Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get Price

5G communication challenge to switching power supply-VAPEL

For the popular networking mode of 5G base station: 3 sectorAAU + 1 BBU, assuming that the AAU efficiency is 20%, the output power of the switchingpower supply supplying power to 5G

Get Price

Power Consumption Modeling of 5G Multi-Carrier Base

However, there is still a need to understand the power consumption behavior of state-of-the-art base station architectures, such as multi-carrier active antenna units (AAUs), as well as the

Get Price

Study on Power Feeding System for 5G Network

HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of power density and voltage drops on the power transmission line in

Get Price

Energy Storage Regulation Strategy for 5G Base Stations

This paper proposes an analysis method for energy storage dispatchable power that considers power supply reliability, and establishes a dispatching model for 5G base station energy

Get Price

Building better power supplies for 5G base stations

Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies

Get Price

Towards Efficient, Reliable, and Cost-Effective Power Supply

Power supplies requirements in 5G telecom base stations The requirements mentioned above for 5G infrastructure translate into some key features required for AC-DC

Get Price

The power supply design considerations for 5G base

As with pulse power, this change requires understanding how the higher voltages would affect PSU designs and component life. Mobile

Get Price

The power supply design considerations for 5G base stations

As with pulse power, this change requires understanding how the higher voltages would affect PSU designs and component life. Mobile operators typically want PSUs to be

Get Price

Power Supply for Base Station Market

What are the primary demand drivers influencing the adoption of power supply solutions in the base station market? The global deployment of 5G networks remains the most significant

Get Price

5G Communication Base Station Backup Power Supply Market:

The 5G communication base station backup power supply market is projected to reach USD 11.9 billion by 2032, driven by the rapid expansion of 5G networks and the increasing need for

Get Price

An optimal dispatch strategy for 5G base stations equipped with

Abstract The escalating deployment of 5G base stations (BSs) and self-service battery swapping cabinets (BSCs) in urban distribution networks has raised concerns

Get Price

5G macro base station power supply design strategy and

For macro base stations, Cheng Wentao of Infineon gave some suggestions on the optimization of primary and secondary power supplies. "In terms of primary power supply, we

Get Price

base station in 5g

A 5G base station, also known as a gNodeB (gNB), is a critical component of a 5G network infrastructure. It plays a central role in enabling wireless communication between user

Get Price

Building better power supplies for 5G base stations

Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies - Technical

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get Price

Modeling and aggregated control of large-scale 5G base stations

The limited penetration capability of millimeter waves necessitates the deployment of significantly more 5G base stations (the next generation Node B, gNB) than their 4G

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get Price

Power Supply for 5G Infrastructure | Renesas

Renesas'' 5G power supply system addresses these needs and is compatible with the -48V Telecom standard, providing optimal performance, reduced energy consumption, and robust

Get Price

5G infrastructure power supply design considerations (Part I)

Higher bandwidths and compression techniques will let 5G networks shuttle more data through systems in a given period, leaving more power-saving idle time. In light of this,

Get Price

Dispatching strategy of base station backup power supply

Abstract: With the mass construction of 5G base stations, the backup batteries of base stations remain idle for most of the time. It is necessary to explore these massive 5G base station

Get Price

Key Technologies and Solutions for 5G Base Station Power Supply

As 5G networks proliferate globally, a critical question emerges: How can we sustainably power 5G base stations that consume 3× more energy than 4G infrastructure? With over 13 million

Get Price

5G Thermal Management Strategies: Keeping

The introduction of fifth-generation (5G) networks has made a change in the telecommunications industry by providing great data speeds,

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

Additionally, these 5G cells will also include more integrated antennas to apply the massive multiple input, multiple output (MIMO) techniques for reliable connections. As a result, a

Get Price

6 FAQs about [5G base station power supply change notification]

How will 5G affect power supply design?

Higher bandwidths and compression techniques will let 5G networks shuttle more data through systems in a given period, leaving more power-saving idle time. In light of this, the move to 5G infrastructure is necessitating new power supply design considerations.

What is a 5G power supply?

The equipment ensures that devices across the infrastructure stack receive reliable power from the mains network, wherever they happen to reside. With it, individuals and organizations can continue to render services to both themselves and their customers. Overviews The 5G network architecture uses multiple types of power supplies.

What is a 5G backhaul power supply?

The backhaul part of the 5G network connects the access interface - including masts, eNodeB, and cell site gateway - to the mobile core and internet beyond. And just like the access equipment, it too has specific power supply requirements. Backhaul power supplies must cater to aggregation routers and core routers.

What is the work difficulty of 5G network & powering solution?

work difficulty. 1) 5G Network general descriptions, cells 2) Powering solution divided into local powering, remote coverage, and impact on powering strategy, powering and share infrastructures in three different type of 5G network and feeding solutions cases and there will be very technical specifications.

How will masts change 5G?

