Europe''s solar power surge hits prices, exposing storage needs

OSLO/PARIS, June 21 (Reuters) - Europe has clocked a record number of hours of negative power prices this year due to a mismatch between demand and supply as solar power

Get Price

Eastern Europe''s solar surge: spotlight on Bulgaria, Romania, and

In the wake of the publication of the EU Market Outlook for Solar Power 2023-2027, it is worth taking a closer look at Eastern Europe, a region that has demonstrated

Get Price

Grid challenges and storage potential in Eastern

Dr Konrad Wojnarowski, undersecretary of state at the Polish Ministry of Development Funds and Regional Policy, opened this week''s

Get Price

Europe''s solar power surge hits prices, exposing

Europe has clocked a record number of hours of negative power prices this year due to a mismatch between demand and supply as solar

Get Price

Europe''s solar power surge hits prices, exposing

OSLO/PARIS, June 21 (Reuters) - Europe has clocked a record number of hours of negative power prices this year due to a mismatch between demand and

Get Price

New interactive map of renewable energy capture

The tool displays the capture price received by wind and solar power assets using hourly production and monthly average price data for

Get Price

European countries'' photovoltaic (PV)subsidy policies

The major types of PV subsidy policies used by different nations are increasing residual feed-in prices, income tax exemptions on income from power

Get Price

The State of the Solar Industry

State-by-State Electricity from Solar (2023) Sources: U.S. Energy Information Administration, "Electric Power Monthly," forms EIA-023, EIA-826, and EIA-861. U.S. Energy Information

Get Price

EU Energy Outlook to 2060: power prices and revenues

Compared to the last edition of the EU Energy Outlook from April 2023, the average power prices between 2030 and 2050 have fallen slightly for both scenarios due to the

Get Price

Perspectives of photovoltaic energy market development in the european

Photovoltaic (PV) energy has recently been gaining much attention worldwide. It is the least expensive energy source which can be used to replace part of the energy from fossil

Get Price

Solar energy in the EU

EU measures to boost solar energy include making the installation of solar panels on the rooftops of new buildings obligatory within a specific timeframe, streamlining permitting procedures for

Get Price

New interactive map of renewable energy capture prices in Europe

The tool displays the capture price received by wind and solar power assets using hourly production and monthly average price data for Spain, Germany, Italy, France, and the

Get Price

European electricity prices and costs

This tool compares European electricity prices, carbon prices and the cost of generating electricity using fossil fuels and renewables. Where possible, data is provided by

Get Price

Europe Solar PV Market Share, Outlook 2025-2034

The price of solar PV modules has decreased significantly over the past decade, with the cost of solar power falling below grid parity in many parts of Europe,

Get Price

Central and Eastern Europe increasingly in the solar

Due to the high energy prices, the first major corporate PPAs (Purchase Power Agreements) were concluded last year. The first combined

Get Price

Central and Eastern Europe increasingly in the solar gigawatt class

Due to the high energy prices, the first major corporate PPAs (Purchase Power Agreements) were concluded last year. The first combined tendering round for renewable

Get Price

Grid challenges and storage potential in Eastern Europe

Dr Konrad Wojnarowski, undersecretary of state at the Polish Ministry of Development Funds and Regional Policy, opened this week''s Large Scale Solar Central

Get Price

From niche to necessity – the PV-boom in Central and

Photovoltaics have transitioned from a niche technology to a crucial energy source in Central and Eastern Europe. Against a varying

Get Price

Large battery storage systems in Europe are all the rage

In Eastern Europe, too, large battery storage systems are becoming increasingly popular as a result of the expansion of renewable

Get Price

European electricity prices and costs

This tool compares European electricity prices, carbon prices and the cost of generating electricity using fossil fuels and renewables. Where

Get Price

eastern european energy storage photovoltaic costs

European PV manufacturing needs to find balance between scale-up and innovation, says ETIP PV The collapse of prices throughout the PV value chain is a direct threat to many

Get Price

Europe Solar PV Market Share, Outlook 2025-2034

The price of solar PV modules has decreased significantly over the past decade, with the cost of solar power falling below grid parity in many parts of Europe, thereby increasing market

