Battery Energy Storage Lifecyle Cost Assessment Summary

Technology Focus This cost assessment focuses on lithium ion battery technologies. Lithium ion currently dominates battery storage deployments and is approximately 90% of the global

Get Price

Energy Storage Technology and Cost Characterization Report

Executive Summary This report was completed as part of the U.S. Department of Energy''s Water Power Technologies Office-funded project entitled Valuation Guidance and Techno-Economic

Get Price

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Do larger energy storage projects have lower costs per unit? Yes. Thanks to economies of scale in energy storage projects, larger installations generally reduce the cost

Get Price

Pumped Storage Hydropower | Electricity | 2024 | ATB | NREL

Pumped storage hydropower does not calculate levelized cost of energy (LCOE) or levelized cost of storage (LCOS) and so does not use financial assumptions. Therefore, all parameters are

Get Price

2020 Grid Energy Storage Technology Cost and

The analysis was done for energy storage systems (ESS) across various power levels and energy-to-power (E/P) ratios. The power levels and durations for each technology were

Get Price

Just right: how to size solar + energy storage projects

The first question to ask yourself when sizing energy storage for a solar project is "What is the problem I am trying to solve with storage?" If you cannot answer that question, it''s

Get Price

New Energy Storage Ratio System Standards: A Guide for Renewable Energy

The secret often lies in their energy storage ratio system standards. With governments worldwide pushing for renewable energy adoption, understanding these

Get Price

Equipment cost ratio of energy storage projects

This inverse behavior is observed for all energy storage technologies and highlights the importance of distinguishing the two types of battery capacity when discussing the cost of

Get Price

Ratio of energy storage station operation and maintenance

Cost of Energy (COEn): In contrast with the above-mentioned metrics, this financial indicator is specific for energy projects, as it is related to the unitary costs of the product, which in this

Get Price

U.S. Solar Photovoltaic System and Energy Storage Cost

Q RTE SG&A SOC USD VDC WAC WDC alternating current battery energy storage system U.S. Bureau of Labor Statistics balance of system capital expenditures direct current U.S.

Get Price

Just right: how to size solar + energy storage projects

The first question to ask yourself when sizing energy storage for a solar project is "What is the problem I am trying to solve with storage?" If you

Get Price

Energy storage ratio table for new energy projects

In this final blog post of our Solar + Energy Storage series, we will discuss how to properly size the inverter loading ratio on DC-coupled solar + storage systems of a given size.

Get Price

National Hydropower Association 2021 Pumped Storage Report

Executive Summary This is the third Pumped Storage Report White Paper prepared by the National Hydropower Association''s Pumped Storage Development Council (Council). The first

Get Price

New Energy Storage Ratio System Standards: A Guide for

The secret often lies in their energy storage ratio system standards. With governments worldwide pushing for renewable energy adoption, understanding these

Get Price

Energy storage ratio of new energy projects

An estimated 387 gigawatts(GW) (or 1,143 gigawatt hours (GWh)) of new energy storage capacity is expected to be added globally from 2022 to 2030,which would result in the size of global

Get Price

Energy storage system cost ratio

The analysis was done for energy storage systems (ESSs) across various power levels and energy-to-power ratios. E/P is battery energy to power ratio and is synonymous with storage

Get Price

Battery Energy Storage System Evaluation Method

In order to normalize and interpret results, Efficiency can be compared to rated efficiency and Demonstrated Capacity can be divided by rated capacity for a normalized Capacity Ratio. The

Get Price

Cost models for battery energy storage systems

1.1 Purpose of the study As the energy sector continues to shift to renewable energy sources, the demand for battery energy storage increases. However, the various technologies and

Get Price

Energy Storage Technology and Cost Assessment:

This is an executive summary of a study that evaluates the current state of technology, market applications, and costs for the stationary energy storage sector.

