Energy sector in Russia

Russia has one of the leading energy sectors worldwide, producing some of the largest volumes of oil, gas, and electricity. Furthermore, it is the fourth-largest consumer of

Get Price

Russia Outdoor Power Equipment Market (2025-2031) Outlook

Market Forecast By Equipment Type (Lawn Mowers, Saws, Trimmers & Edgers, Blowers, Snow Throwers, Tillers & Cultivators, Others), By Applications (Commercial, Residential/DIY), By

Get Price

Outlook: Russia''s Power Tools & Garden Market

Uncover trends in Russia''s power tools and garden equipment sectors. Market performance, demand shifts, and key players revealed.

Get Price

The Majority of Russia''s Electric Supply Comes from

In addition, the development of the electric power industry increased the demand for the products produced by the Russian power

Get Price

Energy sector in Russia

Russia: installed electricity generation capacity 2017-2024 Electricity Power production breakdown in Russia 2023, by source statistics Global comparison Global primary

Get Price

Presentation of the company

Production sites of Parus electro Parus electro LLC was established in 2011. Now the company has more than 400 employees. The main activities are a full cycle of development and

Get Price

Russia''s global grip on nuclear energy

Like its Soviet predecessor, Russia''s nuclear energy industry is a tool of state power pursuing military and foreign policy goals with ruthless ambition.

Get Price

Russian Federation: Outdoor Equipment Market

This report presents a comprehensive overview of the Russian outdoor equipment market, the effect of recent high-impact world events on it, and a forecast for the market

Get Price

Suppliers outdoor equipment Russia

BASK Company Ltd. is Russian research and production company (brand exists since 1992). Our specialty is production of sportswear and equipment for outdoor activities, extreme weather

Get Price

Outdoor Power Equipment Market Size and Share,

Transitioning product lines from gas to electric or developing dual-power options presents challenges to supply chains and production

Get Price

China Switching Power Supply, Rainproof Led Power

Yuxiang is one of leading manufacturers and suppliers in China, specializing in the production of smart switching power supply, rainproof led power supply,

Get Price

Outdoor Power Supply Market Research | 2024-2032

" Outdoor Power Supply Market " Research Report 2024 Presents an Extensive Analysis of Market Dynamics, Competitive Landscape and Emerging Trends By (Below

Get Price

Who are Russia''s allies, and can Kremlin''s war

More than three years since the start of Moscow''s full-scale invasion of Ukraine, Russia''s defense industry has adapted to a new normal.

Get Price

The market of power supply units in Russia

The company specializes in developing and manufacturing of ready-made power supplies only, producing a wide range of power supply units: AC-DC converters, DC-DC

Get Price

The Russian Government has approved "Made in Russia"

The Russian Government has approved "Made in Russia" program until 2030. A key objective is to establish sustainable partnerships with interested foreign states and create

Get Price

Electricity sector in Russia

The electric power industry first developed in Russia under the Tsarist regime. The industry was highly regulated particularly by the Ministry of Finance, the Ministry of Trade and Industry and

Get Price

Systemtechnik group of companies

Systemtechnik group of companies is a Russian manufacture of a wide range of high technology uninterruptible power supply systems and also provider of different integrated power solutions.

Get Price

UNDERSTANDING THE RUSSIAN ELECTRICITY MARKET

Russia''s annual electricity generation is second only to China among the Belt and Road countries over the years. The electricity generation in Russia registered over 1 billion

Get Price

Russian National Power Report 2021

Russian power sector ranked 4th by power output Globally, Russia ranks fifth in terms of installed electricity capacity and fourth in electricity output. By the end of 2019, the aggregate installed

Get Price

The market of power supply units in Russia

The company specializes in developing and manufacturing of ready-made power supplies only, producing a wide range of power supply

Get Price

About TRION company — TRION

TRION is a Russian company, developer and manufacturer of power supplies, emergency kits, lighting control systems and LED modules. The company has its own production facilities, our

Get Price

UNDERSTANDING THE RUSSIAN ELECTRICITY

Russia''s annual electricity generation is second only to China among the Belt and Road countries over the years. The electricity generation

Get Price

Russia Uninterrupted Power Supplies (UPS) Market Overview, 2029

3 days ago· In assessing the uninterruptible power supply (UPS) market in Russia, it is crucial to consider the regulatory environment, economic conditions, and power infrastructure.

Get Price

«Electrosystems» Technical Holding

Now the company is one of the leaders of the uninterruptible, independent and standby power supply systems, providing project development, equipment procurement and technical support

Get Price

Electricity sector in Russia

OverviewHistoryEquipment producersPower companiesMode of productionElectrical gridSee alsoExternal links

The electric power industry first developed in Russia under the Tsarist regime. The industry was highly regulated particularly by the Ministry of Finance, the Ministry of Trade and Industry and the Ministry of Internal Affairs. This led to considerable delay as electrification was not made a priority in the process of industrialisation.

Get Price

AKOM

GEL battery technology is being introduced into production. AKOM is the main supplier of the battery to the Russian market - more than 50% of all supplies, and 70% of all exports of the

Get Price

6 FAQs about [Russian production of outdoor power supplies]

Which power supply systems are used in Russia?

The power supply systems are fully agreed with the operational conditions, accepted on the territory of the Russian Federation. Only the modern high tech units are used for the power supply system production, supplied by Eaton. UPS.

Who is the best power supply company in Russia?

In the world of power supplies (PS), it is quite a well-known company on the Russian market. I know that MEAN WELL company is the absolute leader on the PS market. I became curious about comparing these companies.

Who imports power supplies to Russia?

Import of power supplies under the customs codes 8504408200 and 8504409000, in 2018 by distributors and brokers. The import volume of 32 distributors and brokers of electronic components to Russia amounted to $87 million.

