Solar Power Plant: Types, Benefits, Price, Subsidy

The solar power plant model is becoming increasingly popular for generating electricity without producing carbon emissions and causing environmental

Get Price

How to Invest in the Solar Industry

This cost-effectiveness may present enticing investment opportunities for some but, like any venture, investing in solar power requires

Get Price

Investment in Solar Power Plants: A Comprehensive

Explore the investment landscape in solar power plants. 🌞 Understand economic viability, regulatory factors, and technology insights to guide sustainable

Get Price

Investing In Energy: Top UK Renewable Energy Stocks of 2025

Here''s everything investors need to know about investing in green renewable energy stocks in 2025 as the world transitions away from fossil fuels.

Get Price

Solar power in Germany – output, business

However, the country''s solar PV systems fed 74 terawatt hours (TWh) of electricity into the grid in 2024, accounting for a 14.9 percent share of

Get Price

How to invest in solar power: Adding clean energy to your portfolio

We will address critical factors to consider before investing, provide a step-by-step guide for beginners, outline solar panel manufacturing

Get Price

Want to Invest in Solar System? Read this Step-by

Read this Step-by-Step Guide walks you through everything you need to know to start investing in solar power systems. This guide covers everything from

Get Price

Top 4 Solar Stocks to Watch in 2025 and Why They

Solar energy''s explosive growth and cutting-edge tech make it an investment to watch. This article will uncover the top solar stocks to keep on

Get Price

Renewables

Renewables, including solar, wind, hydropower, biofuels and others, are at the centre of the transition to less carbon-intensive and more sustainable energy systems. Generation capacity

Get Price

Solar Energy Investing: Pros and Cons

Carefully consider the implications of your own desire for solar investing, and figure out where this type of sustainable investing might work in

Get Price

Understanding Solar Photovoltaic (PV) Power Generation

Solar photovoltaic (PV) power generation is the process of converting energy from the sun into electricity using solar panels. Solar panels, also called PV panels, are combined

Get Price

Solar Power: Energy is Good for Texas

Source: Solar Energy Industries Association Federal and state incentives helped facilitate significant growth in utility scale-solar power in Texas, helping to spur

Get Price

Best Solar Energy Stocks to Invest In 2025 | The

Learn to make money while investing in green energy companies like these solar stock industry leaders. Profit while investing for the world you

Get Price

Solar Generators: Working, Cost, Pros & Cons and

Most importantly, solar generators are becoming cost-competitive and attracting more government investments which contributes to cleaner

Get Price

Investing In Solar Energy

In this article, we will embark on a journey to explore the various types of solar energy systems, delve into their advantages and disadvantages, uncover the potential benefits

Get Price

Investing in Solar Energy in 2025: Pros & Cons, Best Stocks & ETFs

This article explores the four ways to invest in solar energy, the best solar energy stocks and ETFs to diversify your portfolio, and the pros and cons of investing in solar energy.

Get Price

Solar Energy Investing: Pros and Cons

Carefully consider the implications of your own desire for solar investing, and figure out where this type of sustainable investing might work in your portfolio and help you

Get Price

Driving Malaysia''s solar power adoption through

This scheme incentivises property owners to invest in solar energy systems by offsetting their electricity bills and potentially earning revenue from surplus

Get Price

Best Solar Power Stocks Of 2025 – Forbes Advisor

Our list of the best solar power stocks is constructed using strict criteria that aim to identify companies with consistently growing operations and strong analyst

Get Price

Investment in Solar Power Plants: A Comprehensive Guide

Explore the investment landscape in solar power plants. 🌞 Understand economic viability, regulatory factors, and technology insights to guide sustainable investments.

Get Price

Solar Energy: A Growing Opportunity for Savvy Investors

Once regarded as too expensive and inefficient, solar energy is now becoming a more viable option for both individual investors and businesses.

Get Price

How to Invest in the Solar Industry

This cost-effectiveness may present enticing investment opportunities for some but, like any venture, investing in solar power requires a solid grasp of the industry. What you

Get Price

How to invest in solar power: Adding clean energy to your portfolio

Government incentives are helping to promote the use of solar energy. Here''s what you need to know on how to add solar to your portfolio.

Get Price

Solar Investment: How To Elevate Income from Solar

Solar Power Systems explains effective ways to make money with solar panels in 2024. See how individuals and businesses maximize their

Get Price

Want to Invest in Solar System? Read this Step-by-Step Guide

Read this Step-by-Step Guide walks you through everything you need to know to start investing in solar power systems. This guide covers everything from understanding the benefits of solar

Get Price

Power Up Your Portfolio: 5 Smart Ways to Invest in

In this blog, we''ll discuss five ways that you can invest — from buying stock to investing in land development, solar projects, solar

Get Price

Power Up Your Portfolio: 5 Smart Ways to Invest in Solar Energy

In this blog, we''ll discuss five ways that you can invest — from buying stock to investing in land development, solar projects, solar manufacturing, and electric vehicle charge

Get Price

National Solar Mission: Investment Projects under National Solar

National Solar Mission is a scheme in India with 63 projects across various states worth USD 2.88 bn. Explore investment projects under National Solar Mission scheme at IIG & connect now for

Get Price

6 FAQs about [Invest in solar power generation systems]

How to invest in solar power?

