Top 30 Solar Inverter Manufacturers Leading the Global

Looking for Top-Tier Solar Inverters? Choosing the best inverter is essential for powering your solar energy system. The volume of global PV inverter shipments significantly influences the

Get Price

Asia Pacific PV Inverter Market Size, Share

The market is witnessing a change in the preference for string inverters over central inverters, especially in residential and commercial applications. String

Get Price

Best Solar Inverters 2025

We review the best grid-connect solar inverters from the worlds leading manufacturers Fronius, SMA, SolarEdge, Fimer, Sungrow, Huawei, Goodwe, Solis and many

Get Price

Asia Pacific PV Inverter Market Size, Share & Forecast by 2030

The market is witnessing a change in the preference for string inverters over central inverters, especially in residential and commercial applications. String inverters offer scalability, easier

Get Price

PV Inverter Market Size, Share & Industry Growth to

Even though string inverters experienced robust growth in North America, central PV inverters are expected to maintain the highest market share throughout the

Get Price

Unveiling Asia Pacific Solar PV Inverters Market Industry Trends

The Asia Pacific solar PV inverter market is experiencing robust growth, driven by increasing renewable energy adoption, supportive government policies, and decreasing costs of solar PV

Get Price

What are central and string solar inverters and how do

The primary difference between central and string inverters is that a string inverter will typically sit at the end of each PV string, is distributed

Get Price

Strategic Vision for Asia-Pacific Solar Inverter Market Industry

The Asia-Pacific solar inverter market showcases a diverse product landscape featuring central, string, and micro inverters, each with specific applications and performance characteristics.

Get Price

Asia Pacific Central PV Inverter Market Opportunity, Growth

Central PV inverters are high-capacity devices designed specifically for large-scale solar installations, including utility solar farms and extensive commercial solar projects.

Get Price

PV Inverter Market Size, Share And Growth Report, 2030

Central inverters, typically used in large-scale solar installations, are key to converting direct current (DC) from solar panels to usable alternating current (AC), making

Get Price

Quiet shift from central to string inverters in utility

Central inverters still dominate the US utility-solar market but string inverters are beginning to get more traction in projects above 10 MW in size.

Get Price

Asia Pacific Solar PV Inverters Market Size

Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity

Get Price

Solar PV Inverter Market Size, Growth & Industry

Solar PV Inverter Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Solar PV Inverter Market Report is Segmented

Get Price

Asia-Pacific Solar Inverter Market Size | Mordor Intelligence

The Asia-Pacific Solar Inverter Market is growing at a CAGR of greater than 2.5% over the next 5 years. Fimer SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric

Get Price

PV Inverter Market Size, Share And Growth Report, 2030

Micro PV inverter is the most lucrative product segment registering the fastest growth during the forecast period. According to the International Energy Agency (IEA), power generation from

Get Price

Asia Pacific Solar PV Inverters Market Size & Competitors

Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50 kW to 1 MW

Get Price

PV Inverter Market Trends, Share and Forecast, 2025

PV INVERTER MARKET SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2025-2032) PV Inverter Market, By

Get Price

Asia Pacific Central PV Inverter Market Opportunity, Growth

Asia Pacific Central PV Inverter Market was estimated at USD 5 billion in 2023 and is anticipated to grow at a CAGR of 8.3% between 2024 and 2032. Central PV inverters are

Get Price

Asia Pacific Central Solar Inverter Market 2025: M&A

Central inverters, typically used in large-scale solar installations, are key to converting direct current (DC) from solar panels to usable alternating current (AC), making

Get Price

Top & Global Leading Solar Power Company in India

Sungrow, a leading solar power company, has installed 30 gigawatts (GW) of PV inverters in India, whose solar system in India caters to diverse sectors with

Get Price

Asia-Pacific Solar Inverter Market Size | Mordor

The Asia-Pacific Solar Inverter Market is growing at a CAGR of greater than 2.5% over the next 5 years. Fimer SpA, Schneider Electric SE,

Get Price

Asia Pacific Central PV Inverter Market Size, 2024

The Asia Pacific central PV inverter market from commercial application is projected to grow at a CAGR of over 8% through 2032, driven by rising

Get Price

Global Photovoltaic Inverter Market Report 2025 Edition, Market

Global Photovoltaic Inverter Market Report 2025 Market Size Split by Type (Central Inverters, String Inverters, Micro Inverters), by Application (On Grid, Off Grid, Battery Backup Inverter)

