Q&A: How China became the world''s leading market for energy storage

However, despite the renewable energy boom, China''s power system still struggles to absorb all of the generation, making energy storage – which bridges temporal and

Get Price

China: Price Cuts To Stimulate Demand, Industrial

The price increase of energy storage has reduced the profitability of power stations, stimulating the development of independent/shared energy

Get Price

Next step in China''s energy transition: energy storage

China''s industrial and commercial energy storage is poised for robust growth after showing great market potential in 2023, yet critical

Get Price

Long on expectations, short on supply: Regional lithium

This study integrates supply-demand analysis with trade network simulations, using eight lithium demand scenarios and two supply scenarios to examine regional lithium

Get Price

China''s troubled energy-storage sector reels from

Slower capital spending and weaker prices projected as tariffs set to hit China''s biggest export market for energy-storage systems.

Get Price

THE CHINA BATTERY ENERGY STORAGE SYSTEM

EXECUTIVE SUMMARY A Battery Energy Storage System (BESS) secures electrical energy from renewable and non-renewable sources and collects and saves it in rechargeable

Get Price

Lithium in the Energy Transition: Roundtable Report

An expert from a sodium-ion battery startup said at the event that sodium-ion batteries, which trade sodium for lithium, are a "pressure release

Get Price

"Mind blowing:" Battery cell prices plunge in China''s

Since then, an auction in China – the country''s biggest for energy storage – suggests that the price decline in battery cells, thanks to intense competition,

Get Price

What Are The Implications Of $66/kWh Battery Packs In China?

The Power Construction Corporation of China drew 76 bidders for its tender of 16 GWh of lithium iron phosphate (LFP) battery energy storage systems (BESS), according to

Get Price

China''s Lithium-Ion Battery Industry – Overcoming Supply Chain

China''s lithium battery industry is seeing rapid growth amid sky-high demand from the electric car and renewable energy industries. However, a reliance on imports for key materials leaves the

Get Price

China Lithium Energy Storage Power Supply Price Trends in 2025

As of February 2025, lithium energy storage systems in China demonstrate significant price variations across different configurations. A 5kW solar-compatible system with 48V lithium

Get Price

Sustainable lithium supply for electric vehicle development in China

Global lithium demand is expected to increase tenfold by 2050 under scenarios aiming to limit global warming to 1.5 °C, driven primarily by the rapid adoption of electric

Get Price

China''s hold on the lithium-ion battery supply chain: Prospects for

The findings of this study hereby provide a foundation upon which sophisticated strategies can be developed to counter China''s dominance and secure a larger share of

Get Price

How does the cost of energy storage systems in China compare

The cost of energy storage systems in China often differs significantly from those in other countries due to various factors such as government policies, economies of scale, and

Get Price

China Energy Storage Market Size, Growth Outlook 2025-2034

The China energy storage market size exceeded USD 223.3 billion in 2024 and is expected to register at a CAGR of 25.4% from 2025 to 2034, driven by the country''s aggressive push for

Get Price

China Storage Price per kWh: The Evolving Cost Dynamics

Recent data from CNESA reveals that while utility-scale storage system prices dropped to ¥1.05/Wh ($0.145/kWh) in coastal provinces, western regions still grapple with ¥1.35/Wh tariffs

Get Price

Lithium prices spiked before retreating sharply; storage cell

At present, lithium carbonate inventories remain elevated, while supply `in non-China markets is relatively sufficient. Consequently, following the easing of production cut

Get Price

China''s CATL pushes beyond batteries into power

The company is also working with Hainan, an island province off China''s southern coast, on a larger, longer-term project that would combine

Get Price

"Mind blowing:" Battery cell prices plunge in China''s biggest energy

Since then, an auction in China – the country''s biggest for energy storage – suggests that the price decline in battery cells, thanks to intense competition, technology and efficiency

Get Price

Where Does China Rank in Energy Storage Costs? A 2025

Let''s cut to the chase: China currently leads the global race in energy storage cost reduction, with 2024 figures showing lithium iron phosphate (LFP) battery systems hitting a

Get Price

How Trump''s Tariffs Could Hobble the Fastest

Across the country, companies have been installing giant batteries that help them use more wind and solar power. That''s about to get much harder.

