How about the foreign trade portable energy storage power supply

The discourse surrounding the foreign trade of portable energy storage power supplies encompasses myriad facets essential to understand its current trajectory and future

Get Price

Addressing Tariffs and Trade in Energy Storage Projects

These components are typically sourced from international suppliers (with China being responsible for around 85% of global battery cell

Get Price

Energy Storage Foreign Trade Products: Trends, Challenges, and

Think renewable energy developers, international traders, policymakers, or even curious investors. These folks want actionable insights—not fluff—about cross-border trade in battery

Get Price

New energy storage power supply foreign trade

Foreign energy storage policies encompass various regulations, incentives, and frameworks that nations utilize to promote the development and implementation of energy storage

Get Price

ESS Price Forecasting Report (Q1

This Interim Update of the Energy Storage System (ESS) Q1 2025 Price Forecasting Report highlights how newly imposed U.S. tariffs are reshaping the cost

Get Price

Battery Tariffs 2025: Impact on U.S. Energy and Trade

Explore how 2025 battery tariffs affect U.S. imports, energy storage, EV production, and sourcing strategies amid rising China tariffs and trade shifts.

Get Price

Cairo''s Foreign Trade Energy Storage: Powering Egypt''s Green

Solar panels and battery racks quietly reshaping Egypt''s energy landscape. With Cairo foreign trade energy storage power supply initiatives gaining momentum, the city is fast becoming the

Get Price

Energy Storage Equipment Foreign Trade: A Global Power Play

Let''s cut to the chase: if you''re in the energy storage equipment foreign trade game, you''re either a manufacturer eyeing overseas markets, a policy wonk tracking green

Get Price

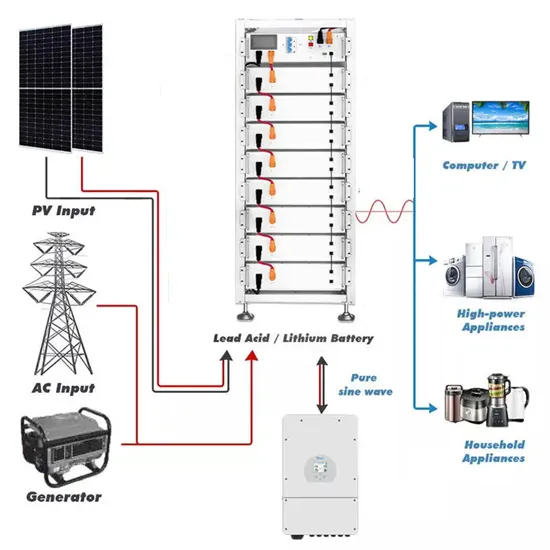

Battery Energy Storage System (BESS) for Foreign-Trade Zone

The solicitation seeks a contractor to provide a Battery Energy Storage System (BESS) at Foreign-Trade Zone No. 9 in Honolulu, Hawaii. The contractor will furnish the BESS and

Get Price

How to Master Energy Storage Foreign Trade: A 2025 Guide for

Well, here''s the thing – the global energy storage market is projected to hit $50 billion by Q4 2025, with cross-border trade accounting for 63% of lithium-ion battery transactions. But why are

Get Price

Foreign trade energy storage news

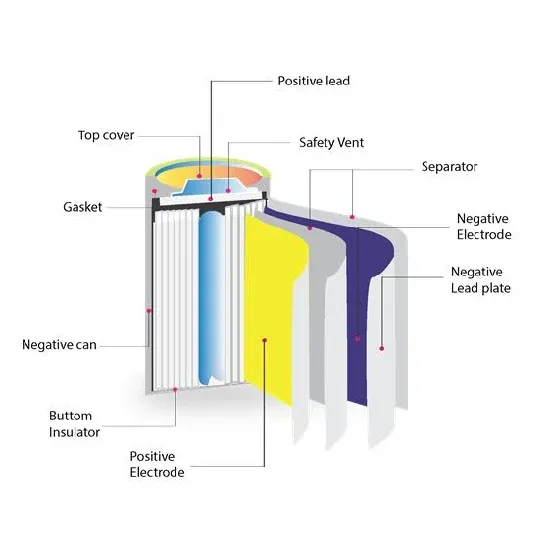

CATL developed new LiFePO batteries which offer ultra long life capabilities, while BYD launched "blade" batteries to further improve battery cell capacities. Other energy storage

Get Price

Addressing Tariffs and Trade in Energy Storage Projects

These components are typically sourced from international suppliers (with China being responsible for around 85% of global battery cell production capacity), which exposes

Get Price

Energy Storage Foreign Trade: Mastering Channel Sales in

The Global Energy Storage Boom: Why Channel Sales Matter Now With the energy storage market projected to hit $50 billion globally by Q4 2025, manufacturers are racing to secure

Get Price

How is the foreign trade of energy storage battery sales?

