6 Infrastructure Projects to Watch in Eastern Libya

Several infrastructure projects are underway in eastern Libya, aimed at supporting long-term economic growth.

Get Price

Total Energies, GECOL and REAoL launch 500 MW

At a site ceremony yesterday, France''s Total Energies, the General Electricity Company of Libya (GECOL) and the Renewable Energy

Get Price

LIBYA''S SOLAR AND WIND AMBITIONS: MOVING BEYOND

Libya''s ambitions with regard to wind and solar energy is not just about power generation; it''s a reflection of a broader vision. A vision that seeks to harness its natural

Get Price

Research on Offshore Wind Power Communication System Based on 5G

Result After the completion of the 5G communication system based on PTN+ integrated small base station, IP transmission based on optical transmission, supporting

Get Price

Optimal Scheduling of 5G Base Station Energy Storage

This research is devoted to the development of software to increase the efficiency of autonomous wind-generating substations using panel structures, which will allow the use of

Get Price

Establishing 5G Communications Networks in Libya

Building 5G communication networks demands a strategic short- and medium-term investment plan to execute infrastructure projects. This includes installing 5G equipment and training

Get Price

5G Infrastructure Network in Libya

The deployment of 5G infrastructure requires substantial investment in physical network components, including base stations, small cells, and fiber-optic backhaul.

Get Price

Massive wind and solar power project in Gansu

The first one million kilowatt wind and solar power project of China''s first 10 million kilowatt multi-energy complementary comprehensive

Get Price

Research and Implementation of 5G Base Station Location

Guoqing Chen, Xin Wang, and Guo Yang Abstract The application requirements of 5G have reached a new height, and the location of base stations is an important factor affecting the

Get Price

Libya''s telecom authority reviews progress on 5G roadmap

During a meeting at the Authority''s HQ, the committee provided an update on its work, including the evaluation of the draft 5G roadmap. The presentation covered technical

Get Price

Low-Carbon Sustainable Development of 5G Base Stations in China

As 5G serves as the foundation for the construction of new infrastructure, China, as the world leader in 5G base station construction, has already built over 1.4 million 5G base

Get Price

Top Renewable Energy Projects in Libya

Such targets are aligned with the 2030 vision of the General Authority for Electricity and Renewable Energy, which seeks to grow clean energy capacity, particularly in solar and

Get Price

Energy-efficiency schemes for base stations in 5G heterogeneous

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

Get Price

Optimal Site Selection of Wind-Solar Complementary Power

Abstract: The wind-solar hybrid power generation project combined with electric vehicle charging stations can effectively reduce the impact on the power system caused by the random

Get Price

China''s first multi-energy and complementary integrated energy base

Relying on the construction of the base, China Huaneng will join hands with the upstream and downstream of the industrial chain to carry out joint innovations, focusing on key

Get Price

Global 5G Base Station Industry Research Report

The 5G base station is the core device of the 5G network, providing wireless coverage and realizing wireless signal transmission between the wired

Get Price

Projects at China''s 1st 10 Million KW Multi-Energy

A view of the 1 million-kilowatt wind-solar power project in Qingyang, Northwest China''s Gansu Province, the first project to enter service

Get Price

Optimization Configuration Method of Wind-Solar and Hydrogen

5G is a strategic resource to support future economic and social development, and it is also a key link to achieve the dual carbon goal. To improve the economy.

Get Price

Optimal Scheduling of 5G Base Station Energy Storage Considering Wind

This research is devoted to the development of software to increase the efficiency of autonomous wind-generating substations using panel structures, which will allow the use of

Get Price

Optimal Scheduling of 5G Base Station Energy Storage Considering Wind

This article aims to reduce the electricity cost of 5G base stations, and optimizes the energy storage of 5G base stations connected to wind turbines and photovoltaics. Firstly, established

Get Price

Harnessing the Desert Sun: Libya''s Vision for a

Libya aims to generate 10% of its power from renewable energy by 2025, following the construction of several large-scale solar photovoltaic

Get Price

Research on Comprehensive Complementary Characteristics

Wind energy, solar energy and hydropower have become the three most widely developed and utilized renewable energy resources. Wind-solar-hydro combined power generation systems

Get Price

Younis E. Abdalla, Int. J. Sci. R. Tech., 2024 1(11), 247-

By addressing the challenges and considerations associated with 5G deployment and establishing a conducive regulatory framework, Libya can position itself at the forefront of the digital

Get Price

Renewable energy powered sustainable 5G network

Renewable energy is considered a viable and practical approach to power the small cell base station in an ultra-dense 5G network infrastructure to reduce the energy provisions

Get Price

Harnessing the Desert Sun: Libya''s Vision for a Cleaner Future

Libya aims to generate 10% of its power from renewable energy by 2025, following the construction of several large-scale solar photovoltaic plants currently underway.

