99% of Wind & Solar Potential Untapped in ASEAN:

In order to attract investment, ASEAN countries need streamlined renewable supply chains, investments in grid extensions and modernization. It

Get Price

Vietnam''s solar and wind power success: Policy implications for the

This study analyzes the factors that have facilitated Vietnam''s recent rapid solar and wind power expansion and draws policy insights for other member states of the Association of

Get Price

A Race to the Top Southeast Asia 2024: Operating

Data from the Global Solar and Wind Power Trackers show that ASEAN countries have grown their utility-scale solar and wind capacity 20% in the last year to

Get Price

ASEAN to Push Utilisation of Storage Technologies

ASEAN Member States (AMS) need to step up their game on energy storage development. As the 6th ASEAN Energy Outlook foretells, ASEAN''s Total Final Energy Consumption (TFEC)

Get Price

A Race to the Top: Southeast Asia 2024

Global Energy Monitor''s Global Solar Power Tracker and Global Wind Power Tracker currently catalog more than 28 GW of operating utility-scale solar and wind capacity across ASEAN

Get Price

NEWS HIGHLIGHTS Renewable Energy

ASEAN Member States Embarking Sustainable Energy Significant developments in Southeast Asia: Plans a USD 2.16 billion wind farm, palm oil exports with 54% market share, and many

Get Price

Meralco PowerGen, KEPCO eye wind, energy storage projects

18 hours ago· Meralco PowerGen Corp. (MGEN) and Korea Electric Power Corp. (KEPCO) are looking to expand their collaboration beyond solar energy into wind and energy storage

Get Price

ASEAN Energy in 2025

Sources: [3], [4], [5] Several energy-focused initiatives introduced at COP29 received endorsement from a few ASEAN Member States (AMS) [2]. These include the Global Energy

Get Price

GMS Energy Sector Strategy 2024-2030

− "Nam Emoun 1, 2 Hydro, Pump Storage and Wind Power Hybrid Projects" − Green Energy Supply of 1000 MW Combination of Hydro, Wind and Geothermal Projects − "Xekong Pump

Get Price

ASEAN''s COPs Energy Pledges and the 2026-2030

Amira Bilqis is an Analyst at Energy Modelling and Policy Planning at the ASEAN Centre for Energy (ACE) and Indira Pradnyaswari is an

Get Price

Energy Storage for Renewable Energy Integration in ASEAN

This report is the result of the project Energy Storage for Renewable Energy Integration in ASEAN: Prospects of Hydrogen as an Energy Carrier vs. Other Alternatives of the Economic

Get Price

Potential Solar, Wind, and Battery Storage Deployment for

This chapter presents perspectives on greening ASEAN by potential solar PV and wind deployment coupled with battery storage to provide a stable and resilient energy system

Get Price

The Workshop of Offshore Wind+ Energy Potential

Dr Geng Dazhou, Specialist, New Energy Department of CREEI opened the discussion by sharing China''s experience in offshore wind power

Get Price

Vietnam''s solar and wind power success: Policy implications for

This study analyzes the factors that have facilitated Vietnam''s recent rapid solar and wind power expansion and draws policy insights for other member states of the Association of

Get Price

Asean Power Grid: Can South-east Asia finally plug into a shared

Asean Power Grid: Can South-east Asia finally plug into a shared power future? Cross-border clean energy projects are gaining momentum, with 2025 shaping up as a

Get Price

Country and Regional Projects in South Asia and the Pacific

Highlights include evaluating the potential for floating solar on regional waterbodies, building resilience in urban energy, water, and food systems, supporting investment decisions

Get Price

ASEAN to Push Utilisation of Storage Technologies

First Gen Hydro Power, one of the leading providers of clean and renewable power in the Philippines, is currently investing US$124.89 million to develop a

Get Price

Asean Power Grid: Can South-east Asia finally plug into a shared power

Asean Power Grid: Can South-east Asia finally plug into a shared power future? Cross-border clean energy projects are gaining momentum, with 2025 shaping up as a

Get Price

ASEAN''s clean power pathways: 2024 insights | Ember

This report presents strategies to fine-tuning policies to reduce dependence on fossil fuels and start the systemic shift necessary for a clean power sector transition, providing

Get Price

EMBER: ASEAN''s interconnected grids could unlock 30 GW of

A report identifies 30 GW of solar and wind potential along Southeast Asia''s interconnection corridors, highlighting the challenges tied to regional electricity infrastructure.

