Timor-Leste solar energy power station

What is Timor-Leste''s energy policy? The government of "Timor-Leste" is also trying to shift its policy to the introduction of clean energy, such as hydraulic, wind, and solar power generation.

Get Price

EDTL.EP

The power plants are under an operation and maintenance (O&M) contract with Wartsila, which ends in 2022. This O&M contract is likely to be extended until EdTL gains sufficient experience

Get Price

East Timor News Monitoring Service & Press Release Distribution

Wind Power Generator Market Estimated to Flourish By 2032 - NORDEX SE, Goldwind, Senvion, Samsung Electronics, etc. Wind Power Generator Market to Witness

Get Price

In diesel-dependent East Timor, renewable energy

Renewable energy potential is strong in East Timor, according to the Asian Development Bank, with almost the entire territory having the

Get Price

In diesel-dependent East Timor, renewable energy transition

Renewable energy potential is strong in East Timor, according to the Asian Development Bank, with almost the entire territory having the potential to successfully

Get Price

ENERGY PROFILE Timor-Leste

Distribution of wind potential Annual generation per unit of installed PV capacity (MWh/kWp) Wind power density at 100m height (W/m2)

Get Price

Lariguto, Viqueque has the highest potential for wind power

"It has been identified that four locations have the highest potential for the development of the project, including Lariguto. Meanwhile, the other three locations are Oeleu

Get Price

In diesel-dependent East Timor, renewable energy transition

East Timor has made domestic and international commitments to scale up its share of renewable energy generation.

Get Price

EDTL.EP

The power plants are under an operation and maintenance (O&M) contract with Wartsila, which ends in 2022. This O&M contract is likely to be extended until

Get Price

Signing of Power Purchase Agreement (PPA) for Solar and

Currently, Timor-Leste relies almost entirely on imported diesel fuel for its power generation, which poses significant challenges in terms of fiscal burden and greenhouse gas

Get Price

Lights, power and action in East Timor

We are considering a wind power system for a village which would be reticulated to homes via the old disused town power grid. Other projects could include a small-scale hy-dro system, solar

Get Price

East Timor Renewable Energy Electrification Plan

The East Timor Renewable Energy Electrification Plan consists on the thorough analysis of wind, solar and hydro resources (including wind measurement stations installation).

Get Price

Timor-Leste – Asia Wind Energy Association

A study was done, at the national level, which will allow the development of an energy policy for Timor-Leste. The study was concluded on the 29 May and analzysed several sources

Get Price

Electrification in post-conflict Timor-Leste: Opportunities for

Timor-Leste, in Southeast Asia, emerged from decades of conflict in the late 20th century to become an independent nation in 2002. A key focus for the new nation has been to

Get Price

Powerhouse Wind | Revolutionising Small Wind Power

Renewable, inexhaustible, clean, free. Sustainable Development Wind and solar generation is renewable and inexhaustible and offers long term energy

Get Price

East Timor: Slow green revolution facing dependence on diesel

Find out how East Timor is slowly moving towards renewable energy despite its heavy reliance on diesel. This in-depth analysis explores the government''s commitments and challenges to

Get Price

Timor-Leste budget solar power station

UNDP Launches 35 MW Solar Project in Timor The new solar energy project, titled "Solar for All," is a key component of UNDP''''s broader efforts to promote renewable energy in Timor-Leste.

Get Price

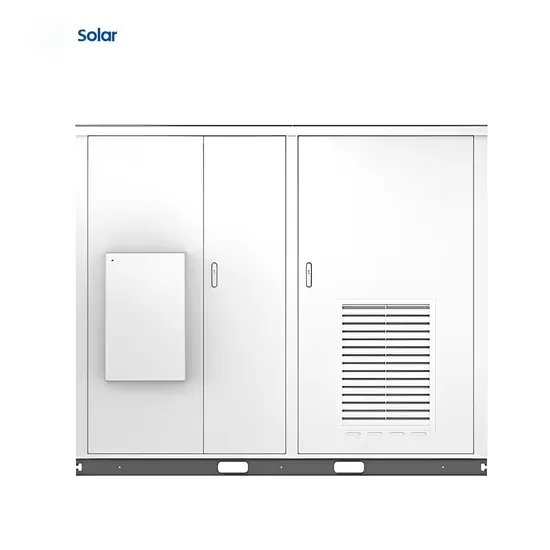

ENERGY STORAGE CONTAINER MANUFACTURERS SERVING EAST TIMOR

Is biomass a source of electricity in East Timor? Traditional biomass – the burning of charcoal, crop waste, and other organic matter – is not included. This can be an important source in

Get Price

Lessons learned from development of the SDG 7 Roadmap

Timor-Leste plans to implement 72 MW solar and 50 MW wind by 2024 and 2026 respectively. This will increase RE share in power generation from 0.2% in 2021 to 35.4% in 2030. Under

Get Price

Timor-Leste and renewable energy | Research Starters

Summary: East Timor has not yet developed rich oil and natural gas deposits, given some disputes over its sovereignty, and remains dependent on imported fossil fuels while

Get Price

Off-Grid Containerized Energy Systems | Micro-Grids

The hybridization of small-scale wind, solar PV and energy storage provides a more resilient and reliable supply of power compared to solar PV and energy

Get Price

Solar generator power Timor-Leste

Solar generator power Timor-Leste Why is solar energy implemented in Timor Leste? Plotting of analyses of solar radiation in Timor Leste. power generation is dependent on the cli mate. The

Get Price

Electrification in post-conflict Timor-Leste: Opportunities for

Stakeholder interviews and observations regarding the electrification pathway of Timor-Leste generally first discussed electricity generation and then moved on to community

Get Price

Lariguto, Viqueque has the highest potential for wind

"It has been identified that four locations have the highest potential for the development of the project, including Lariguto. Meanwhile, the other

Get Price

Property in East Timor on a map

Convenient search for properties in East Timor for sale on the interactive map with addresses, prices, photos and brief descriptions of objects.