Get Price

The Future of Power Storage in South Eastern Europe

The European Commission''s Joint Research Centre (JRC) and the Ministry of Energy and Industry of Albania held a joint workshop on the future role of energy storage in South Eastern

Get Price

Eastern Europe''s stealthy surge in solar generation | Reuters

Eastern Europe is often overlooked in discussions about solar power generation in Europe, where the likes of Germany and Spain dominate the growth in deployed solar

Get Price

The economic use of centralized photovoltaic power generation

Finally, this study takes the data of a photovoltaic power station in Shanghai as an example for calculation, and the results show that photovoltaic grid connection is currently the

Get Price

What to expect of power prices in Central and Eastern Europe

Hitachi Energy using Solar VOM, FOM and overnight construction cost forecasts from NREL, H2-2024 Power Reference Case capacity factors (market average) and WACC assumed to be

Get Price

European Electricity Review 2024

About The European Electricity Review analyses full-year electricity generation and demand data for 2023 in all EU-27 countries to understand the region''s progress in

Get Price

Top 10 Solar Investors in Europe | PF Nexus

Explore how Europe''s solar energy landscape is transforming with significant investments in solar capacity. Learn about the key players and

Get Price

6 FAQs about [Eastern European photovoltaic power generation and energy storage prices]

How much money does the European Investment Bank (EIB) invest in solar?

For instance, in February 2022, the European Investment Bank (EIB) announced a co-financing of USD 97.81 million to speed up the development of solar PV and onshore wind renewable projects in Portugal and Spain between 2021 to 2024.

How has distributed generation impacted the Romanian PV sector?

The distributed generation segment played a pivotal role in driving impressive developments in the Romanian PV sector. The market is currently undergoing a new boom phase, fuelled by the prevailing security context, the imperative of the green transition, and a favourable permitting framework.

Will European natural gas price be based on global market price?

For natural gas, it is assumed in the power price scenarios that the European natural gas price will be based on the global market price for LNG in the medium term. As the most important import source for Europe, US LNG can be assumed to set the price.

Is the natural gas price in Europe higher than the APS scenario?

This price is used in the scenario as an assumption for the year 2030. Compared to the IEA’s current World Energy Outlook 2023 (IEA, 2023) , it is around 3 EUR /MWh higher than the value assumed in the “Announced Pledges Scenario” (APS) for the natural gas price in Europe for 2030.

Why is Trianel rethinking how it sells photovoltaic power?

In the day-ahead market, this has seen more European markets experience price drops at the lowest demand point in the middle of the day. Trianel told Reuters the company has invested in 800 megawatt (MW) of photovoltaic capacity and has a project pipeline of 2,000 MW but the lower prices are forcing it to reconsider how it sells the power.

Why are photovoltaic systems more expensive than wind?

The average sales and capture price of photovoltaic systems fall more sharply compared to wind in both the “Central” and “GoHydrogen” scenarios (see Figure 13). The reason for this is the significant expansion of photovoltaic capacity, including in Germany, in conjunction with the pronounced cannibalisation effect of PV.

More related information

-

Japan s energy storage photovoltaic power generation prices

Japan s energy storage photovoltaic power generation prices

-

Brazil photovoltaic power generation and energy storage prices

Brazil photovoltaic power generation and energy storage prices

-

Canada photovoltaic power generation and energy storage prices

Canada photovoltaic power generation and energy storage prices

-

Costa Rica s photovoltaic energy storage power generation prices

Costa Rica s photovoltaic energy storage power generation prices

-

What is the price of photovoltaic power generation and energy storage in Barbados

What is the price of photovoltaic power generation and energy storage in Barbados

-

Photovoltaic power generation and energy storage equipment complete set manufacturer

Photovoltaic power generation and energy storage equipment complete set manufacturer

