Power Generation Solutions

Oil and gas Power Generation Solutions involve technologies like gas turbines, compressors, and electric motors to convert fossil fuels into electrical energy, essential for powering equipment

Get Price

Power generation

The energy transition is well underway, as the power industry moves toward a low-carbon future. We help you to develop innovative renewable energy projects, and ensure the safe operation

Get Price

Libya Paves Way for Power Sector, Clean Energy Transformation

Major projects include the restoration of existing power plants, upgrading grid infrastructure and building new capacity, with construction launched on the 1,320 MW gas-fired

Get Price

Libya''s power infrastructure – revised September 2020

Power generation data was drawn from our African Energy Live Data platform, which contains project level detail on power plants and projects across Africa. The map is

Get Price

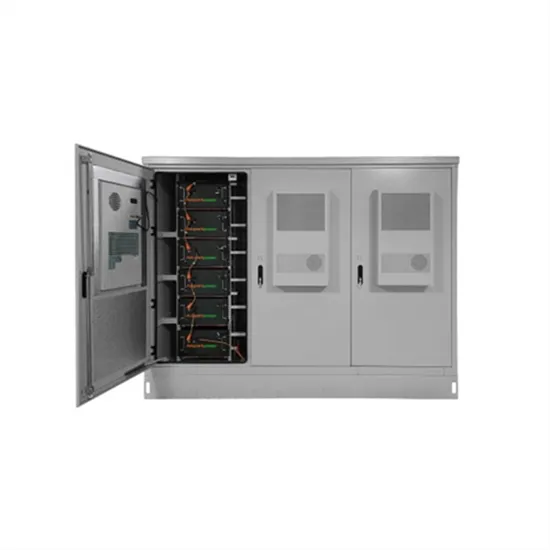

Libya energy storage container manufacturer | Solar Power

By interacting with our online customer service, you''ll gain a deep understanding of the various Libya energy storage container manufacturer featured in our extensive catalog, such as high

Get Price

Harnessing the Desert Sun: Libya''s Vision for a

Embracing renewable energy solutions marks a pivotal move for the country, whose power generation capacity has been fueled by oil and

Get Price

Libya Power Generation Equipment Market (2025-2031) | Trends,

6Wresearch actively monitors the Libya Power Generation Equipment Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Get Price

Reliable Energy Storage Containers in Libya: Powering the

A 2024 Gartner report shows energy storage containers could reduce Libya''s generator dependence by 61% within a decade.

Get Price

Libya: Oil and gas infrastructure map and production

The main map provides an overview of Libya''s main oil and gas production areas and power generation sites. Fields are marked alongside

Get Price

Libya power generation and transmission map

Revised in April 2023, this map provides a detailed view of the power sector in Libya. The locations of power generation facilities that are

Get Price

Libya Paves Way for Power Sector, Clean Energy

Major projects include the restoration of existing power plants, upgrading grid infrastructure and building new capacity, with construction

Get Price

The arrival of the equipment of the first power generation plant

The construction works for the power generation plant in Tobruk, Libya, with a total power output of 650MW, led by Sustainable Engineering Solutions Business Unit of MYTILINEOS, are now

Get Price

Libya Energy

The General Electricity Company of Libya (GECOL) announced 26 April that technical teams have begun the installation and assembly of the third gas

Get Price

Libya Launches 20 Strategic Power Projects to Bolster Energy

This initiative aligns with the government''s strategy to enhance Libya''s generation capacity through gas-to-power projects, renewable energy and regional grid interconnections.

Get Price

Libya Electricity Generation Mix 2023 | Low-Carbon Power Data

Libya''s electricity mix includes 74% Gas, 23% Unspecified Fossil Fuels and 0% Solar. Low-carbon generation peaked in 2012.

Get Price

Power Generation in Libya

Power Generation in Libya industry profile provides top-line qualitative and quantitative summary information including: market size (value and volume 2014-18, and

Get Price

Global Power Outages: Causes, Effects, and Libya''s

Increased Generation Capacity Libya''s power generation capacity has increased significantly, reaching 8,200 megawatts (MW) in 2023, up from

Get Price

Country Analysis Brief: Libya

Libya''s electricity generation has declined overall since 2013, and output was an estimated 30 terawatthours (TWh) of power generation in 2022.62 Over a decade of civil war and insufficient

Get Price

Libya''s power infrastructure – revised September 2020

Power generation data was drawn from our African Energy Live Data platform, which contains project level detail on power plants and projects

Get Price

Libya power generation and transmission map including Man

Revised in April 2023, this map provides a detailed view of the power sector in Libya. The locations of power generation facilities that are operating, under construction or

Get Price

Power Generation in Libya

SUMMARY Power Generation in Libya industry profile provides top-line qualitative and quantitative summary information including: market size (value and volume 2014-18, and

Get Price

The arrival of the equipment of the first power

The construction works for the power generation plant in Tobruk, Libya, with a total power output of 650MW, led by Sustainable Engineering Solutions

Get Price

Libya Launches 20 Strategic Power Projects to Bolster Energy

The event will gather international investors and local stakeholders to highlight Libya''s advancements in infrastructure and energy development, underscoring its commitment

