Top 10: Energy Storage Companies | Energy Magazine

By supplying high-quality lithium products and driving innovation in battery technology, it enables the widespread adoption of renewable energy

Get Price

12 Best Energy Storage Stocks to Buy in 2025

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth as the demand for renewable energy

Get Price

Which companies are investing in energy storage projects?

Various players, from tech companies to established energy firms, are entering this lucrative market, providing innovative solutions ranging from residential applications to

Get Price

Energy storage manufacturer invests $100M to build assembly

Hithium Tech USA Inc. has announced plans to establish a new battery module and system assembly facility in Mesquite, Texas. The company, which specializes in stationary

Get Price

U.S. Battery Storage Manufacturers Commit $100B to

U.S.-based battery storage technology firms are uniting to commit to investing $100 billion toward building and buying American-made energy

Get Price

Energy Storage Rides a Wave of Growth but Uncertainty Looms:

This report comes to you at the turning of the tide for energy storage: after two years of rising prices and supply chain disruptions, the energy storage industry is starting to see price

Get Price

Top 10: Hydrogen Companies | Energy Magazine

2. Air Products Industrial gas giant Air Products is a global leader in liquefied natural gas (LNG) processing technology and equipment, one of the world''s largest suppliers

Get Price

Li-Cycle

As of August 8th 2025, Li-Cycle has been acquired by Glencore Plc. We''re excited for Li-Cycle to be part of Glencore and confident that this will bring continued value and enhanced service to

Get Price

North America''s EV Battery Manufacturing and Energy Storage

Discover the top EV battery manufacturing and energy storage projects currently underway or slated for construction in North America. Read now!

Get Price

Top Battery Storage Companies to Watch in 2025

This has led to substantial investment and development in alternative chemistries and mechanical systems, such as iron-air batteries (Form Energy), gravity-based storage

Get Price

Best Solar Power Stocks Of 2025 – Forbes Advisor

It also offers power optimizers, "smart energy" management tools, energy storage solutions and other add-ons that help make the most of solar arrays.

Get Price

U.S. Battery Storage Manufacturers Commit $100B to Production

U.S.-based battery storage technology firms are uniting to commit to investing $100 billion toward building and buying American-made energy storage. This week, the American

Get Price

Top Battery Storage Companies to Watch in 2025

This has led to substantial investment and development in alternative chemistries and mechanical systems, such as iron-air batteries

Get Price

Leading storage players feature in Energy Transition Power List

Make up of Tamarindo Energy Transition Power List 2024 reflects the global surge in energy storage deployment Key players from major investment funds & storage developers

Get Price

Top 10 energy storage manufacturers in Spain

In 2022, Iberdrola invested 10.7 billion euros, successfully boosted its installed capacity to 40GW, an increase of 5% year-on-year, and launched its first

Get Price

Top 19 Energy Storage Investors in the US

Khosla Ventures has a notable focus on energy storage, having invested in companies such as Ambri, which is developing liquid metal battery technology for grid-scale energy storage, and

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid

Get Price

U.S. Energy Storage Industry to Invest $100 Billion in

The energy storage industry is planning to deliver and expand upon these investments and continue the battery manufacturing boom jump-started by rapid energy storage deployment.

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid-scale storage and other

Get Price

مرزا پکا یک اے جو کہیں ہماری بات سخت اے وہ بھی یک اے

Tesla has invested heavily in creating powerful and long-lasting batteries, not only for cars but also for energy storage solutions like Powerwall. Autopilot and Full Self-Driving: Tesla''s

Get Price

Grid-Scale Battery Storage Companies Make $100B US

A coalition of companies making and using large batteries for energy storage on the electric grid announced Tuesday a $100 billion investment commitment to make and buy

Get Price

Top 10: Energy Storage Companies | Energy Magazine

By supplying high-quality lithium products and driving innovation in battery technology, it enables the widespread adoption of renewable energy and, as well as this,

Get Price

U.S. Energy Storage Industry to Invest $100 Billion in

Industry Commits to Investing $100 Billion into Building and Buying American-Made Grid Batteries The U.S. energy storage industry is committed to investing more than $100 billion in American

Get Price

The Economics of Tesla''s Batteries Business

Tesla is breaking ground in electric cars, solar panels, and clean energy storage. Here''s a closer look at the economics of Tesla batteries.

Get Price

Energy Storage Is Now Booming As The World Moves Faster To Renewable Energy

BNEF forecasts a 122x increase in global energy storage from 2018 to 2040. Some listed energy storage companies and some ETFs to consider.

Get Price

Residential battery storage market competition is

As noted in our 2024 Energy Storage System Buyer''s Guide, the market is jam packed with new solutions and new companies vying for their

Get Price

Energy Storage Grand Challenge Energy Storage Market

This report, supported by the U.S. Department of Energy''s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected

Get Price

Energizing American Battery Storage Manufacturing

One, the United States will continue to face barriers in meeting its full solar and energy storage potential without a robust domestic manufacturing base. And two, the country''s

Get Price

6 FAQs about [Are energy storage products invested in by manufacturers ]

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

Why is battery energy storage important?