Does Russia have a two tier electricity market?

Segmentation of the Russian electricity market Russia currently has a two-tier electricity and capacity market (wholesale and retail).

Does Russia have a competitive electricity market?

Russia has basically established an electricity market which is highly competitive and market-oriented with high standardization since its reform in 2006, which is much more complicated than the traditional overseas electricity markets familiar to Chinese companies. I. Legislative framework of the Russian electricity market

Is Russia moving away from fossil fuels?

Russia is home to some of the leading energy companies across the globe, such as Gazprom, Lukoil, and Rosneft. In 2022, seven out of ten Russians stated that it was important to them that their country shifts away from fossil fuels. Discover all statistics and data on Energy sector in Russia now on statista.com!

More related information

-

Are there any production standards for outdoor power supplies

Are there any production standards for outdoor power supplies

-

Russian portable outdoor energy storage power supply

Russian portable outdoor energy storage power supply

-

Costa Rican company that makes outdoor power supplies

Costa Rican company that makes outdoor power supplies

-

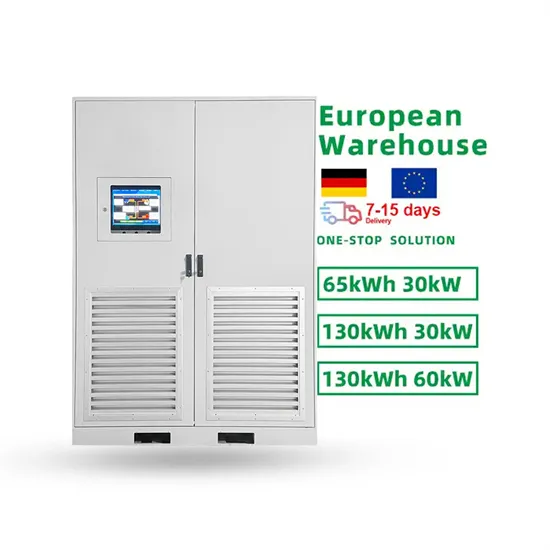

Manufacture of large-capacity outdoor power supplies

Manufacture of large-capacity outdoor power supplies

-

Can lithium batteries be used in Honduras outdoor power supplies

Can lithium batteries be used in Honduras outdoor power supplies

-

What are the bidirectional outdoor power supplies

What are the bidirectional outdoor power supplies

-

Can two outdoor power supplies be connected in series

Can two outdoor power supplies be connected in series

-

Two Huawei outdoor power supplies

Two Huawei outdoor power supplies

Commercial & Industrial Solar Storage Market Growth

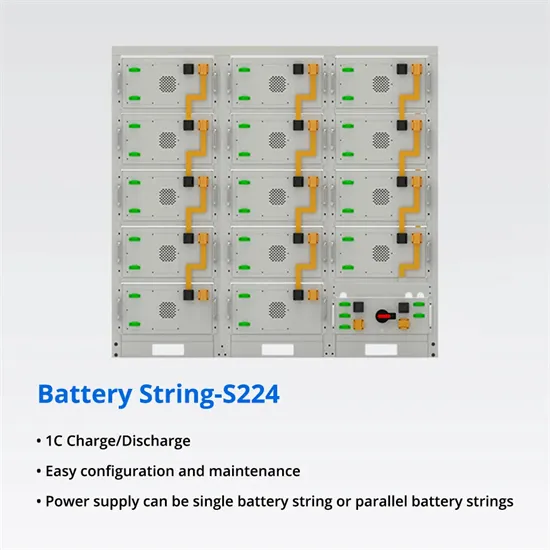

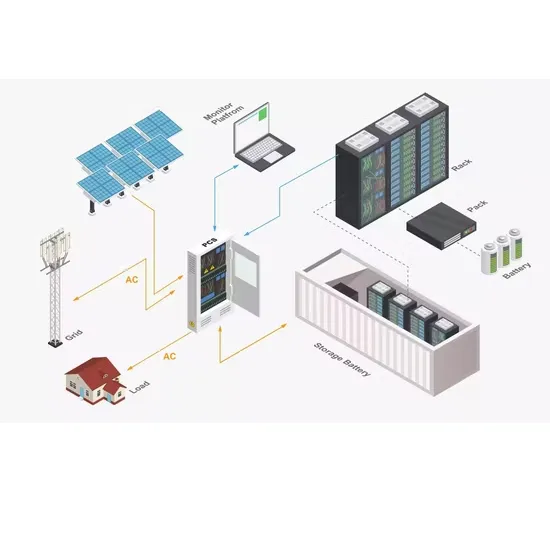

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

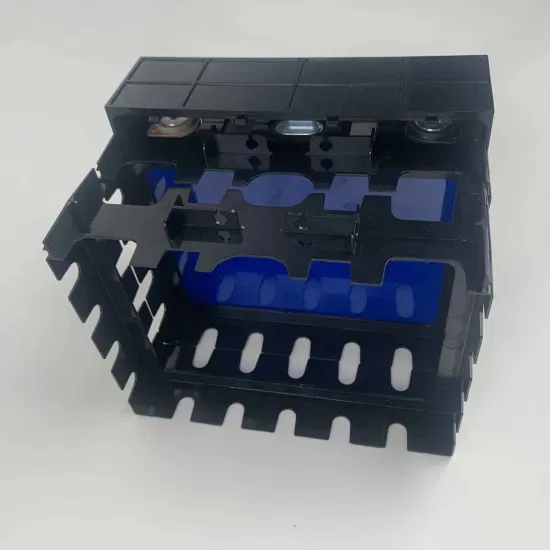

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.