Energy Storage Investments – Publications

Estimates indicate that global energy storage installations rose over 75% (measured by MWhs) year over year in 2024 and are expected to go beyond the terawatt-hour

Get Price

India Cuts GST on Solar Cells and New Energy Equipment from

3 days ago· India has slashed the GST on solar modules from 12% to 5%, a move expected to significantly reduce project costs. The tax reduction will benefit renewable energy developers

Get Price

Solar and Battery Storage Expected to Lead New

The U.S. Energy Information Administration has released predictions for 2025 in its latest Preliminary Monthly Electric Generator

Get Price

Reliance Industries Ltd

The investment will help Reliance commercialise and grow its long-duration energy storage systems business globally. Along with strategic investors Paulson & Co. Inc. and Bill Gates

Get Price

Energy Storage Program

Integrating storage in the electric grid, especially in areas with high energy demand, will allow clean energy to be available when and where it is most

Get Price

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

4 days ago· Safeway''s rooftop solar panels and on-site energy storage bring clean, reliable power closer to demand. It uses The Sun Company''s renewable-energy microgrids and

Get Price

New Energy Outlook: What 2025 Holds for Solar, Wind, Storage,

Explore what 2025 holds for clean energy—from solar and wind growth to storage innovations and grid modernization. Key insights from FFI Solutions.

Get Price

So, you''re ready to invest in renewable energy

As an investor in community solar projects with or without energy storage, you can invest in three distinct stages. Each stage carries different

Get Price

Global Energy Storage Growth Upheld by New Markets

The global energy storage market is poised to hit new heights yet again in 2025. Despite policy changes and uncertainty in the world''s two largest markets, the US and China,

Get Price

New Energy Outlook: What 2025 Holds for Solar,

Explore what 2025 holds for clean energy—from solar and wind growth to storage innovations and grid modernization. Key insights from FFI

Get Price

NEWS RELEASE: New 2023 data shows 11.2% growth for wind, solar & energy

Image 3: Canada''s actual installed capacity vs. Targets for wind, solar and energy storage: CanREA''s 2023 data shows a total installed capacity of 21.9 GW of wind and solar

Get Price

NV Energy Plans New Solar, Battery Storage, and Methane Gas Projects

The latest integrated resource plan (IRP) by NV Energy, recently previewed for stakeholders, calls for three new solar and battery storage projects – as well as new methane

Get Price

MTerra Solar Project Breaks Ground: A Monumental

RE Milestone. President Ferdinand Marcos Jr. (center) leads the groundbreaking ceremony of the MTerra Solar Project — the world''s largest

Get Price

Solar Energy Storage: Technologies, Costs & ROI Explained

1 day ago· Learn how energy storage in solar plants works, compare technologies, and discover key cost and ROI metrics to guide investment decisions.

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

Investment in New Energy Storage Projects: Opportunities,

With global renewable energy capacity soaring and grid stability becoming as precious as gold, investment in new energy storage projects isn''t just smart—it''s essential.

Get Price

So, you''re ready to invest in renewable energy projects. Here''s

As an investor in community solar projects with or without energy storage, you can invest in three distinct stages. Each stage carries different risk profiles, time horizons, and

Get Price

How much is the total investment in energy storage and new

The interplay between energy storage advancements and new energy investment is crucial. The synergies created through storage technologies enhance the viability of new

Get Price

Overview and key findings – World Energy Investment

Global energy investment is set to exceed USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure.

Get Price

How much is the total investment in energy storage and new energy

The interplay between energy storage advancements and new energy investment is crucial. The synergies created through storage technologies enhance the viability of new

Get Price

What''s driving the surge in Colorado renewable energy?

A surge of new solar and renewable energy storage projects across Colorado reflects both new subsidies and the plummeting costs of installing

Get Price

A strong quarter for new investment in renewable energy and storage

Investment in energy storage projects, critical for the growth of generation and grid stability, also continued to power ahead, with eight projects setting a new 12-month quarterly

Get Price

Next step in China''s energy transition: energy storage

China''s industrial and commercial energy storage is poised for robust growth after showing great market potential in 2023, yet critical

Get Price

ENERGY STORAGE PROJECTS

. Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for

Get Price

Solar Market Insight Report Q3 2025

4 days ago· Strong demand for new energy supply and rising power prices strengthen the market fundamentals for new solar projects in the long term. Overall, our low case is 18% lower than

Get Price

Project Overview | Project Gemini

Gemini is the largest co-located solar plus battery energy storage project operating in the US, providing a consistent, dispatchable energy resource

Get Price

RIC Energy and Rosemawr announce financing partnership to deploy solar

Its initiatives include solar PV, BESS, biogas, wind and green hydrogen and derivatives projects, reaffirming its commitment to the global energy transition. Visit ric.energy

Get Price

6 FAQs about [New energy solar energy storage project investment]

What drives energy storage project development?

