What the budget bill means for energy storage tax credit eligibility

"One of the positives in the final bill is that, in the interim bill, there was a provision on leasing systems," Collins said, adding that the final bill narrowed the provision, making

Get Price

North Carolina Clean Energy Plan

The purpose of this supporting document (Part 3: Electricity Rates and Energy Burden) is to provide a high level background on North Carolina''s electricity rate setting process and factors

Get Price

A1C test

An A1C test result shows the average blood sugar level over the past 2 to 3 months. The A1C test measures what percentage of hemoglobin in the blood is coated with

Get Price

Menopause

Menopause can happen in the 40s or 50s. But the average age is 51 in the United States. Menopause is natural. But the physical symptoms, such as hot flashes, and emotional

Get Price

The State of Play for Energy Storage Tax Credits –

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

Get Price

Utility-Scale Battery Storage | Electricity | 2024 | ATB | NREL

Base year costs for utility-scale battery energy storage systems (BESSs) are based on a bottom-up cost model using the data and methodology for utility-scale BESS in (Ramasamy et al.,

Get Price

What is the tax rate for energy storage power station income?

The tax rate applicable to income generated by energy storage power stations varies based on several factors including the jurisdiction, the nature of the business entity, and

Get Price

Battery energy storage systems: Benefits and tax incentives

This article explains the benefits of battery storage systems, and provides information on tax credits that the owners of battery storage systems can claim to help defray

Get Price

Estradiol (topical application route)

Description Estradiol topical emulsion is used to treat moderate to severe symptoms of menopause (eg, feelings of warmth in the face, neck, and chest, or sudden strong feelings

Get Price

Mayo Clinic corrected QT interval (QTc) calculator

Worried about QT interval prolongation? This online evidence based resource will help guide you how to measure the QT interval and calculate the QTc value with an easy to use calculator

Get Price

Renewable energy facilities and taxes | Deloitte US

Given the scale of capital investment required, certain renewable energy facilities could face substantial property tax assessments, absent incentives and exemptions. Across the country,

Get Price

How much tax is charged on energy storage revenue | NenPower

One of the most significant factors influencing the tax burden on energy storage revenue is the variation of tax rates across different jurisdictions. Each region may implement

Get Price

Blood pressure chart: What your reading means

A diagnosis of high blood pressure is usually based on the average of two or more readings taken on separate visits. The first time your blood pressure is checked, it should be

Get Price

Water: How much should you drink every day?

For your body to function properly, you must replenish its water supply by consuming beverages and foods that contain water. So how much fluid does the average,

Get Price

How much tax does an energy storage power station

The taxation imposed on energy storage power stations varies significantly based on several factors including jurisdiction, the nature of

Get Price

Metoprolol (oral route)

Appropriate studies have not been performed on the relationship of age to the effects of metoprolol oral liquid and tablets in the pediatric population. Safety and efficacy have

Get Price

How much tax is charged on energy storage revenue

One of the most significant factors influencing the tax burden on energy storage revenue is the variation of tax rates across different

Get Price

Fluoxetine (oral route)

Description Fluoxetine is used to treat depression, obsessive-compulsive disorder (OCD), bulimia nervosa, premenstrual dysphoric disorder (PMDD), and panic disorder. It is

Get Price

The State of Play for Energy Storage Tax Credits – Publications

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits

Get Price

Calorie calculator

If you''re pregnant or breast-feeding, are a competitive athlete, or have a metabolic disease, such as diabetes, the calorie calculator may overestimate or underestimate your actual calorie needs.

Get Price

Tax Burden by State in 2025

To determine the residents with the biggest tax burdens, WalletHub compared the 50 states based on the cost of three types of state tax burdens

Get Price

Economic evaluation of kinetic energy storage

In recent years, energy-storage systems have become increasingly important, particularly in the context of increasing efforts to

Get Price

High energy burden and low-income energy affordability:

Because energy efficiency, PV systems, electric vehicles, home storage, and microgrids can all influence energy burdens, the technology scope of this bibliography and our review is quite

Get Price

Average tax burden on energy storage systems

By reducing the upfront costs of energy storage systems, these tax credits make it more affordable to enhance energy security, improve grid stability, and reduce environmental

Get Price

How do tax credits for energy storage systems work

How Tax Credits for Energy Storage Systems Work Tax credits for energy storage systems are designed to incentivize the adoption of clean

Get Price

How much tax is paid per acre for energy storage projects?

