Tariffs: Analysis spells out extent of challenge

New analysis from Clean Energy Associates (CEA) and Wood Mackenzie highlights the challenges facing the US battery storage market due to trade tariffs. According to research

Get Price

48.4%! US Tariffs on Chinese Energy Storage

By January 2026, the comprehensive tariff on Chinese-made batteries and energy storage systems in the US will reach an astonishing

Get Price

US increases tariffs on batteries from China to 25%

The Biden Administration will more than triple the tariffs paid on batteries and battery parts imported into the US from China, from 7.5% to 25%, in a huge move for the industry.

Get Price

Grid-Scale Battery Storage: Costs, Value, and

Grid-Scale Battery Storage: Costs, Value, and Regulatory Framework in India Webinar jointly hosted by Lawrence Berkeley National Laboratory and Prayas Energy Group

Get Price

Tariff uncertainty grips US battery development

The Trump administration''s China tariffs have piled atop existing and developing trade barriers on battery energy storage systems,

Get Price

Addressing Tariffs and Trade in Energy Storage Projects

Mitigating tariff risk in battery energy storage system (BESS) projects is crucial for ensuring project financial viability, as tariff changes can significantly affect cost structures and

Get Price

Battery energy storage tariffs tripled; domestic content

Tariffs tripled On May 14, 2024, the Biden Administration announced changes to section 301 tariffs on Chinese products. For energy

Get Price

Tariffs reshape project economics for U.S. energy

A backlog of warehoused batteries may buffer the energy storage industry from immediate shocks, but time is running out, according to reports

Get Price

Impacts of Trump Administration Tariffs on the Battery

Proposed tariff increases on Chinese lithium-iron-phosphate (LFP) battery imports threaten to disrupt the United States'' deployment of battery

Get Price

Best Electricity Tariff for Battery Storage UK

Battery storage systems have revolutionised how UK households manage electricity. When paired with the right smart tariff, these systems allow homeowners to store

Get Price

U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

This article comprehensively analyses U.S. tariffs on Chinese lithium batteries, exploring the latest tariff rates, their economic effects, and future implications for industries and

Get Price

Expert discusses how tariffs on Chinese batteries are reshaping

Investing -- Soaring tariffs on Chinese battery imports are driving up costs and reshaping supply chains across the U.S. grid-scale energy storage sector, according to

Get Price

US increases tariffs on batteries from China to 25

The Biden Administration will more than triple the tariffs paid on batteries and battery parts imported into the US from China, from 7.5% to

Get Price

48.4%! US Tariffs on Chinese Energy Storage Products Take Effect

By January 2026, the comprehensive tariff on Chinese-made batteries and energy storage systems in the US will reach an astonishing 48.4%. This figure will undoubtedly put

Get Price

The trade war beginsWhat does this mean for EVs, batteries

With EVs not set to be affected by the reciprocal and universal tariffs, the focus turns to the second largest battery demand market in the US, energy storage. In 2024, over 90% of

Get Price

How much is the tariff for energy storage batteries?

Understanding the nuances of tariffs associated with energy storage batteries is vital for stakeholders in the energy market. The variability in costs

Get Price

Tariff Shockwave: U.S. Slaps 82% Duties on Chinese

US imposes 82.4% tariff on Chinese lithium-ion battery imports, sparking a global trade battle and reshaping the future of clean energy

Get Price

Expert Deep Dive: Impact of New U.S. Tariffs on the

This article explores the impact of new U.S. section 301 tariff changes on the energy storage industry and strategies for thriving in this

Get Price

Battery Tariffs 2025: Impact on U.S. Energy and Trade

Explore how 2025 battery tariffs affect U.S. imports, energy storage, EV production, and sourcing strategies amid rising China tariffs and trade shifts.

Get Price

USA Tariffs on China Manufactured BESS

If you''re in the business of battery energy storage systems (BESS), you''ve probably felt the squeeze of tariffs on Chinese imports. For years, China has been a go-to for

Get Price

How much is the tariff for energy storage batteries? | NenPower

Understanding the nuances of tariffs associated with energy storage batteries is vital for stakeholders in the energy market. The variability in costs is influenced by numerous

Get Price

Impacts of Trump Administration Tariffs on the Battery Energy Storage

Proposed tariff increases on Chinese lithium-iron-phosphate (LFP) battery imports threaten to disrupt the United States'' deployment of battery energy storage systems (BESS), a

Get Price

The Biggest Clean Energy Impacts from Trump''s

Batteries Grid batteries are facing a roughly 65% tariff that could rise to more than 80% by next year—just as the U.S. was expected to see

Get Price

Addressing Tariffs and Trade in Energy Storage Projects

Mitigating tariff risk in battery energy storage system (BESS) projects is crucial for ensuring project financial viability, as tariff changes can

Get Price

US energy storage costs could spike 50% – tariffs are

Tariffs could drive up US clean energy costs – especially energy storage – by up to 50%, warns Wood Mackenzie in a new report.

Get Price

Trump tariffs, orders rein in thriving battery storage

Tariffs and funding overhauls by the Trump administration are set to raise energy storage prices and hit short term deployment as domestic

Get Price

Tariff uncertainty grips US battery development

The Trump administration''s China tariffs have piled atop existing and developing trade barriers on battery energy storage systems, components, and materials – destabilizing

Get Price

Octopus Energy

Comprehensive guide examining the best UK electricity tariffs for home battery storage in 2024: Time-of-use tariff, dynamic tariff and export tariff.

