What are the energy storage projects in the Netherlands?

Energy storage projects in the Netherlands encompass diverse initiatives aimed at enhancing grid stability, integrating renewable resources, and optimizing energy distribution.

Get Price

First four-hour battery storage in the Netherlands goes

Both issues are expected to persist for the foreseeable future. We know that storage solutions are essential to keep the grid stable and energy

Get Price

BESS in the Netherlands

This article examines the structure of the Dutch energy market, focusing on renewables and BESS (battery energy storage systems) and identifying opportunities and

Get Price

Energy storage

The main energy storage method in the EU is by far ''pumped hydro'' storage, but battery storage projects are rising. A variety of new technologies to store energy are also

Get Price

RWE Launches First Inertia-Ready Battery Storage System in the

On June 16, RWE officially brought its first inertia-ready battery energy storage system (BESS) into commercial operation at its power plant in Moerdijk, the Netherlands. This

Get Price

PhD position in AI-based Grid Capacity Optimization using

Job description The BATT-AI project aims to develop advanced methodologies based on artificial intelligence (AI) for optimising the integration of large-scale Battery Energy

Get Price

Leclanché: Hybrid energy storage for grid stabilization

S4 Energy and Leclanché SA have completed collaboration on a second highly innovative hybrid energy storage project in the northern portion

Get Price

Energy storage

Energie-Nederland proposes placing the costs of the electricity grid on consumers instead of on energy storage, production and conversion. Efforts are being made globally to address

Get Price

First operational 4-hour Battery Energy Storage

S4 Energy, Rotterdam-based leader in European grid-scale storage, has operationalized its state-of-the-art 4-hour Battery Energy Storage

Get Price

Energy storage: Development of the market | Deloitte Netherlands

Within this article we focus on grid-scale electricity storage and examine the development of the market in the Netherlands, how policy and regulation is supporting the

Get Price

News in TWS

As a pioneer in Europe''s green energy transition, the Netherlands has accelerated its renewable energy deployment in recent years. However, the intermittency and instability of

Get Price

Empowering dutch grid reliability

Our flexible battery energy storage systems (BESS) serve as grid-scale solutions that can support the infrastructure of entire regions or, in the case of the Netherlands, even

Get Price

Netherlands – a small giant in energy storage

Wärtsilä''s energy storage technology is facilitating a sea-change in the Dutch energy market by enabling sustainable energy producers to meet demand quickly and cost

Get Price

How the Netherlands is Shaping the Smart Energy System of the

Short term storage can be supplied by batteries, and research into various options for long term storage is underway in the Netherlands. The development of green hydrogen

Get Price

Energy Storage in The Netherlands

Focus on three key technologies that are already developing strongly in the east of the Netherlands: electrical energy engineering, electrochemical energy storage and sustainable

Get Price

Gridlock in the Netherlands

Gridlock in the Netherlands Zsuzsanna Pató Having no grid capacity on high- and medium-voltage electricity networks seems to be the new normal in the Netherlands.1 Grids across the

Get Price

Energy Storage in The Netherlands

In the coming years, S4 Energy plans to develop and build multiple new energy storage installations across Europe, emphasizing its commitment

Get Price

New energy storage in the netherlands

The flurry of large-scale projects progressing recently in the Netherlands - LC Energy, Giga Storage, Lion Storage and also one from SemperPower and Corre Energy - is a "slight

Get Price

Long Duration Energy Storage in The Netherlands

The Netherlands'' transition to renewable energy requires careful consideration of long duration storage options that align with its geographic characteristics, existing infrastructure, and

Get Price

First operational 4-hour Battery Energy Storage System ("BESS")

In the coming years, S4 Energy plans to develop and build multiple new energy storage installations across Europe, emphasizing its commitment to a resilient, stable and

Get Price

The Roadmap to 9 GW of Dutch Energy Storage Capacity by 2030

Dutch Transmission Service Operator (TSO) TenneT has projected that The Netherlands will need to have at least 9 GW of large-scale battery energy storage system

Get Price

How the Netherlands is Shaping the Smart Energy

Short term storage can be supplied by batteries, and research into various options for long term storage is underway in the Netherlands. The

Get Price

What are the energy storage projects in the

Energy storage projects in the Netherlands encompass diverse initiatives aimed at enhancing grid stability, integrating renewable resources,

Get Price

Grid Energy Storage Systems: How Utilities and Developers Are

As the U.S. power grid faces growing challenges—ranging from renewable intermittency and peak demand spikes to extreme weather events and aging

