Battery Energy Storage Systems (Bess)

Profitability through Empowering Energy Supply By harnessing our container energy storage solutions, we empower you to not only meet your energy

Get Price

An Economic Analysis of Energy Storage Systems Participating in

Energy storage systems (ESS) are becoming increasingly important as high shares of renewable energy generation causes increased variability and intermittency of the power

Get Price

THE POWER OF SOLAR ENERGY CONTAINERS: A

Integration with smart grid systems and energy storage solutions: Explore the benefits of combining solar containers with smart grid

Get Price

The Economics of Battery Storage: Costs, Savings,

The global shift towards renewable energy sources has spotlighted the critical role of battery storage systems. These systems are essential

Get Price

Cost Analysis for Energy Storage: A Comprehensive

Understanding OPEX is vital for conducting a cost analysis of energy storage, which is essential for assessing the long-term sustainability

Get Price

BUSINESS MODELS AND PROFITABILITY OF ENERGY STORAGE

The analysis of the business models enabled us to compile 42 business models clustered under 11 overarching themes in the solar program areas. The analysis of the financing instruments

Get Price

Energy storage project profitability analysis

Energy storage project profitability analysis Abstract: The economic benefit of energy storage projects is one of the important factors restric. ed the application of energy storage systems.

Get Price

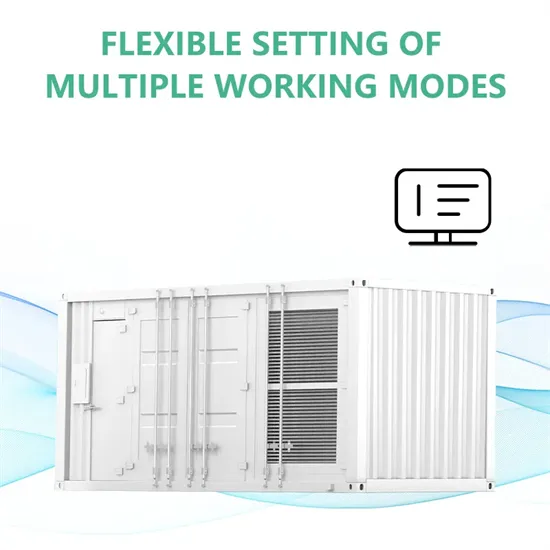

Container energy storage container: a revolutionary energy storage

Renewable energy storage Container energy storage container can effectively store electricity generated by renewable energy such as wind and solar energy, convert it into

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

Profit Analysis of the Solar Energy Storage Sector: Trends,

With global renewable capacity set to double by 2030, solar storage is the Swiss Army knife of the energy transition. Sure, there are hurdles—but as Tesla''s 70% YoY storage revenue growth

Get Price

Profits from processing energy storage containers

Is it profitable to provide energy-storage solutions to commercial customers? The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial

Get Price

Financial Analysis Of Energy Storage

Learn about the powerful financial analysis of energy storage using net present value (NPV). Discover how NPV affects inflation & degradation.

Get Price

Profitability of battery energy storage system coupled with

The present work proposes a long-term techno-economic profitability analysis considering the net profit stream of a grid-level battery energy storage system (BESS)

Get Price

Regenerative Energy BESS Container: Stop Port Crane Energy

Tired of port cranes wasting €55k/year on energy? Maxbo Solar''s Regenerative Energy BESS Container captures 92% of that wasted juice, slashes costs by €38k–55k/year,

Get Price

Solar Energy Storage Container Prices in 2025:

With the accelerating global shift towards renewable energy, solar energy storage containers have become a core solution in addressing both

Get Price

Solar Energy Storage Container Prices in 2025: Costs,

With the accelerating global shift towards renewable energy, solar energy storage containers have become a core solution in addressing both grid-connected and off-grid power

Get Price

Cost Analysis for Energy Storage: A Comprehensive Step-by

Understanding OPEX is vital for conducting a cost analysis of energy storage, which is essential for assessing the long-term sustainability and profitability of power reserve initiatives.