Each jurisdiction may implement specific guidelines that establish tax obligations based on the characteristics of the energy storage systems being deployed. Factors such as

Get Price

How much tax is paid per acre for energy storage

Each jurisdiction may implement specific guidelines that establish tax obligations based on the characteristics of the energy storage systems

Get Price

SALT and Battery: Taxes on Energy Storage | Tax Notes

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

Get Price

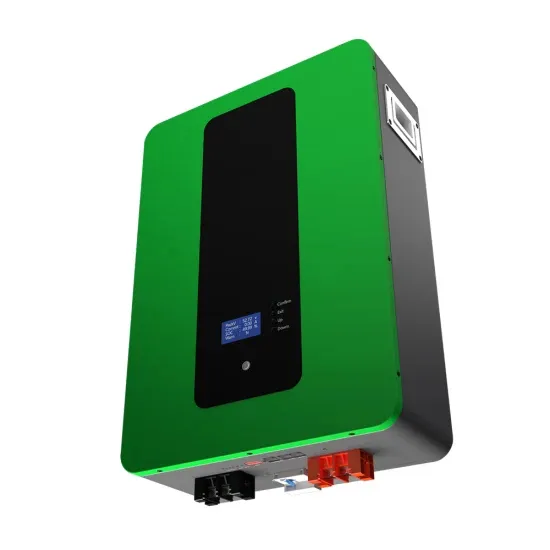

Do You Need to Pay Tax on Energy Storage Cabinets? Let''s

In the U.S., energy storage cabinets can be taxed—but it''s not a one-size-fits-all scenario. Here''s where things get spicy: Thanks to the Inflation Reduction Act (IRA),

Get Price

6 FAQs about [Average tax burden on energy storage systems]

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

What regulatory guidance has the government released on energy storage?

Of particular importance to the energy storage industry, the government has released final regulatory guidance for the ITC (both Section 48 and 48E of the Code), prevailing wage and apprenticeship (PWA) requirements, and transferability and direct payment, as well as other guidance on the energy community and domestic content tax credit “adders.”

What is a taxpayer compliance burden?

Taxpayer compliance burden is generally defined as the time and money taxpayers spend to comply with their tax filing responsibilities. Time-related activities include recordkeeping, tax planning, gathering tax materials, learning about the law, and completing and submitting the return.

What are the New IRA rules for energy storage?

Energy storage was one of the major beneficiaries of the IRA’s new rules on both the deployment and manufacturing sides. The IRA enacted the long-sought investment tax credit (ITC) under Section 48 and 48E of the Internal Revenue Code (the Code) for standalone energy storage facilities.

Do energy storage systems qualify for a manufacturing exemption?

The Texas comptroller has published at least two private letter rulings explaining that energy storage systems do not qualify for the manufacturing exemption because the batteries are for storing the energy, and storage is not essential to generating the energy. 17

More related information

-

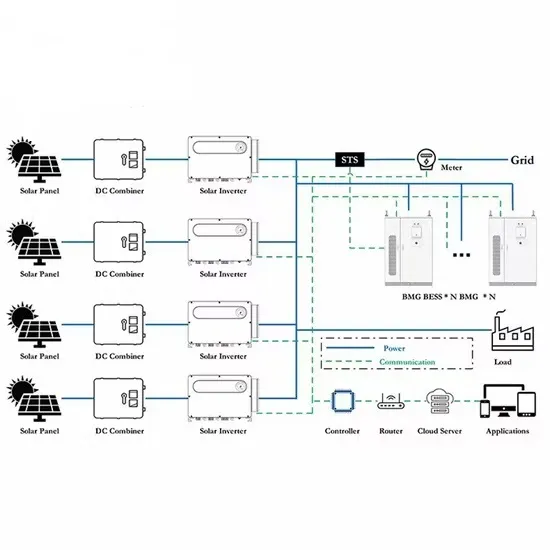

What are the specifications for energy storage photovoltaic systems

What are the specifications for energy storage photovoltaic systems

-

For distributed energy storage systems

For distributed energy storage systems

-

South Africa about photovoltaic energy storage systems

South Africa about photovoltaic energy storage systems

-

What kind of battery cells are generally used in energy storage systems

What kind of battery cells are generally used in energy storage systems

-

Will PLC be used in energy storage systems

Will PLC be used in energy storage systems

-

Is there anyone in Swaziland who makes energy storage systems for communication base stations

Is there anyone in Swaziland who makes energy storage systems for communication base stations

-

Safety of Grid Energy Storage Systems

Safety of Grid Energy Storage Systems

-

Planning requirements for energy storage systems for small communication base stations

Planning requirements for energy storage systems for small communication base stations

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.