Argentina Wind Prospecting | Kenex

This has primarily been focused within Argentina, where a rapidly growing business relationship has been fostered with Buenos Aires-based company Emprendimientos Energeticos y

Get Price

Company Profile

To be the leading company in electricity production in Argentina, based on market share, operational excellence, and profitability. To accompany the

Get Price

Argentina''s Wind Energy Sector

Argentina, the second largest country in South America, is making significant progress in harnessing the power of the winds. With its vast plains and coastal regions, the

Get Price

Top 92 Wind Energy Companies in Argentina (2025) | ensun

Find the right companies for free by entering your custom query! The company is a specialist in wind energy services, providing comprehensive solutions for electrical installations, including

Get Price

Argentina Electric Vehicle Charging Station Market Size and Share

5 days ago· Argentina''s EV charging station market is anticipated to grow at more than 26.24% CAGR from 2025 to 2030, fueled by rising electric vehicle adoption and government policies

Get Price

Virtual Power Plant for South America | energy & meteo systems

Grid operators in Argentina and Brazil experience in theory and practice the advantages of the Virtual Power Plant as a control center for renewable energies.

Get Price

Wind power in Argentina

Installed capacity is forecast to increase from 2024 to 2035, at which point wind power is expected to account for 17% of total installed generation capacity. Onshore wind

Get Price

Argentina''s Wind Energy Sector

Argentina, the second largest country in South America, is making significant progress in harnessing the power of the winds. With its vast plains

Get Price

Argentina

Argentina - Países - Acceso en línea - The Wind Power - Wind energy Market IntelligenceAsociaciones de energía eólica Argentina Wind Energy Assosiacion Camara

Get Price

Argentina Renewable Energy Market Analysis

Key market players have capitalized on the abundant solar and wind resources in Argentina, establishing large-scale projects that contribute to the national

Get Price

Power plant profile: Puerto Madryn, Argentina

Puerto Madryn is a 223.2MW onshore wind power project. It is located in Chubut, Argentina. According to GlobalData, who tracks and profiles over 170,000 power plants worldwide, the

Get Price

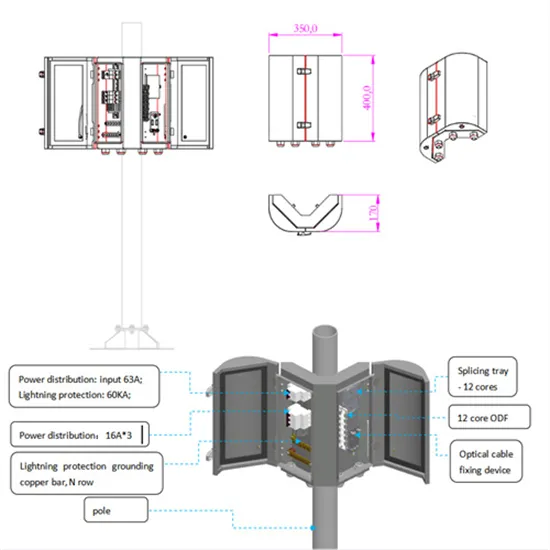

Renewable energy sources for power supply of base station

Abstract — An overview of research activity in the area of powering base station sites by means of renewable energy sources is given. It is shown that mobile network operators express

Get Price

Argentina: Outdoor Equipment Market

The Argentine Outdoor Equipment Market Report Description This report presents a comprehensive overview of the Argentine outdoor equipment market, the effect of recent high

Get Price

Wind Power in Argentina, Chinese Technology Wind

Four wind power parks with Chinese technology began operating in Argentina since last April, managing to join the Argentine Interconnection

Get Price

POWERCHINA Ltd. Sucursal Argentina

Actualmente POWERCHINA participa en Argentina, en el desarrollo de 5 Parques Eólicos con 355 Mw totales y 4 Parques Solares de 412,6 MW totales, todos en ejecución, con una

Get Price

[Discover Treasure Base] Availability 99.6%! How

Huaneng North Inner Mongolia Shangdu Megawatt Wind Power Base Project is one of the first large-scale new energy base projects to start

Get Price

Towers

Onshore GRI Towers was born with the acquisition of Ganomagoga in 2008, and it has become an important player in the supply of renewable wind energy components. In 2015, GRI Towers

Get Price

Wind Power in Argentina

This report provides an overview of wind power in Argentina, highlighting its renewable nature, the electricity generation process, and global production trends. Argentina has significant wind

Get Price

Country Analysis Brief: Argentina

Argentina''s most notable coal-fired power plant is the 375-megawatt (MW) San Nicolás power station located in Buenos Aires. The plant was commissioned in 1983 and is scheduled to be

Get Price

Outset Energy Solutions

OUTSET es una empresa Argentina que proporciona soluciones de energía ofreciendo una opción energética renovable, sustentable y económica adaptada a las necesidades de los

