Vanadium Redox Battery Market

By component type, the electrolyte segment accounted for 43% of the vanadium redox flow battery market size in 2024, while membranes are

Get Price

Vanadium Redox Flow Battery Market | Industry

Vanadium flow batteries boast longer cycle life, greater scalability, and the ability to provide stable energy over extended periods, making them ideal for both

Get Price

Vanadium Redox Flow Battery Market | Industry Report, 2030

Vanadium flow batteries boast longer cycle life, greater scalability, and the ability to provide stable energy over extended periods, making them ideal for both utility-scale projects and industrial

Get Price

All Vanadium Redox Flow Battery Market Size 2025-2030

In short, this section orients executives to the technical, operational, and commercial levers that determine where and how all‑vanadium redox flow batteries are being evaluated today and

Get Price

Vanadium Flow Batteries: Industry Growth & Potential

Vanadium is a high-strength, corrosion-resistant metal widely used to improve the performance of steel alloys, but it is also emerging as a promising material in next-generation

Get Price

All Vanadium Redox Flow Battery: Competitive Landscape and

The All Vanadium Redox Flow Battery (VRFB) market is experiencing robust growth, projected to reach a market size of $70.4 million in 2025 and exhibiting a Compound Annual Growth Rate

Get Price

Development of the all‐vanadium redox flow battery for energy

The commercial development and current economic incentives associated with energy storage using redox flow batteries (RFBs) are summarised. The analysis is focused on

Get Price

Top 10 Companies in the All-Vanadium Redox Flow Batteries Industry

In this analysis, we profile the Top 10 Companies in the All-Vanadium Redox Flow Batteries Industry —technology innovators and project developers who are commercializing

Get Price

DOE ESHB Chapter 6 Redox Flow Batteries

Abstract Redox flow batteries (RFBs) offer a readily scalable format for grid scale energy storage. This unique class of batteries is composed of energy-storing electrolytes, which are pumped

Get Price

Principle, Advantages and Challenges of Vanadium Redox Flow

Examples of the electrochemical evaluation of the performance of a redox flow battery (a) Galvanostatic charge/ discharge and (b) Cell voltage of the battery for different

Get Price

Vanadium Redox Battery Market

By component type, the electrolyte segment accounted for 43% of the vanadium redox flow battery market size in 2024, while membranes are advancing at an 18.6% CAGR

Get Price

All Vanadium Redox Flow Battery Market Size 2025-2030

Discover the latest trends and growth analysis in the All Vanadium Redox Flow Battery Market. Explore insights on market size, innovations, and key industry players.

Get Price

Global All Vanadium Redox Flow Battery Market Outlook,

1 day ago· The global All Vanadium Redox Flow Battery market is projected to grow from US$ 23.4 million in 2024 to US$ 70.4 million by 2031, at a CAGR of 17.3% (2025-2031), driven by

Get Price

All Vanadium Redox Flow Battery Vrfb Store Energy Market: A

All Vanadium Redox Flow Battery Vrfb Store Energy Market Size was estimated at 448.07 (USD Billion) in 2023. The All Vanadium Redox Flow Battery Vrfb Store Energy Market Industry is

Get Price

All-Vanadium Redox Flow Battery Market 2024-2031: Industry

The global All-Vanadium Redox Flow Battery market size was valued at USD 426.56 million in 2022 and is expected to expand at a CAGR of 73.

Get Price

Top 10 Companies in the All-Vanadium Redox Flow Batteries

In this analysis, we profile the Top 10 Companies in the All-Vanadium Redox Flow Batteries Industry —technology innovators and project developers who are commercializing

Get Price

Vanadium Redox Flow Battery Market Size, Share

Based on product type, the global vanadium redox flow battery market is segmented into graphene electrodes and carbon-felt electrodes. The carbon

Get Price

China Sees Surge in 100MWh Vanadium Flow Battery Energy

Except for SPIC, all other projects explicitly specified vanadium flow battery systems. The majority of these tenders were organized by subsidiaries of CNNC, showcasing

Get Price

Vanadium redox flow batteries

A Redox Flow Battery (RFB) is a special type of electrochemical storage device. Electric energy is stored in electrolytes which are in the form of bulk fluids stored in two

Get Price

Vanadium Redox Flow Battery Market Size & Growth

Vanadium Redox Flow Battery Market Size Will reach $ 1,214.97 Mn by 2030, exhibiting a CAGR of 19.5%. Global VRFB Market Report Based on Market

Get Price

Comprehensive Analysis of Critical Issues in All

Vanadium redox flow batteries (VRFBs) can effectively solve the intermittent renewable energy issues and gradually become the most

Get Price

Bringing Flow to the Battery World (II)

RFBs typically serve applications similar to those served by lithium-ion batteries (LIBs). The applications include energy shifting, backup power, microgrids and ancillary

Get Price

Vanadium Redox Flow Battery Market Size, Share | Industry

Based on product type, the global vanadium redox flow battery market is segmented into graphene electrodes and carbon-felt electrodes. The carbon-felt electrodes segment is

