Europe considers ban on Chinese solar inverters, citing

Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions about restricting high-risk

Get Price

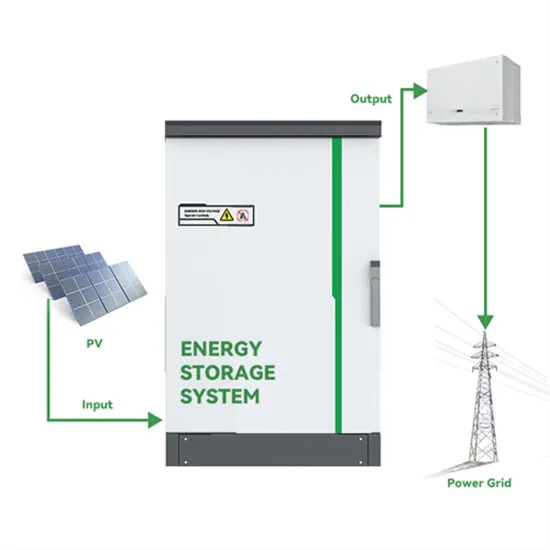

Making your own local grid

In Cameroon, technologies supplied by Huawei have enabled the construction of independent power grids in villages that previously depended on generators for their electricity.

Get Price

Call for an EU "Inverter Security Toolbox"

• 70% of all inverters installed in 2023 came from Chinese vendors, mainly Huawei and Sungrow. • These two companies alone already control remote access to 168 GW of PV

Get Price

Huawei Dominates the Solar Inverter Market in Europe

Huawei, the Chinese technology giant, continues to dominate the solar inverter market in Europe, according to a new report by Wood Mackenzie. The company has been

Get Price

Cameroon exempts imported PV components from

PV modules, inverters, charge controllers, batteries and cables intended for rooftop solar systems will benefit from exemptions from customs

Get Price

Huawei: Our inverters are not a cybersecurity threat

Huawei has defended the security of its solar inverters in the wake of calls from a group of US senators for them to be removed from use in the

Get Price

Rogue communication devices found in Chinese solar

U.S. energy officials are reassessing the risk posed by Chinese-made devices that play a critical role in renewable energy infrastructure after

Get Price

Rogue communication devices found in Chinese solar power inverters

While inverters are built to allow remote access for updates and maintenance, the utility companies that use them typically install firewalls to prevent direct communication back

Get Price

Huawei Ousted from SolarPower Europe Amid EU Investigation

By the end of 2023, Huawei and Sungrow alone had supplied more than 160GW of photovoltaic inverters to the region. In contrast, European manufacturers such as SMA are

Get Price

Floating-PV Powers Singapore | Huawei Enterprise

Sunseap selected Huawei to supply its field-proven smart string inverters to make the floating solar farm in Singapore more efficient, safer, and more reliable.

Get Price

Power costs in Cameroon dropped from XAF375 to XAF100 per

Cameroon''s current policy is to promote all energy efficiency measures mainly through energy-saving bulbs and equipment. The country also encourages good practices

Get Price

Huawei launches smart PV solutions for all scenarios of African

At the end of the conference agenda, Huawei together with local partners held a "lighting ceremony" for the launch with Huawei smart photovoltaic (PV) solutions for all

Get Price

Rural Cameroon Uses Microgrid Solar | Huawei Enterprise

Prevent the importation into Cameroon of dangerous products, which do not comply with quality and/or safety standards, as well as counterfeits. To ensure the quality of products, the health

Get Price

Banned Huawei signs deals for UK solar power

Concerns centred around Huawei''s links to the Chinese state. National security laws require all citizens and organisations to help Beijing if required and Ren Zhengfei,

Get Price

Huawei: Our inverters are not a cybersecurity threat

Huawei has defended the security of its solar inverters in the wake of calls from a group of US senators for them to be removed from use in the States.

