5 Ways Battery Storage Is Transforming Solar Energy

Solar power''s biggest ally, the battery energy storage systems (BESS), has arrived in force in 2024. The pairing of batteries with solar

Get Price

Trinasolar Named in S&P Global Commodity Insights'' Premier

1 day ago· "Being named as Tier 1 by S&P Global for both solar PV modules and energy storage systems, further underscores our global influence, sustainability leadership, and capability to

Get Price

Energy Storage System Buyer''s Guide 2025

What is UL 9540? As part of our 2025 Energy Storage System Buyer''s Guide, we asked manufacturers to explain 9540A testing, and what installers should

Get Price

Top Renewable Energy & Battery Storage Stocks Worth

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing global electricity demand.

Get Price

Top 10 Energy Storage Investors (2025) | Industry Guide

Whether you''re a founder looking for investment or an aspiring investor in Energy Storage, these individuals represent some of the most knowledgeable and active participants

Get Price

Future Trends in Photovoltaic Energy Storage Systems

For consumers, integrated photovoltaic energy storage systems promise reliable, cost-effective, and sustainable energy solutions that enhance energy independence and

Get Price

Top 10: Energy Storage Companies | Energy Magazine

Whether it be energy that powers smartphones or even fuelling entire cities, energy storage solutions support infrastructure that acts as a

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium

Get Price

Top 19 Energy Storage Investors in the US

Explore energy storage investors like MassVentures and Climate Capital who are driving innovation and funding within the US energy storage sector.

Get Price

Storage is bigger than solar for ESG investors

Respondents also saw energy storage as delivering a better return on investment than solar PV from 2025 onwards. The research could be viewed as a relatively reliable

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium and battery technology.

Get Price

Comprehensive review of energy storage systems technologies,

The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Get Price

What are the photovoltaic energy storage stocks?

Photovoltaic energy storage stocks represent companies involved in the manufacturing and deployment of technologies that harness solar

Get Price

Subsidy Policies and Economic Analysis of

In the context of China''s new power system, various regions have implemented policies mandating the integration of new energy sources with

Get Price

17 Best Active Energy storage Investors in 2025

Investor Rankings are calculated using our Seedtable Score – a 1 to 100 score that uses quantitative and qualitative data points (like the size of their fund or the quality of the

Get Price

New Energy Storage Photovoltaic Stocks: The Bright Future of

Without storage, solar energy is like a burst of confetti—spectacular but fleeting. The magic happens when companies combine PV tech with advanced storage solutions like lithium

Get Price

Which investors are doing photovoltaic energy storage

Portable Solar Power Stations for Off-Grid Use Designed for off-grid applications, our portable solar power stations combine photovoltaic panels, energy storage, and inverters into a single

Get Price

Top Renewable Energy & Battery Storage Stocks

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

What are the best photovoltaic energy storage stocks?

1. The leading photovoltaic energy storage stocks for investment consideration include **Enphase Energy, NextEra Energy Partners, Tesla, and Array Technologies. Each of

Get Price

Renewable Energy Investors You Need to Know in 2025

Discover notable renewable energy investors of 2025 driving innovation in solar, wind, fusion, and more for a sustainable future.

Get Price

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

3 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get Price

Subsidy Policies and Economic Analysis of Photovoltaic Energy Storage

Taking a specific photovoltaic energy storage project as an example, this paper measures the levelized cost of electricity and the investment return rate under different energy

Get Price

6 FAQs about [Reliable Investor of Photovoltaic Energy Storage]

Why do we need reliable energy storage solutions?

As industries across the board are rapidly embracing renewable energy worldwide for a more sustainable future, the need for reliable energy storage solutions has surged significantly over the past decade.

Is Bloom Energy a good energy storage stock?

Bloom Energy is one of the smaller picks on this list, but it may be the most dynamic energy storage stock out there. It specializes in advanced fuel cell energy platforms, which use a proprietary solid oxide technology to convert natural gas, biogas or hydrogen into electricity with low or even zero carbon emissions.

Are investors hoovering up renewable assets?

"Major investors like Brookfield Asset Management and CDPQ are ' hoovering up renewable assets' at attractive valuations," notes one industry analysis, suggesting long-term investors view current conditions as buying opportunities.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

Why did affiliate Energy Group invest in the Sun Company?

Kim Eaves, president of Affiliate Energy Group, invested specifically for the technology's practical benefits: "I chose to invest in The Sun Company and The BESSt Company because their technology directly tackles the demand charges and peak power costs that have long burdened my customers.

