North Africa''s Renewable Potential and Strategic Location

North Africa''s business case for renewables is strong; costs of solar and wind technologies have come down significantly.

Get Price

North Africa''s Renewable Potential and Strategic Location

As the African continent''s largest energy market, the region – apart from Sudan – is characterised by notable socio-economic development, industrialisation and access to

Get Price

Intelligent Energy Storage Systems Market Size Forecasts 2037

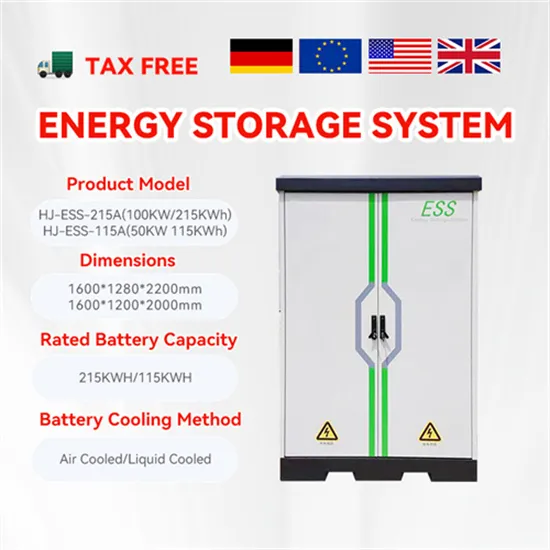

The intelligent energy storage systems market size was valued at USD 13.27 billion in 2024 and is expected to reach USD 44.74 billion by 2037, registering around 9.8% CAGR during the

Get Price

Energy storage and the role of energy innovation in

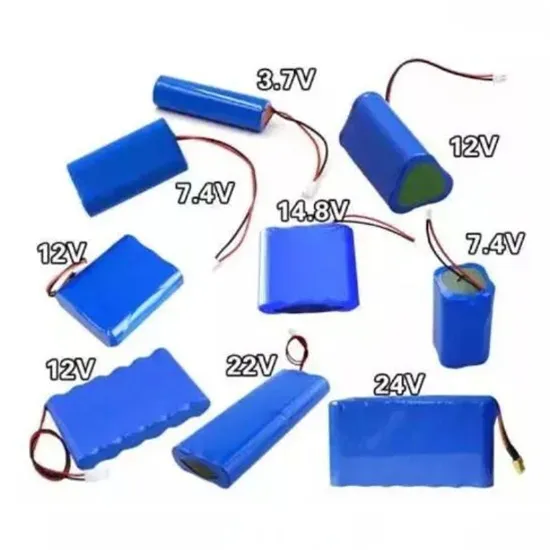

Energy storage systems, such as batteries, pumped hydroelectric storage, and compressed air energy systems, empower grid operators to

Get Price

Africa''s Energy Storage Market

As Africa accelerates its transition toward sustainable energy systems, the continent''s energy storage market is poised for transformative growth. LondianESS, as a pioneer in smart energy

Get Price

Africa Energy Review 2024

Africa''s energy sector is driving a Just Energy Transition, focusing on equitable access and the synergy between natural gas and renewables like solar and wind. Key stakeholders highlight

Get Price

Energy Storage Systems Market Trends and Future

The Global Energy Storage Systems Market was valued at USD 256,488.1 Million in 2024 and is anticipated to reach a value of USD 478,269.6 Million by 2032 expanding at a CAGR of 8.1%

Get Price

The African Continental Power Systems Masterplan

Development of a continental master plan The African Union (AU) has articulated a vision for a continent-wide interconnected power system (the Africa Single Electricity Market (AfSEM))

Get Price

Energy storage and the role of energy innovation in Africa''s energy

Energy storage systems, such as batteries, pumped hydroelectric storage, and compressed air energy systems, empower grid operators to match supply with demand

Get Price

Wind Energy in Africa: Progress and Challenges

Zafarana Wind Power Plant is located in Egypt in North Africa, with an installed generation capacity of 550MW and formulated in different stages.

