India''s battery storage to reach 66 GW by 2032, ₹5

New Delhi: India''s battery energy storage system (BESS) market is projected to expand to 66 GW by 2032 from less than 0.2 GW currently,

Get Price

What stocks to buy in the energy storage sector | NenPower

Investing in the energy storage sector necessitates a careful consideration of various companies that drive innovation and sustainability. Notable options include 1. Tesla

Get Price

Top Battery Storage Companies to Watch in 2025

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an accelerating shift to renewables,

Get Price

Investing in the grid: PE''s battery storage strategy

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE

Get Price

Insightful Strategies for Battery Technology Investment Growth

Explore vital Battery Technology Investment Insights, uncovering trends, leading companies, and strategies for navigating today''s evolving market landscape.

Get Price

Energy storage battery investment prospects

Accordingly,battery energy storage systems are the fastest growing storage technology today,and their deployment is projected to increase rapidly in all three scenarios.

Get Price

India''s expanding battery ecosystem presents $42bn

An SBI Capital Markets (SBICAPS) report says funding of the battery energy storage industry in India presents an INR 3.5 trillion opportunity

Get Price

Top Battery Storage Companies to Watch in 2025

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an

Get Price

5 Lithium & Battery Tech ETFs to Consider in 2025

Learn about ETFs that provide investments in top lithium and battery technology for the electric vehicle industry.

Get Price

Who are the top 5 US storage companies by operating capacity?

US storage capacity increased 53% to 14.7GW in the last year Tamarindo''s Energy Storage Report identifies the five leading US storage companies by operating capacity But

Get Price

Top Renewable Energy & Battery Storage Stocks Worth

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing global electricity demand.

Get Price

The 10 most attractive energy storage investment

Given the complexity of BESS investment, EY has ranked the attractiveness of the 10 top global battery investment markets. The ranking –

Get Price

Top Small Cap Renewable Energy Stocks: Guide & Picks

5 hours ago· Companies categorized within the lower end of market capitalization that operate in the environmentally friendly power sector represent a distinct segment of the investment

Get Price

The 13 Best Energy Storage Stocks To Buy For September 2025

Read on to learn about some of the top energy storage stocks on the market and why you should consider investing in them. As the world shifts towards renewable energy,

Get Price

The 13 Best Energy Storage Stocks To Buy For September 2025

5 days ago· In this report, we highlight the top energy storage stocks to watch, curated for exposure to breakthroughs in advanced li-ion, flow & zinc, solid

Get Price

Top 10 Energy Storage Companies in North America | PF Nexus

In this article, PF Nexus highlights the Top 10 energy storage companies in North America driving the renewable energy transition. North America is leading a global energy

Get Price

The 10 most attractive energy storage investment markets

Given the complexity of BESS investment, EY has ranked the attractiveness of the 10 top global battery investment markets. The ranking – which takes into account factors such

Get Price

Top Energy Storage Stocks 2025: Pure-Play Watchlist

5 days ago· In this report, we highlight the top energy storage stocks to watch, curated for exposure to breakthroughs in advanced li-ion, flow & zinc, solid-state, and green hydrogen

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Welcome to PF Nexus''s guide on the top energy storage investors in North America. In this article, we highlight the key players driving the energy transition through

Get Price

Energy Outlook 2025: Energy Storage

The aim is to further promote the integration of renewables into the wider energy system which will stimulate energy storage growth in turn.

Get Price

Top Renewable Energy & Battery Storage Stocks

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid-scale storage and other

Get Price

7 Solid-State Battery Stocks to Watch in 2025

The growth prospects for renewable energy and battery storage stocks like AEE, CMS, BE and STEM remain promising, backed by growing

Get Price

Energy storage – an accelerator of net zero target with US

Since we first published a Q-Series on the Energy Storage theme, the market has developed ahead of our expectations, owing to technology-induced cost reductions and favourable

Get Price

Standalone battery investment prospects approved by Aurora

Aurora Energy Research has endorsed standalone battery investments following favorable results of a study conducted by the research company on the sector''s prospects.

Get Price

Top 10 Energy Storage Companies to Watch in 2025

The article discusses top 10 energy storage companies that are working on new solutions to support global energy needs.

Get Price

7 Solid-State Battery Stocks to Watch in 2025

Considering an investment in solid-state battery companies? It''s important to weigh the advantages and disadvantages of putting your money into stocks of these firms.

Get Price

Energy Storage Stocks: Investment Opportunities in Renewables

Investing in energy storage stocks can lead to substantial returns as demand surges. The sector presents an exciting growth opportunity for investors looking to benefit from

Get Price

Investing in the grid: PE''s battery storage strategy

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands.

Get Price

6 FAQs about [Investment prospects of battery energy storage companies]

Why should you invest in battery storage?

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an accelerating shift to renewables, surging electricity demand from new industrial loads, and supportive policy frameworks worldwide.

Why should you invest in invinity batteries?

