Private equity targets battery energy storage, driven largely by

Private equity and venture capital investments in the battery energy storage system, energy management and energy storage sector so far in 2024 have exceeded 2023''s levels and are

Get Price

Hydropower Investment Opportunities Remain Untapped

With the clean energy transition well under way, there is plenty of exciting news about increasing deployment of renewable energy solutions like solar. Yet as more and more

Get Price

What are the energy storage power station markets?

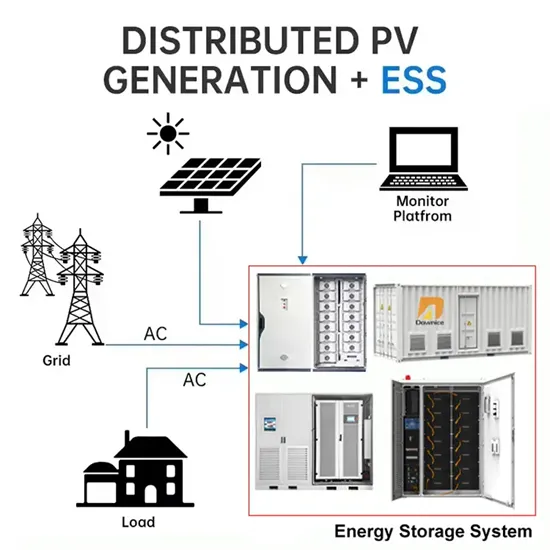

From a technological perspective, lithium-ion batteries have captured significant attention due to their declining costs and increasing efficiency. The rapid growth of electric

Get Price

Uniper recommissions Happurg pumped-storage plant

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our

Get Price

Energy Storage: How Private Capital is Transforming the Power

Unlike typical power equipment manufacturers, which are usually state-owned or heavily influenced by government interests, the energy storage field is driven largely by private

Get Price

How about investing in energy storage power station companies?

Investing in energy storage power station companies presents numerous opportunities and challenges. 1. Energy storage technologies are gaining traction due to their

Get Price

Investing in the grid: PE''s battery storage strategy

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE

Get Price

What are the industrial energy storage power stations?

Industrial energy storage power stations are specialized facilities designed to store energy for later use, playing a crucial role in enhancing grid

Get Price

Investment challenges in US renewable energy

Navigating investment challenges in US renewable energy landscape A report from the National Renewable Energy Laboratory (NREL)

Get Price

U.S. Energy Storage Industry Commits $100 Billion

WASHINGTON, D.C., April 29, 2025 – Today the American Clean Power Association (ACP), on behalf of the U.S. energy storage industry, announced

Get Price

How much subsidy does the country have for energy storage power stations?

Alternative funding models have begun to emerge, such as green bonds and public-private partnerships, fostering collaborative investments in energy storage solutions that

Get Price

How can I invest in energy storage power stations? | NenPower

Investing in energy storage power stations entails several strategies and considerations for potential investors. 1. Understand the Market Dynamics, which

Get Price

Research on investment decision-making of energy storage power station

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Get Price

Research on investment decision-making of energy storage

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Get Price

How can I invest in energy storage power stations? | NenPower

Investing in energy storage power stations can yield multiple advantageous outcomes. Firstly, the primary benefit is the contribution to a more sustainable energy

Get Price

Energy Storage Power Station Investment Insights: Breaking

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get Price

Uniper recommissions Happurg pumped-storage plant for around

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our previously announced strategy to invest in

Get Price

Investing in the grid: PE''s battery storage strategy

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands.

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

Innovative Financing for Energy Storage Projects: Leveraging

To learn more about innovative financing for energy storage projects and public-private partnerships, I invite you to visit the European Future Energy Forum website.

Get Price

How much does it cost to acquire an energy storage power station?

Acquiring an energy storage power station involves various financial considerations. 1. The costs can range substantially based on the technology chosen and the

Get Price

Investing in the grid: PE''s battery storage strategy

As investment in energy infrastructure continues to grow, PE firms are turning to large-scale battery storage to solve the issue of storing

Get Price

Approval and progress analysis of pumped storage power stations

Pumped storage power stations in Central China are typical for their large capacity, large number of approved pumped storage power stations and rapid approval. This

Get Price

Innovative Financing for Energy Storage Projects:

To learn more about innovative financing for energy storage projects and public-private partnerships, I invite you to visit the European

Get Price

Pumped Hydro Roadmap

Pumped hydro energy storage is "nature''s battery" and its ability to act as a long-term bulk storage facility, while delivering many of the grid regulating functions

Get Price

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

3 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get Price

6 FAQs about [Private investment in energy storage power stations]

Why is PE investment in battery energy storage growing?

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE investments in energy storage and infrastructure have more than doubled since 2014, reaching $21.1 billion in 2024 alone.

Why should we invest in a pumped storage power plant?

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our previously announced strategy to invest in growth and transformation towards a greener business.

Is battery storage a fundamental part of energy infrastructure?