Globally, energy storage project development is increasingly driven by the utility-scale segment, with mandates and targeted auctions driving gigawatt-hour projects in markets like China, Saudi Arabia, South Africa, Australia and Chile.

Will solar power grow in 2025?

Solar and battery plants will account for 61% of power generation additions in 2025, marking a record year, according to the Energy Information Administration projections. With their ability to quickly bridge supply-demand gaps, solar and storage remain the fastest-growing solution to America’s energy needs.

Is China entering a new era of energy storage demand?

Mainland China accounts for most of the global energy storage demand, driven in the near term by regional requirements for new utility-scale wind and solar projects to include energy storage capacity. However, the Chinese market is entering an era of change.

Should energy storage be removed from energy grid connection?

For energy storage, the new Chinese policy emphasized the need to remove energy storage as a prerequisite for renewable energy project grid connection, a requirement that has been a major driver for battery build. Nonetheless, BNEF still expects strong demand for batteries, as the policy doesn’t explicitly require mandates to stop.

How will wind & solar payments work in 2025?

New policy introduced in February 2025 requires wind and solar payment mechanisms to move toward more market-based structures, where 100% of wind and solar generation is to be traded in the wholesale market with local governments left to define their own implementation details by the end of the year.

Are investors hoovering up renewable assets?

"Major investors like Brookfield Asset Management and CDPQ are ' hoovering up renewable assets' at attractive valuations," notes one industry analysis, suggesting long-term investors view current conditions as buying opportunities.

More related information

-

New energy storage project investment

New energy storage project investment

-

German Energy Investment Wind Solar and Storage Project

German Energy Investment Wind Solar and Storage Project

-

Samoa New Energy Storage Wind and Solar Project

Samoa New Energy Storage Wind and Solar Project

-

Huawei s energy storage project investment model

Huawei s energy storage project investment model

-

Solar Energy Storage Project in the Republic of South Africa

Solar Energy Storage Project in the Republic of South Africa

-

Israel Energy Investment Energy Storage Project

Israel Energy Investment Energy Storage Project

-

How much investment is needed for Kuwait s energy storage project

How much investment is needed for Kuwait s energy storage project

-

New investment projects in Taipei energy storage

New investment projects in Taipei energy storage

Commercial & Industrial Solar Storage Market Growth

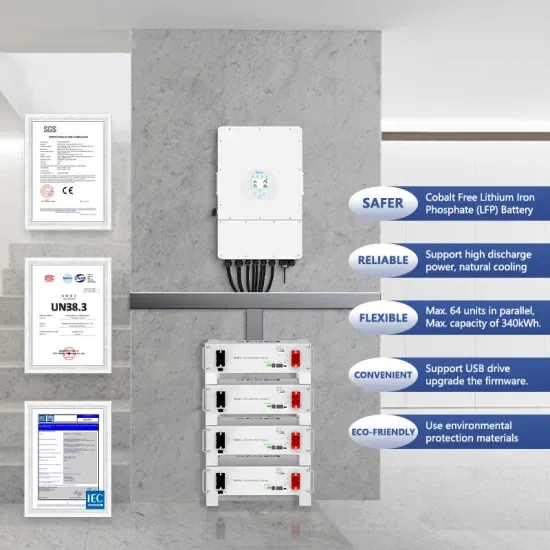

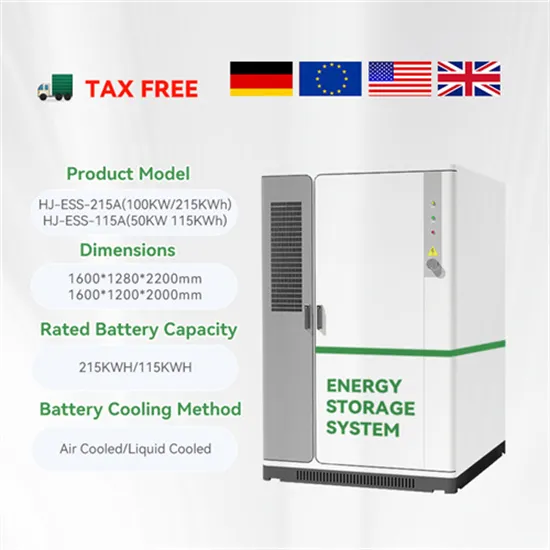

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.