Get Price

North Africa Renewable Energy Market

The North Africa Renewable Energy Market is growing at a CAGR of greater than 6% over the next 5 years. Vestas Wind Systems A/S, Scatec

Get Price

Top 10: Energy Storage Technologies | Energy Magazine

The top energy storage technologies include pumped storage hydroelectricity, lithium-ion batteries, lead-acid batteries and thermal energy

Get Price

Africa Energy Storage Market 2024-2030

Top countries in Global Africa Energy Storage Market, are South Korea, Japan, Germany, US and China. New commercial and industrial

Get Price

Energy Storage Systems and Renewable Generation

The rise of renewable generation (solar and wind) in the world is leading to a very rapid development of energy storage systems since they allow solving regulatory, economic and

Get Price

How energy storage can support Africa''s growing wind energy market

The integration of energy storage beacons positive prospects for Africa, especially in the context of wind energy. The investments in storage technologies will enable nations to

Get Price

How energy storage can support Africa''s growing wind energy

The integration of energy storage beacons positive prospects for Africa, especially in the context of wind energy. The investments in storage technologies will enable nations to

Get Price

Energy Storage as a Service Market Size and

Key Takeaways from Analyst: Global energy storage as a service market growth is driven by rising need for reliable and affordable energy and

Get Price

Projects Transforming North Africa''s Energy Landscape

Countries in North Africa - including Egypt, Algeria, Morocco and Tunisia - are advancing cooperation with global partners to advance the

Get Price

EE23_076 North Africa Energy Report_V1 dd

However, recent advances in battery storage and the rise of the more afordable and safer cobalt-free LFP battery solutions could finally present a viable opportunity for large-scale stationary

Get Price

Renewable Energy Market Analysis: Africa and its Regions

Africa has vast resource potential in wind, solar, hydro, and geothermal energy and falling costs are increasingly bringing renewables within reach. Central and Southern Africa have abundant

Get Price

North Africa Renewable Energy Market

The North Africa Renewable Energy Market is growing at a CAGR of greater than 6% over the next 5 years. Vestas Wind Systems A/S, Scatec Solar ASA, SkyPower Ltd,

Get Price

Renewable energy market in Africa: Opportunities, progress,

With abundant renewable resources such as solar, wind, hydropower, and biomass, Africa is uniquely positioned to play a key role in the global low carbon energy

Get Price

Energy Storage Technology Market Size, Share & Growth, 2032

The energy storage technology market size was valued at USD 239.20 billion in 2023 and is expected to reach USD 577 billion by 2032 at a CAGR of 10.28%

Get Price

North african energy storage industry

North Africa lithium-ion battery industry size from the energy storage applications is anticipated to attain 24% gains between 2023 and 2032, with increasing demand for grid stability and

Get Price

Africa''s Energy Storage Market

LondianESS, as a pioneer in smart energy solutions, analyzes the key drivers and emerging opportunities that will shape Africa''s storage landscape through 2030.

Get Price

North Africa Energy Storage Study: Powering the Future of

Welcome to North Africa, where the energy storage study isn''t just academic—it''s the missing puzzle piece for unlocking solar and wind potential. With countries like Morocco

Get Price

6 FAQs about [North African wind power market energy storage solutions]

Where does North Africa Invest in renewables?

So far, most of the investments are concentrated in Morocco and Egypt. Contrary to the global trend in the period of 2013-2020 which shows private sector financing as the primary source of funding for renewables development, North Africa sees public finance play a far more important role.

Why is integrating solar and wind energy into Africa's power grids a challenge?

Integrating solar and wind energy into Africa's power grids poses challenges due to variability and outdated infrastructure . Renewable energy depends on environmental factors, causing fluctuations that disrupt supply-demand balance.

Why does North Africa need a backup power system?

The industry needs hardware, software and international standards – and on top of all this, there is an increasing requirement for power to come from renewable sources. North Africa is witnessing a rising number of refinery green- and brownfield projects, which will warrant an increase in backup power requirements.

What are the future opportunities for the North African battery market?

Similarly, the expanding involvement of the countries in the region towards its renewable and Electric Vehicle (EV) sector is likely to create several future opportunities for the North African battery market. Committed to reducing emissions by 65% in the oil and gas sector, and 7% in the transportation sector by 2030.

Will North Africa's power sector be impacted by Green- and brownfield projects?

North Africa is witnessing a rising number of refinery green- and brownfield projects, which will warrant an increase in backup power requirements. But, as with every sector, the critical power sector must be mindful of environmental reforms and stringent emission regulations.