“Battery storage is now viewed as a fundamental part of energy infrastructure, much like LNG terminals and oil tankers,” said Gresham House infrastructure and energy transition investor Lefteris Stakosias. Stakosias said this investment boom reflects a broader shift in the global energy market toward renewables.

How will a pumped storage power plant contribute to the energy transition?

The company is making a significant contribution to the energy transition and is continuing its corporate transformation towards more renewable energy generation. By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany.

Will Green flexibility be Europe's largest battery energy storage system?

The project is expected to be one of Europe’s largest battery energy storage systems. Partners Group’s January investment in Green Flexibility, a German battery storage developer, underscores the focus on scaling high-potential businesses in energy markets with strong policy support.

Is lithium ion the future of stationary energy storage?

The second gap involved technology. "I didn't believe lithium ion was the future of stationary energy storage," Michaelson says, referring to fixed-location energy storage systems for homes, businesses, and industrial facilities—distinct from mobile applications like electric vehicles. The third gap went deeper than business fundamentals.

More related information

-

Investment and Franchise Conditions for Japanese Energy Storage Power Stations

Investment and Franchise Conditions for Japanese Energy Storage Power Stations

-

What battery energy storage power stations are there in Algeria

What battery energy storage power stations are there in Algeria

-

Cost of energy storage power stations in Denmark

Cost of energy storage power stations in Denmark

-

What are the small energy storage power stations in New Zealand

What are the small energy storage power stations in New Zealand

-

Energy storage power stations receive government subsidies

Energy storage power stations receive government subsidies

-

What are the lithium battery energy storage power stations in Slovenia

What are the lithium battery energy storage power stations in Slovenia

-

Benefits of investing in energy storage power stations

Benefits of investing in energy storage power stations

-

Is there a 5-year BESS for energy storage power stations

Is there a 5-year BESS for energy storage power stations

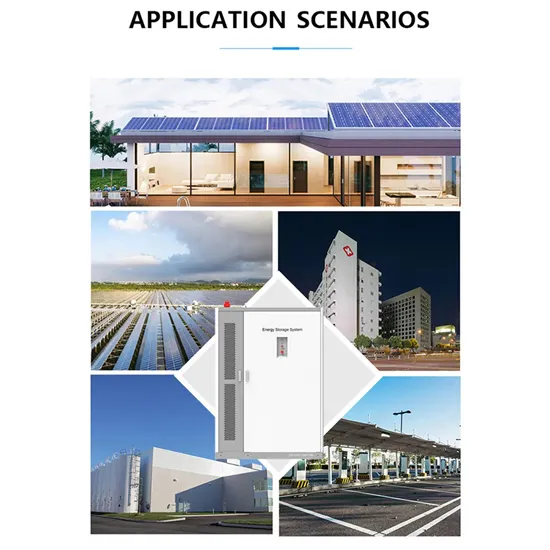

Commercial & Industrial Solar Storage Market Growth

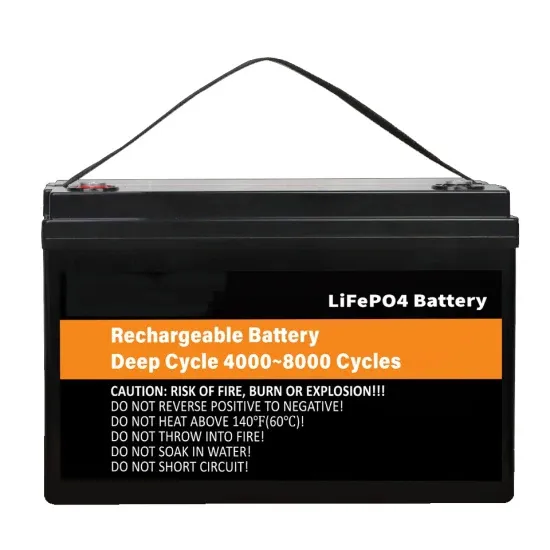

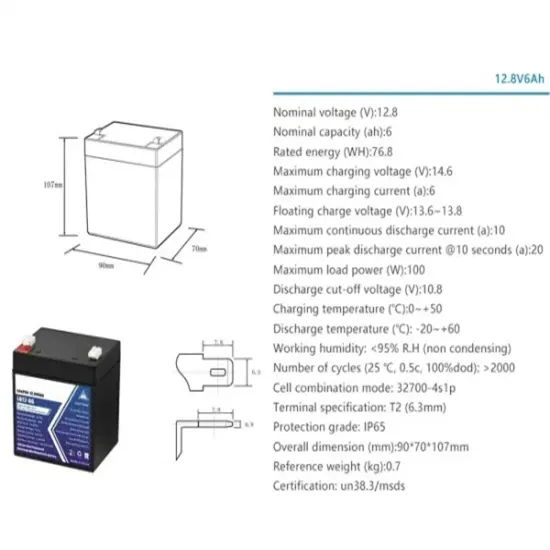

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.