As nations work toward meeting climate goals, the increasing reliance on intermittent renewable sources like solar and wind necessitates robust energy storage

Get Price

Tariffs: Analysis spells out extent of challenge for US

New analysis from Clean Energy Associates (CEA) and Wood Mackenzie highlights the challenges facing the US battery storage market due

Get Price

Tariffs: Analysis spells out extent of challenge for US BESS

New analysis from Clean Energy Associates (CEA) and Wood Mackenzie highlights the challenges facing the US battery storage market due to trade tariffs.

Get Price

How is the foreign trade of battery energy storage companies?

Despite the promising landscape, challenges abound for battery energy storage companies in pursuing foreign trade. Navigating different regulatory environments presents a

Get Price

Tariff Volatility Reshapes Battery Storage Landscape: CEA''s

A mid-quarter update from Clean Energy Associates (CEA) reveals how recent shifts in U.S. trade policy are significantly altering the economics of battery energy storage

Get Price

48.4%! US Tariffs on Chinese Energy Storage

By January 2026, the comprehensive tariff on Chinese-made batteries and energy storage systems in the US will reach an astonishing

Get Price

Quotation for Energy Storage Air Conditioning G

The company relies on a well-trained team of foreign trade employees and links with hundreds of manufacturing companies. With the business purpose of "reputation first, customer first, and

Get Price

Potential US-China battery trade war escalates with first AD/CVD

Background image above: Manufacturing of BYD''s Blade Battery. Image: BYD. The rhetoric around new and increased trade barriers between the US and China affecting

Get Price

Lithium battery energy storage foreign trade

Foreign-Trade Zone (FTZ) 129-Bellingham, Washington, Notification of Proposed Production Activity Corvus Energy USA, Ltd. (Lithium-Ion Battery Energy Storage In the

Get Price

Foreign trade energy storage new energy prospects

In the transport sector, the increasing electrification of road transport through plug-in hybrids and, most importantly, battery electric vehicles leads to a massive rise in battery demand. Energy

Get Price

48.4%! US Tariffs on Chinese Energy Storage Products Take Effect

By January 2026, the comprehensive tariff on Chinese-made batteries and energy storage systems in the US will reach an astonishing 48.4%. This figure will undoubtedly put

Get Price

Energy storage battery foreign trade docking

The foreign trade of battery energy storage companies is a rapidly evolving sector in the global market. The key points in understanding this dynamic industry can be highlighted as follows: 1.

Get Price

Energy storage battery foreign trade group

The Philippines'''' first large-scale solar-plus-storage hybrid (pictured), was commissioned in early 2022. Image: ACEN. The Philippines Department of Energy (DOE) has outlined new draft

Get Price

Quotation for Portable Energy Storage Air Conditioner G

The company relies on a well-trained team of foreign trade employees and links with hundreds of manufacturing companies. With the business purpose of "reputation first, customer first, and

Get Price

6 FAQs about [Foreign trade energy storage battery quotation]

Which stationary energy storage products are affected by battery tariffs?

Stationary Energy Storage Products Affected by Battery Tariffs Large-format stationary energy storage systems like Tesla’s Powerwall and Megapack also face cost increases due to the latest tariffs. These products rely heavily on lithium battery cells sourced from Chinese suppliers.

How does tariff risk affect a battery energy storage system (BESS) project?

Mitigating tariff risk in battery energy storage system (BESS) projects is crucial for ensuring project financial viability, as tariff changes can significantly affect cost structures and overall project economics.

Are Chinese tariffs affecting the battery market?

The U.S. battery market has entered a period of pricing uncertainty due to expanded battery tariffs. Starting in 2025, new Chinese tariffs on imported lithium-ion cells and components—especially those used in energy storage systems—have reached levels as high as 104%, according to updated trade filings.

How are battery tariffs reshaping global trade?

As new battery tariffs and expanded China tariffs continue to reshape global trade, U.S. policymakers and businesses are reevaluating the domestic battery supply chain. This section outlines the current status of U.S. battery production, the resources required to scale it, and the challenges involved in reducing reliance on overseas suppliers.

Which international trade issues will remain a concern for energy storage projects?

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply chain integrity.

How has the 2025 expansion of battery tariffs impacted solar storage?

The 2025 expansion of battery tariffs has significantly impacted the pricing structure of solar battery storage projects across the U.S. Utility-scale storage systems, often used to support renewable energy sources such as solar and wind, are now subject to import duties ranging from 54% to over 100% on components sourced from China.