Masts in 5G systems have more control over their own operation instead of being controlled by a central tower. However, these changes mean that power supplies need to evolve. Small cells will need to be able to fit in compact environments, such as traffic lights, utility poles, and rooftops.

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

More related information

-

Iraq 5G base station power supply change

Iraq 5G base station power supply change

-

5g base station power supply calculation

5g base station power supply calculation

-

Jamaica s 5G base station electricity supply converted to direct power supply

Jamaica s 5G base station electricity supply converted to direct power supply

-

Qatar 5G micro base station power supply solution

Qatar 5G micro base station power supply solution

-

Tajikistan 5G base station power supply and distribution facilities

Tajikistan 5G base station power supply and distribution facilities

-

5g base station power supply costs

5g base station power supply costs

-

China Communications 5G base station hybrid power supply

China Communications 5G base station hybrid power supply

-

What power supply does Huawei s 5G base station use

What power supply does Huawei s 5G base station use

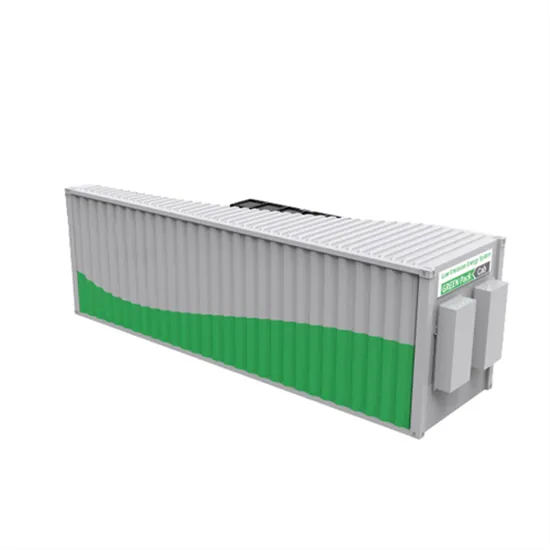

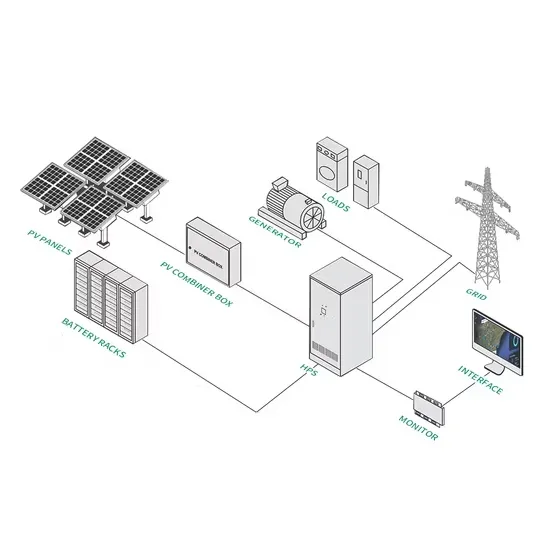

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

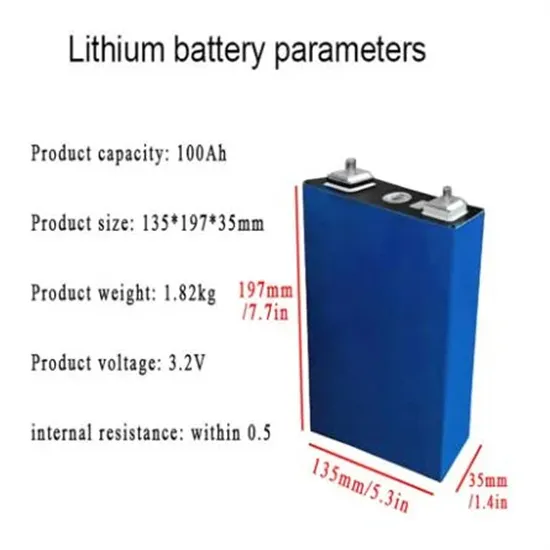

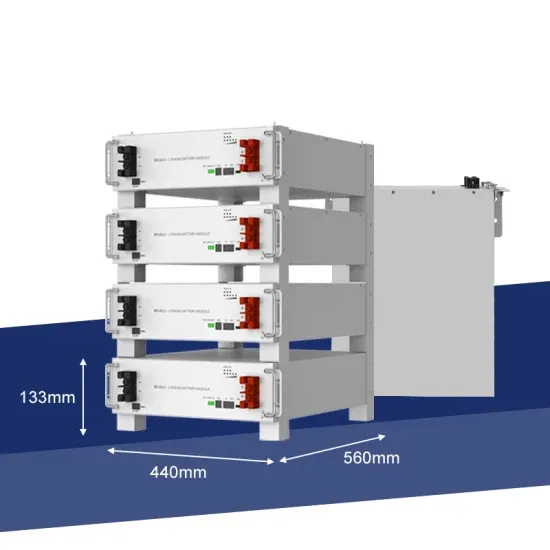

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.