Types of Assets: Asset Classification & Examples

Valuing a company or preparing its financial statements requires a good grasp of assets and their classification. There are many different ways to classify

Get Price

CHART OF ACCOUNTS

The following list of equipment is not in any way all-inclusive but does represent many of the common equipment items. Items of built-in or fixed equipment are not included in the list

Get Price

What are Assets?

Types of Asset Classes So what is an asset class? When assets are presented on the balance sheet, they are typically divided into different classes or

Get Price

List of Furniture and Fittings in Accounting: Essential Items for

List of Furniture and Fittings in Accounting: Essential Items for Your Office Table of contents Key Takeaways Understanding Furniture and Fittings in Accounting Classification of Assets

Get Price

9 General Categories of Fixed Assets (With Explanation)

What are the Main Types of Assets? An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic

Get Price

Asset Classification Analysis: How to Classify Your Assets into

These are some of the common ways to classify assets into different categories and subcategories. However, there is no one-size-fits-all approach, and the classification may

Get Price

Asset Classification: How to Categorize and Group

Asset classification is the process of organizing and categorizing your assets based on their characteristics and functions. It is an important step

Get Price

Types of Assets

What are the Main Types of Assets? An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic

Get Price

The proper classification of fixed assets — AccountingTools

If an asset meets both of the preceding criteria, then the next step is to determine its proper account classification. The most common classifications used are noted below.

Get Price

What Expense Category Does Equipment Come Under?

Fixed assets are long-term investments used for business operations and not intended for resale. This classification distinguishes equipment from short-term assets like

Get Price

What Are the Classifications Of An Asset? | Finance

Asset Classification Assets are classified by different characteristics they have. Some of those characteristics include an asset:

Get Price

Asset Classification: How to Categorize and Group Your Assets

Asset classification is the process of organizing and categorizing your assets based on their characteristics and functions. It is an important step in asset management, as it helps

Get Price

Examples of fixed assets — AccountingTools

When acquired, fixed assets are recorded in a fixed asset account. For accounting purposes, these items are segregated into multiple accounts, based on their characteristics.

Get Price

Property vs. expense: unraveling the classification of air

The classification of assets, including air conditioner s, as fixed or current is crucial for effective financial reporting and decision-making. Understanding the criteria that determine

Get Price

Accounting for Repair Expenses: Classification, Treatment, and

Explore the nuances of accounting for repair expenses, their classification, treatment, and the broader financial and tax implications for businesses.

Get Price

Office equipment definition — AccountingTools

Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. This account is classified as a long-term asset account.

Get Price

Assets: Definition and Classification in Financial Statements

Explore the definition and classification of assets in financial statements, focusing on current and non-current assets and their significance in evaluating a company''s financial

Get Price

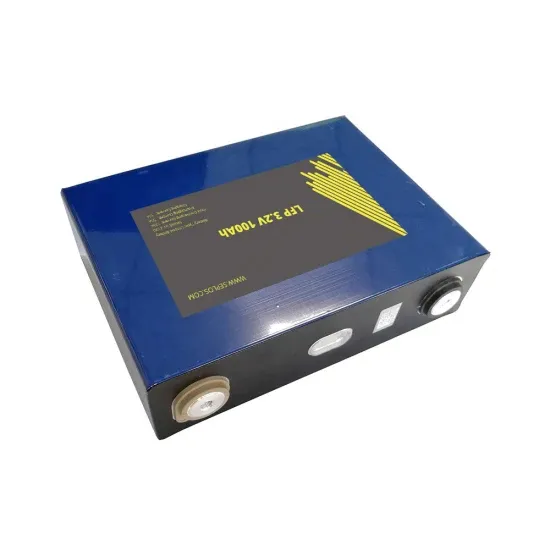

Would you capitalize a machine battery? : r/Accounting

I''ve reviewed AS-10 and I''m conflicted as to whether or not the batteries should be capitalized. They do not increase the revenue producing capabilities of the machine, but I''m not sure if

Get Price

Guidelines for Distinguishing Between Supplies and Equipment

Guidelines for Distinguishing Between Supplies and Equipment One common accounting challenge districts face is that of distinguishing between supplies and equipment, between

Get Price

The proper classification of fixed assets — AccountingTools (2025)

3 days ago· Fixed assets are tangible, long-lived assets used by a company in its operations, such as machinery, factories, tools, furniture and computers. They are listed in the noncurrent

Get Price

Examples of fixed assets — AccountingTools

For example, computer software would fall into a Software fixed asset classification, while a building would fall into a Buildings classification. Examples of Fixed

Get Price

Microsoft Word

Expenditures made by districts for equipment, improvement of sites, building fixtures and service systems are charged as capital outlay; expenditures for supplies are charged as current

Get Price

Capital cost allowance (CCA) classes

Capital cost allowance (CCA) classes Footnotes Property in Class 14.1 is excluded from the definition of capital property for GST/HST purposes. 1 You can choose to

Get Price

9 General Categories of Fixed Assets (With Explanation)

Fixed assets are the balance sheet items. They are reported at their book value at the end of the accounting period in different categories based on nature, their use, and the depreciation rate.

Get Price

What does the battery cabinet invoicing code belong to

Battery Cabinet | New and Used Battery Cabinets for Sale Battery cabinets from diverse manufacturers APC, Toshiba, CC Power, Eaton, Powerware, Mitsubishi, Narada, and

Get Price

6 FAQs about [What asset classification does the battery cabinet belong to ]

How are fixed assets classified?

