Telkomsel takes base stations to the borders

Indonesian operator Telkomsel, the mobile arm of Telkom Indonesia, has announced further progress with delivering connectivity to disadvantaged areas of the country.

Get Price

base station | English to Indonesian | Telecom (munications)

In radio communications, a base station is a wireless communications station installed at a fixed location.

Get Price

Techno-economic analysis of an optimized hybrid

Nowadays, the implementation of the telecommunications industry in Indonesia should be encouraged to be more environmentally friendly,

Get Price

Indonesia LTE Base Station System Market (2025-2031)

The Indonesia LTE base station system market is poised for significant growth in the coming years, driven by the increasing demand for high-speed internet connectivity and the rapid

Get Price

Long way to 5G in Indonesia – MTN Consulting

Indonesia, the world''s fourth most populous country, is expected to face an uphill battle to enable 5G. Reasons include its complex geography, unavailability of

Get Price

Indonesia Cellular Network Map

Currently, there are six cellular operators operating in Indonesia using various generations of cellular networks. The number of BTS owned by each operator

Get Price

Indonesia | Telecommunication Statistics: Network Data | CEIC

Discover data on Telecommunication Statistics: Network Data in Indonesia. Explore expert forecasts and historical data on economic indicators across 195+ countries.

Get Price

Teleglobal and Kacific delivering mobile backhaul services for

Kacific has partnered with Indonesian operator Teleglobal to provide a large-scale deployment of mobile backhaul services to the archipelago''s major telecommunications

Get Price

BAKTI to build 630 new cell towers in remote parts of Indonesia

Indonesia''s Telecommunications and Information Accessibility Agency (BAKTI) has outlined plans to construct 630 base transceiver stations (BTS) in remote areas by the end of

Get Price

Indonesia Island Base Stations: Engineering Solutions for

With over 17,000 islands spanning three time zones, Indonesia''s telecommunications landscape presents a unique paradox. While Jakarta enjoys 5G speeds rivaling Singapore, residents in

Get Price

Indonesia

The Indonesian telecommunications market thrives as a mobile-centric industry, featuring four large network operators and a dominant fixed-line provider with a near

Get Price

Teleglobal and Kacific complete large-scale deployment of mobile

Kacific Broadband Satellites Group has successfully partnered with PT Indo Pratama Teleglobal in Indonesia to provide a large-scale deployment of mobile backhaul services to

Get Price

Active and Leading Mobile Network Operators (MNOs) in Indonesia

This overview provides a comprehensive snapshot of Indonesia''s leading MNOs, reflecting th eir critical role in one of the world''s largest and most dynamic telecom markets.

Get Price

Teleglobal Taps Kacific to Drive Mobile Backhaul in Indonesia

To ensure equal access for the 3T areas of Indonesia, the Ministry of Communication and Information Technology (Kominfo) through the Indonesian Information and Accessibility

Get Price

Telkom Indonesia: number of 4G BTS 2024| Statista

At the end of financial year 2024, the total number of 4G base transceiver stations (BTS) of PT Telkom Indonesia Group amounted to around ******* units.

Get Price

Statistics of Indonesia Communications 2023

Telecommunication Statistics in Indonesia to provide data about telecommunication development in Indonesia, including data on

Get Price

Indonesia Cellular Network Map

Currently, there are six cellular operators operating in Indonesia using various generations of cellular networks. The number of BTS owned by each operator shows the breadth of cellular

Get Price

Statistics of Indonesia Communications 2023

Telecommunication Statistics in Indonesia to provide data about telecommunication development in Indonesia, including data on telecommunication networks

Get Price

Mobile Monsters: The World''s Biggest Operators

The Rest of the Top 20 Two of China Mobile''s domestic competitors—China Telecom and China Unicom—sit in the third and fifth

Get Price

Telecommunications industry in Indonesia

As Indonesia becomes increasingly digitalized and seeks to meet its connectivity needs, the telecommunications market is expected to continue its rapid growth. Leading

Get Price

Mobile Cellular Technology Forecast for the Indonesian

Abstract: Current mobile telecommunications deployment in Indonesia, based on 2G, behind many other developing countries because of Indonesia''s larger territory. This

Get Price

BAKTI to build 630 new cell towers in remote parts of

Indonesia''s Telecommunications and Information Accessibility Agency (BAKTI) has outlined plans to construct 630 base transceiver stations

Get Price

Indonesia in focus: charting a path to network excellence

Opensignal reports and analyses are the definitive guide to understanding the true experience consumers receive on mobile and broadband networks. Indonesia, the world''s

Get Price

Feasibility Analysis of Indonesian Cellular Operator Consolidation

Abstract The high population and increasing growth in the penetration of the use of cellular telecommunications services in Indonesia have encouraged businesses to provide cellular

Get Price

6 FAQs about [Base stations of Indonesian telecommunications operators]

How many cellular operators are there in Indonesia?

In Indonesia, there are six cellular operators registered with the Ministry of Communication and Informatics (Kominfo), namely Telkomsel, Indosat Ooredoo, XL Axiata, Hutchison 3 (Tri) Indonesia, Smartfren, and Sampoerna. Each operator has the right to use the radio frequency spectrum to roll out cellular network services.

What is the status of Indosat Base Transceiver Station data?

