EXPANSION OF 5G NETWORK IN THE COUNTRY

Since its launch in October 2022, 5G services have been rolled out in all States/ UTs across the country and presently it is available in 99.6% of the districts in the country.

Get Price

The Rapid Expansion of 5G BTS Deployments in India

India has witnessed an extraordinary surge in the number of 5G Base Transceiver Stations (BTS) deployments over the past 17 months. In

Get Price

India''s 5G Base Stations Top 4.6 Lakh, but Rollout Pace Slows

India''s 5G base transceiver stations (BTS) count recently surpassed 4.6 lakh in October 2024, adding just a few thousand in the past months. Following an initial rapid

Get Price

What is a base station and how are 4G/5G base

The architecture of the 5G network must enable sophisticated applications, which means the base stations design required must also be

Get Price

2026 pan-India 5G coverage unlikely, has slow pace

In comparison, 4G usage varied from 75-100 percent across all three telcos. This is despite earlier government announcements confirming 5G

Get Price

India 5G market and development, 2025

Table of contents India''s mobile market Chart 1: India''s mobile market overview, 3Q24 Handset Chart 2: India''s 5G smartphone sales and

Get Price

Vietnam''s 5G Base Stations are ready for India

The company has deployed this technology in several provinces across Vietnam, including Hanoi and Da Nang, and plans further expansion. Notably, Viettel High Tech is also exporting its 5G

Get Price

Indian operators expand 5G to 469k base stations,

The Indian government has reckons 5G coverage now extends to all states and 99.6 percent of districts nationwide. India had 469,000 5G base

Get Price

India now has 250 million 5G subscribers, says ministry

India''s 5G subscriber base has reportedly grown to around 250 million since commercial 5G services were launched almost two and a half years ago, according to the

Get Price

Has India surpassed 450,000 5G base stations, and is

The Department of Telecommunications (DoT) said that over 450,000 5G base transceiver stations (BTS) had been built nationally as of July. BTS were introduced in October 2022 and

Get Price

5G base station additions plunge as Jio and Airtel slow down

Recent data highlights a significant reduction in quarterly 5G base station additions by Reliance Jio and Bharti Airtel. The decreased rollout of 5G sites is leading to slower

Get Price

5G base station additions plunge as Jio and Airtel

Recent data highlights a significant reduction in quarterly 5G base station additions by Reliance Jio and Bharti Airtel. The decreased rollout of 5G

Get Price

5G Base Station – WiSig Networks

We are developing a trusted, secure, dis-aggregated and standard compliant 5G Bharat RAN solution for Indian market that inter-operates with 5G Core and

Get Price

Indian operators expand 5G to 469k base stations, 250m subcribers

The Indian government has reckons 5G coverage now extends to all states and 99.6 percent of districts nationwide. India had 469,000 5G base stations at the end of

Get Price

India Crosses 250 Million 5G Users as Network Expansion

According to official data, Uttar Pradesh leads in 5G expansion, with 8,451 villages equipped with base stations. It is followed by Maharashtra (6,910 villages), Rajasthan (5,393

Get Price

Comprehensive Plan for the Nationwide Rollout of 5G Technology

Thereafter, the 5G services were launched on 01st October 2022. As on 31st Oct 2024, 5G services have been rolled out in all States/ UTs across the country and presently 5G

Get Price

Indian Army Introduces First Indigenous 4G Base Station by

The Indian Army has inducted its first-ever indigenous chip-based 4G mobile base station, procured from Bangalore-based firm Signaltron via the government e-marketplace

Get Price

India adds 52,776 5G BTS in 2024, slow growth for

As of December 31, 2024, the number of 5G BTS (Base Transceiver Stations) in India was 464,990, up from 412,214 on December 31,

Get Price

5g base station architecture

5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

Get Price

2026 pan-India 5G coverage unlikely, has slow pace of adoption

Data from Telecom Regulatory Authority of India has shown low 5G usage in various parts of India, and according to experts the slow pace of adoption means that the

Get Price

Pan-India 5G coverage by 2026 is unattainable goal: says

Data from Telecom Regulatory Authority of India has shown low 5G usage in various parts of India, and according to experts the slow pace of adoption means that the

Get Price

The Rapid Expansion of 5G BTS Deployments in India

India has witnessed an extraordinary surge in the number of 5G Base Transceiver Stations (BTS) deployments over the past 17 months. In January 2023, the total number of 5G

Get Price

2026 pan-India 5G coverage unlikely, has slow pace

Data from Telecom Regulatory Authority of India has shown low 5G usage in various parts of India, and according to experts the slow pace of

Get Price

6 FAQs about [India s 5G base stations are rarely used]

Why are 5G base stations reducing in India?

Recent data highlights a significant reduction in quarterly 5G base station additions by Reliance Jio and Bharti Airtel. The decreased rollout of 5G sites is leading to slower revenue growth for tower companies like Indus, as India's top telcos have nearly completed their 5G rollouts and 4G network expansions.

Which state has the most 5G base stations in India?