Get Price

Modeling and aggregated control of large-scale 5G base stations

A significant number of 5G base stations (gNBs) and their backup energy storage systems (BESSs) are redundantly configured, possessing surplus capacit

Get Price

LIBYA''S SOLAR AND WIND AMBITIONS: MOVING

Libya''s ambitions with regard to wind and solar energy is not just about power generation; it''s a reflection of a broader vision. A vision that

Get Price

6 FAQs about [Libya 5G communication base station wind and solar complementary construction project]

Can Libya become a green energy hub?

Diplomatic and Trade Opportunities: Becoming a green energy hub can open avenues for Libya in international renewable energy markets and collaborations. Challenges Ahead

Why is Libya investing in solar & wind power?

In a world rapidly shifting its energy focus, Libya, known predominantly for its vast oil reserves, is embracing a vision that might once have seemed improbable. The nation is investing in solar and wind power, signalling its commitment to a more diversified and sustainable energy future.

Should a company participate in Libya's energy transition?

From a strategic perspective, participating in Libya’s energy transition can cement a company’s goodwill and secure ties with a nation known for its oil reserves’ geopolitical significance.

What is the new perspective in sustainable 5G networks?

The new perspective in sustainable 5G networks may lie in determining a solution for the optimal assessment of renewable energy sources for SCBS, the development of a system that enables the efficient dispatch of surplus energy among SCBSs and the designing of efficient energy flow control algorithms.

Who is building a solar power plant in Libya?

Construction of the plant is being led by Alhandasya, a Libyan company specialized in engineering services, electromechanical works and renewable energy development and implementation. The construction of a solar photovoltaic power plant is already underway in Kufra, with a planned capacity of 100 MWp.

How will a 5G base station affect energy costs?

According to the mobile telephone network (MTN), which is a multinational mobile telecommunications company, report (Walker, 2020), the dense layer of small cell and more antennas requirements will cause energy costs to grow because of up to twice or more power consumption of a 5G base station than the power of a 4G base station.

More related information

-

Brunei 5G communication base station wind and solar complementary project

Brunei 5G communication base station wind and solar complementary project

-

Maldives 5G communication base station wind and solar complementary

Maldives 5G communication base station wind and solar complementary

-

How is the construction of wind and solar complementary 5G communication base stations in Tajikistan progressing

How is the construction of wind and solar complementary 5G communication base stations in Tajikistan progressing

-

Vanuatu 5G Communication Base Station Inverter Construction Project

Vanuatu 5G Communication Base Station Inverter Construction Project

-

Communication base station wind and solar complementary cooling company

Communication base station wind and solar complementary cooling company

-

Property rights unit of wind and solar complementary communication base station

Property rights unit of wind and solar complementary communication base station

-

Tunisia 5G Communication Base Station Inverter Grid Connection Construction Project

Tunisia 5G Communication Base Station Inverter Grid Connection Construction Project

-

Nigeria 5G Communication Base Station Energy Management Construction Project

Nigeria 5G Communication Base Station Energy Management Construction Project

Commercial & Industrial Solar Storage Market Growth

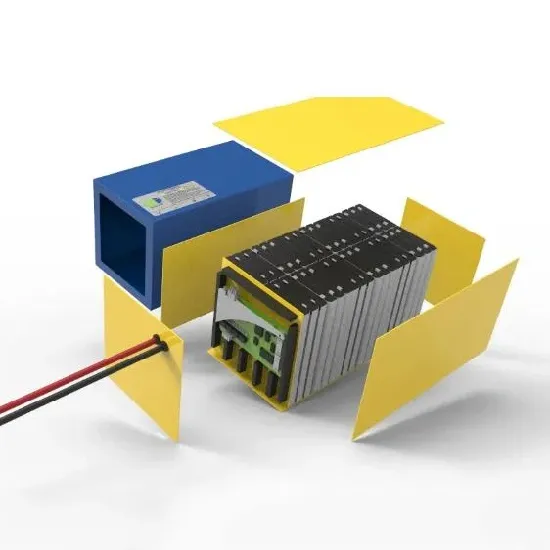

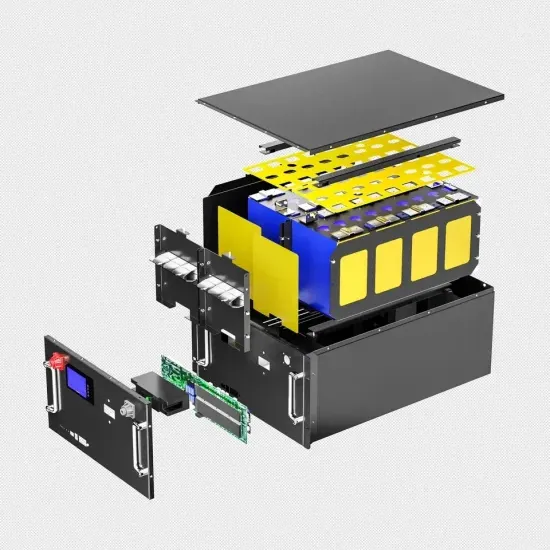

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.