Inversores solares fotovoltaicos de América del Sur empresas

Descargar PDF Gratis Ahora Home Market Analysis Energy & Power Research Power Equipment Research Solar Equipment Research Solar PV Inverter Research South America Solar PV

Get Price

Tamanho do mercado de inversores solares fotovoltaicos da

Compre Agora Baixar PDF Grátis Agora Home Market Analysis Energy & Power Research Power Equipment Research Solar Equipment Research Solar PV Inverter Research

Get Price

Top 5 Inverter Manufacturers In South America

Below are the list of the top 5 inverter manufacturers in South America — Ingeteam, Ginlong (Solis) Technologies, Mitsubishi Electric Corporation, Enphase Energy,

Get Price

PV Inverters

1.2 PV Inverters for Already Installed Systems (as of April 2019) System failures due to excessive power output of AC sources in the stand-alone grid If the power of the AC sources (e.g. PV

Get Price

South America Solar PV Inverters Market Size & Share Analysis

South America Solar PV Inverters analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report

Get Price

1500V product lineup featured by Sungrow at Intersolar South America

Sungrow, the global leading inverter supplier for renewables, presents its flagship 1500V inverters, featured residential and commercial rooftop PV inverter solutions at Intersolar

Get Price

South America Solar PV Inverters Market 2025 Trends and

The South America Solar PV Inverters Market is segmented by application, inverter type, and end-user. The residential segment is projected to retain its dominance in the market,

Get Price

South America Solar PV Inverters Market Size, Share, Growth,

The South America solar photovoltaic (PV) inverters market has been witnessing significant growth in recent years, driven by the increasing adoption of renewable energy sources,

Get Price

South America Solar PV Inverters Market

The number of utility-scale projects across South America is increasing rapidly, and choosing the best inverter is increasingly important to generate a massive

Get Price

to supply inverters for South America project

, an inverter company, has been selected to supply more than 45 of its ULTRA central inverters to the second-largest installation of its kind in South America.

Get Price

South America Solar PV Inverters Market

The number of utility-scale projects across South America is increasing rapidly, and choosing the best inverter is increasingly important to generate a massive amount of energy efficiently for

Get Price

South America Solar PV Inverters Market Size, Share

The string inverters segment is estimated to dominate the South America solar PV Inverters market due to its cost-effectiveness, ease of installation, and

Get Price

Top 5 Inverter Manufacturers In South America

Below are the list of the top 5 inverter manufacturers in South America — Ingeteam, Ginlong (Solis) Technologies, Mitsubishi Electric

Get Price

South America Solar PV Inverters Market Size, Share & Forecast

The string inverters segment is estimated to dominate the South America solar PV Inverters market due to its cost-effectiveness, ease of installation, and suitability for residential and

Get Price

Latin America''s Growing Solar Inverter Market Opportunities

With no doubt, countries like China, Taiwan, and Singapore overtake destinations like South America when it comes to technological prowess and electronics. You can just take

Get Price

South America Solar PV Inverters Market Size 2026

The South America Solar PV Inverters Market showcases significant regional diversity, with key markets spread across North America, Europe, Asia-Pacific, Latin America, and the Middle

Get Price

Strategic Planning for South America Solar PV Inverters Market

South America Solar PV Inverters Market: A Comprehensive Report (2019-2033) This comprehensive report provides an in-depth analysis of the South America Solar PV Inverters

Get Price

South America Solar PV Inverters Market 2024-2032

Solar photovoltaic (PV) inverters are an essential component of solar energy systems in South America. As the region embraces renewable energy sources, the South America Solar PV

Get Price

KSTAR Showcases Advanced Solar and Storage Solutions at

KSTAR, a global provider of power electronics and renewable energy solutions, presented its latest innovations in solar inverters and energy storage systems at Intersolar

Get Price

Standalone Three Phase PV Inverter Market

3 days ago· Regionally, the standalone three phase PV inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia

Get Price

South America Solar PV Inverters

The number of utility-scale projects across South America is increasing rapidly, and choosing the best inverter is increasingly important to generate a massive amount of energy efficiently for

Get Price

Top 7 Solar Panel Manufacturers in Brazil

Brazil, with its abundant sunshine and favorable government policies, is at the forefront of solar energy production in South America. In this article, we will explore the top seven solar

Get Price

Leading Solar Inverter and Energy Storage Solutions Provider

Sungrow, a global leader in renewable energy solutions in the USA, provides innovative solar power systems for diverse programs in North America.