Network: Annual: Indosat: Base Transceiver Station data remains active status in CEIC and is reported by Indosat. The data is categorized under Global Database’s Indonesia – Table ID.TE003: Telecommunication Statistics: Network Data. Network: Annual: Telkomsel: Base Transceiver Station (BTS) data was reported at 189,081.000 Unit in 2018.

How many BTS units are there in Indonesia?

The data is categorized under Global Database’s Indonesia – Table ID.TE003: Telecommunication Statistics: Network Data. Network: Annual: Telkomsel: Base Transceiver Station (BTS) data was reported at 189,081.000 Unit in 2018. This records an increase from the previous number of 160,705.000 Unit for 2017.

What is cellular network coverage in Indonesia?

Cellular network coverage in Indonesia is the result of the development of wireless communication technology that began in 1985. Currently, there are six cellular operators operating in Indonesia using various generations of cellular networks. The number of BTS owned by each operator shows the breadth of cellular network coverage in Indonesia.

What is the telecommunications industry in Indonesia?

The industry encompasses mobile and fixed broadband subscriptions and mobile phone services. As Indonesia becomes increasingly digitalized and seeks to meet its connectivity needs, the telecommunications market is expected to continue its rapid growth.

Does Indonesia lag behind other developing countries in mobile telecommunications deployment?

Abstract: Current mobile telecommunications deployment in Indonesia, based on 2G,3G and 4G technologies, lag behind many other developing countries because of Indonesia’s larger territory. This paper presents recent data on revenue growth (%) and the number of Base Transceiver Stations (BTSs) in Indonesia, divided among 2G, 3G and 4G technologi

More related information

-

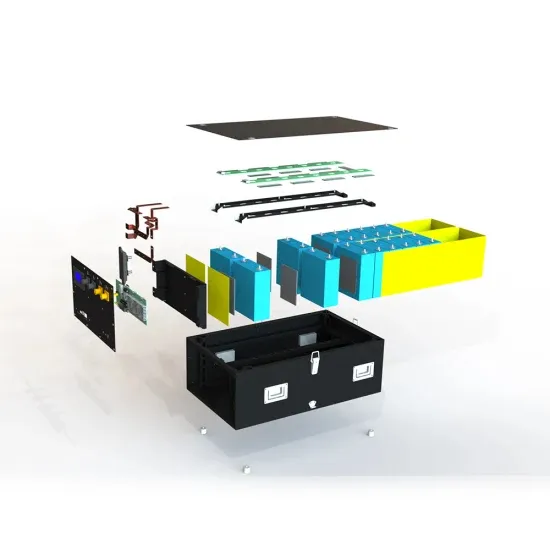

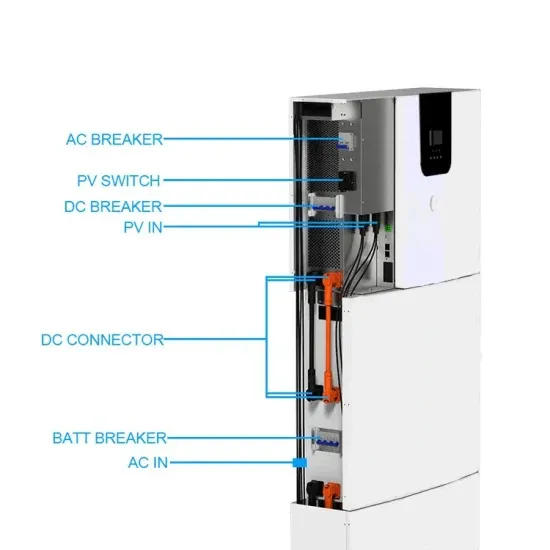

Energy base stations of three telecommunications companies

Energy base stations of three telecommunications companies

-

Are base stations built by telecommunications companies

Are base stations built by telecommunications companies

-

Communication operators and base stations

Communication operators and base stations

-

5g base stations built by telecommunications companies

5g base stations built by telecommunications companies

-

Expansion of green communication base stations

Expansion of green communication base stations

-

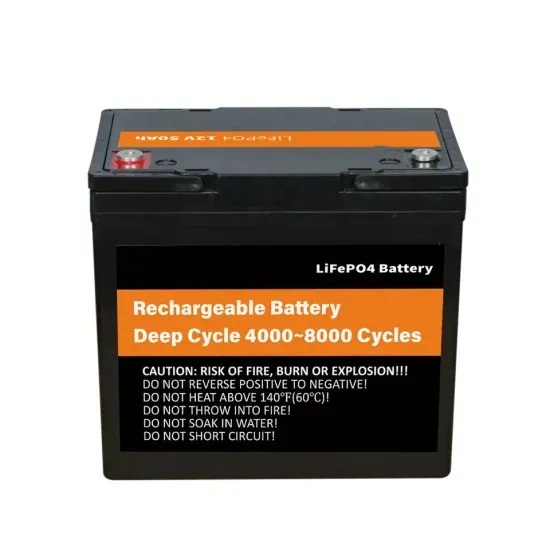

Are the battery installation requirements for Libya s communication base stations high

Are the battery installation requirements for Libya s communication base stations high

-

Analysis of power generation costs for communication base stations

Analysis of power generation costs for communication base stations

-

What batteries are used in Chinese communication base stations

What batteries are used in Chinese communication base stations

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.