Get Price

CUSTOMS HANDBOOK FOR SOLAR SYSTEMS IN

Prevent the importation into Cameroon of dangerous products, which do not comply with quality and/or safety standards, as well as counterfeits. To ensure the quality of products, the health

Get Price

Huawei: residential solutions

Huawei offers a wide range of solutions for residential installations that maximize energy efficiency and the intelligent management of photovoltaic energy. With a focus on ease

Get Price

Rogue communication devices found in Chinese solar

While inverters are built to allow remote access for updates and maintenance, the utility companies that use them typically install firewalls to

Get Price

Residential Products List | HUAWEI Smart PV Global

Residential Products List covers all household photovoltaic products, including inverters, energy storage, optimizers, controllers and other household

Get Price

Green power that floats

And in The Netherlands, Huawei''s inverters are used in the largest floating power plant outside Asia. It meets 6% of the energy needs of Zwolle, a city of

Get Price

Hybrid Solar Inverter: Revolutionizing Green Energy

Maximize your green energy solution with a hybrid solar inverter—proven to optimize consumption, ensure power stability, and reduce

Get Price

Europe considers ban on Chinese solar inverters,

Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions

Get Price

Cameroon exempts imported PV components from customs duties

PV modules, inverters, charge controllers, batteries and cables intended for rooftop solar systems will benefit from exemptions from customs duties until 2025.

Get Price

EU Restricts Chinese Inverters In The Name Of Safety

According to data from the European Solar Manufacturing Council (ESMC), Chinese inverters account for 70% of the European market share,

Get Price

Rural Cameroon Uses Microgrid Solar | Huawei Enterprise

According to the Cameroon national power development planning, the current investments into hydropower, thermal power stations, and national grid construction is quite extensive, yet

Get Price

EU Restricts Chinese Inverters In The Name Of Safety

According to data from the European Solar Manufacturing Council (ESMC), Chinese inverters account for 70% of the European market share, and companies such as

Get Price

SPECIAL EDITION DEVELOPED IN PARTNERSHIP WITH

Huawei: Leading the charge to create a new energy system This is the seventh special edition pv magazine has produced in partnership with Huawei. The Shenzhen-based

Get Price

6 FAQs about [Huawei s photovoltaic inverters are banned in Cameroon]

Could Huawei solar inverters be a threat to the power grid?

The debate mirrors the 2019 US ban on Huawei solar inverters, which cited potential remote control threats to the power grid, particularly during wartime.

Why did the US ban on Huawei inverters?

The 2019 US ban on Huawei inverters was driven by fears that adversaries could remotely disrupt critical applications like home electricity and electric vehicle charging. Although Huawei has exited the US market, other Chinese manufacturers have filled the gap, offering cost-competitive products that continue to dominate globally.

Are China-made photovoltaic inverters a cybersecurity risk?

Europe is grappling with growing concerns over the cybersecurity risks posed by Chinese-made photovoltaic inverters, prompting discussions about restricting high-risk suppliers from connecting to its power systems.

How Huawei inverters are changing people's lives in Cameroon?

Huawei inverters are built to provide durability and reliability at levels unmatched in the rest of the industry. But see for yourself how in Cameroon, Huawei technology is changing people’s lives. The media could not be loaded, either because the server or network failed or because the format is not supported.

Why has Huawei defended its solar inverters?

Huawei has defended the security of its solar inverters in the wake of calls from a group of US senators for them to be removed from use in the States. The letter, released on Monday urged Congress to put in place action similar to that which blocks Huawei and fellow Chinese firm ZTE from providing telecommunications infrastructure.

Should Chinese inverters be banned?

Critics argue that banning Chinese inverters could raise costs and disrupt supply chains, as European alternatives are 30-50% more expensive. The European Commission is assessing cybersecurity risks in the solar value chain, with the ESMC advocating for measures like Lithuania's 2023 ban on Chinese inverters.