Get Price

Ember: ASEAN grid investments could unlock 24GW of new solar

Expanding the grid infrastructure of countries in the Association of Southeast Asian Nations (ASEAN) could unlock 24GW of new solar capacity, alongside 5.6GW of new

Get Price

ASEE–ASEAN Smart Energy & Energy Storage Expo

Smart Grid eMobility & Battery Biomass Energy Energy Storage Battery Supply & Charging Equipment Wind Energy Power Supply

Get Price

8th ASEAN Energy Outlook

ASEAN''s power generation is expected to make a substantial shift towards renewable energy, particularly solar and wind, with the RAS and CNS leading this transition.

Get Price

ASEE Global News | SEWind''s 40MW Wind Power Project in

Shanghai Electric Wind Power Group (SEWind) has announced that the Hai Anh Wind Power Project in Vietnam was fully connected to the grid on July 28, marking the official

Get Price

Wind and solar capacity in south-east Asia climbs

Solar and wind capacity in the South East Asia increased by 20% in 2023, bringing the total to more than 28 gigawatts (GW).

Get Price

99% of Wind & Solar Potential Untapped in ASEAN: EMBER

In order to attract investment, ASEAN countries need streamlined renewable supply chains, investments in grid extensions and modernization. It requires to be combined

Get Price

6 FAQs about [ASEAN Wind Power Energy Storage Project]

Should ASEAN invest in solar & wind power?

Investments in solar and wind power also reduce the stranded asset risks associated with fossil fuel assets. It has been estimated that ASEAN could save about US$26 billion on fuel costs by achieving its 23% renewable energy target by 2025 (ASEAN Centre for Energy, 2020).

How successful is ASEAN in solar and wind power uptake?

Despite progress in some countries, ASEAN's success in solar and wind uptake has been mixed. Solar and wind power uptake has recently stalled in Thailand and the Philippines, the earlier pioneers in the region (International Renewable Energy Agency, 2021).

Should ASEAN transition to solar and wind power?

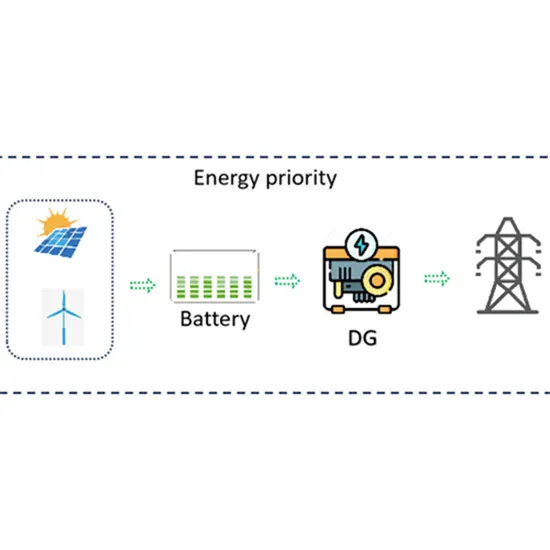

Early preparation in terms of electricity transmission and distribution and also energy storage would enable ASEAN to better benefit from transitioning to intermittent but increasingly cost-effective sources of electricity in the form of solar and wind power. There is a sizeable literature on solar and wind development policies.

Is ASEAN moving towards clean power?

The EMBER report finds that an increasing use of solar and wind generation by ASEAN countries, has led to a shift towards clean power. This is especially true when 99% of the wind and solar potential in ASEAN, reportedly remains untapped.

Do ASEAN countries have solar and wind power potential?

The ASEAN countries have significant solar and wind power potential. The resource base for solar and onshore wind power at sites with a levelized cost of electricity (LCOE) of less than US$150/MWh as of 2018 has been estimated to exceed 31 TW (Lee et al., 2020).

What will ASEAN's Energy Future look like?