Get Price

More related information

-

South America PV wide voltage 10kw single phase inverter

South America PV wide voltage 10kw single phase inverter

-

Chilean PV inverters

Chilean PV inverters

-

South America sine wave inverter manufacturer

South America sine wave inverter manufacturer

-

South America Solar Energy Storage Fire Fighting System

South America Solar Energy Storage Fire Fighting System

-

Inverters are required for communication base stations in the Republic of South Africa

Inverters are required for communication base stations in the Republic of South Africa

-

South America 96v to 220v inverter company

South America 96v to 220v inverter company

-

Energy storage batteries face market challenges in South America

Energy storage batteries face market challenges in South America

-

Differences between PV inverters

Differences between PV inverters

Commercial & Industrial Solar Storage Market Growth

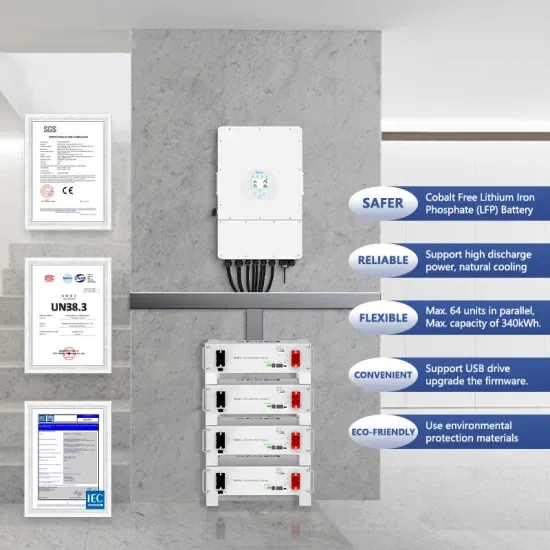

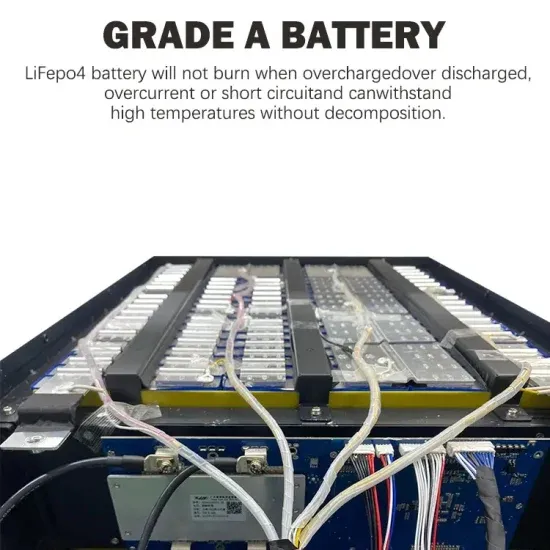

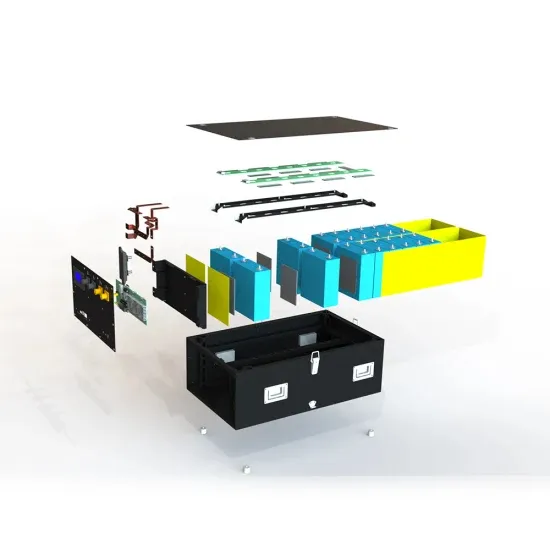

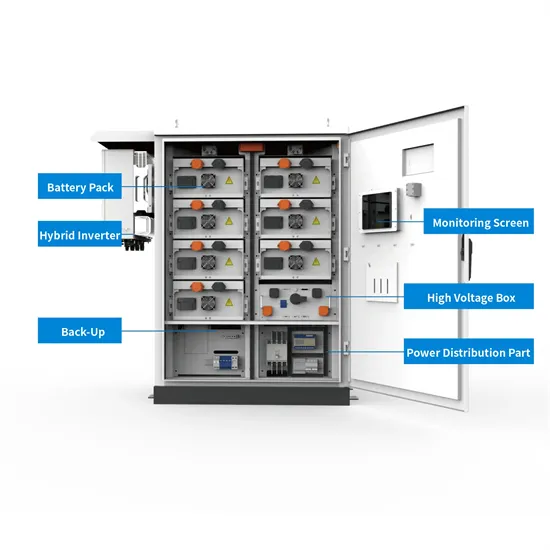

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.