South Korea Household Energy Storage Battery System Market

The South Korea Household Energy Storage Battery System market is undergoing rapid transformation, driven by technological innovation, shifting consumer behaviors, and

Get Price

Lithium battery Korea KC certification dynamic

The new standard is: kc62133:2019, kc62133-2:20, 19.As the KC law of energy storage battery ESS is urgently needed to be implemented, the implementation of kc62133-2:2019 is postponed.

Get Price

South Korea Energy Storage Systems Market Outlook to 2030

In South Korea, various energy storage solutions are used, including pumped hydro, electrochemical batteries, and others. Depending on the energy storage technology and

Get Price

South Korea launches $29 billion battery storage

South Korea''s battery makers, including LG Energy Solution and SK On, have been squeezed by waning EV subsidies and shifting demand,

Get Price

South Korea Battery Energy Storage Market (2022-2031)

South Korea Battery Energy Storage Market Competition 2023 South Korea Battery Energy Storage market currently, in 2023, has witnessed an HHI of 8920, Which has increased slightly

Get Price

South Korea Home Battery Energy Storage System Market By Application

The South Korea home battery energy storage system market is experiencing significant growth due to the increasing adoption of renewable energy sources and the rising

Get Price

Top five energy storage projects in South Korea

Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database. GlobalData uses proprietary data and

Get Price

south korea Archives

South Korea''s Ministry of Trade, Industry and Energy will host a competitive solicitation for battery storage capacity in two locations.

Get Price

Hanwha Aerospace and SK Enmove unveil immersion cooling energy storage

South Korean companies Hanwha Aerospace and SK Enmove have collaborated to produce the world''s first immersion cooling energy storage system (ESS), marking a

Get Price

South Korea launches $29 billion battery storage initiative

South Korea''s battery makers, including LG Energy Solution and SK On, have been squeezed by waning EV subsidies and shifting demand, prompting a strategic pivot

Get Price

South Korea Industrial Energy Storage Battery Market By Application

The South Korea industrial energy storage battery market is segmented by application into several key areas. Grid stabilization remains a primary application, where

Get Price

Battery Energy Storage Systems Market by Applications: South Korea

The Battery Energy Storage Systems Market, valued at 6.46 Bn in 2025, is expected to grow at a CAGR of 16.15% from 2026 to 2033, reaching 15.86 Bn by 2033. This

Get Price

Battery Energy Storage Systems in Korea and Germany

Lithium-ion batteries were first invented in the late 1970s and are also commonly applied in household battery energy storage systems as well as electric vehicle (EV) batteries and

Get Price

What are the energy storage industries in South Korea?

Lithium-ion batteries have emerged as a cornerstone in the energy storage sector, serving both stationary and mobile applications. Their

Get Price

South Korea Energy Storage Stacked Battery Market By Application

The South Korean energy storage stacked battery market by application is segmented into several key areas. Residential applications focus on providing energy storage

Get Price

South Korea grid connected battery storage

LG Energy Solution Vertech, a subsidiary of South Korea-based LG Corporation, plans to build 10 grid-scale battery storage facilities with a total energy storage capacity of 10 gigawatt hours in

Get Price

What are the energy storage industries in South Korea?

Lithium-ion batteries have emerged as a cornerstone in the energy storage sector, serving both stationary and mobile applications. Their prominence can be largely attributed to

Get Price

South Korea Battery Energy Storage System Fire Protection

Commercial applications of battery energy storage systems in South Korea also require effective fire protection measures. In commercial settings, such as office buildings,

Get Price

South Korea Energy Storage Market Size, Growth,

A robust energy supply for South Korea''s future is also ensured by the development of energy storage technologies such as flow batteries and solid

Get Price

KOREA''S ENERGY STORAGE THE SYNERGY OF PUBLIC

It seems likely that the energy storage market will continue to expand with the growing deployment of renewables worldwide and that the core component of ESS, Li-ion battery, will

Get Price

Korean energy storage application scenarios

It can be seen from the above table that under the user-side application scenario, the lead-acid battery energy storage power station has a total investment of 475.48 million yuan and an

Get Price

South Korea launches $29 billion battery storage

SEOUL, May 26 (AJP) - South Korea has launched its most ambitious energy storage initiative yet, opening the door to what officials estimate could become

Get Price

South Korea: Government tenders central contracts for

South Korea''s Ministry of Trade, Industry and Energy will host a competitive solicitation for battery storage capacity in two locations.

Get Price

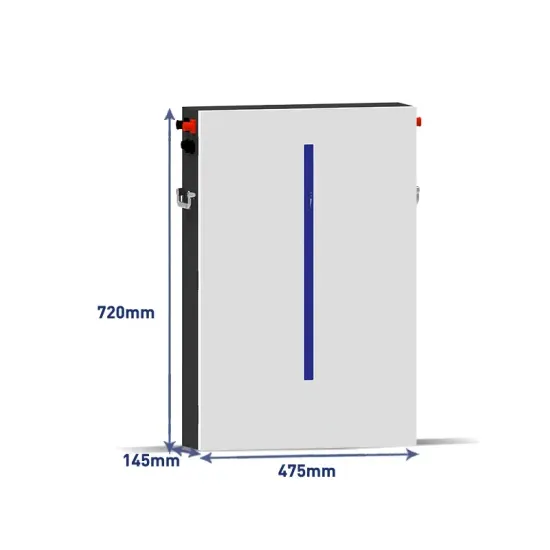

South Korea Wall-mounted Energy Storage Battery Pack Market

The residential sector is a significant application area for wall-mounted energy storage battery packs in South Korea. Homeowners are increasingly adopting these battery

Get Price

South Korea Energy Storage Lithium-ion Batteries Market By Application

The South Korea energy storage lithium-ion batteries market is segmented by application into several key sectors. In the residential segment, there is a growing demand for

Get Price

6 FAQs about [Korean energy storage battery application]

Which energy storage solutions are used in South Korea?