Get Price

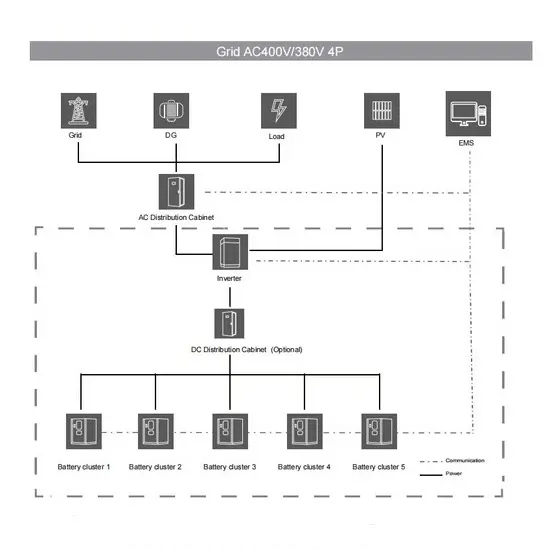

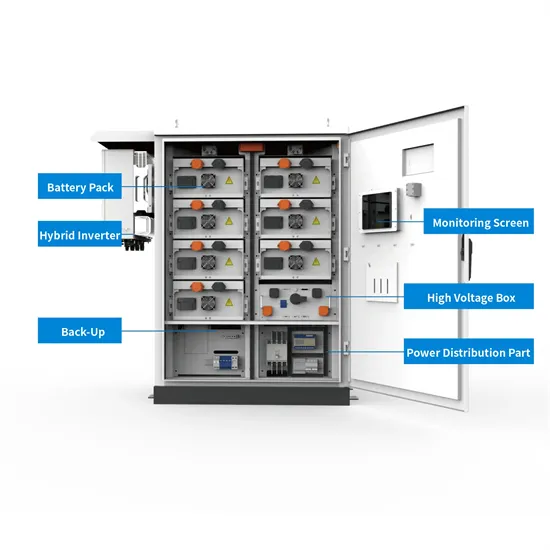

Battery energy storage systems | BESS

Battery energy storage (BESS) offer highly efficient and cost-effective energy storage solutions. BESS can be used to balance the electric grid, provide

Get Price

6 FAQs about [Netherlands power grid energy storage application]

How do grid managers work in the Netherlands?

They work together with energy suppliers, often private parties, who buy or generate the actual power and energy. Grid managers are not allowed to buy energy on the market themselves in the Netherlands. Examples of regional grid managers are Liander and Stendin. entrepreneurs who want to become active across borders.

How much money does the Dutch power grid need?

Part of that plan is subsidies for different phases of innovation. The demand on the Dutch power grid is evident in the investments that are planned by the Dutch transmission system operator (TSO) TenneT: 4 to 8 billion euros annually in the Netherlands over the next ten years to expand the grid and to resolve congestion.

Are grid managers allowed to buy energy in the Netherlands?

Grid managers are not allowed to buy energy on the market themselves in the Netherlands. Examples of regional grid managers are Liander and Stendin. entrepreneurs who want to become active across borders. Prohibits the placing on the market of certain batteries manufactured with mercury or cadmium. Encourages the recycling of (parts of) batteries.

How much energy storage does the Netherlands need?

To achieve its renewable energy targets, reports in 2021 indicate that the Netherlands will need to install between 29 and 54 gigawatts (GW) of energy storage capacity by 2050. Storage with efficient management systems and digital controls is a crucial element of a reliable, flexible and affordable energy system.

Is there a roadmap for energy storage in the Netherlands?

In the Netherlands, there has also historically not been a roadmap or detailed industrial strategy with supportive legislation, policy, taxation reliefs, or investment incentives for the energy storage market.

What are the laws & regulations on energy storage in the Netherlands?

No specific laws & regulations: In the Netherlands, energy storage is not described in Dutch laws and regulations as a specific item. Standard requirements: It has to meet standard requirements for production and consumption and some specific technologies that are part of the energy storage system must comply with standardisation.

More related information

-

Solomon Islands Energy Storage Power Station China Southern Power Grid

Solomon Islands Energy Storage Power Station China Southern Power Grid

-

Distributed energy storage power grid connection subsidies

Distributed energy storage power grid connection subsidies

-

West Asian Power Grid Energy Storage

West Asian Power Grid Energy Storage

-

Estonian power grid energy storage station area

Estonian power grid energy storage station area

-

Energy storage power station connected to the grid

Energy storage power station connected to the grid

-

Iraq Southern Power Grid Energy Storage Project

Iraq Southern Power Grid Energy Storage Project

-

Classification and application of energy storage systems in Serbia power plants

Classification and application of energy storage systems in Serbia power plants

-

Price Standards for Energy Storage Power Stations Connected to the Grid

Price Standards for Energy Storage Power Stations Connected to the Grid

Commercial & Industrial Solar Storage Market Growth

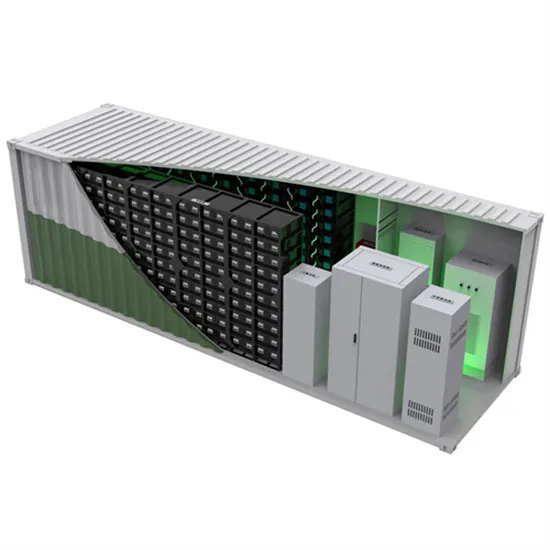

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.