Get Price

Trump tariffs, orders rein in thriving battery storage sector

Tariffs and funding overhauls by the Trump administration are set to raise energy storage prices and hit short term deployment as domestic manufacturing capacity falls short.

Get Price

Battery energy storage tariffs tripled; domestic content rules updated

Tariffs tripled On May 14, 2024, the Biden Administration announced changes to section 301 tariffs on Chinese products. For energy storage, Chinese lithium-ion batteries for

Get Price

ACP Statement on 301 Tariffs for Battery Storage

As energy demand grows, battery energy storage is lowering costs for American families and businesses. Moreover, this emerging industry

Get Price

6 FAQs about [What is the Tariff on Energy Storage Batteries in]

What are the tariffs on batteries?

Tariffs have been levied on batteries and other clean energy technology products, particularly solar cells, since 2018 under the previous Trump Administration. The existing 7.5% rate for batteries rises to 10.89% when importing full containerised battery energy storage system (BESS) products containing lithium-ion cells from China.

How does tariff risk affect a battery energy storage system (BESS) project?

Mitigating tariff risk in battery energy storage system (BESS) projects is crucial for ensuring project financial viability, as tariff changes can significantly affect cost structures and overall project economics.

Which stationary energy storage products are affected by battery tariffs?

Stationary Energy Storage Products Affected by Battery Tariffs Large-format stationary energy storage systems like Tesla’s Powerwall and Megapack also face cost increases due to the latest tariffs. These products rely heavily on lithium battery cells sourced from Chinese suppliers.

What are China's new tariffs on lithium-ion batteries?

On May 14, 2024, the Biden Administration announced changes to section 301 tariffs on Chinese products. For energy storage, Chinese lithium-ion batteries for non-EV applications from 7.5% to 25%, more than tripling the tariff rate. This increase goes into effect in 2026. There is also a general 3.4% tariff applied lithium-ion battery imports.

Why are battery tariffs increasing?

Recent trade adjustments have introduced significant increases in battery tariffs, ranging from 54% to 104%, depending on product type and classification. These duties now apply to a broad range of products, including: These costs for utility-scale energy storage systems directly affect capital expenses and deployment schedules.

Are Chinese tariffs affecting the battery market?

The U.S. battery market has entered a period of pricing uncertainty due to expanded battery tariffs. Starting in 2025, new Chinese tariffs on imported lithium-ion cells and components—especially those used in energy storage systems—have reached levels as high as 104%, according to updated trade filings.

More related information

-

What are the two types of batteries for energy storage

What are the two types of batteries for energy storage

-

What brands of energy storage batteries are there in Djibouti

What brands of energy storage batteries are there in Djibouti

-

What are the energy storage batteries in photovoltaics

What are the energy storage batteries in photovoltaics

-

What types of energy storage batteries are there

What types of energy storage batteries are there

-

What are the types of stacked energy storage lithium batteries

What are the types of stacked energy storage lithium batteries

-

What companies use energy storage cabinet batteries

What companies use energy storage cabinet batteries

-

What is the price of Belarusian special energy storage batteries

What is the price of Belarusian special energy storage batteries

-

What are the uses of energy storage batteries in communication base stations

What are the uses of energy storage batteries in communication base stations

Commercial & Industrial Solar Storage Market Growth

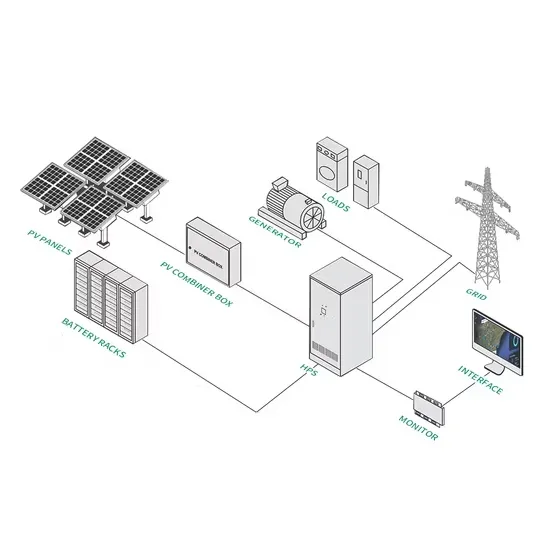

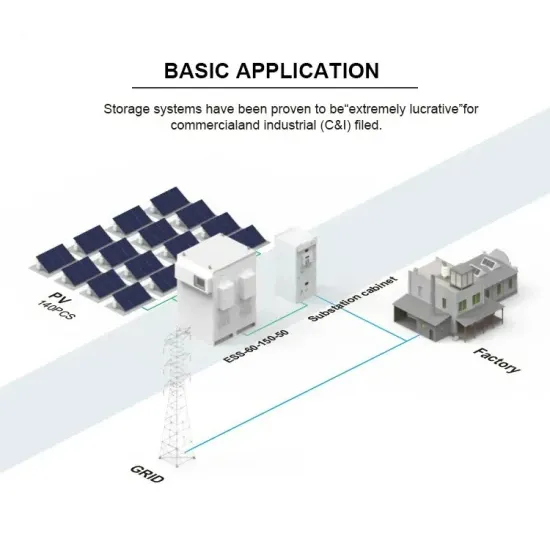

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.