Get Price

Solar Photovoltaic (PV) Market | Global Market Analysis Report

3 days ago· Regionally, the solar photovoltaic (PV) industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus,

Get Price

Asia Pacific Central PV Inverter Market Size, 2024-2032 Report

The Asia Pacific central PV inverter market from commercial application is projected to grow at a CAGR of over 8% through 2032, driven by rising demand for cost-effective inverters that offer

Get Price

Top 15 Solar Inverter Manufacturers In the World

By 2023, it had achieved the coveted position of world market share leader, with global solar inverter shipments reaching 28,000 megawatts in 2022.Main Products: String inverters, central

Get Price

Asia Pacific Solar PV Inverters Market Insightful Analysis: Trends

Asia Pacific Solar PV Inverters Market: A Comprehensive Report (2019-2033) This comprehensive report provides an in-depth analysis of the Asia Pacific solar PV inverters

Get Price

Top 5 Non-Chinese Solar Inverter Manufacturers

Top non-Chinese solar inverter manufacturers: SMA Solar Technology, Fronius International, SolarEdge Technologies, FIMER, and

Get Price

6 FAQs about [What are the photovoltaic inverters in Central Asia ]

What is the Asia-Pacific solar inverter market?

The Asia-Pacific Solar Inverter Market is Segmented by Type (Central Inverters, String Inverters, Micro Inverters, Cellular Glass, and Other Types), Application (Residential, Commercial & Industrial, and Utility-scale), and Geography (China, India, Japan, and Rest of Asia-Pacific).

Who are the key players in the Asia-Pacific solar inverter market?

The Asia-Pacific solar inverter market is fragmented. Some of the key players in the market (in no particular order) include Fimer SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Which country has the largest PV inverter market in 2023?

The U.S. emerged as the largest market in North America in 2023. It is a significant market for different types of PV inverters. Some recent inverter trends in the U.S. include an increase in the sizes of central inverters (1.5 MW plus) and three-phase string inverters (60 kW).

What is a solar PV inverter?

The solar PV inverter is the most important component of a solar energy system that converts the direct current (DC) electricity (generated by solar panels) to alternating current (AC) electricity (the power used by the grid).

How competitive is the market for PV inverters?

The market for PV inverters is highly competitive and moderately fragmented due to the presence of numerous market players. The dominant trend in operations of these solar companies includes vertical integration, which defends against market power and reduces competition.

What is the market share of solar PV inverters in 2023?

According to the Solar Energy Industries Association (SEIA), prices for solar PV installations have fallen 43% over the last 10 years in California, U.S. Based on product, the string PV inverter segment emerged as the leading segment with the maximum revenue share of 47.10% in 2023.

More related information

-

What are the photovoltaic sub-segment inverters

What are the photovoltaic sub-segment inverters

-

What are some famous brand photovoltaic inverters

What are some famous brand photovoltaic inverters

-

Central Asia Photovoltaic Panel Manufacturer

Central Asia Photovoltaic Panel Manufacturer

-

What are the major brands of photovoltaic inverters

What are the major brands of photovoltaic inverters

-

Huawei Central Asia Photovoltaic Panels

Huawei Central Asia Photovoltaic Panels

-

What is the best DC voltage for photovoltaic inverters

What is the best DC voltage for photovoltaic inverters

-

What is the cost of photovoltaic energy storage

What is the cost of photovoltaic energy storage

-

What is the price of environmentally friendly inverters in Barbados

What is the price of environmentally friendly inverters in Barbados

Commercial & Industrial Solar Storage Market Growth

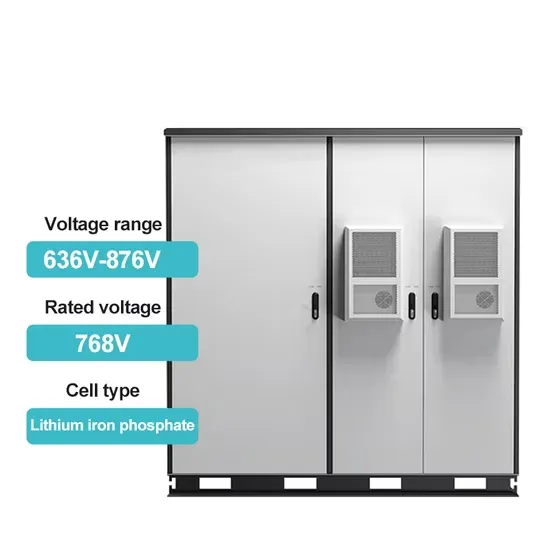

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.