the research and development, as well as the production of water

Get Price

6 FAQs about [How many Czech energy storage equipment manufacturers are there ]

How many companies supply thermal energy in the Czech Republic?

A total of around 1 000 entities operate in the production and distribution of thermal energy, with three companies (EPH, ČEZ and MVV) accounting for about 25% of the market in terms of heat supplied. More than 1.5 million dwellings are supplied by DH, representing over 40% of all households in the Czech Republic in 2015.6

Will a battery storage system help Czech companies achieve net zero?

The high penetration of renewable generation projects in the region could deliver a large amount of clean energy and really accelerate the journey to net zero, but at the moment Czech companies are not in a position to reap the full benefits of solar and other renewable energy sources. To do so, battery storage will be essential.

How many oil storage facilities are there in the Czech Republic?

The Czech Republic has 17 oil product storage facilities, with a total capacity of 1.5 million cubic metres (mcm), and one key crude oil storage facility, with a capacity of 1.675 mcm. The product storage sites are connected by a 1 100 km long pipeline and consist mainly of gasoline and gasoil.

What is the current gas storage capacity of the Czech Republic?

Current capacity is 3.3 bcm and once the ongoing expansion projects are completed in 2022, the country’s total storage capacity available will be almost 4 bcm. This is almost half the current annual gas consumption of the Czech Republic, and such a ratio is very high compared to the level of storage capacity in other countries.

Is the Czech Republic ready for pumped-storage hydroelectric power plants?

Bulk energy storage is currently dominated by hydroelectric dams, both conventional as well as pumped. There are six localities considered for new pumped-storage hydroelectric power plants in the Czech Republic but public acceptance presents a challenge. Front-of-meter installations in the Czech Republic are mired in regulations.

Why is Czech energy-accumulation so expensive?

According the report, the main reason is the regulatory framework biased in favor of classical energy models. The Czech Republic is no exception. It is fair to say that none of available energy-accumulation technology is perfect yet, and cost-effectiveness can be reached under specific conditions only.

More related information

-

How much does energy storage equipment cost in Qatar

How much does energy storage equipment cost in Qatar

-

How much does the Cyprus communication base station energy storage system equipment cost

How much does the Cyprus communication base station energy storage system equipment cost

-

Enterprise energy storage equipment manufacturers

Enterprise energy storage equipment manufacturers

-

How is energy storage equipment produced in Honduras

How is energy storage equipment produced in Honduras

-

How many energy storage battery manufacturers are there in Peru

How many energy storage battery manufacturers are there in Peru

-

How much does the energy storage charging pile equipment cost in Abkhazia

How much does the energy storage charging pile equipment cost in Abkhazia

-

Icelandic energy storage equipment manufacturers

Icelandic energy storage equipment manufacturers

-

Household photovoltaic energy storage equipment manufacturers

Household photovoltaic energy storage equipment manufacturers

Commercial & Industrial Solar Storage Market Growth

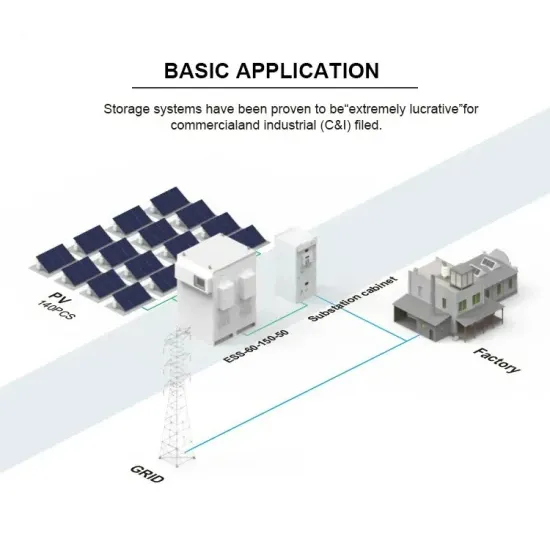

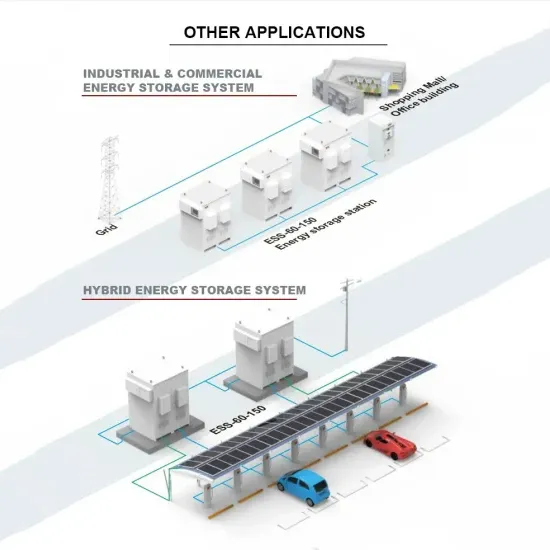

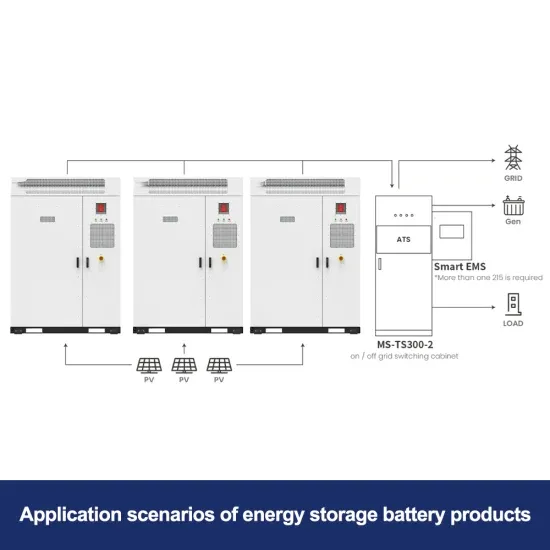

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

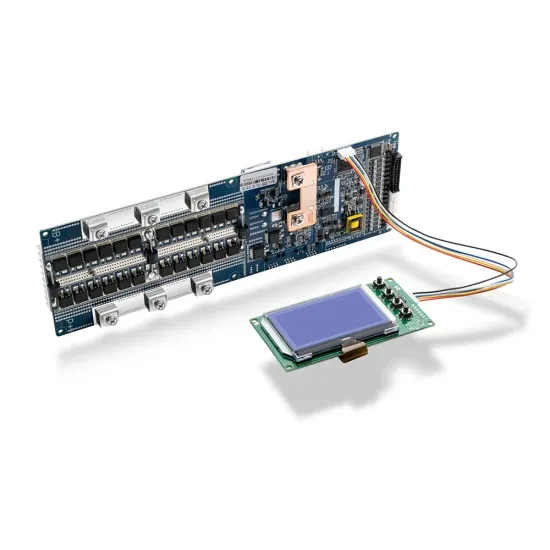

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.