According to official data, Uttar Pradesh leads in 5G expansion, with 8,451 villages equipped with base stations. It is followed by Maharashtra (6,910 villages), Rajasthan (5,393 villages), Bihar (4,601 villages), and West Bengal (4,521 villages), highlighting strong regional adoption.

Does India have 5G?

The Indian government has reckons 5G coverage now extends to all states and 99.6 percent of districts nationwide. India had 469,000 5G base stations at the end of February, according to the latest available figures from the country’s Ministry of Communications.

Which telecom companies have rolled out 5G in India?

Leading telecom operators Reliance Jio and Bharti Airtel completed their pan-India 5G rollouts in early 2024, while Vodafone Idea (Vi) recently launched its commercial 5G services in Mumbai.

How big is India's 5G subscriber base?

According to Finnish telecom equipment provider Nokia, India’s 5G subscriber base is projected to rise from 290 million (29 crores) in 2024 to 770 million (77 crores) by 2028, driven by the growing penetration of 5G-enabled smartphones and continued expansion of high-speed broadband networks.

Which state is leading in 5G expansion?

The government noted that further network expansion will depend on the techno-commercial considerations of telecom companies. According to official data, Uttar Pradesh leads in 5G expansion, with 8,451 villages equipped with base stations.

More related information

-

Can photovoltaic communication 5g base stations be used

Can photovoltaic communication 5g base stations be used

-

How many 5G network base stations are there in Ghana

How many 5G network base stations are there in Ghana

-

How many 5G base stations does Tanzania have

How many 5G base stations does Tanzania have

-

Are there any 5G base stations in Lithuania

Are there any 5G base stations in Lithuania

-

Does Denmark currently have 5G base stations for communication

Does Denmark currently have 5G base stations for communication

-

How many 5G network base stations are there in Greece

How many 5G network base stations are there in Greece

-

Distribution of 5G base stations in South Ossetia

Distribution of 5G base stations in South Ossetia

-

Are 5G base stations solar powered

Are 5G base stations solar powered

Commercial & Industrial Solar Storage Market Growth

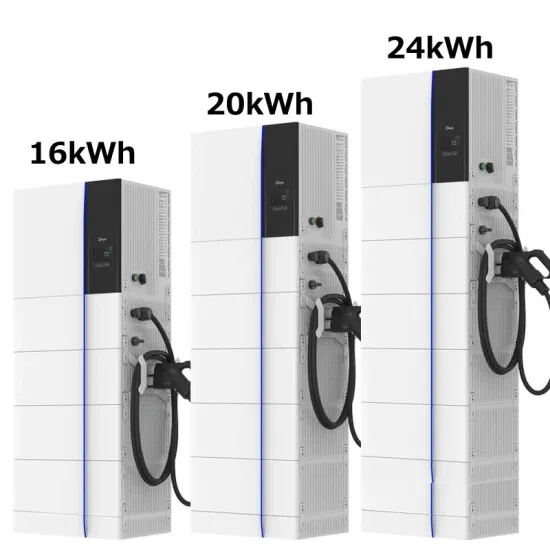

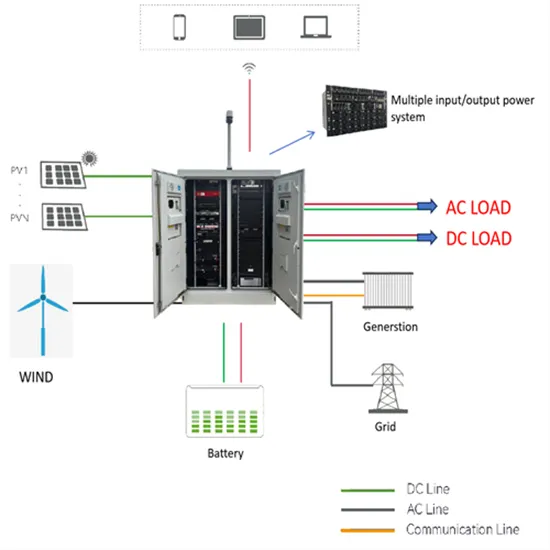

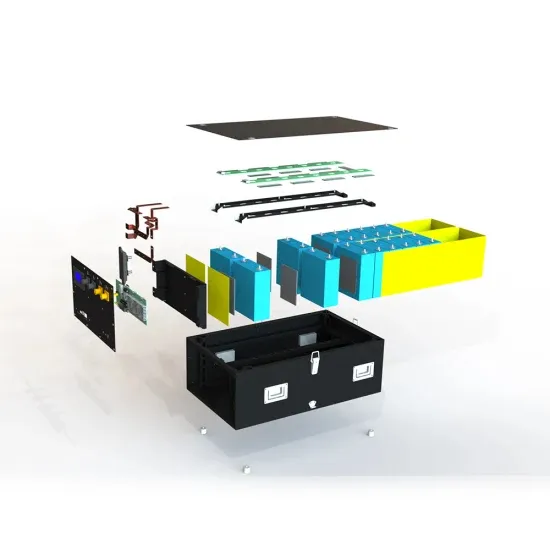

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.