Solar Market Insight Report Q3 2025

4 days ago· 1. Key Figures The US solar industry installed 7.5 gigawatts direct current (GW dc) of capacity in Q2 2025, a 24% decline from Q2 2024 and a 28% decrease since Q1 2025. Solar

Get Price

REC Solar Panels Review 2025: Performance, Cost & Expert

10 hours ago· REC Group has established itself as a premium solar panel manufacturer since 1996, consistently delivering high-quality photovoltaic modules that compete with industry

Get Price

Solar energy status in the world: A comprehensive review

Through a systematic literature survey, this review study summarizes the world solar energy status (including concentrating solar power and solar PV power) along with the

Get Price

The extra climate benefits of solar farms

Expanding the focus to floating 8 or rooftop 9 solar farms is also essential to pave the way for a global sustainable solar industry that fosters climate-positive outcomes.

Get Price

The residential solar market: Down, not out | McKinsey

Declines in residential solar markets have been a hit to the industry—but its foundation is strong. Worldwide, 2024 was a difficult year for

Get Price

Cover Story: US tariffs shine spotlight on Malaysian

ONCE again, Sino-US tensions have put Malaysia''s solar photovoltaic (PV) module manufacturing industry in the countries'' crosshairs,

Get Price

US solar installation forecast slashed due to Trump policies,

4 days ago· The U.S. solar industry is at risk of installing 27% less capacity between 2026 and 2030 than before the passage of President Donald Trump''s tax law that rolled back subsidies

Get Price

5 Top KPIs to Help Keep Solar Projects on Track

Looking for the 5 top KPIs to help keep solar projects on track? In the vast solar industry, maintaining project alignment with strategic objectives is essential for success.

Get Price

Sector Spotlight: Solar PV Supply Chain

As solar PV plays an increasingly large role in supplying power, U.S. manufacturing of solar modules and their component parts (silicon

Get Price

2025 Solar Energy Statistics: Latest Industry Survey Data

EnergySage has released its nineteenth semiannual Solar & Storage Marketplace Report, which analyzes millions of transaction-level data points from

Get Price

Solar panel ppt | PPTX

This experiment aimed to study the current-voltage characteristics and power curve of a solar panel to determine the maximum power point (MPP) and efficiency. Observations of voltage,

Get Price

Solar Market Insight Report 2024 Year in Review – SEIA

The industry remains optimistic about the role of solar in achieving energy dominance and meeting rising electricity demand. State-level initiatives and corporate demand

Get Price

Quarterly Solar Industry Update

Each quarter, the National Renewable Energy Laboratory conducts the Quarterly Solar Industry Update, a presentation of technical trends within the solar industry.

Get Price

A 13-year Old''s Discovery Shows Promise For Solar Panel Winter

2 days ago· Solar panel winter efficiency improvement may come from nature itself. A 13-year-old student built a solar tree model based on the Fibonacci pattern of tree branches and found it

Get Price

Quarterly Solar Industry Update

Each quarter, the National Renewable Energy Laboratory conducts the Quarterly Solar Industry Update, a presentation of technical

Get Price

2025 Solar Industry Data and Insights | EnergySage

EnergySage has released its nineteenth semiannual Solar & Storage Marketplace Report, which analyzes millions of transaction-level data points from homeowners shopping on

Get Price

2025 Solar Energy Statistics: Latest Industry Survey Data

In early 2025, SolarReviews concluded our third annual survey of companies in the U.S. solar industry. We heard from hundreds of companies that comprise various industry sectors, from

Get Price

Solar PV Panels Market Size, Share & Trends Report, 2030

Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive the growth of solar PV

Get Price

The 2025 Solar Industry Survey: Insights from the U.S. Market

50% cited changes to solar incentives as a major issue, reflecting uncertainty over policies affecting consumer adoption of solar energy. 46% identified political and legislative

Get Price

Hazards associated with solar panel installation and maintenance

The Relevance of HSE in Solar Panel Installation Health, Safety, and Environment (HSE) protocols are critical in the solar industry. From the initial installation to ongoing

Get Price

A Survey on Solar Power for Present and Future

Abstract and Figures In the ancient world, there was no fossil fuel, mineral oil and coal available for utilization. Renewable energy sources

Get Price

Solar Supply Chain and Industry Analysis

NREL''s quarterly solar industry updates provide information on trends within the solar industry. These quarterly updates cover an array of photovoltaic module and system

Get Price

2025 Solar Energy Statistics: Latest Industry Survey

These statistics explain the American solar industry, as hundreds of companies share their top brands, biggest challenges, and outlook for 2025.

Get Price

Solar PV Panels Market Size, Share & Trends Report,

Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive

Get Price

The residential solar market: Down, not out | McKinsey

Declines in residential solar markets have been a hit to the industry—but its foundation is strong. Worldwide, 2024 was a difficult year for the residential solar market. After

Get Price

6 FAQs about [Solar Panel Industry Observation]

What will drive the growth of solar PV panels industry?

Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive the growth of solar PV panels industry in the coming years. Asia Pacific held the largest market share of over 54.0% in 2023.

How will solar impact the energy industry?

The industry remains optimistic about the role of solar in achieving energy dominance and meeting rising electricity demand. State-level initiatives and corporate demand will gain more relevance and drive solar development, potentially mitigating the impact of federal mandates.

What factors influence the competitiveness of solar PV panel industry?

The high degree of forward integration, security of raw material feedstock, technology sourcing, skilled manpower, and strong R&D are among the prominent factors governing the competitiveness of solar PV panel industry. Globally, rising renewable energy demand in addition to growing energy security concerns is driving market growth.