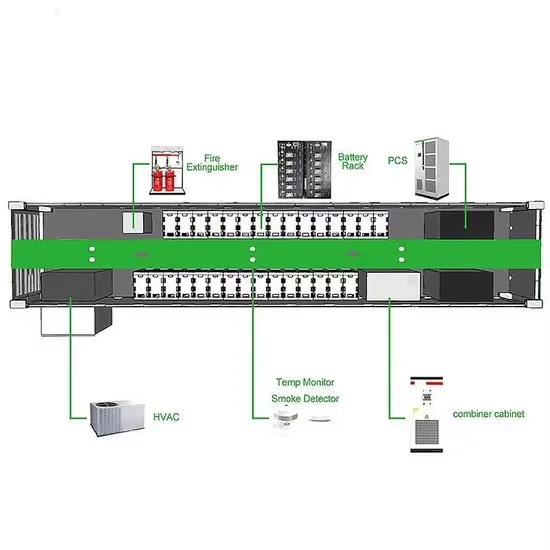

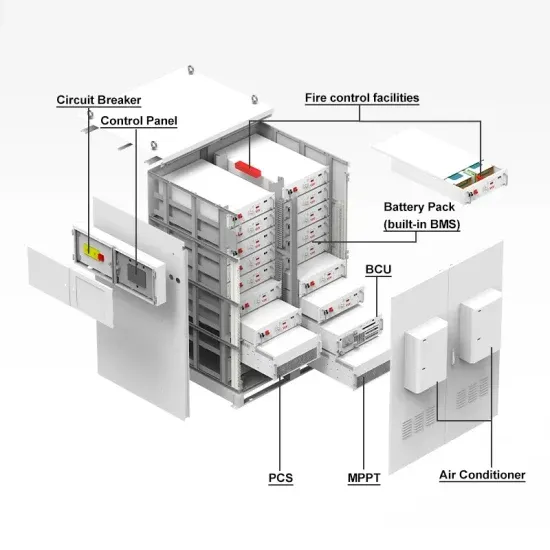

ASEAN’s power generation is expected to make a substantial shift towards renewable energy, particularly solar and wind, with the RAS and CNS leading this transition. Energy storage technologies, including Battery Energy Storage Systems, will play a critical role in stabilising the grid and supporting the ASEAN Power Grid.

More related information

-

Energy storage configuration for Marshall Islands wind power project

Energy storage configuration for Marshall Islands wind power project

-

Israel Wind and Solar Energy Storage Power Station Project

Israel Wind and Solar Energy Storage Power Station Project

-

India Wind Power Energy Storage Project

India Wind Power Energy Storage Project

-

Northern Cyprus wind power project plus energy storage policy

Northern Cyprus wind power project plus energy storage policy

-

Uzbekistan wind power project with energy storage

Uzbekistan wind power project with energy storage

-

Bhutan Wind Power Energy Storage Project

Bhutan Wind Power Energy Storage Project

-

North Korean Wind and Solar Energy Storage Power Station

North Korean Wind and Solar Energy Storage Power Station

-

Czech wind power energy storage requirements

Czech wind power energy storage requirements

Commercial & Industrial Solar Storage Market Growth

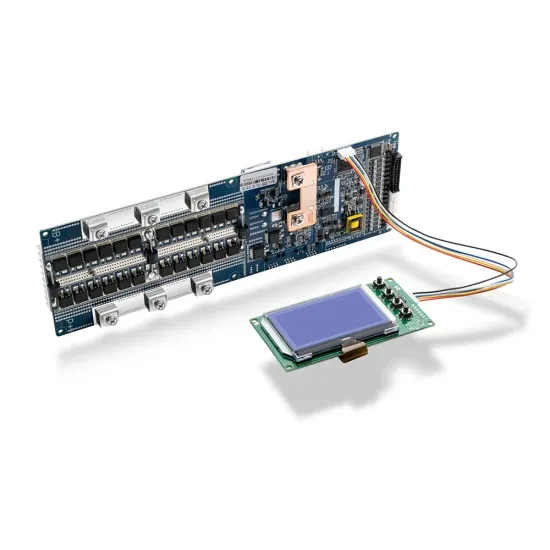

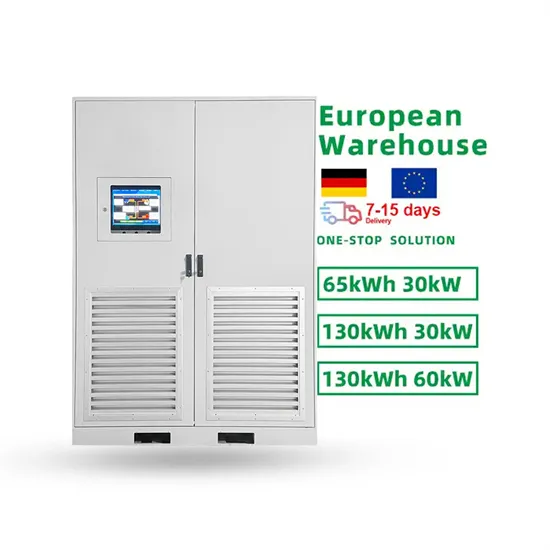

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.