You can purchase shares of a company stock, including solar panel manufacturers. You can also buy exchange-traded funds (ETFs) or index funds that invest in solar companies. And lastly, you can invest directly in private businesses involved in the production of solar power. 1. Solar Stocks

What is solar investing?

Solar investing encompasses investments in various aspects of the solar energy supply chain. Perhaps you invest in companies like First Solar (ticker: FSLR) that produce large-scale solar panels. It might even mean investing in a popular company like Tesla (TSLA) that hopes to create smaller solar products for homes.

Is solar energy a sustainable investment?

As more individuals, companies and governments become concerned about global climate change caused by carbon emissions, there's an increased interest in renewable energy as part of a socially responsible investing portfolio. One of the most often-cited types of alternative energy is solar power. 6 Places to Find Sustainable Investments.

Which companies are investing in solar energy?

Sunrun (NASDAQ: RUN) has been expanding its services and product offerings into states beyond its California headquarters. Tesla, while famous for its electric cars, is also investing heavily in solar energy—from the manufacturing of solar panels to installation and energy storage with its Powerwall batteries.

Why should you invest in solar energy?

The primary lures are the rewarding opportunity of facilitating a sustainable future and the potential profit that the industry’s expansion presents. Furthermore, government incentives and policies in support of renewable energy can craft a favorable canvas for solar investments.

How do I start investing in the solar sector?

It only takes a few minutes. Check out the advisors' profiles, have an introductory call on the phone or introduction in person, and choose who to work with. Investing in the solar sector may require an understanding of the various products and services that comprise the industry.

More related information

-

Two solar power generation systems in parallel

Two solar power generation systems in parallel

-

Various solar power generation systems

Various solar power generation systems

-

Chile is installing solar power generation systems

Chile is installing solar power generation systems

-

Wind and solar power generation and lithium battery energy storage

Wind and solar power generation and lithium battery energy storage

-

Solar thermal power generation energy storage medium

Solar thermal power generation energy storage medium

-

How much does solar power generation cost for household use

How much does solar power generation cost for household use

-

Solar photovoltaic power generation supplier for communication base stations

Solar photovoltaic power generation supplier for communication base stations

-

Full solar power generation for home use

Full solar power generation for home use

Commercial & Industrial Solar Storage Market Growth

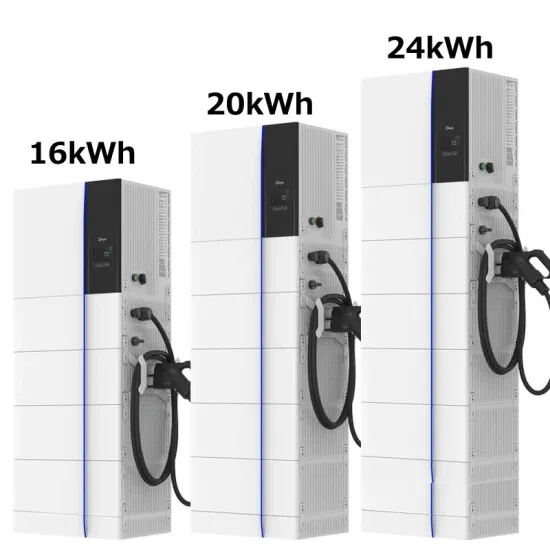

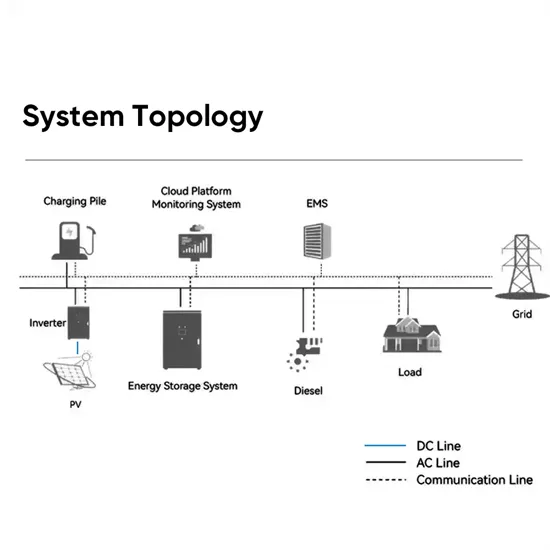

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

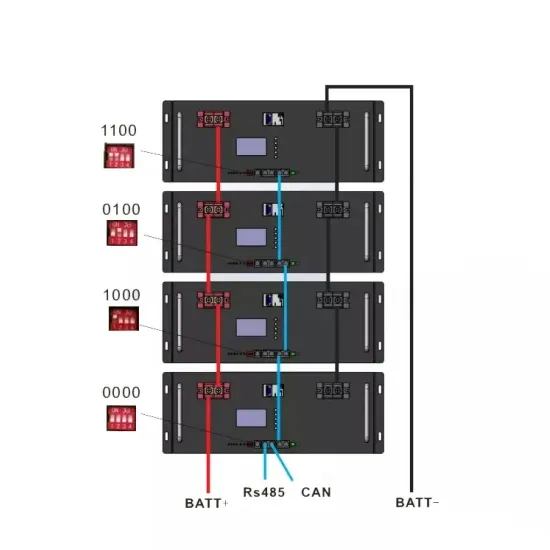

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.