Brazil Reinstates 12% Import Tariff on Photovoltaic Components!

On December 12, the Brazilian government approved measures to increase import tariffs on photovoltaic components and wind turbines, citing the promotion of local renewable

Get Price

Brazil Reinstates 12% Import Tariff on Photovoltaic

On December 12, the Brazilian government approved measures to increase import tariffs on photovoltaic components and wind turbines, citing

Get Price

Imports of photovoltaic cells in Brazil will be subject to higher

At its last meeting in 2023, CAMEX (Foreign Trade Chamber of Commerce) decided to increase, from zero to 9.6%, the tariff for importing photovoltaic cells assembled into

Get Price

How U.S. Solar Panel Trade Policies Are Reshaping Global

The United States'' solar panel import landscape has transformed dramatically over the past decade, reshaping global solar PV markets and domestic energy policies. Chinese

Get Price

Brazil has decided to impose a 12% import tariff on photovoltaic

According to foreign reports, on December 12 (last Tuesday), the Brazilian government approved measures to increase import tariffs on photovoltaic modules and wind

Get Price

Solar module prices rising in Brazil

Despite global overcapacity, several factors may contribute to a slight increase in solar panel prices in Brazil, with shipping costs and quotas for fiscal exemptions on imported

Get Price

PV Module Demand in Brazil''s Centralized Generation Market

The share of imported modules for this segment dropped to 23% of the 22.3 GWp total modules entering Brazil in 2024, down from 35% of the 17.5 GWp imported in 2023. A

Get Price

U.S. Energy Information Administration

Table 7. Photovoltaic module import shipments by country Imports at the national level are included in Table 6. Country of origin is not published to protect the confidentiality of individual

Get Price

Brazil Boosts Solar Module Import Tariff to 25%

Brazil hikes solar module tariffs to 25%, aiming to boost local manufacturing. But experts warn it might jeopardize 281 projects worth over BRL 97 billion.

Get Price

Brazil Imposes 25% Extra-Quota Tariff On Solar

Brazil has implemented a quota system for Solar Panels and core components, applying different rates for in-quota and extra-quota imports. While in-quota

Get Price

Prices of photovoltaic energy storage systems in Brazil

How much does solar energy cost in Brazil? The average monthly electricity bill for a house in Brazil is R$500, while the cost of installing solar energy on the roof is around R$15,000,

Get Price

Brazil increases import tariffs on solar modules to 25%

The Brazilian government has raised this week (12 November) the import tax rate on solar modules from 9.6% to 25%.

Get Price

Federal government imposes taxes on imports of solar modules

The import of wind turbines and solar panels in Brazil corresponds to 99% of all modules used, with the majority being imported from China. In 2022, imports of wind turbines

Get Price

Taxes on imported solar panels: Brazil says yes, the

From 2024 to 2027, photovoltaic modules assembled in Brazil will be subject to an import tariff of 10.8%. The shadow of new protectionist

Get Price

With the reintroduction of import taxes on Chinese solar panels, Brazil

For years, Brazil has relied on Chinese solar panels to power its green energy transition. With a new tax on solar energy equipment imports, this industry could be shaken.

Get Price

Brazil increases import tariffs on solar modules to 25

The Brazilian government has raised this week (12 November) the import tax rate on solar modules from 9.6% to 25%.

Get Price

Taxes on imported solar panels: Brazil says yes, the

From 2024 to 2027, photovoltaic modules assembled in Brazil will be subject to a 10.8% taxes on imported solar panels.

Get Price

Brazil Installed Solar Capacity Touches 50 GW In 2024

Brazil''s solar installed capacity recently reached 50 GW according to new data from the Brazilian Photovoltaic Solar Energy Association

Get Price

Brazil Imposes 25% Extra-Quota Tariff On Solar Panels: Major

While in-quota imports enjoy reduced tariffs, extra-quota imports incur high tariffs. In June 2024, Brazil''s Foreign Trade Secretariat (Secex) introduced a new quota allocation

Get Price

Shipping Guide for Imported PV Products from China

Basenton Logistics has negotiated shipping prices for many photovoltaic products, when you import from China, contact us to get the best export shipping cost for photovoltaic

Get Price

Cape Verde imported photovoltaic cell price list

Brazil imported 17.5GW of solar PV modules in 2023 Despite a decrease of 0.3GW modules imported between 2023 and 2022, the last quarter of 2023 ended on a positive note, with over

Get Price

Taxes on imported solar panels: Brazil says yes, the EU reflects

From 2024 to 2027, photovoltaic modules assembled in Brazil will be subject to an import tariff of 10.8%. The shadow of new protectionist measures also wraps Europe, but the

Get Price

Brazil has decided to impose a 12% import tariff on

According to foreign reports, on December 12 (last Tuesday), the Brazilian government approved measures to increase import tariffs on

Get Price

Brazil''s Solar Tax Hike Sparks Industry Alarm

Brazil''s Ministry of Development, Industry, Trade, and Services (MDIC) raised the import tax on solar modules from 9.6% to 25%.