Get Price

7 Labor vs Material Cost Ratios in Solar Panel Projects

Introduction: Why Labor vs Material Cost Ratios Matter in Solar Projects When you''re planning a solar panel project, it''s easy to get caught up in wattages, panel brands, and

Get Price

What is the cost ratio of energy storage equipment? | NenPower

What is the cost ratio of energy storage equipment? The cost ratio of energy storage equipment varies based on several key factors. 1. Technology type, 2. Size and

Get Price

Battery Energy Storage Financing Structures and Revenue

Battery Energy Storage Revenue Streams The varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for battery energy

Get Price

Process Equipment Cost Estimating By Ratio And Proportion

Indirect costs consist of project services, such as overhead and profit, and engineering and administrative fees. Direct costs are construction items for the project and include property,

Get Price

Understanding battery energy storage system (BESS)

Project implementation planning begins with finalization of the following components: Capacity of each BESS container Number of BESS

Get Price

Commercial Battery Storage | Electricity | 2021 | ATB

The 2021 ATB represents cost and performance for battery storage across a range of durations (1–8 hours). It represents lithium-ion batteries only at this

Get Price

6 FAQs about [Ratio of energy storage project equipment]

How many MW is a battery energy storage system?

For battery energy storage systems (BESS), the analysis was done for systems with rated power of 1, 10, and 100 megawatts (MW), with duration of 2, 4, 6, 8, and 10 hours. For PSH, 100 and 1,000 MW systems at 4- and 10-hour durations were considered. For CAES, in addition to these power and duration levels, 10,000 MW was also considered.

How is energy storage capacity calculated?

The energy storage capacity, E, is calculated using the efficiency calculated above to represent energy losses in the BESS itself. This is an approximation since actual battery efficiency will depend on operating parameters such as charge/discharge rate (Amps) and temperature.

Are energy storage systems changing?

Rapid change is underway in the energy storage sector. Prices for energy storage systems remain on a downward trajectory. The deployment of energy storage systems (ESSs) -- measured by capacity or energy -- continue to grow in the U.S., with a widening array of stationary power applications being successfully targeted.

Should energy storage be a grid asset?

Focus is placed on lithium ion and flow battery technologies; the former being the current market leader, the latter in the early stages of market adoption. Results of this analysis support the continued evaluation and potential deployment of energy storage as a grid asset.

How do you calculate a unit energy cost metric?

The unit energy or power annualized cost metric is derived by dividing the total annualized cost paid each year by either the rated energy to yield $/rated kilowatt-hour (kWh)-year or by rated power to yield $/rated kilowatt (kW)-year, where the kWh and kW are rated energy and power of the ESS, respectively.

How much does the Goldendale energy storage project cost?

The Goldendale Energy Storage Project has a head of 2,400 feet and is expected to cost $1,800/kW for C&I. Higher head for the project also reduced tunnel excavation costs due to the fact the pump/turbine centerline depth below the lower reservoir bottom decreased with increasing head (Miller, 2020a).

More related information

-

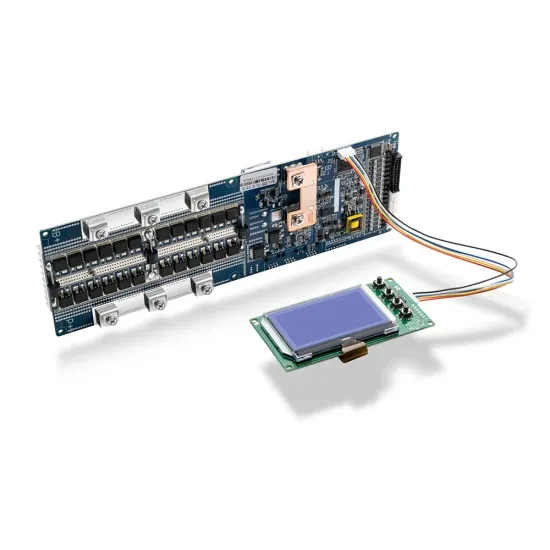

Energy Storage Equipment Project

Energy Storage Equipment Project

-

New Energy Storage Equipment Manufacturing Project

New Energy Storage Equipment Manufacturing Project

-

Ghana energy storage equipment renovation project

Ghana energy storage equipment renovation project

-

Rwanda factory energy-saving energy storage equipment project

Rwanda factory energy-saving energy storage equipment project

-

What equipment does the energy storage project have

What equipment does the energy storage project have

-

Central African Republic Energy Storage Equipment Renovation Project

Central African Republic Energy Storage Equipment Renovation Project

-

Hungarian Power Grid Energy Storage Equipment Procurement Project

Hungarian Power Grid Energy Storage Equipment Procurement Project

-

Electric Energy Storage Equipment Room Project

Electric Energy Storage Equipment Room Project

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.