More related information

-

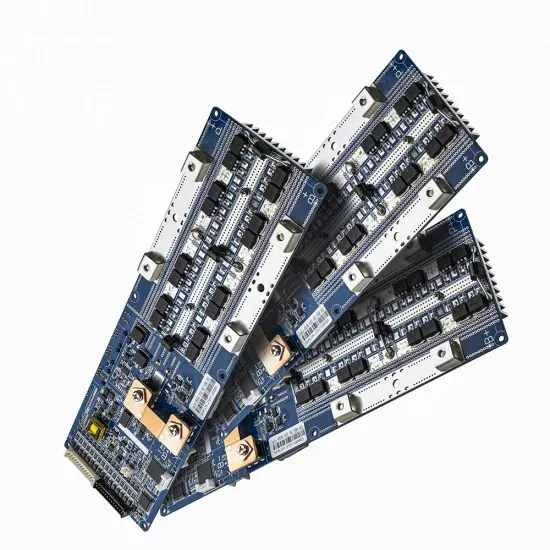

Advantages of Huawei string photovoltaic inverters

Advantages of Huawei string photovoltaic inverters

-

Huawei Cameroon Photovoltaic Curtain Wall

Huawei Cameroon Photovoltaic Curtain Wall

-

Huawei has photovoltaic grid-connected inverters

Huawei has photovoltaic grid-connected inverters

-

Huawei Huazhi produces photovoltaic inverters

Huawei Huazhi produces photovoltaic inverters

-

Source of Huawei s photovoltaic inverters

Source of Huawei s photovoltaic inverters

-

What are some famous brand photovoltaic inverters