Get Price

Development status, challenges, and perspectives of key

All-vanadium redox flow batteries (VRFBs) have experienced rapid development and entered the commercialization stage in recent years due to the characteristics of

Get Price

Fact Sheet: Vanadium Redox Flow Batteries (October 2012)

Unlike other RFBs, vanadium redox flow batteries (VRBs) use only one element (vanadium) in both tanks, exploiting vanadium''s ability to exist in several states. By using one element in

Get Price

Vanadium Redox Flow Batteries

Guidehouse Insights has prepared this white paper, commissioned by Vanitec, to provide an overview of vanadium redox flow batteries (VRFBs) and their market drivers and barriers.

Get Price

ALL-VANADIUM REDOX FLOW BATTERY

The fluorine-free proton exchange membrane independently developed by CE, which is composed of hydrocarbon polymers, has excellent performance and can be used for a variety

Get Price

Bringing Flow to the Battery World (II)

RFBs typically serve applications similar to those served by lithium-ion batteries (LIBs). The applications include energy shifting, backup

Get Price

6 FAQs about [Entering the all-vanadium redox flow battery industry]

How can vanadium redox flow batteries increase their share in energy storage?

Overcoming the barriers related to high capital costs, new supply chains, and limited deployments will allow VRFBs to increase their share in the energy storage market. Guidehouse Insights has prepared this white paper, commissioned by Vanitec, to provide an overview of vanadium redox flow batteries (VRFBs) and their market drivers and barriers.

How has Emergen research segmented the global vanadium redox flow battery market?

For the purpose of this report, Emergen Research has segmented the global vanadium redox flow battery market on the basis of product type, application, end-use, and region: What is the expected revenue Compound Annual Growth Rate (CAGR) of the global vanadium redox flow battery market over the forecast period (2023–2032)?

What is a vanadium redox battery?

The vanadium redox battery is a genuine Redox Flow Battery (RFB) that uses vanadium redox couples to store energy. These active ingredient species are completely always dissolved in sulfuric electrolyte solutions.

What is the global vanadium redox flow battery (VRFB) market size?

The global Vanadium Redox Flow Battery (VRFB) market size was USD 242.0 Million in 2022 and is expected to register a revenue CAGR of 19.9% during the forecast period. Rising demand for environmental battery solutions and increasing need for energy storage systems are factors driving market revenue growth.

What is a redox flow battery?

Although there are many different flow battery chemistries, vanadium redox flow batteries (VRFBs) are the most widely deployed type of flow battery because of decades of research, development, and testing. VRFBs use electrolyte solutions with vanadium ions in four different oxidation states to carry charge as Figure 2 shows.

Will flow battery suppliers compete with metal alloy production to secure vanadium supply?

Traditionally, much of the global vanadium supply has been used to strengthen metal alloys such as steel. Because this vanadium application is still the leading driver for its production, it’s possible that flow battery suppliers will also have to compete with metal alloy production to secure vanadium supply.

More related information

-

All-vanadium redox flow battery industry

All-vanadium redox flow battery industry

-

Jordan s all-vanadium redox flow battery layout

Jordan s all-vanadium redox flow battery layout

-

Ethiopia All-Vanadium Redox Flow Battery Energy Storage Project

Ethiopia All-Vanadium Redox Flow Battery Energy Storage Project

-

Finnish all-vanadium redox flow battery

Finnish all-vanadium redox flow battery

-

All-vanadium redox flow battery discharge rate

All-vanadium redox flow battery discharge rate

-

American all-vanadium redox flow battery brand

American all-vanadium redox flow battery brand

-

All-vanadium redox flow battery 100mw

All-vanadium redox flow battery 100mw

-

Kenya Industrial All-vanadium Redox Flow Battery Project

Kenya Industrial All-vanadium Redox Flow Battery Project

Commercial & Industrial Solar Storage Market Growth

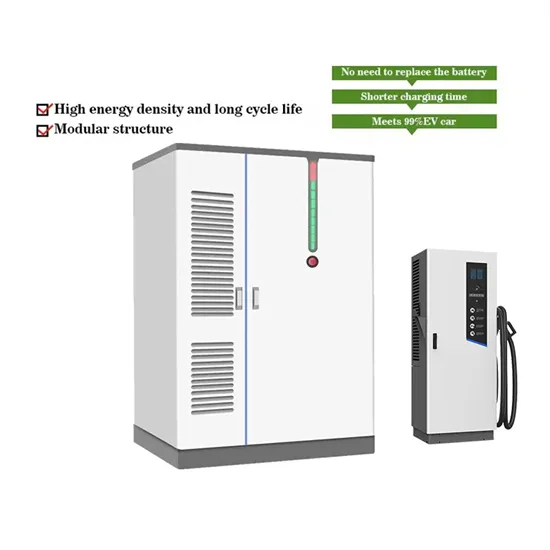

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.