5G Base Station Growth: How Many Are Active? | PatentPC

Explore the rise of 5G base stations worldwide. Get key stats on active installations and how they impact network coverage.

Get Price

5G-oriented Site Evolution

Mobile operators in China are ramping up 5G and 5G-A rollouts, with the former now at 4.5 million cell sites and the latter in 300 cities; a new

Get Price

5G Base Station Equipment Market Report 2025: 5G Base

5G base stations form the backbone of next-generation wireless networks, enabling enhanced bandwidth, ultra-low latency, and broader coverage to support rising

Get Price

Best Practices to Accelerate 5G Base Station

Strategy Analytics predicts an explosive growth of emerging 5G networks. They forecasted the number of new base station sectors deployed

Get Price

5G

Verizon 5G base station utilizing Ericsson equipment in Springfield, Missouri, USA. 5G networks are cellular networks, [5] in which the service area is

Get Price

Best Practices to Accelerate 5G Base Station Deployment: Your

Strategy Analytics predicts an explosive growth of emerging 5G networks. They forecasted the number of new base station sectors deployed to double between 2018 and

Get Price

Huawei-Ultra-Lean-Site

Accelerating 5G deployment and fast growing 5G services will continue to increase site resource demand. Huawei provides an all-new scenario-specific pole site solution based on the next

Get Price

5G-oriented Site Evolution

5G presents many daunting challenges for site evolution. Market insights show that only one pole can be deployed for each sector at 50% of sites. New antennas cannot be installed due to

Get Price

How to find 5G cell towers near you

Learn how to find 5G towers in rural and remote areas with limited coverage. Explore methods using online maps, mobile apps, and community insights to ensure optimal connectivity.

Get Price

China 5G rush – 4.5m 5G base stations, 300 5G-A cities, 75% 5G

Mobile operators in China are ramping up 5G and 5G-A rollouts, with the former now at 4.5 million cell sites and the latter in 300 cities; a new 2027 roadmap will see 75% of

Get Price

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

Get Price

5GNR Base Station Measurements in the Field

Changes in Cellular Base Station Deployment Testing The first commercial 5GNR networks compliant to the 3GPP specifications started to be deployed in 2019. 5G technology offers the

Get Price

Mobile Communication Network Base Station Deployment Under 5G

This paper discusses the site optimization technology of mobile communication network, especially in the aspects of enhancing coverage and optimizing base station layout.

Get Price

What is the difference between Node B, eNodeB, and

Node B is the radio base station in 3G UMTS networks; eNodeB is the radio base station in 4G LTE networks; gNodeB (gNB) is the radio base

Get Price

5G Base Station Energy Storage Development New Direction

As global 5G base station deployments surpass 7 million units, a critical question emerges: How can energy storage systems keep pace with the 300% surge in power demand per cell site?

Get Price

5g base station

A 5G base station, also known as a 5G cell site or 5G NodeB, is a critical component of a 5G wireless network. It serves as the interface between the mobile devices

Get Price

Constructing 5G Sites infrastructure

End-to-end solutions for the construction of 5G radio sites that are both future-proof and cost-effective for mobile networks that will operate profitably.

Get Price

Coverage Map

Mastdata is a UK mobile telecoms base station resource tool for use by contractors and operators across the mobile telecommunications sector. This site is designed to drive best practice by

Get Price

5G Base Station

5G base station is the core equipment of 5G network, which provides wireless coverage and realizes wireless signal transmission between

Get Price

Top 5G Base Station gNodeB Manufacturers & Vendors

In 5G NR (New Radio) technology, the base station is referred to as gNodeB or gNb. 5G gNodeB base stations are critical for ensuring seamless network coverage and high-speed data

Get Price

Recent Developments in 5G Base Station Engineering –

Particularly in the Central European enclave—comprising Germany, Belgium, the Netherlands, Luxembourg, Austria, and Switzerland—a simmering cauldron of innovation and

Get Price

US cell site count nears half a million

The association said that the US wireless industry collectively built almost 70,000 new cell sites between 2019 and 2021, up from the 42,000 sites constructed during the period

Get Price

Econet expands 5G network, adds 32 new base stations in Harare

The Zimbabwe Stock Exchange listed telecoms giant, Econet Wireless Zimbabwe Limited has bolstered its 5G network by deploying 32 new base stations in Harare, with plans

Get Price

GLOBAL CELL-SITE CONSTRUCTION AND EVOLUTION

MARKET OUTLOOK MNOs have started to roll out 5G networks across diferent regions around the world. China has deployed more than 500,000 5G base stations among the three big

Get Price

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can

Get Price

Simplified Sites for Rapid 5G Deployment

PoleStar2.0 reserves standard base station interfaces for operators. Large-scale introduction of PoleStar2.0 during smart city building will allow smart poles to interconnect with 5G base

Get Price

6 FAQs about [New 5G base station sites]

What are 5G base stations?

5G base stations form the backbone of next-generation wireless networks, enabling enhanced bandwidth, ultra-low latency, and broader coverage to support rising connectivity demands. Driven by surging smartphone adoption (78% global mobile ownership in 2023, per ITU) and escalating internet usage, the market is poised for robust growth.

Will 5G base stations grow in 2024?