For investors, Invinity offers pure-play exposure to vanadium flow batteries—a durable, fully recyclable complement to lithium-ion. Electric vehicle (EV) adoption is one of the main drivers of energy storage technology. Solid-state batteries promise the holy trinity: higher energy density, faster charging, and inherent safety.

Why is PE investment in battery energy storage growing?

PE investment in battery energy storage systems is surging, fueled by their high return potential and growing energy transition demands. PitchBook data shows that PE investments in energy storage and infrastructure have more than doubled since 2014, reaching $21.1 billion in 2024 alone.

Is battery storage a fundamental part of energy infrastructure?

“Battery storage is now viewed as a fundamental part of energy infrastructure, much like LNG terminals and oil tankers,” said Gresham House infrastructure and energy transition investor Lefteris Stakosias. Stakosias said this investment boom reflects a broader shift in the global energy market toward renewables.

Are battery projects a good investment?

As a result, returns are reaching up to 30%. David Scaysbrook, cofounder of Quinbrook Infrastructure, highlighted that some battery projects can even achieve payback periods as short as three years, making them an increasingly attractive investment for PE firms.

Why is a battery storage company important?

These companies are critical to the battery storage ecosystem, providing the fundamental materials required for battery production. Their market position and operational efficiency directly impact the entire supply chain.

More related information

-

Prospects of lead-zinc battery energy storage

Prospects of lead-zinc battery energy storage

-

Danish energy storage battery investment

Danish energy storage battery investment

-

Malawi local energy storage battery companies

Malawi local energy storage battery companies

-

Energy storage battery companies in Cambodia

Energy storage battery companies in Cambodia

-

Australian battery energy storage container companies

Australian battery energy storage container companies

-

Nauru total investment in energy storage battery projects

Nauru total investment in energy storage battery projects

-

Battery Energy Storage Companies in Tuvalu

Battery Energy Storage Companies in Tuvalu

-

Eritrea imports energy storage battery companies

Eritrea imports energy storage battery companies

Commercial & Industrial Solar Storage Market Growth

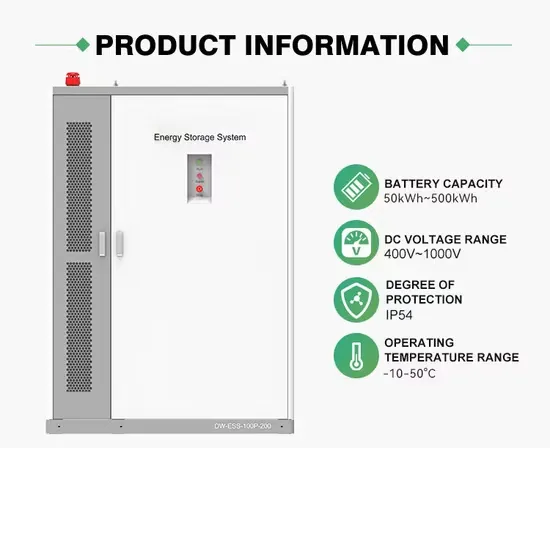

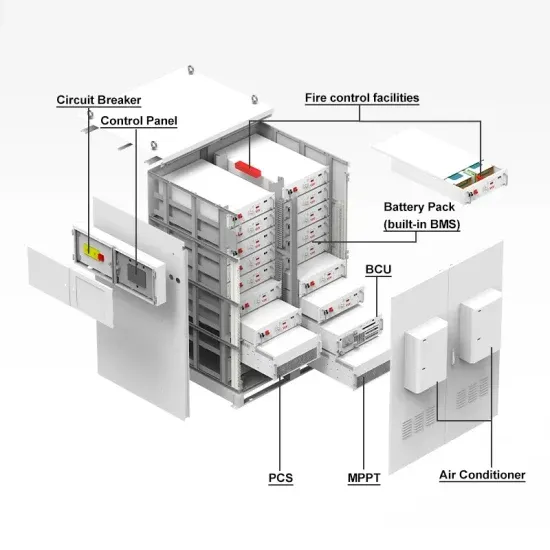

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

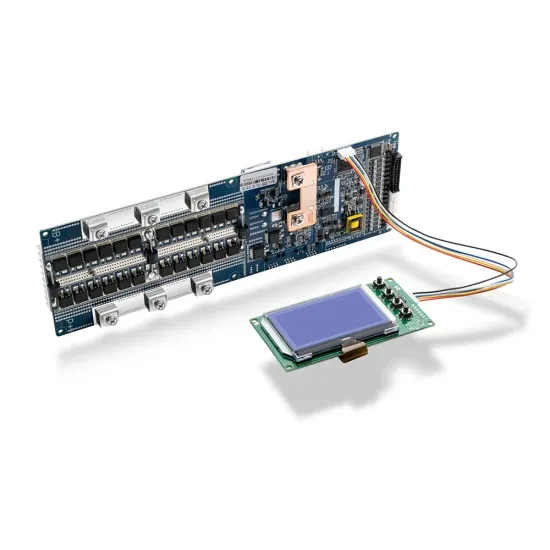

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.