Get Price

What goes up must come down: A review of BESS

For example, although supply/demand imbalances drove price volatility from 2021 through 2023, the magnitude of those price excursions was

Get Price

China''s lithium prices hit 4-year low on oversupply

Chinese lithium carbonate prices have hit a four-year low because of rising supply and escalating geopolitical tensions that have weighed on battery export growth.

Get Price

How does the cost of energy storage systems in

The cost of energy storage systems in China often differs significantly from those in other countries due to various factors such as

Get Price

China aims to nearly double battery storage by 2027 in $35 billion

2 hours ago· China is looking to almost double its so-called new energy storage capacity to 180 gigawatts (GW) by 2027, according to an industry plan announced by authorities on Friday.

Get Price

China Lithium Energy Storage Power Supply Price Trends in 2025

The focus of current energy storage system trends is on enhancing current technologies to boost their effectiveness, lower prices, and expand their flexibility to various applications.

Get Price

China: Price Cuts To Stimulate Demand, Industrial And Commercial Energy

The price increase of energy storage has reduced the profitability of power stations, stimulating the development of independent/shared energy storage models. Domestic

Get Price

6 FAQs about [China s lithium energy storage power supply price]

What are the leading energy storage battery companies in China?

Leading energy storage battery companies in China include BYD (002594.SZ), which is also the country's biggest electric vehicle maker, and CATL (300750.SZ).

How big is China's energy storage capacity?

Sign up here. Current installed new energy storage capacity, which is made up mostly of lithium-ion battery storage, was 95 GW as of June, the regulator, the National Energy Administration, said in August. China has raced ahead of its energy storage targets in the past.

Which materials are used in lithium ion batteries?

Lithium, nickel, manganese, and cobalt are of particular significance for the dominant lithium-ion battery (LIB) technology, primarily relying on lithium iron phosphate (LFP) and lithium nickel manganese cobalt oxide (NMC) cathodes. Geographically, the global supply is heavily reliant on China with competition expected to intensify.

How does China influence the supply chain?

China governs the largest production shares within the supply chain (11 out of 12). China, Europe and the USA use capital power to boost impact across the supply chain. Political factors further strengthen China's control in mining. China's dominance in LFP-production exceeds 98 %.

What is new energy storage?

New energy storage refers to electricity storage processes that use electrochemical, compressed air, flywheel and supercapacitor systems, but not pumped hydro, which uses water stored behind dams to generate electricity when needed. Our Standards: The Thomson Reuters Trust Principles.

Which countries are most impacted by lithium & cobalt acquisitions?

Whilst the USA ranks second in ownership stakes regarding the mining of Lithium and Europe's stakes are negligible (Fig. 2), the situation is the opposite for nickel and cobalt. The most substantial regions impacted by the corporate acquisitions are Australia, Indonesia, and the DRC with regard to lithium, nickel, and cobalt, respectively.