Get Price

An Economic Analysis of Energy Storage Systems

Energy storage systems (ESS) are becoming increasingly important as high shares of renewable energy generation causes increased variability

Get Price

Profitability Analysis of Battery Energy Storage in

This paper investigates the opportunity for a Battery Energy Storage System (BESS) to participate in multiple energy markets. The study

Get Price

BATTERY ENERGY STORAGE SYSTEM CONTAINER,

TLS OFFSHORE CONTAINERS /TLS ENERGY Battery Energy Storage System (BESS) is a containerized solution that is designed to store and manage energy generated from renewable

Get Price

German batteries stabilizing solar energy prices at expense of

German batteries stabilizing solar energy prices at expense of own profitability Analyst THEMA Consulting Group has calculated the impact of rapid expansion of battery

Get Price

U.S. Solar Photovoltaic System and Energy Storage Cost

Executive Summary This report benchmarks installed costs for U.S. solar photovoltaic (PV) systems as of the first quarter of 2021 (Q1 2021). We use a bottom-up method, accounting for

Get Price

BESS Container Revolutionizing Chile''s Solar-Powered

Much like a smartphone battery plummeting from 100% to 1% in the blink of an eye, solar power generation can plummet when clouds obscure the sun. This is where the BESS

Get Price

Air Energy Storage Profitability Analysis: Is It the Cash Cow of

As we''ve seen in this air energy storage profitability analysis report, the technology isn''t just hot air – it''s financial oxygen for the renewable energy sector.

Get Price

Analysis of Profitability of Energy Storage Containers

This paper explores the potential of using electric heaters and thermal energy storage based on molten salt heat transfer fluids to retrofit CFPPs for grid-side energy storage systems (ESSs),

Get Price

6 FAQs about [Analysis of profitability of energy storage container solar energy]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Should energy storage be undervalued?

The revenue potential of energy storage is often undervalued. Investors could adjust their evaluation approach to get a true estimate—improving profitability and supporting sustainability goals.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

More related information

-

Energy storage container solar energy research and development of new alkali polishing technology

Energy storage container solar energy research and development of new alkali polishing technology

-

Energy Storage Container Solar Energy and Energy Storage Container Photovoltaic

Energy Storage Container Solar Energy and Energy Storage Container Photovoltaic

-

China Photovoltaic Solar Energy Storage Container Communication Power Supply

China Photovoltaic Solar Energy Storage Container Communication Power Supply

-

Solar integrated energy storage cabinet container installation

Solar integrated energy storage cabinet container installation

-

Photovoltaic solar cell with energy storage container and energy storage cabinet

Photovoltaic solar cell with energy storage container and energy storage cabinet

-

Solar container energy storage cabinet

Solar container energy storage cabinet

-

220v solar energy system storage container

220v solar energy system storage container

-

China s energy storage container solar photovoltaic vertical integration project

China s energy storage container solar photovoltaic vertical integration project

Commercial & Industrial Solar Storage Market Growth

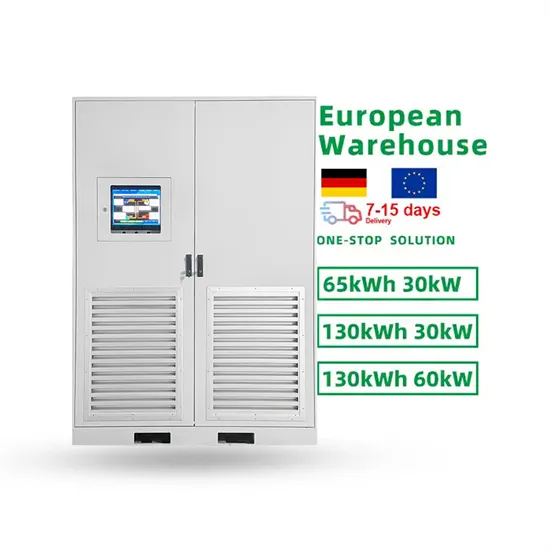

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.