When acquired, fixed assets are recorded in a fixed asset account. For accounting purposes, these items are segregated into multiple accounts, based on their characteristics. For example, computer software would fall into a Software fixed asset classification, while a building would fall into a Buildings classification.

Is equipment a fixed asset or a non-current asset?

Equipment is a fixed asset, or a non-current asset. This means it's not going to be sold within the next accounting year and cannot be liquidized easily. While it's good to have current assets that give your business ready access to cash, acquiring long-term assets can also be a good thing. What are the four levels of classification?

What are the different types of assets?

An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic benefit. Common types of assets include current, non-current, physical, intangible, operating, and non-operating.

How are assets classified?

Assets are generally classified in three ways: Convertibility: Classifying assets based on how easy it is to convert them into cash. Physical Existence: Classifying assets based on their physical existence (in other words, tangible vs. intangible assets). Usage: Classifying assets based on their business operation usage/purpose.

What is a fixed assets line item?

This fixed assets line item is paired with an contra account to reveal the net amount of fixed assets on the books of the reporting entity. Fixed assets are items that are expected to provide a benefit to the purchasing organization for more than one reporting period.

How do you classify assets based on their characteristics?

For example, by classifying your assets into different categories based on their characteristics, such as tangible or intangible, fixed or current, or owned or leased, you can report your asset values, liabilities, and equity in accordance with the relevant accounting standards and principles.

More related information

-

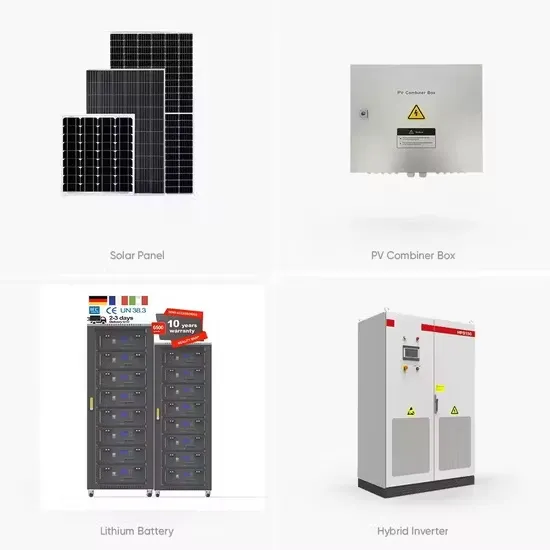

What parts does the battery cabinet of energy storage products include

What parts does the battery cabinet of energy storage products include

-

What are the battery cabinet manufacturers

What are the battery cabinet manufacturers

-

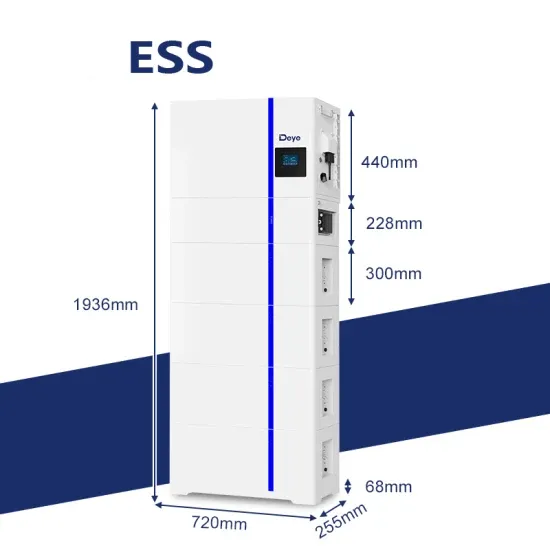

What are the dimensions and specifications of the floor-standing battery cabinet

What are the dimensions and specifications of the floor-standing battery cabinet

-

What brand of battery cabinet is it

What brand of battery cabinet is it

-

What is the maximum power of the new energy battery cabinet

What is the maximum power of the new energy battery cabinet

-

What is the approximate current of the energy storage cabinet battery

What is the approximate current of the energy storage cabinet battery

-

What to do if the battery in the energy storage cabinet becomes hot

What to do if the battery in the energy storage cabinet becomes hot

-

What are the battery swap cabinet sites in Maldives

What are the battery swap cabinet sites in Maldives

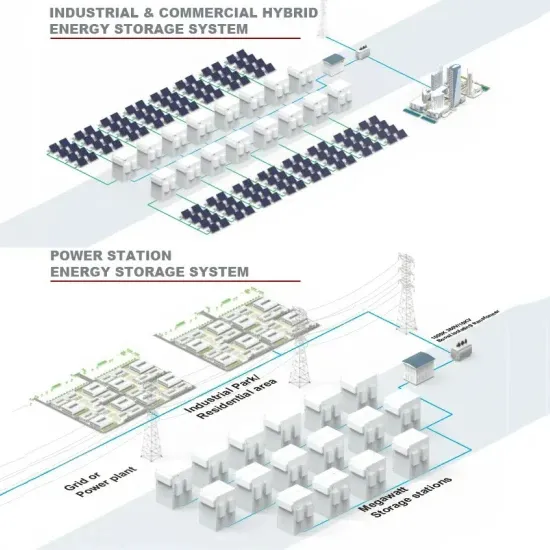

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.