By 2024, 5G base station installations are expected to grow by over 25% annually worldwide The growth of 5G base stations is not slowing down. By 2024, global installations are expected to increase by more than 25% annually, meaning millions of new stations will be deployed each year.

Who makes 5G base station equipment?

19. The top 5 telecom equipment providers for 5G base stations are Huawei, Ericsson, Nokia, ZTE, and Samsung When it comes to 5G base station equipment, five companies dominate the market: Huawei, Ericsson, Nokia, ZTE, and Samsung. These firms provide the hardware and software needed to power the world’s 5G networks.

How many 5G base stations does China have?

China has deployed over 2.4 million 5G base stations as of 2023, accounting for over 60% of the global total China is leading the 5G revolution. With over 2.4 million base stations, the country accounts for more than 60% of all 5G infrastructure globally.

Why are telecom companies installing indoor 5G base stations?

To solve this, telecom companies are installing indoor 5G base stations, which are growing at a compound annual growth rate (CAGR) of over 30%. For businesses operating in offices, malls, or large commercial spaces, installing indoor 5G solutions can greatly enhance connectivity.

How many base stations will 5G have in 2025?

The U.S. has ambitious plans for 5G expansion, aiming to have more than 300,000 active base stations by 2025. This goal is being driven by investment from private telecom providers and government initiatives like the Rural 5G Fund. For businesses in the U.S., this means increasing access to high-speed connectivity.

More related information

-

Distribution of 5G base station sites in Spain

Distribution of 5G base station sites in Spain

-

How to calculate the hybrid power supply of 5G base station sites

How to calculate the hybrid power supply of 5G base station sites

-

United Arab Emirates New Communications 5G Base Station

United Arab Emirates New Communications 5G Base Station

-

Huijue Battery Communication 5G New Base Station Investment Project

Huijue Battery Communication 5G New Base Station Investment Project

-

5G base station sites built in the Democratic Republic of Congo

5G base station sites built in the Democratic Republic of Congo

-

Base station electricity charges electricity consumption communication and new energy sites

Base station electricity charges electricity consumption communication and new energy sites

-

5G base station power supply scale

5G base station power supply scale

-

Indonesia Hybrid Energy Branch 5G Base Station

Indonesia Hybrid Energy Branch 5G Base Station

Commercial & Industrial Solar Storage Market Growth

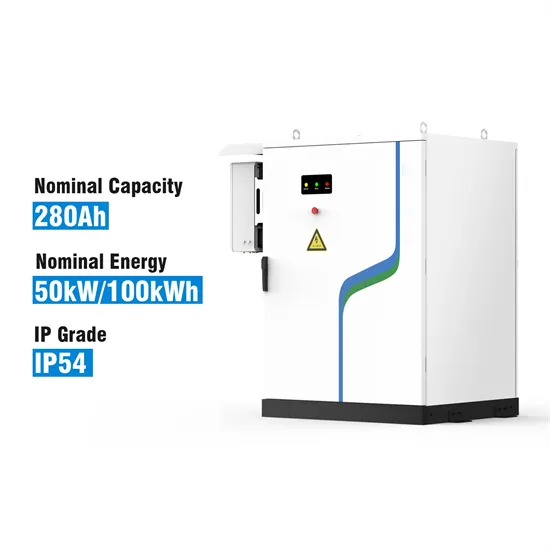

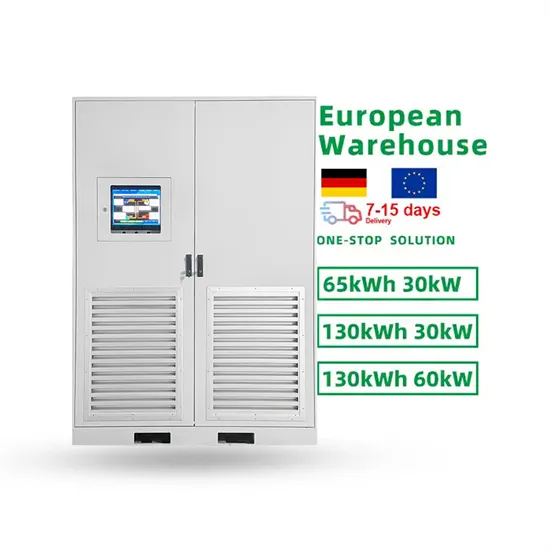

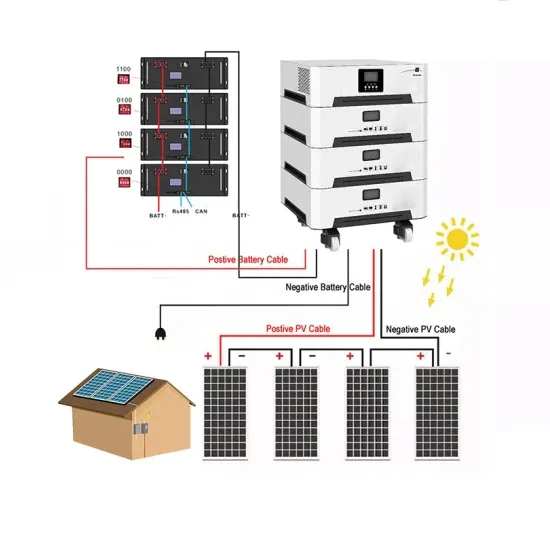

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.