What are NREL's quarterly solar industry updates?

NREL's quarterly solar industry updates provide information on trends within the solar industry. These quarterly updates cover an array of photovoltaic module and system technologies as well as energy storage and concentrating solar power. The quarterly solar industry updates often cover: Updates on related government programs and policies.

How are the proposed measures affecting the solar sector?

The proposed measures have varying degrees of impact on each solar segment. We have identified some initiatives that are contributing to a challenging environment for the sector: Energy emergency declaration. President Trump declared an energy emergency, prioritizing thermal and hydropower generation over wind, solar and storage.

What is the market share of solar PV panels in 2023?

Based on application, the industrial segment accounted for a dominant share of over 40.0% in solar PV panels sector in 2023. Companies in the commercial and industrial sectors are among the major consumers of solar photovoltaic panels owing to the large-scale demand for green energy.

More related information

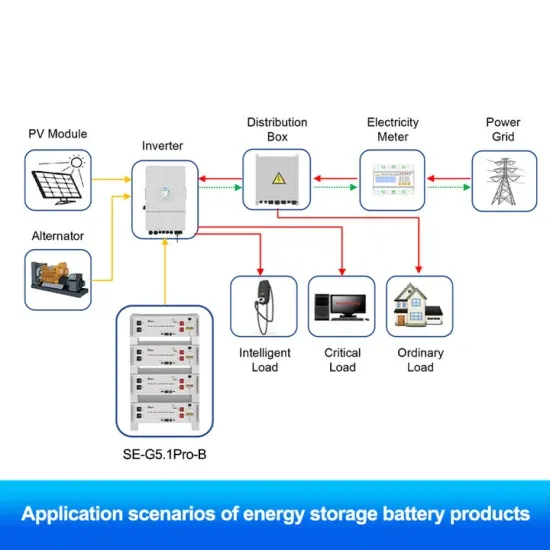

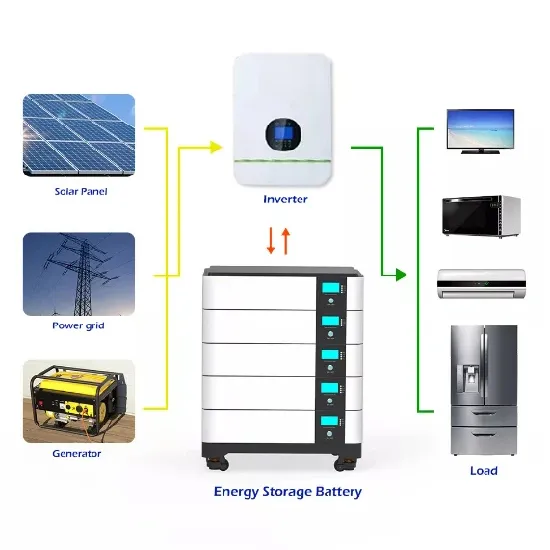

Commercial & Industrial Solar Storage Market Growth

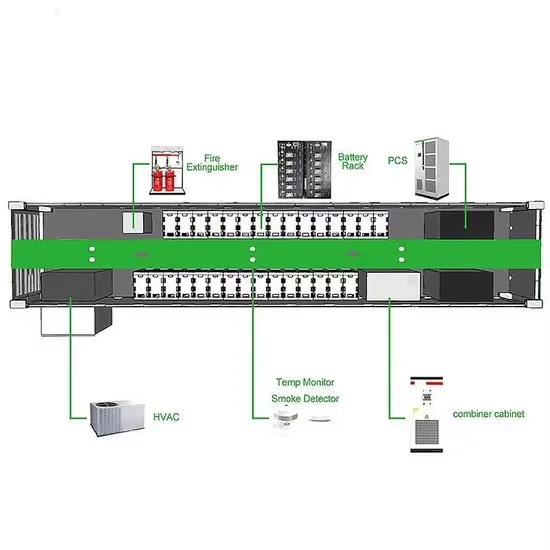

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

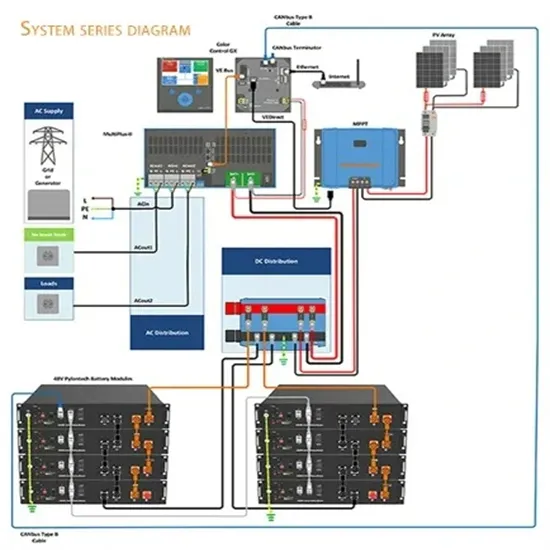

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.

Current solar panel industry

Current solar panel industry

Solar Panel Industry Company

Solar Panel Industry Company

Top 10 Solar Panel Industry

Top 10 Solar Panel Industry

China-Africa Solar Photovoltaic Panel Industry

China-Africa Solar Photovoltaic Panel Industry

Photovoltaic solar panel industry

Photovoltaic solar panel industry

Solar Panel Base Project

Solar Panel Base Project

Swaziland non-standard solar panel assembly flexible

Swaziland non-standard solar panel assembly flexible

Huawei Cadmium Telluride Solar Panel

Huawei Cadmium Telluride Solar Panel