In South Korea, various energy storage solutions are used, including pumped hydro, electrochemical batteries, and others. Depending on the energy storage technology and delivery characteristics, an ESS can serve many roles in the electricity market.

Does South Korea have a battery storage system?

In terms of battery storage system deployment, South Korea stands among the global leaders. By the end of 2022, the cumulative installed capacity of battery storage in the country had reached an impressive 4.1 gigawatts. In October 2023, the South Korean government unveiled the Korean Energy Storage Systems (ESS) industry development strategy.

Will South Korea install 540 megawatts of battery energy storage systems?

The Ministry of Trade, Industry and Energy unveiled plans for a nationwide tender to install 540 megawatts of battery energy storage systems (BESS), marking the country's first major government-led deployment of its kind. The project is part of a broader effort to modernize South Korea’s power grid and support the transition to renewable energy.

Are South Korean companies investing in energy storage systems?

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more sustainable energy future. However, a string of ESS-related fires and a lack of infrastructure had dampened investments in this market.

Does South Korea have a battery industry?

But South Korea’s battery industry faces mounting pressure from China, whose manufacturers, led by CATL, currently account for nearly 90 percent of global energy storage battery capacity. CATL expanded its footprint in January by establishing a South Korean subsidiary, signaling an aggressive push into the local market.

How do you choose the best energy storage technology?

Numerous methods and technologies exist for storing these varied energy forms. The choice of energy storage technology is commonly influenced by factors like the specific application, economic considerations, integration within the system, and the availability of resources.

More related information

-

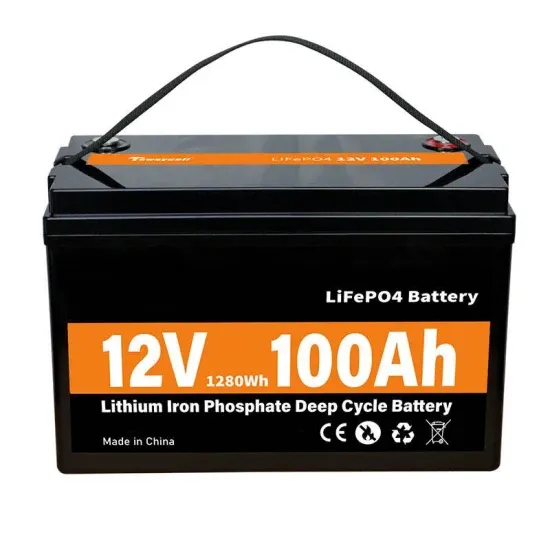

Korean 12v 440ah energy storage battery

Korean 12v 440ah energy storage battery

-

North Korean energy storage battery prices

North Korean energy storage battery prices

-

Application scenarios of battery energy storage cabinets

Application scenarios of battery energy storage cabinets

-

Container Energy Storage Battery Application Scenarios

Container Energy Storage Battery Application Scenarios

-

How Much Does a Korean Energy Storage Battery Cost

How Much Does a Korean Energy Storage Battery Cost

-

The application of energy storage battery foreign trade

The application of energy storage battery foreign trade

-

Battery Energy Storage Equipment Application

Battery Energy Storage Equipment Application

-

Energy storage container battery cabinet structure

Energy storage container battery cabinet structure

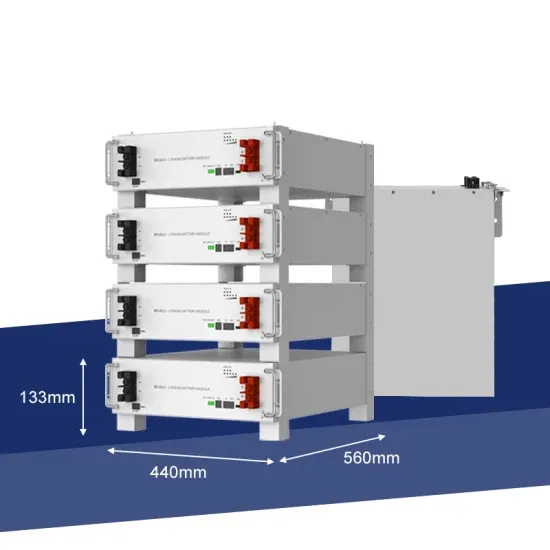

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

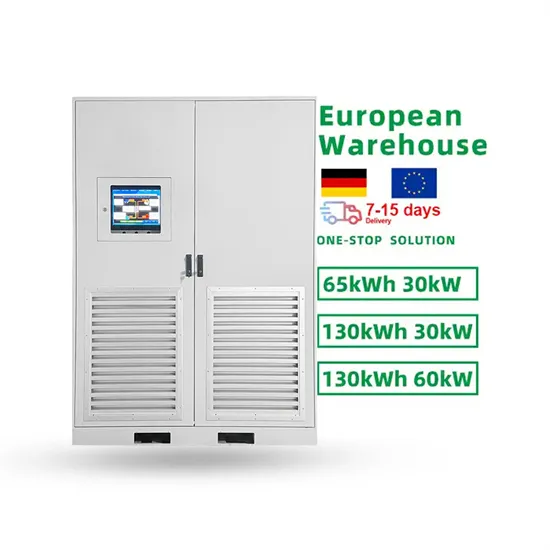

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.