Get Price

Brazil Penalizes the Import of Photovoltaics

The increase in the import tax on photovoltaic solar panels, announced by Brazil in 2023, puts at risk the installation of 18 GW of solar

Get Price

Solar module prices rising in Brazil

Despite global overcapacity, several factors may contribute to a slight increase in solar panel prices in Brazil, with shipping costs and quotas

Get Price

Brazil Announces Increase in Import Tariff on PV Modules to

SMM, Nov 18: The Brazil Ministry of Development, Industry and Foreign Trade (MDIC) announced on November 15 that the import tariff on PV modules would be increased

Get Price

Latest Solar Price Chart and Dashboard• Carbon Credits

Commercial solar PV refers to solar photovoltaic (PV) systems installed on businesses, offices, factories, and other commercial properties to generate

Get Price

Brazil Imposes 25% Extra-Quota Tariff On Solar

While in-quota imports enjoy reduced tariffs, extra-quota imports incur high tariffs. In June 2024, Brazil''s Foreign Trade Secretariat (Secex) introduced a new

Get Price

Brazil Imposes 25% Extra-Quota Tariff On Solar Panels: Major

Brazil has implemented a quota system for Solar Panels and core components, applying different rates for in-quota and extra-quota imports. While in-quota imports enjoy reduced tariffs, extra

Get Price

4 FAQs about [Price of imported photovoltaic panels in Brazil]

Which country exports most photovoltaic modules to Brazil?

Because most of Brazil's photovoltaic modules are imported from China. From January to October this year, China exported US$3.164 billion of photovoltaic modules to Brazil, ranking second among the top ten exporters of photovoltaic modules.

Why are solar panels so expensive in Brazil?

Despite global overcapacity, several factors may contribute to a slight increase in solar panel prices in Brazil, with shipping costs and quotas for fiscal exemptions on imported PV modules playing a key role. From pv magazine Brazil Brazil imported around 10.1 GW of PV modules between January and May, according to PV InfoLink.

When will photovoltaic imports come into force?

The measure, wanted by the Executive Management Committee of the Foreign Chamber of Commerce (Gecex-Camex), should enter into force on 1 January 2024 and remain active until 2017 with different methods for wind and solar. On photovoltaic import, in fact, it is not a matter of adding, but rather of taking away.

Is photovoltaic import a matter of adding or taking away?

On photovoltaic import, in fact, it is not a matter of adding, but rather of taking away. Gecex-Camex has decided to put an end to the reduction of the import tariffs of the assembled modules, since there is an internal production in the country, revoking also a series of fiscal subsidies on the import.

More related information

-

Price of imported photovoltaic panels in Canada

Price of imported photovoltaic panels in Canada

-

What is the price difference between grade A and grade B photovoltaic panels

What is the price difference between grade A and grade B photovoltaic panels

-

BESS price of photovoltaic panels in Panama

BESS price of photovoltaic panels in Panama

-

BESS price for home photovoltaic panels in Thailand

BESS price for home photovoltaic panels in Thailand

-

Can the price of photovoltaic panels fall further

Can the price of photovoltaic panels fall further

-

The actual price of photovoltaic panels

The actual price of photovoltaic panels

-

Latest price of 560w photovoltaic panels

Latest price of 560w photovoltaic panels

-

Price of home three-phase photovoltaic panels

Price of home three-phase photovoltaic panels

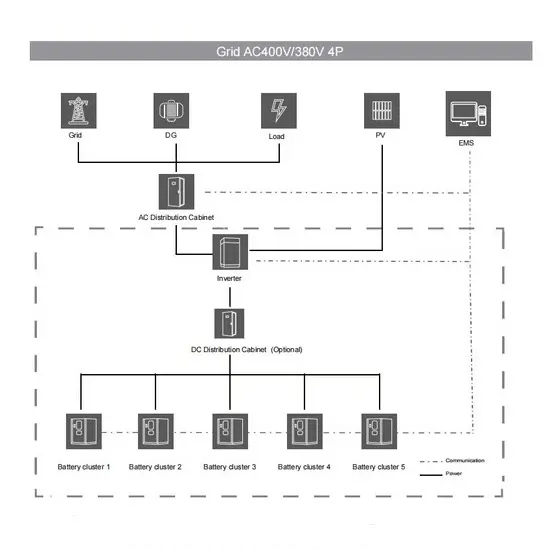

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

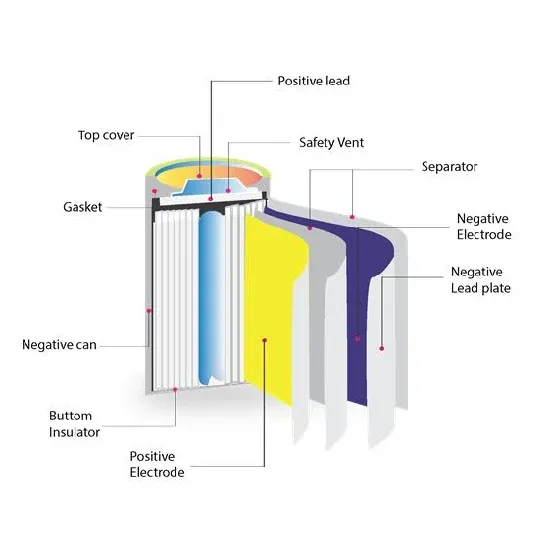

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.