Get Price

How Modern Power Generation Solutions are Optimizing Power Generation

With ongoing advancements in technology and a shared commitment to excellence, this partnership is set to drive further innovations in the energy sector, ensuring that Libya remains

Get Price

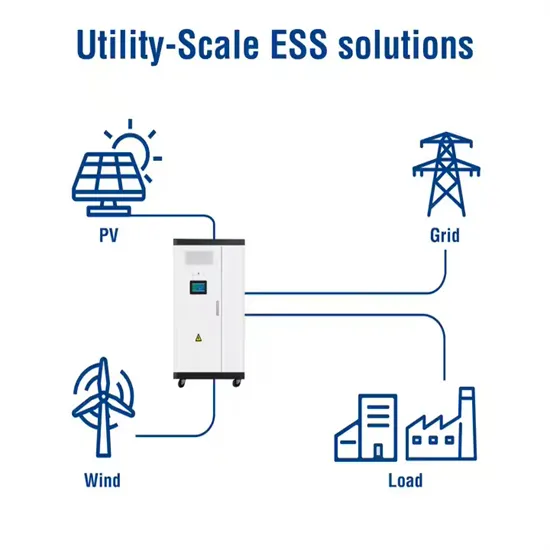

Types of power backup systems Libya

-Maximum power point tracking in PV systems. - Efficient management of energy production and consumption in a hybrid system. - Control of power consumption for both priority and non

Get Price

Libya: Oil and gas infrastructure map and production data

The main map provides an overview of Libya''s main oil and gas production areas and power generation sites. Fields are marked alongside associated mid- and downstream

Get Price

Energy Storage Container Installation in Libya: A Complete Guide

With daily blackouts lasting up to 8 hours in Tripoli and Benghazi [3], energy storage containers have become the talk of the town. These steel-clad power banks could be the missing puzzle

Get Price

6 FAQs about [Libya power generation container factory]

What is the power sector in Libya?

Revised in September 2020, this map provides a detailed overview of the power sector in Libya. The locations of power generation facilities that are operating, under construction or planned are shown by type – including liquid fuels, gas and liquid fuels, natural gas, nuclear, solar (PV and CSP) and wind.

How much electricity does Libya produce a year?

Libya’s electricity generation has declined overall since 2013, and output was an estimated 30 terawatthours (TWh) of power generation in 2022.62 Over a decade of civil war and insufficient maintenance and investment in aging plants and equipment reduced Libya’s ability to produce electricity.

How many MW of electricity does Libya generate in 2023?

66 Libya Oil Monitor, “GECOL gives update on power plant maintenance,” December 4, 2023; Libya Herald, “Libya generates 8,200 MW of electricity for the first time ever: GECOL,” March 20, 2023. 67 France24, “Libya lights up after years of power cuts,” September 3, 2023.

Does totalenergies have a solar project in Libya?

In addition to its recent investment in Libya’s oil and natural gas sectors, TotalEnergies intends to develop 500 MW of solar power projects in the country.72 Libya has also discussed solar power projects with Repsol, PowerChina, Petro Techna (Canada), and others.73

What fuel does Libya use?

Libya fueled its electricity generation with natural gas (71%) and oil (29%) in 2022.63 Diesel and fuel oil accounted for most of the petroleum used in power plants, although the Ubari power plant at the Sharara oil field uses crude oil as a fuel.

Does Libya produce condensate & natural gas plant liquids?

Libya’s natural gas fields produce condensates and natural gas plant liquids (NGPL) and contribute relatively small volumes to the country’s total petroleum and other liquids production. We estimate that condensate and NGPL production was less than 100,000 b/d in 2023.27

More related information

-

Indonesia factory solar power generation for home use

Indonesia factory solar power generation for home use

-

Container power generation capacity

Container power generation capacity

-

Power generation container room design

Power generation container room design

-

German container solar power generation for home use

German container solar power generation for home use

-

Is container power generation good

Is container power generation good

-

Iraq Container Power Generation BESS

Iraq Container Power Generation BESS

-

German power generation container customization

German power generation container customization

-

Double-layer container power generation

Double-layer container power generation

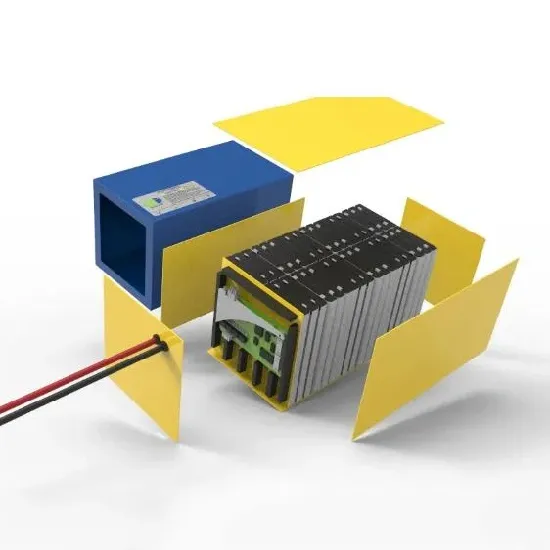

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.