More related information

-

China s lithium energy storage power supply retail price

China s lithium energy storage power supply retail price

-

Canadian lithium energy storage power supply wholesale price

Canadian lithium energy storage power supply wholesale price

-

Lithium energy storage power supply price in India

Lithium energy storage power supply price in India

-

What is the price of lithium energy storage power supply in Asia

What is the price of lithium energy storage power supply in Asia

-

Cyprus lithium energy storage power supply price

Cyprus lithium energy storage power supply price

-

Estonia lithium energy storage power supply price

Estonia lithium energy storage power supply price

-

What is the price of lithium energy storage power supply in Sierra Leone

What is the price of lithium energy storage power supply in Sierra Leone

-

What is the price of lithium energy storage power supply in Bahrain

What is the price of lithium energy storage power supply in Bahrain

Commercial & Industrial Solar Storage Market Growth

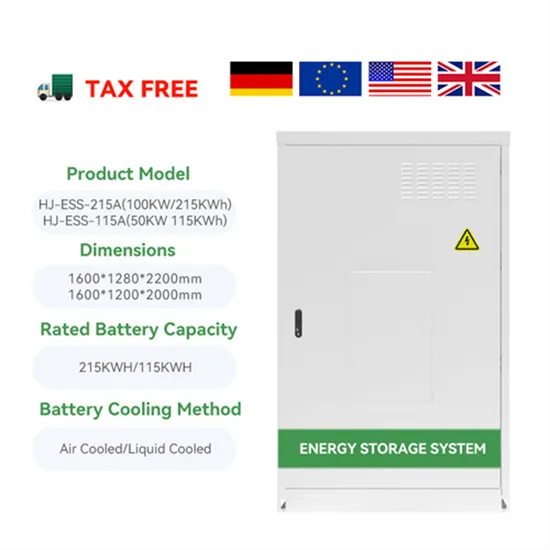

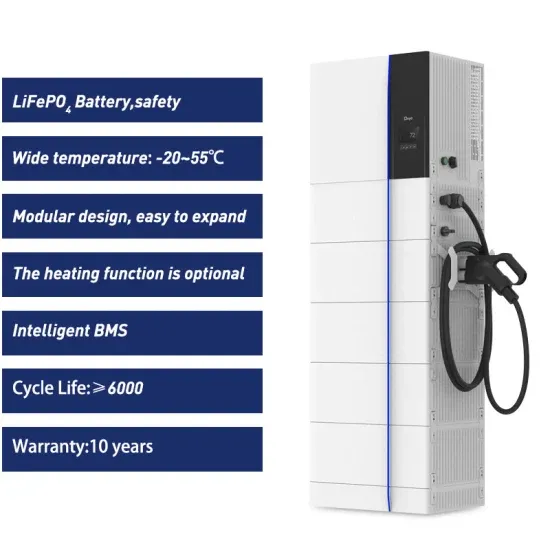

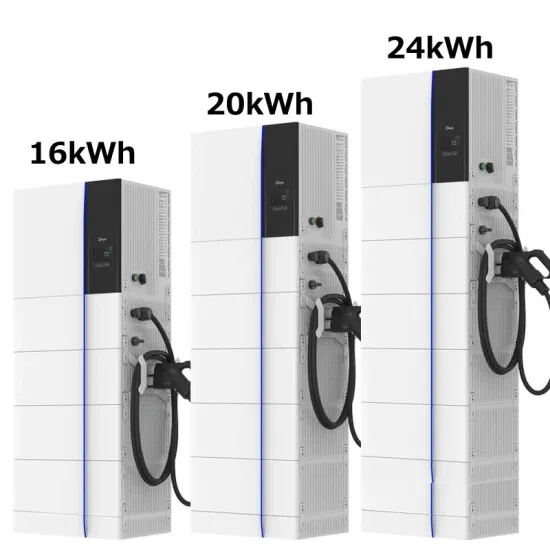

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

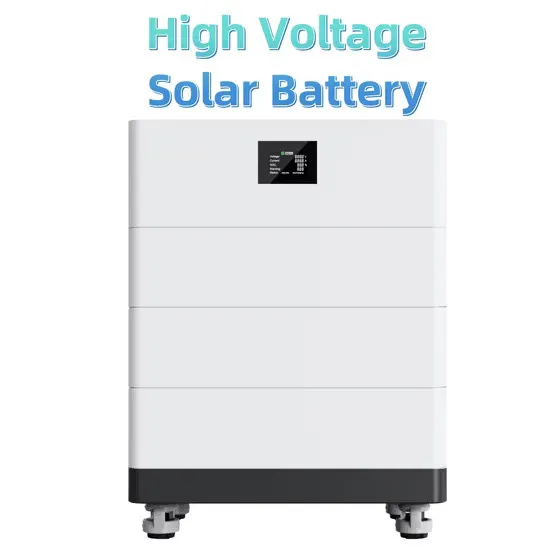

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.