Should North Africa Invest in green hydrogen?

With high renewables potential that can be tapped at low costs, and geographical proximity to Europe where demand for renewables-based or green hydrogen is rising, many North African countries have entered into agreements with other countries and private companies to explore pilot projects for green hydrogen production and exportation.

More related information

-

Large-scale wind power market energy storage power station

Large-scale wind power market energy storage power station

-

North Korean Wind and Solar Energy Storage Power Station

North Korean Wind and Solar Energy Storage Power Station

-

North African Power Plant Energy Storage Power Station

North African Power Plant Energy Storage Power Station

-

Mobile energy storage site wind power equipment

Mobile energy storage site wind power equipment

-

Bulgaria 450 Wind Power Energy Storage

Bulgaria 450 Wind Power Energy Storage

-

Central Asia Wind Power Energy Storage Group

Central Asia Wind Power Energy Storage Group

-

Wind Energy Storage Mobile Power Supply

Wind Energy Storage Mobile Power Supply

-

Canadian wind power energy storage battery manufacturer

Canadian wind power energy storage battery manufacturer

Commercial & Industrial Solar Storage Market Growth

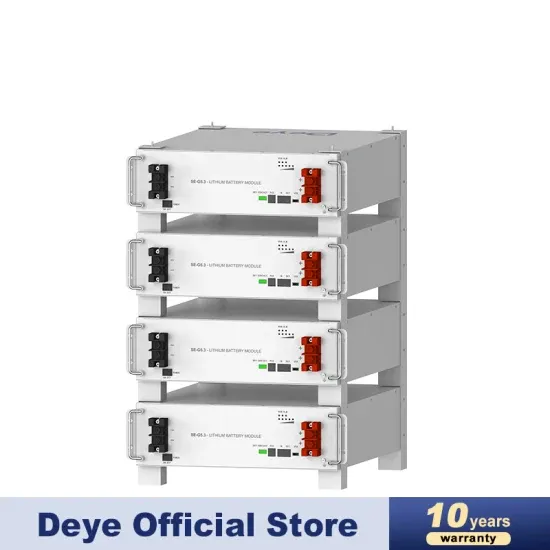

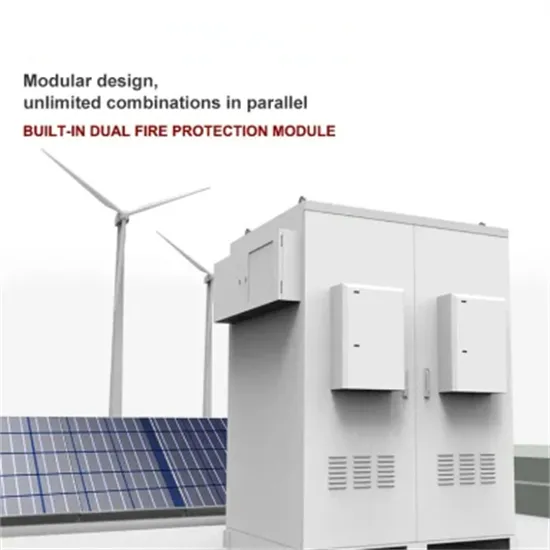

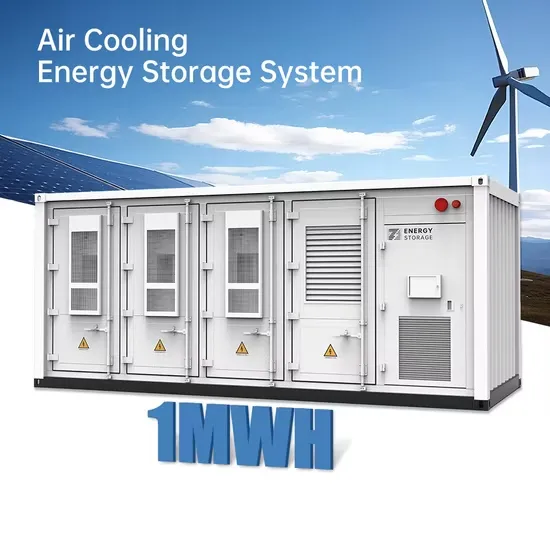

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.