What is a reasonable budget for a home solar panel

A mid-sized system should have a payback of less than 4 years - thanks to high electricity prices. Don''t install a hybrid battery system, they will

Get Price

Wired for profit: Grid is the key to unlock ASEAN energy investment

Grid is the driver to unlock solar and wind markets and provide opportunities for fossil-dependent countries to be renewables exporters.

Get Price

The Potential of Distributed Energy System from Renewable

This is a study on the overall status and policies of DESs in selected ASEAN countries. It uses literature surveys and information exchange through meetings with relevant parties, such as

Get Price

A decade of solar PV deployment in ASEAN: Policy landscape

There are certain roadblocks in the progress of solar PV deployment in ASEAN. This paper aims to investigate the solar PV policies in the ASEAN region over the past

Get Price

ASEAN''s 30 GW of solar and wind potential along the grid

Jakarta, 15 May – Modern, flexible and interconnected grids can help ASEAN achieve a resilient market where solar and wind can be the solutions for ensuring energy security. The grid routes

Get Price

ASEAN''s growing potential in the global solar race

With increasing energy demand across the region, ASEAN countries are looking at solar energy as a viable alternative.

Get Price

Smart Grid in ASEAN: Overview and Opportunities to Support the ASEAN

Smart grid can help ASEAN integrate more renewable energy, particularly solar and wind, so as to meet the target share of RE in the energy mix.

Get Price

Smart Grid in ASEAN: Overview and Opportunities to

Smart grid can help ASEAN integrate more renewable energy, particularly solar and wind, so as to meet the target share of RE in the energy

Get Price

Beyond tripling: Keeping ASEAN''s solar & wind momentum

About This report tracks solar and wind generation in ASEAN between 2015 and 2022, and analyses the additional capacity needed by 2030 to align with the International

Get Price

The Vulnerability of ASEAN''s Solar PV Trade – ACI Perspectives

Summary: According to the forecasts by the International Energy Agency (IEA), solar photovoltaic (PV) is set to become the largest renewable source in the near future. [1]

Get Price

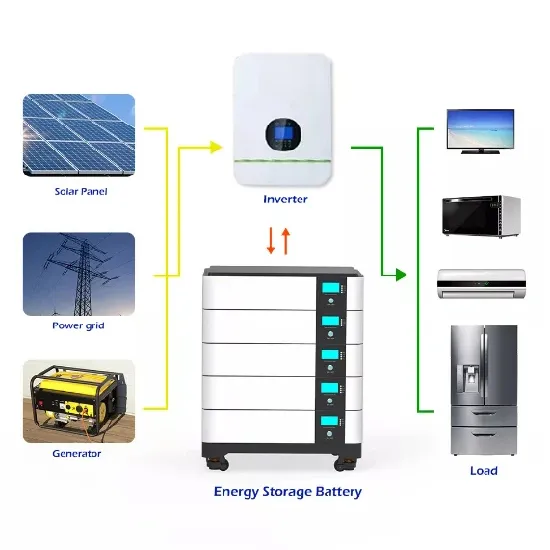

Market attractiveness analysis of battery energy storage systems

Battery energy storage systems (BESS) have emerged as a solution for mitigating the intermittent nature of solar and wind power with the rise of renewable energy. The application of BESS is

Get Price

How Should ASEAN Member States (AMS) Address

The ASEAN Member States (AMS) is seeing an enormous move toward renewable energy sources, with member countries significantly

Get Price

Solar power in ASEAN: Market and M&A updates,

Solar power in ASEAN: Market and M&A updates, highlights and outlook What are the latest trends in the ASEAN solar energy scene? The

Get Price

Mapping the future of solar capacity in Southeast Asia

Sunny Southeast Asia has made significant strides in solar energy, with solar farm capacity exceeding 20GW across ASEAN countries. Despite this rapid growth and ambitious

Get Price

ASEAN Solar PV & Energy Storage Expo – pv magazine

ASEAN Solar PV & Energy Storage Marketing info 1Government support: Many ASEAN countries have launched initiatives to promote the use of solar energy and reduce

Get Price

Status of Solar Energy Potential, Development and

For the off-grid area, Myanmar has mainly emphasis on solar home system and mini-grid system to be sustainable, affordable and environmental

Get Price

Distributed Energy System in Southeast Asia

This report was prepared by the Working Group for Distributed Energy System (DES) in ASEAN under the Energy Project of the Economic Research Institute for ASEAN and East Asia

Get Price

Beyond tripling: Keeping ASEAN''s solar & wind

About This report tracks solar and wind generation in ASEAN between 2015 and 2022, and analyses the additional capacity needed by

Get Price

Mapping the future of solar capacity in Southeast Asia

Sunny Southeast Asia has made significant strides in solar energy, with solar farm capacity exceeding 20GW across ASEAN countries. Despite

Get Price

The Top 5 Largest Solar Projects In South East Asia

Currently, ASEAN''s renewable energy capacity stands at 32 percent, comprising hydropower, geothermal, bioenergy, solar, and wind. To meet this goal, countries of South

Get Price

Maximizing solar energy production in ASEAN region

The ASEAN region is richly endowed with diverse renewable energy sources. One of them is solar energy, which is considered the most reliable and promising form of renewable

Get Price

ASEAN Renewables: Opportunities and Challenges

ASEAN countries such as Vietnam, Thailand, Malaysia, Indonesia and Singapore have all committed to either net-zero emissions or carbon neutrality by 2050. Governments have

Get Price

P.V. Solar Hot Water System. D.I.Y.