Get Price

Top five onshore wind power plants in operation in Argentina

Of the total global onshore wind capacity, 0.43% is in Argentina. Listed below are the five largest active onshore wind power plants by capacity in Argentina, according to

Get Price

Argentina Renewable Energy Market Analysis

Key market players have capitalized on the abundant solar and wind resources in Argentina, establishing large-scale projects that contribute to the national energy grid. The market''s future

Get Price

(PDF) Design of an off-grid hybrid PV/wind power

This paper presents the solution to utilizing a hybrid of photovoltaic (PV) solar and wind power system with a backup battery bank to provide

Get Price

Towers

Onshore GRI Towers was born with the acquisition of Ganomagoga in 2008, and it has become an important player in the supply of renewable wind energy

Get Price

Argentina Wind Prospecting | Kenex

This has primarily been focused within Argentina, where a rapidly growing business relationship has been fostered with Buenos Aires-based company

Get Price

GOLDWIND

So far, all five wind power projects of Goldwind in Argentina have come into commercial operation (COD). All five wind farms are equipped with GW 3S smart wind turbines, with a total of 109

Get Price

List of power stations in Argentina

Location of power stations in Argentina Nuclear, gas, coal, hydroelectricThe following power stations are located in Argentina.

Get Price

6 FAQs about [Argentina outdoor wind power base station customization company]

What is the wind power market in Argentina?

According to GlobalData, wind power accounted for 8% of Argentina’s total installed power generation capacity and 10% of total power generation in 2023. GlobalData uses proprietary data and analytics to provide a complete picture of this market in its Argentina Wind power Analysis: Market Outlook to 2035 report. Buy the report here.

Why is wind power growing in Argentina?

In recent years, Argentina has witnessed an increase in wind power projects. This growth has been fueled by the government’s Renewable Energy Law, enacted in 2015, which calls for 20% of the country’s electricity to come from renewable sources by 2025.

Is Argentina a good place to invest in wind power?

Argentina has favorable wind conditions for both onshore and offshore wind power projects, with further potential for expansion. Argentina has a long history of hydroelectric power generation, utilizing its rivers and water resources.

Does Argentina need a hydro power plant?

Argentina has a long history of hydroelectric power generation, utilizing its rivers and water resources. Small hydro projects and potential expansion of existing hydro facilities present opportunities for further renewable energy development.

Is Argentina a good place for solar power?

Abundant Solar and Wind Resources: Argentina possesses vast solar and wind potential, particularly in regions such as Patagonia and the northwest. The country’s favorable climate conditions and geographical characteristics make it an ideal location for solar and wind power generation.

What are Argentina's energy transition goals?

Energy Transition Goals: Argentina has set ambitious targets to increase the share of renewable energy in its overall energy mix. The National Renewable Energy Plan aims to achieve a 20% renewable energy target by 2025 and 8% by 2030, highlighting the government’s commitment to sustainable energy development.

More related information

-

South Ossetia outdoor wind power base station customization

South Ossetia outdoor wind power base station customization

-

Outdoor Wind Power Base Station Company

Outdoor Wind Power Base Station Company

-

Serbia Communication Base Station Wind Power Construction Company

Serbia Communication Base Station Wind Power Construction Company

-

Central Asia Communication Base Station Wind Power Outdoor Site

Central Asia Communication Base Station Wind Power Outdoor Site

-

Is the base station wind power indoor or outdoor

Is the base station wind power indoor or outdoor

-

Which outdoor wind power base station is cheaper

Which outdoor wind power base station is cheaper

-

Suriname communication base station wind power tower manufacturer customization

Suriname communication base station wind power tower manufacturer customization

-

North Macedonia Mobile Company Communication Base Station Wind Power

North Macedonia Mobile Company Communication Base Station Wind Power

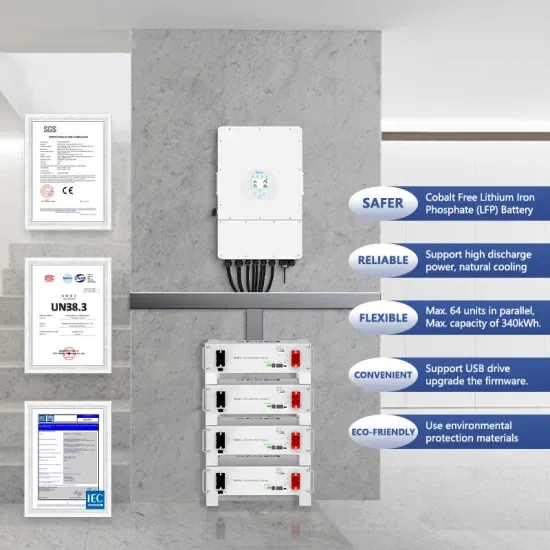

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.