Lead Acid Battery Market Size and YoY Growth Rate,

Pricing Analysis: Lead Acid Battery Market Lead acid battery pricing ranges from $0.08 to $0.25 per Wh, influenced by application, capacity,

Get Price

Past, present, and future of lead–acid batteries | Science

When Gaston Planté invented the lead–acid battery more than 160 years ago, he could not have foreseen it spurring a multibillion-dollar

Get Price

Lead Acid Battery Market Size, Share, Trend Analysis by 2033

Price trends are expected to be influenced by fluctuating raw material costs, including lead, impacting the overall market dynamics. Need Clarity? From market sizing and competitive

Get Price

Lead Acid Battery Market Size 2025-2034, Global Report

The lead acid battery market size exceeded USD 98.9 billion in 2024 and is expected to register at a CAGR of 3% from 2025 t0 2034, driven by innovations in enhanced flooded and AGM

Get Price

Battery price per kwh 2025| Statista

The cost of lithium-ion batteries per kWh decreased by 20 percent between 2023 and 2024. Lithium-ion battery price was about 115 U.S. dollars per kWh in 202.

Get Price

Lead Acid Battery Market Size and YoY Growth Rate, 2025-2032

Lead acid battery pricing ranges from $0.08 to $0.25 per Wh, influenced by application, capacity, brand, and raw material costs. Prices remain stable across standard

Get Price

Lead Acid Battery Market Size, Trends & Forecast 2024-2034

Lead acid battery pricing ranges from $0.08 to $0.25 per Wh, influenced by application, capacity, brand, and raw material costs. Prices

Get Price

Japan Battery Market Report | Industry Analysis, Size

Japan Battery Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Japan Battery Market report segments the

Get Price

2022 Grid Energy Storage Technology Cost and

Recycling and decommissioning are included as additional costs for Li-ion, redox flow, and lead-acid technologies. The 2020 Cost and Performance

Get Price

Lead Acid Battery Market Growth Drivers

The global lead acid battery market in terms of revenue was estimated to worth $41.6 billion in 2019 and is poised to reach $52.5 billion by 2024 growing at a

Get Price

Lead Acid Battery for Energy Storage Future Forecasts: Insights

This report offers a comprehensive overview of the lead-acid battery market for energy storage, providing valuable insights into market trends, growth drivers, challenges, and

Get Price

Lead Acid Battery Market Size, Share, Trend Analysis

The Lead Acid Battery Market size is expected to reach a valuation of USD 84.1 billion in 2033 growing at a CAGR of 5.00%. The Lead Acid Battery Market

Get Price

Lithium Battery Costs: Key Drivers Behind Pricing Trends

Lithium battery costs impact many industries. This in-depth pricing analysis explores key factors, price trends, and the future outlook.

Get Price

Lead Acid Battery Market Size, Growth & Industry Report by 2033

The global lead acid battery market size was valued at USD 53.3 billion in 2024 and is projected to reach from USD 55.95 billion in 2025 to USD 82.78 billion by 2033, growing at a CAGR of

Get Price

Lead Acid Battery Market Trends, Growth Analysis & Outlook

Explore the global lead acid battery market with in-depth analysis on trends, opportunities, challenges, and regional growth insights. Get accurate forecasts, top key

Get Price

Is the Cost of Lead Acid Batteries Justified in 2024?

Explore whether the current lead acid battery price offers value for your investment in India''s evolving energy storage market. India is on its way to a greener and stronger energy

Get Price

Is the Cost of Lead Acid Batteries Justified in 2024?

Explore whether the current lead acid battery price offers value for your investment in India''s evolving energy storage market. India is on its way

Get Price

Lead Acid Battery Market Size, Growth and Forecast 2032

Key trends include a shift towards eco-friendly alternatives and recycling initiatives, promoting sustainable practices within the industry. Together, these factors contribute to the robust

Get Price

Utility-Scale Battery Storage | Electricity | 2023 | ATB

The Storage Futures Study report (Augustine and Blair, 2021) indicates NREL, BloombergNEF (BNEF), and others anticipate the growth of the overall battery

Get Price

Lead Acid Battery Market Size, Share, Trend Analysis

Price trends are expected to be influenced by fluctuating raw material costs, including lead, impacting the overall market dynamics. Need Clarity? From

Get Price

Lead-Acid Battery Prices Rise: What''s Behind the Surge?

Discover why lead-acid battery prices are surging in 2025 due to raw material costs and supply chain pressures affecting e-bikes.

Get Price

Lead Acid Battery Market Size, Share & Growth

The global lead acid battery market reached over USD 41.33 Billion in 2024 and is projected to grow at a CAGR of 4.50% from 2025 to 2034.