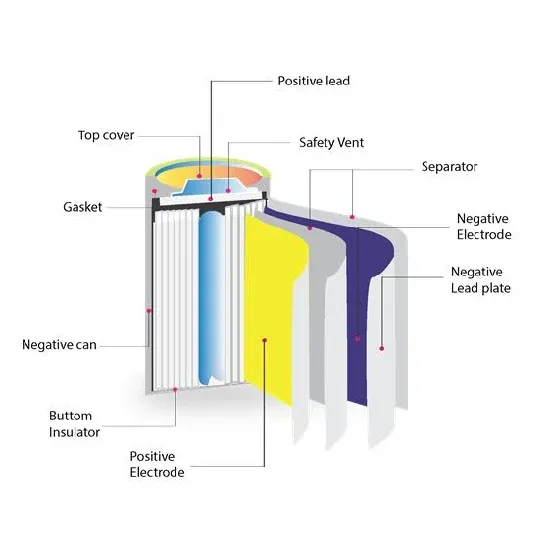

At the heart of this transition lies battery energy storage, an indispensable technology for ensuring grid stability, reliability, and the efficient integration of intermittent power generation from sources like solar and wind.

Does Tesla have a battery storage business?

Tesla has been growing its energy storage business in recent years. Established as a key player in the electric automotive industry, it has diversified its offerings to include battery storage — now one of its strongest offerings. Tesla Energy’s energy storage business has never been better.

Why should you invest in battery storage?

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an accelerating shift to renewables, surging electricity demand from new industrial loads, and supportive policy frameworks worldwide.

Why do electric utilities need storage?

Storage can also help electric utility companies make the grid more resilient to interruptions from extreme weather, avoiding costly and dangerous outages. Workers assembling an iron-based battery at the Form Energy factory in Weirton, West Virginia.

Should battery energy storage be integrated with renewables?

Battery energy storage, particularly when integrated with renewables, offers a faster and more flexible deployment solution compared to traditional power generation methods.

More related information

-

South American energy storage lithium battery manufacturers

South American energy storage lithium battery manufacturers

-

Low-cost home energy storage products

Low-cost home energy storage products

-

Huawei Bahamas Industrial Energy Storage Products

Huawei Bahamas Industrial Energy Storage Products

-

How do home energy storage products store energy

How do home energy storage products store energy

-

Energy storage battery system manufacturers

Energy storage battery system manufacturers

-

Microgrid small energy storage equipment manufacturers

Microgrid small energy storage equipment manufacturers

-

Energy storage container photovoltaic manufacturers

Energy storage container photovoltaic manufacturers

-

Energy storage cabinet manufacturers

Energy storage cabinet manufacturers

Commercial & Industrial Solar Storage Market Growth

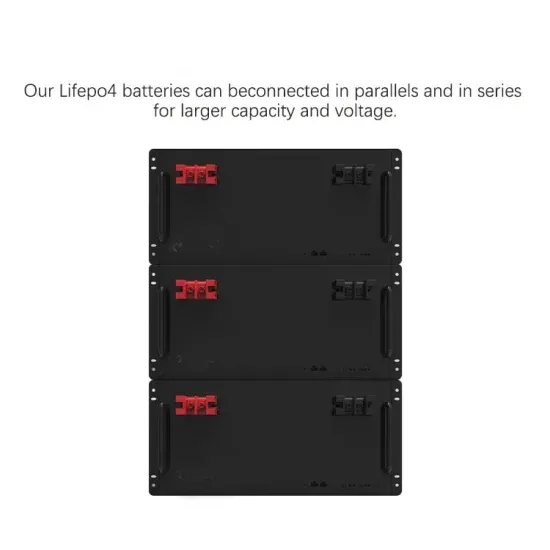

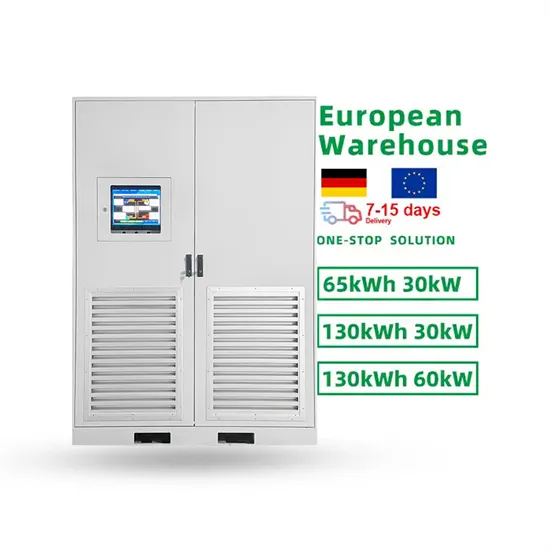

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.