-

Ghana Kumasi Photovoltaic Power Generation and Energy Storage Project

Ghana Kumasi Photovoltaic Power Generation and Energy Storage Project

-

Japan s photovoltaic power generation and energy storage power station

Japan s photovoltaic power generation and energy storage power station

Commercial & Industrial Solar Storage Market Growth

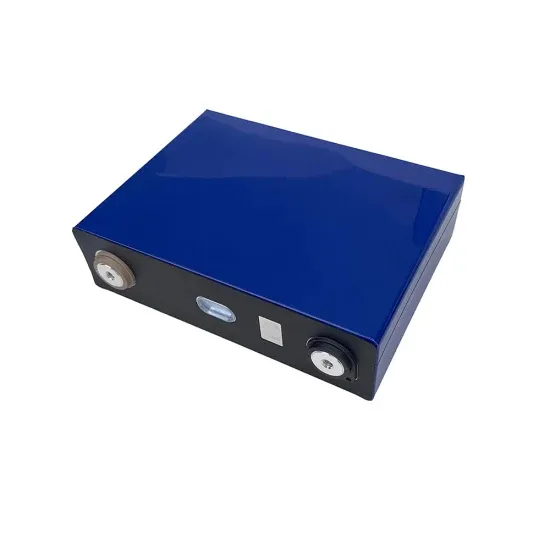

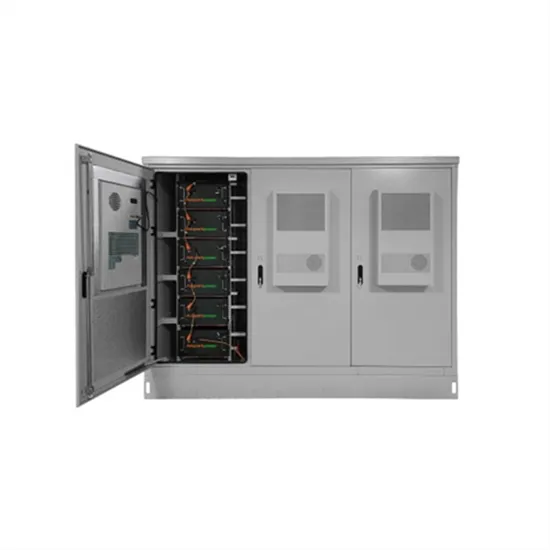

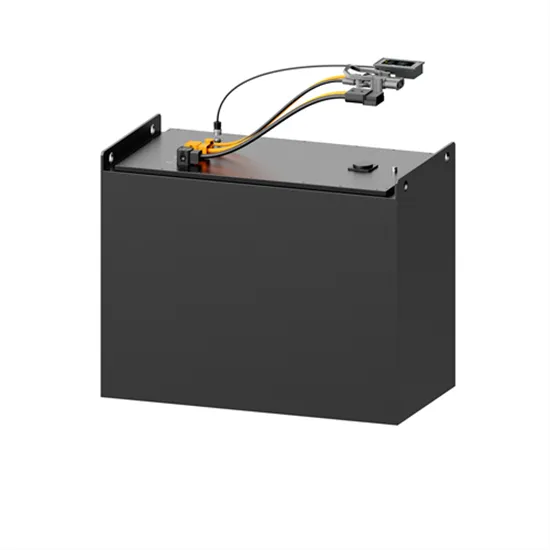

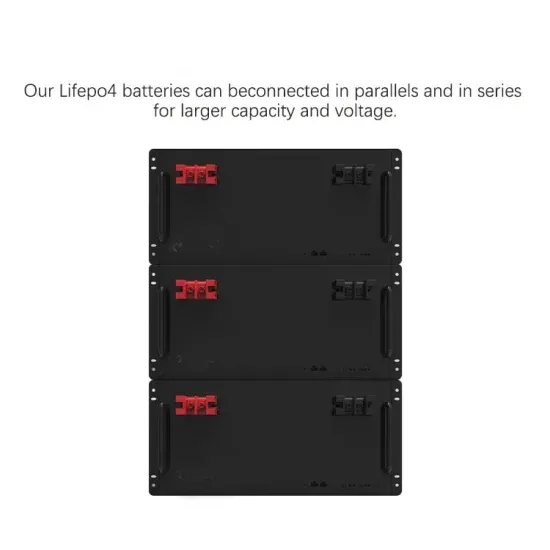

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.