Get Price

Energy Storage Systems (ESS) Market Size, Share, Trend, 2033

ENERGY STORAGE SYSTEMS (ESS) MARKET SEGMENTATION By Type Based on Type, the global market can be categorized into Lithium, Lead Acid, NaS, and

Get Price

Lead Acid Battery Market Size, Trends & Forecast 2024-2034

Lead-acid or Pb-acid batteries, often known as rechargeable batteries are set to find increasing applications in different fields due to their high reliability, low cost, and relatively

Get Price

Lead Acid Battery Market Size, Growth and Forecast 2032

The lead acid battery market is projected to grow from USD 50,325 million in 2024 to USD 79,006.86 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.80%.The

Get Price

Lead Acid Battery Market Size & Share Analysis

The Lead-acid Battery Market size is estimated at USD 49.37 billion in 2025, and is expected to reach USD 61.23 billion by 2030, at a CAGR of 4.4% during the forecast period

Get Price

Battery prices collapsing, grid-tied energy storage

We are in the midst of a year-long acceleration in the decline of battery cell prices – a trend that is reminiscent of recent solar cell price

Get Price

6 FAQs about [Lead-acid energy storage battery price trend]

What is the lead acid battery market?

The Lead Acid Battery Market report segments the industry into Application (SLI (Starting, Lighting, Ignition) Batteries, Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.), Portable Batteries (Consumer Electronics, etc.),

How much is a lead acid battery worth in 2020?

In 2020, lead acid batteries made up 70% of the worldwide energy storage market. They were worth about $40 billion. They are expected to grow and bring new innovations. Fenice Energy leads in adding these new features to their budget-friendly lead acid battery offerings.

How do material costs affect lead acid battery prices?

Material costs greatly influence lead acid battery prices. Once dominant in electric vehicles, their prices have felt the impact of volatile mineral prices. Yet, with smart management of inflation and material costs, lead acid batteries remain affordable. Fenice Energy exemplifies smart economic strategy in this area.

Why are lead acid batteries important?

Lead acid batteries are crucial for starting cars, and for the lights and ignition systems. Fenice Energy is very important in the energy storage market in India. It offers advanced and affordable lead acid battery options to the customers. Lead acid batteries have a long life. This makes them great for storing renewable energy.

What is the segmentation of the global lead acid battery market?

On the basis of application, the global lead acid battery market is segmented into automotive, UPS, telecom, electric bikes, transport vehicles, and others. The automotive segment is expected to account for significantly large revenue share in the global lead acid battery market during the forecast period.

Which segment dominated the lead acid battery market in 2022?

The SLI segment accounted for largest revenue share in the global lead acid battery market in 2022. This is due to rising demand for lead acid batteries to power start motors, lights, ignition systems, or other internal combustion engines while ensuring high performance, long life, and cost-efficiency.

More related information

-

Lead-acid energy storage battery price in Armenia

Lead-acid energy storage battery price in Armenia

-

South Africa energy storage lead-acid battery price

South Africa energy storage lead-acid battery price

-

Sudan We lithium battery energy storage cabinet price

Sudan We lithium battery energy storage cabinet price

-

Price of lithium battery energy storage cabinets in Sri Lanka

Price of lithium battery energy storage cabinets in Sri Lanka

-

Flow battery energy storage container selling price

Flow battery energy storage container selling price

-

Guyana energy storage lithium battery price

Guyana energy storage lithium battery price

-

Price of lithium battery for energy storage in Western Europe

Price of lithium battery for energy storage in Western Europe

-

Reverse polarity energy storage lead-acid battery

Reverse polarity energy storage lead-acid battery

Commercial & Industrial Solar Storage Market Growth

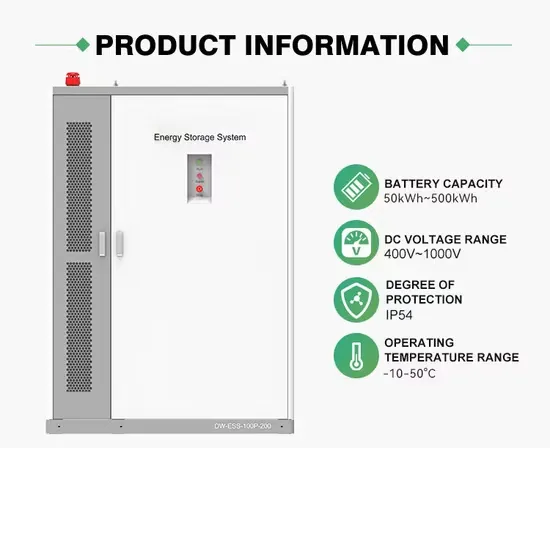

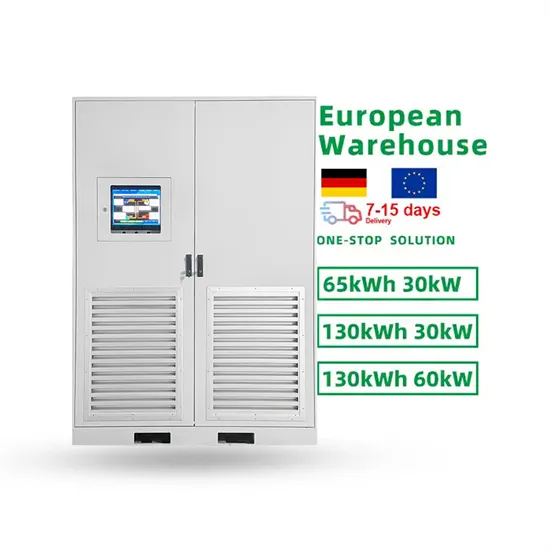

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.