Noticed in a recent article about "last power bill ever" some are using solar water panels at ground level for hot water systems, the temps are probably not great, and tanks

Get Price

What is a reasonable budget for a home solar panel system

A mid-sized system should have a payback of less than 4 years - thanks to high electricity prices. Don''t install a hybrid battery system, they will never pay back the investment

Get Price

ASEAN urged to grow home solar market

Southeast Asian countries should accelerate their energy transition and boost domestic solar demand to mitigate the potential effect of steep US tariffs on solar panels

Get Price

Solar power in ASEAN: A snapshot and outlook of the solar

The ASEAN region (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam) exhibits many important drivers for the

Get Price

ASEAN Energy Storage Market Size & Share Analysis

ASEAN Energy Storage Market News In March 2022, the Indonesian government launched a 5MW battery energy storage system

Get Price

How Should ASEAN Member States (AMS) Address Electricity

The ASEAN Member States (AMS) is seeing an enormous move toward renewable energy sources, with member countries significantly increasing their usage of solar, wind,

Get Price

Parliament one of 1st in ASEAN to install high-capacity solar system

MALAYSIA''S Parliament building has become one of the first in ASEAN and the world to be equipped with a large-scale rooftop solar photovoltaic (PV) system, as part of the

Get Price

6 FAQs about [ASEAN Solar Home System]

Will solar energy be a mainstay in Asean's energy mix?

In Malaysia, the introduction of the Net Energy Metering and tax allowances serve as catalysts for solar PV installation, while government-led tariff adjustments further propel the adoption of solar energy. These concerted efforts show how solar energy is set to be a mainstay in ASEAN’s energy mix for decades to come.

How much solar energy do ASEAN countries receive a year?

ASEAN countries receive abundant solar energy throughout the year. Global Horizontal Irradiation (GHI) value varies between 1400 kWh/m 2 /year and 1900 kWh/m 2 /year . Over the past decade, remarkable growth in solar PV installations has been observed in the South East Asia region.

Are there support mechanisms for solar PV development in ASEAN countries?

ASEAN countries are expected to have substantial growth in solar PV deployment. The PV market in the ASEAN region has not evolved into a solid, self-sustaining PV market. Hence there is a necessity for policies and support mechanisms in ASEAN countries. Fig. 1. Different types of support mechanisms for solar PV development. 3.1.

How much solar power does Southeast Asia have?

Presently, ASEAN boasts 28 GW of large utility-scale solar and wind power, contributing 9 percent to the region’s total electricity capacity. Solar photovoltaics (PV) play a pivotal role renewable energy revolution of Southeast Asia. Abundant sunlight, economic growth, and the rising demand for clean energy drive this shift.

Why should ASEAN invest in solar energy?

Furthermore, ASEAN's solar energy targets are also enabled by strategic partnerships and foreign investments. Through collaborations with global players, the region aims to leverage both expertise and resources, fostering a conducive environment for solar energy development across borders.

How much solar power does the ASEAN region have in 2022?

The ASEAN region has 27 GW of solar and 6.8 GW of wind installed capacity in 2022, representing less than 1% of the approximately 30,523 GW of solar and 1,383 GW of wind theoretical potential estimated by the National Renewable Energy Laboratory (NREL).

More related information

-

ASEAN Home Solar Photovoltaic Systems

ASEAN Home Solar Photovoltaic Systems

-

Flexible solar power generation system for home use

Flexible solar power generation system for home use

-

Solar Photovoltaic Home Control System

Solar Photovoltaic Home Control System

-

Honduras solar power system home complete set

Honduras solar power system home complete set

-

All-night home solar power machine

All-night home solar power machine

-

Is solar power good for home use in Romania

Is solar power good for home use in Romania

-

Complete set of solar home power supply systems

Complete set of solar home power supply systems

-

1100W solar panel 220v home complete set

1100W solar panel 220v home complete set

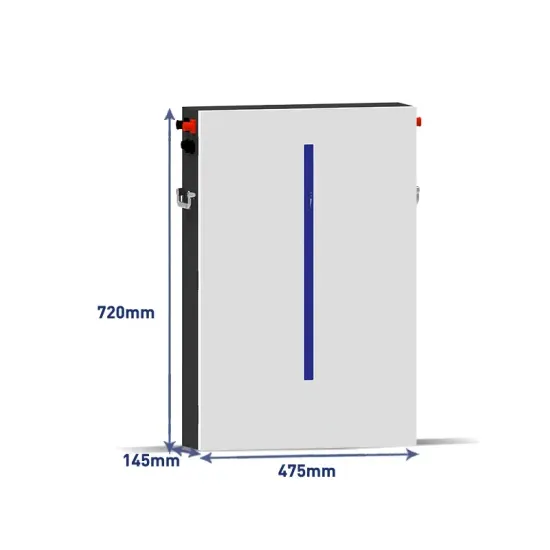

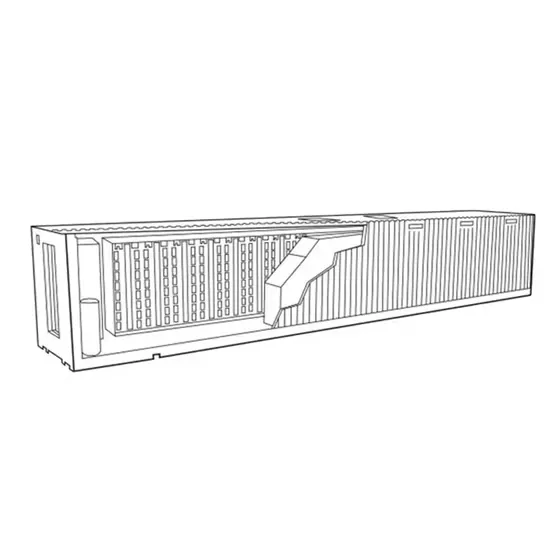

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.