Solar Hybrid Base Station: Revolutionizing Off-Grid

Did you know over 1.4 billion people still lack reliable mobile connectivity? As 5G deployment accelerates, traditional diesel-powered base stations struggle with energy inefficiency and

Get Price

Energy Management Strategy for Distributed

The sharp increase in energy consumption imposes enormous pressure on grid power supply and operation costs [7], thus attracting

Get Price

Key Technologies and Solutions for 5G Base Station Power Supply

Why Power Management Is the Achilles'' Heel of 5G Deployment? As 5G networks proliferate globally, a critical question emerges: How can we sustainably power 5G base stations that

Get Price

How to power 4G, 5G cellular base stations with

Researchers from Kuwait''s Kuwait University have proposed operating 4G and 5G cellular base stations (BSs) with local hybrid plants of

Get Price

5G Base Station Energy Storage Future-proof Strategies: Trends

The long-term forecast points to sustained growth, driven by continuous 5G network expansion and advancements in energy storage technology, resulting in improved efficiency, reliability,

Get Price

Lockheed Martin to demonstrate space-based 5G network

The test included five hybrid base stations with 5G, tactical datalinks and space backhaul. Potential customers The company is considering several options to market this

Get Price

Li-Ion Battery for 5G Base Station Report 2025–2033

The Li-Ion Battery for 5G Base Station market is witnessing substantial growth due to the increasing deployment of 5G networks globally. Li-Ion batteries are critical for providing

Get Price

5G BTS Hybrid Power: Reliable, Green, and Cost-Saving

At HighJoule, we''re engineering the next generation of power solutions for telecom. This article offers a deep dive into the design, applications, and global impact of hybrid energy

Get Price

How to power 4G, 5G cellular base stations with photovoltaics,

Researchers from Kuwait''s Kuwait University have proposed operating 4G and 5G cellular base stations (BSs) with local hybrid plants of solar PV and hydrogen.

Get Price

Research on Carbon Emission Prediction for 5G Base Stations

To address the carbon emission prediction challenge in 5G base stations, this study proposes a hybrid forecasting model based on the deep integration of a

Get Price

5G BTS Hybrid Power: Reliable, Green, and Cost-Saving

As 5G deployment momentum grows globally, power demands for telecom base stations (BTS) are increasing exponentially. Traditional single-source power solutions reliant

Get Price

Enhancing energy efficiency and QoS in 5G networks with

The rapid expansion of 5G networks and increasing user equipment (UEs) necessitate innovative approaches for improved energy efficiency. UE-to-UE communication is

Get Price

Sustainable Connections: Exploring Energy Efficiency

Although 5G networks offer larger capacity due to more antennas and larger bandwidths, their increased energy consumption is concerning.

Get Price

Kyocera Develops AI-powered 5G Virtualized Base

Kyocera will showcase its 5G virtualized base station at Mobile World Congress 2025 (MWC), the world''s largest communications technology

Get Price

Next-Generation Base Stations: Deployment, Disaster

5G stations consume significantly more power, requiring hybrid energy systems (solar + batteries + generator). Advanced models integrate

Get Price

The Future of Hybrid Inverters in 5G Communication Base Stations

As 5G networks expand, hybrid inverters will play a pivotal role in powering next-gen base stations—providing stable, cost-effective, and green energy solutions that support

Get Price

The Future of Energy-Efficient 5G Base Station Design

The advent of 5G technology marks a significant leap in telecommunications, promising unprecedented data speeds, reduced latency, and enhanced connectivity for a

Get Price

Multi-objective capacity optimization configuration strategy for

In this paper, a multi-objective capacity optimization allocation strategy for hybrid energy storage microgrids applicable to 5G base stations in remote areas is proposed. The strategy combines

Get Price

Research on Carbon Emission Prediction for 5G Base

Abstract: The rapid deployment and widespread adoption of 5G networks have rendered the energy consumption and carbon emissions of base stations increasingly prominent, posing a

Get Price

On hybrid energy utilization for harvesting base station in 5G

In this paper, hybrid energy utilization was studied for the base station in a 5G network. To minimize AC power usage from the hybrid energy system and minimize solar

Get Price

Renewable energy powered sustainable 5G network

Renewable energy is considered a viable and practical approach to power the small cell base station in an ultra-dense 5G network infrastructure to reduce the energy provisions

Get Price

5G Base Station Chips: Driving Future Connectivity by 2025

As 5G networks become the backbone of modern communication, 5G base station chips are emerging as a cornerstone of this transformation. With projections showing

Get Price

5G Base Station Hybrid Power Supply | HuiJue Group E-Site

By 2025, expect hybrid power stations to integrate ammonia cracking for hydrogen production. NTT Docomo''s prototype in Osaka achieves 99.999% availability using this

Get Price

Multi-objective capacity optimization configuration strategy for hybrid

In this paper, a multi-objective capacity optimization allocation strategy for hybrid energy storage microgrids applicable to 5G base stations in remote areas is proposed. The strategy combines