More related information

-

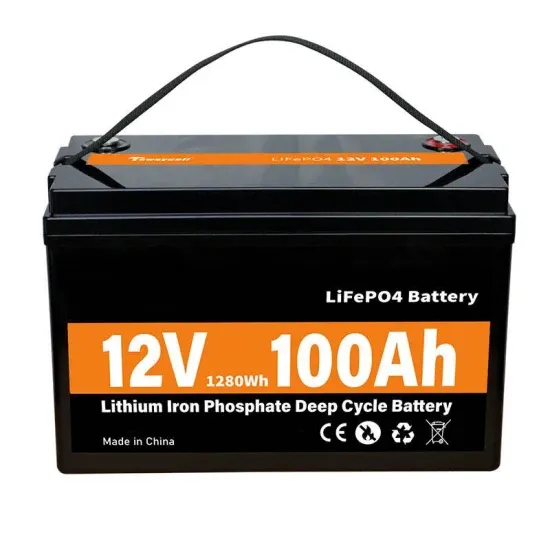

Somalia container photovoltaic energy storage lithium battery foreign trade

Somalia container photovoltaic energy storage lithium battery foreign trade

-

Outdoor energy storage battery foreign trade

Outdoor energy storage battery foreign trade

-

The application of energy storage battery foreign trade

The application of energy storage battery foreign trade

-

Lithium battery energy storage system quotation

Lithium battery energy storage system quotation

-

Huawei energy storage battery quotation unit

Huawei energy storage battery quotation unit

-

Timor-Leste 210 degree liquid cooling energy storage cabinet foreign trade

Timor-Leste 210 degree liquid cooling energy storage cabinet foreign trade

-

Tonga 100kw lithium battery energy storage system inverter quotation

Tonga 100kw lithium battery energy storage system inverter quotation

-

Turkmenistan foreign trade portable energy storage emergency power supply

Turkmenistan foreign trade portable energy storage emergency power supply

Commercial & Industrial Solar Storage Market Growth

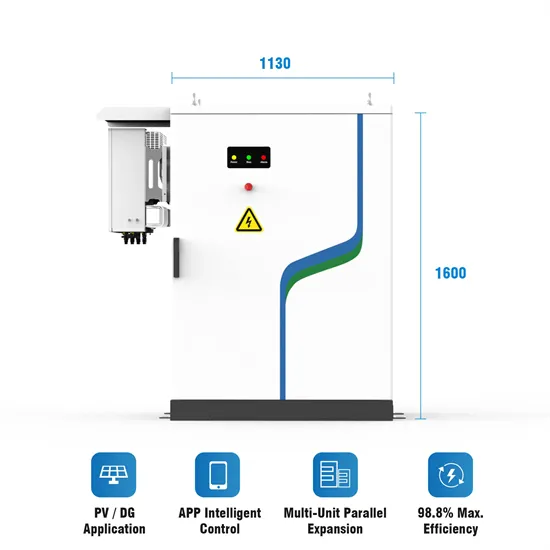

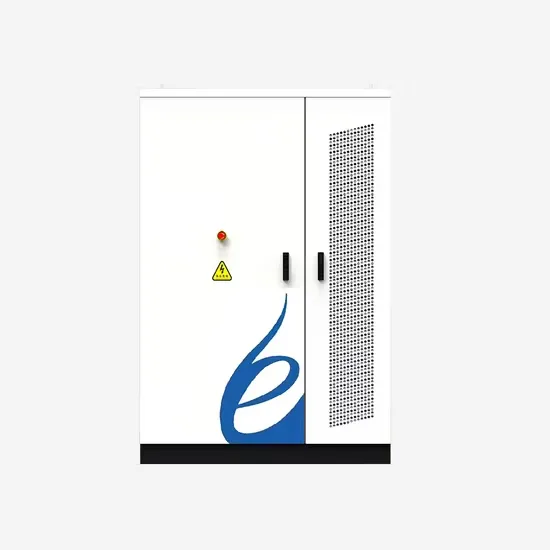

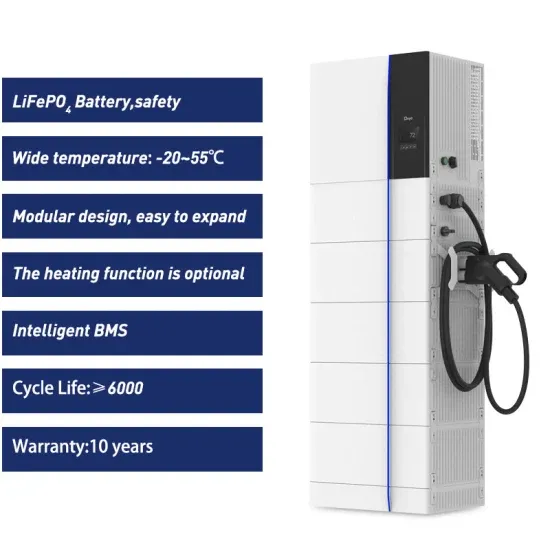

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.