Get Price

Container Generators

our eco° GEN-C series features all-in-one packaged power generation solution, engineered for mobility, easy deployment and scalability each power container is engineered to meet specific

Get Price

6 FAQs about [East Timor container house wind power generation]

Is East Timor interested in solar power?

East Timor President José Ramos-Horta told The Associated Press in an interview in Dili last week that his country is interested in exploring various types of renewable energy sources, including wind, sea and especially solar power. “We have plenty of sun,” he said, adding that the cost of solar technology continues to fall.

Does East Timor need financing?

The share of renewable energy in the country’s energy mix has only made slow progress in recent years, indicating that additional efforts are needed to meet the set goals. One of the main obstacles for East Timor remains financing.

Where will a 50MW wind power project be implemented in Timor-Leste?

The head of the International Finance Corporation (IFC) in Timor-Leste, David Freedman said that according to the report of Scaling Wind Phase, Lariguto is the chosen location for the implementation of the 50MW wind power project.

Does East Timor have electricity?

Access to electricity is a modern development for many of East Timor’s 1.3 million people, after much of the country’s infrastructure was razed by Indonesian forces during the war for independence. Recovery was slow after East Timor gained formal independence in 2002.

Is East Timor a polluting country?

Currently, electricity in East Timor is primarily generated by diesel -powered plants, a highly polluting energy source. These facilities, while essential for meeting the country’s energy needs, significantly contribute to greenhouse gas emissions and harm the environment.

Where is a scaling wind project happening in Timor?

Meanwhile, the other three locations are Oeleu in Bobonaro, Lequidoe in Aileu, and another site in Baucau,” Freedman made the comments during the presentation of the Scaling Wind Phase report, at Hotel Timor, in Dili.

More related information

-

North Korea container house wind power generation

North Korea container house wind power generation

-

Middle East Solar Panel House Photovoltaic Power Generation

Middle East Solar Panel House Photovoltaic Power Generation

-

East Africa Power Generation Container BESS

East Africa Power Generation Container BESS

-

East Timor Energy Storage Container Power Station Manufacturer

East Timor Energy Storage Container Power Station Manufacturer

-

Customized container house for power generation equipment

Customized container house for power generation equipment

-

Eastern European Energy Storage Power Generation Container

Eastern European Energy Storage Power Generation Container

-

Sophia power generation container sales

Sophia power generation container sales

-

Ghana silent power generation container

Ghana silent power generation container

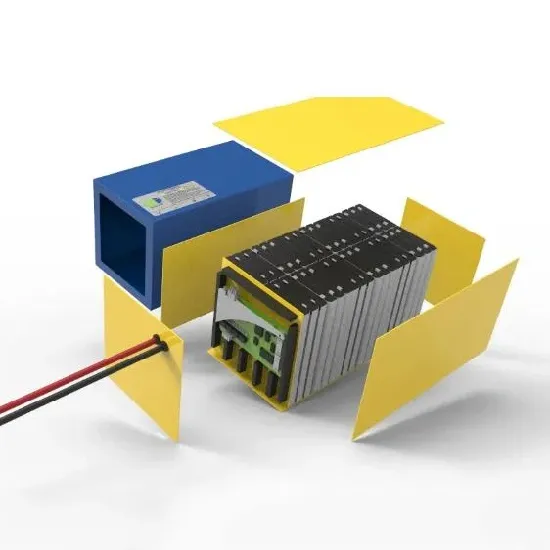

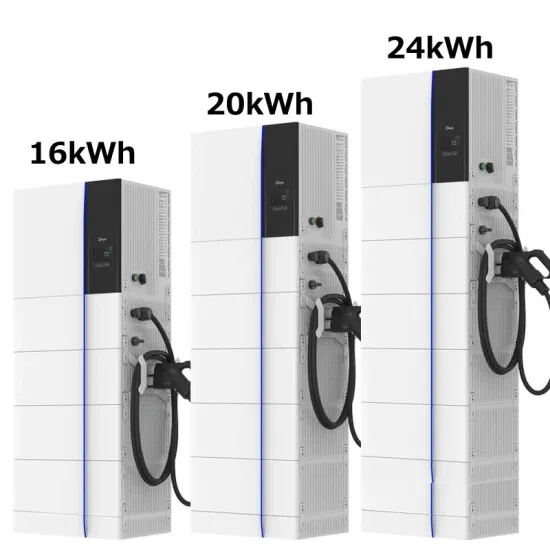

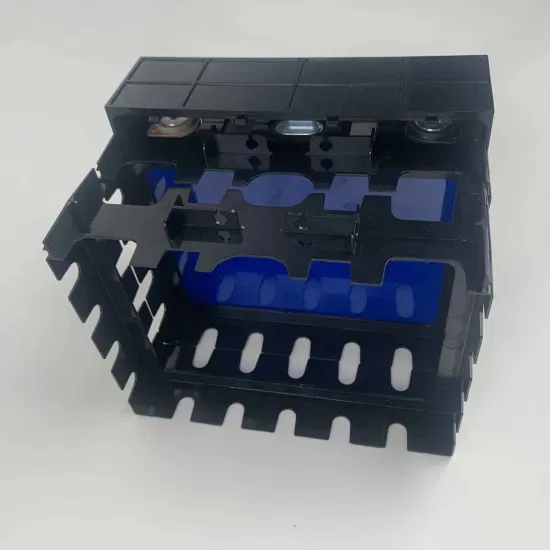

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.