Get Price

More related information

-

Burundi 2025 Hybrid Energy 5G Base Station Hybrid Power Supply

Burundi 2025 Hybrid Energy 5G Base Station Hybrid Power Supply

-

China s hybrid energy 5G base station 2025

China s hybrid energy 5G base station 2025

-

Vanuatu hybrid energy 5g base station latest

Vanuatu hybrid energy 5g base station latest

-

China s hybrid energy 5MWH liquid-cooled 5g base station

China s hybrid energy 5MWH liquid-cooled 5g base station

-

5G communication base station hybrid energy construction planning

5G communication base station hybrid energy construction planning

-

What does a 5G hybrid energy base station look like

What does a 5G hybrid energy base station look like

-

China Hybrid Energy 5G Base Station Project

China Hybrid Energy 5G Base Station Project

-

Malawi 5G base station hybrid energy mobile

Malawi 5G base station hybrid energy mobile

Commercial & Industrial Solar Storage Market Growth

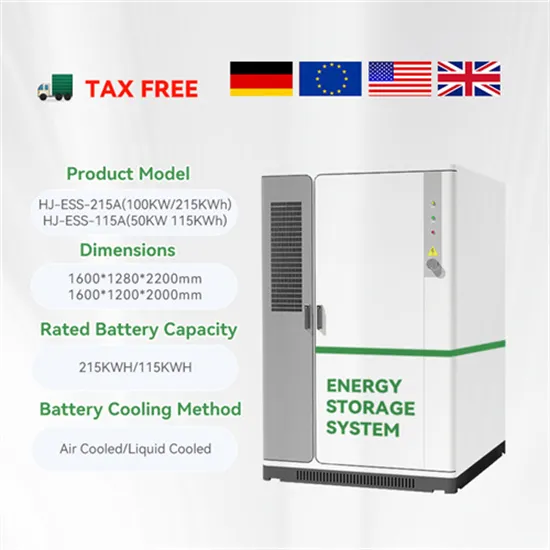

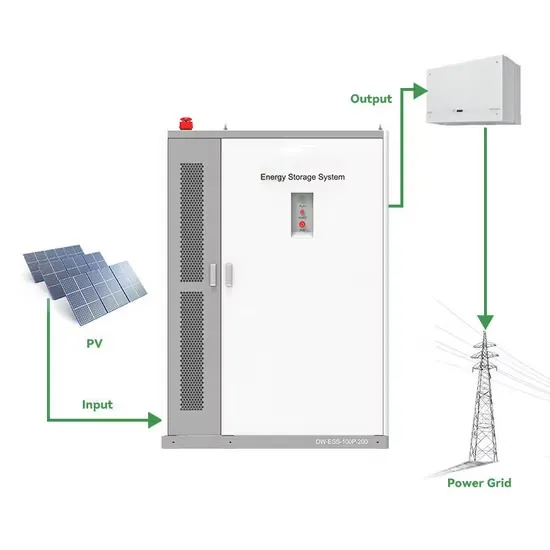

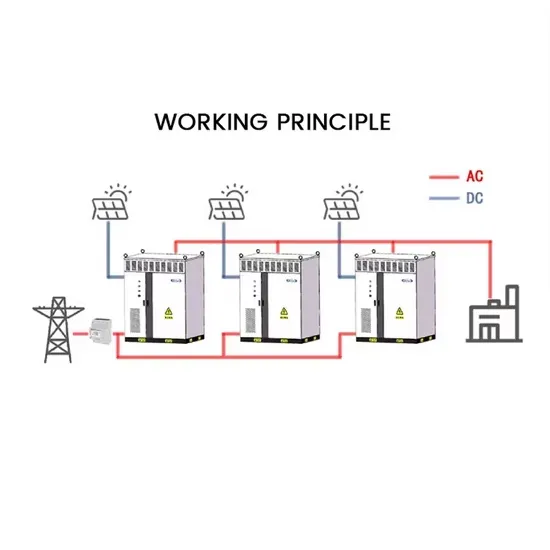

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

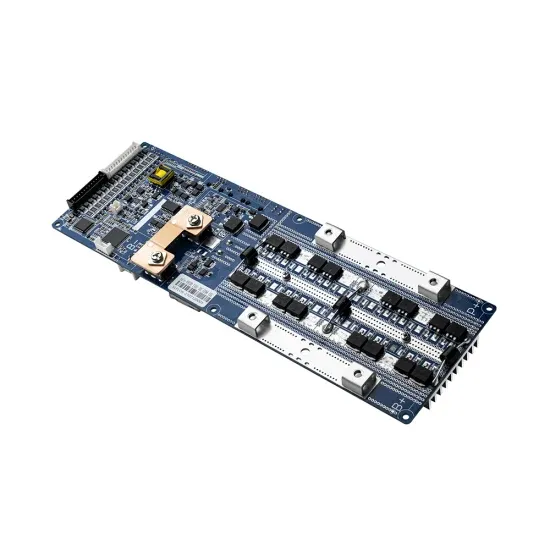

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.