What are some famous brand photovoltaic inverters

-

Huawei Peru foldable photovoltaic panels

Huawei Peru foldable photovoltaic panels

-

Huawei Southern Europe Energy Storage Photovoltaic Panels

Huawei Southern Europe Energy Storage Photovoltaic Panels

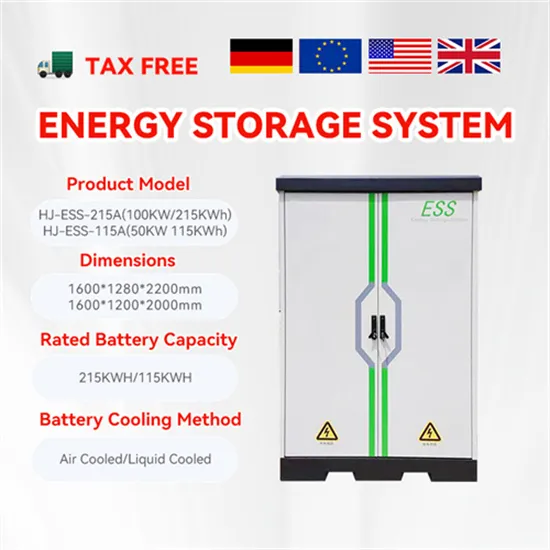

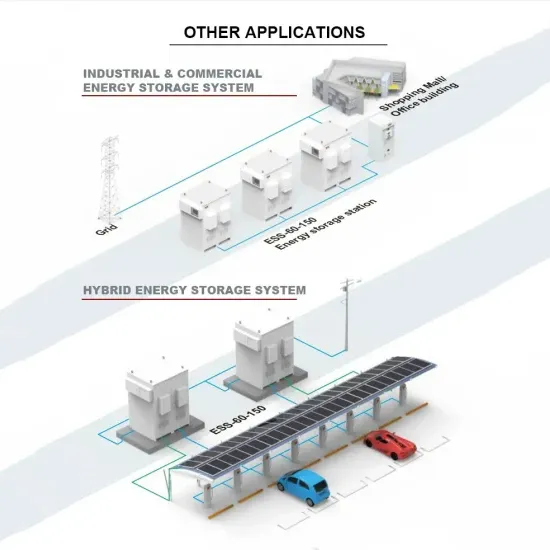

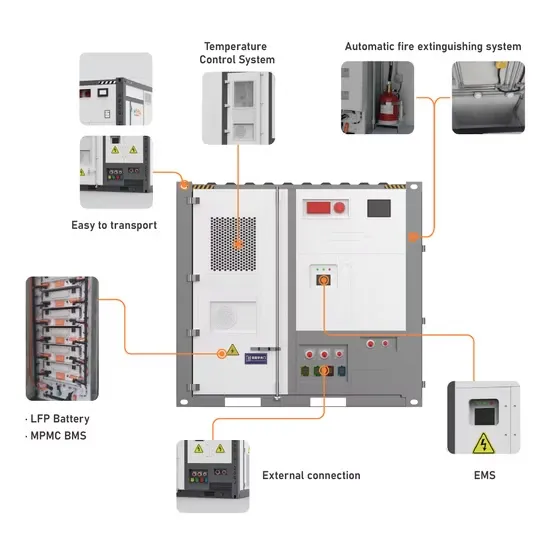

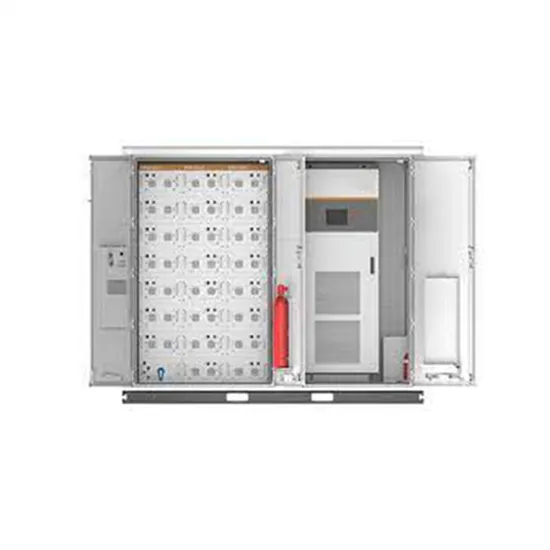

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

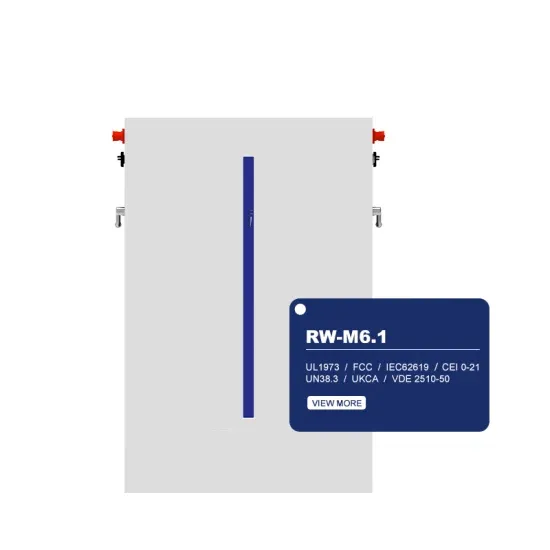

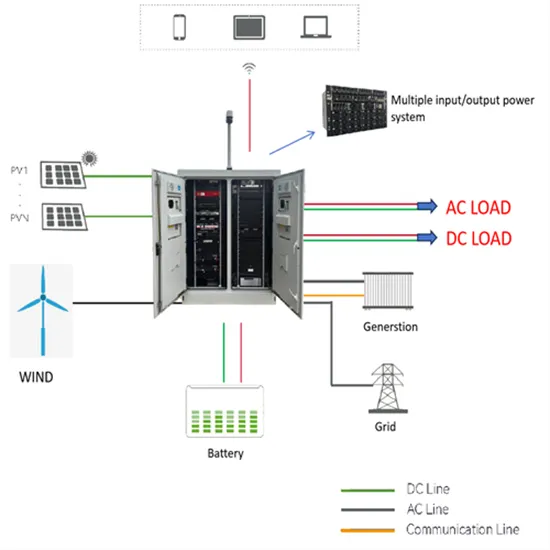

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.