Is lithium ion the future of stationary energy storage?

The second gap involved technology. "I didn't believe lithium ion was the future of stationary energy storage," Michaelson says, referring to fixed-location energy storage systems for homes, businesses, and industrial facilities—distinct from mobile applications like electric vehicles. The third gap went deeper than business fundamentals.

More related information

-

Netherlands Off-grid Photovoltaic Energy Storage

Netherlands Off-grid Photovoltaic Energy Storage

-

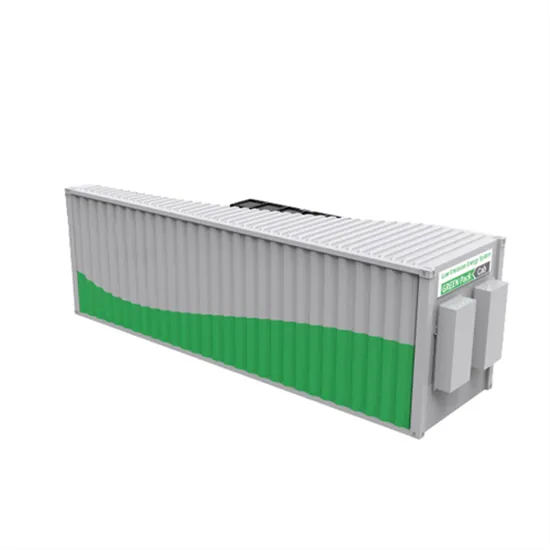

Congo container photovoltaic energy storage wholesale

Congo container photovoltaic energy storage wholesale

-

Costa Rica Home Photovoltaic Energy Storage

Costa Rica Home Photovoltaic Energy Storage

-

Photovoltaic curtain wall with energy storage

Photovoltaic curtain wall with energy storage

-

Swaziland Photovoltaic Power Plant Energy Storage

Swaziland Photovoltaic Power Plant Energy Storage

-

How much energy storage should be provided with a 20 kW photovoltaic system

How much energy storage should be provided with a 20 kW photovoltaic system

-

Central African Republic photovoltaic energy storage solution

Central African Republic photovoltaic energy storage solution

-

Saudi Arabia Xinzhong Photovoltaic Energy Storage Project

Saudi Arabia Xinzhong Photovoltaic Energy Storage Project

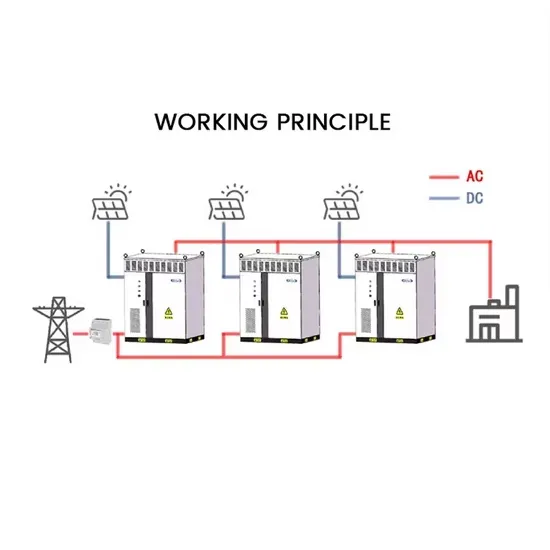

Commercial & Industrial Solar Storage Market Growth

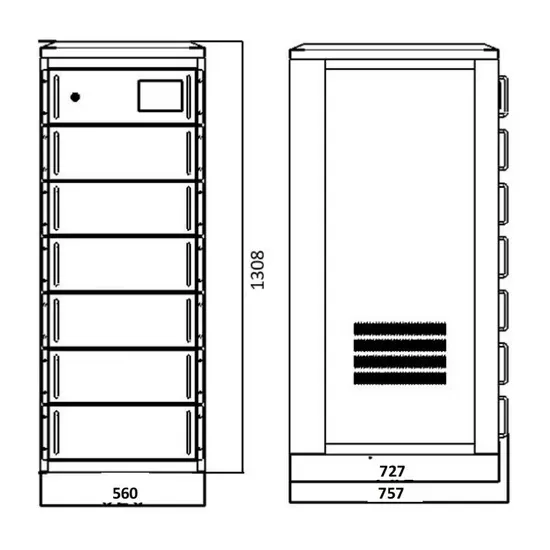

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.