PV Modules Driving Indian Solar Exports Surging

India''s PV modules exports surged 23x, reaching $2B in FY2024, shifting from net importer to net exporter of PV products.

Get Price

China''s imports and exports of photovoltaic products

In 2019, China''s total export of photovoltaic products (silicon wafers, cells, modules) was about 20.78 billion US dollars, with a year-on-year

Get Price

Executive summary – Solar PV Global Supply Chains

High commodity prices and supply chain bottlenecks led to an increase of around 20% in solar panel prices over the last year. These challenges have resulted in delays in solar panel

Get Price

India''s Solar Exports Drop from $1,969 Mn To $782.11

Solar PV module exports from India have evolved over the last few years. In FY 2021-22, the value of exports of solar PV modules was around 83

Get Price

New paradigms of global solar supply chain

In the backdrop of huge capacities likely to be set up in the U.S. under the Inflation Reduction Act (IRA), Indian photovoltaic (PV) module exports to the U.S. may experience a

Get Price

Solar Panel Exports Stall in Q1 After FY22 Surge

India''s solar panel exports, which had experienced a notable surge since the fiscal year 2022-23, hit a plateau in the first quarter of the current financial year. This stagnation is

Get Price

Solar products exports decline 16% to $1.5 billion in 2024

India''s solar product exports dropped 16% to $1.5 billion in 2024 due to shipment scrutiny and concerns over Chinese components. The US

Get Price

Monthly Solar Photovoltaic Module Shipments Report

This table includes the total shipments, values, and average values of module shipments by year and month. This table is a compilation of annual Tables 2, 3, and 4.

Get Price

Solar panel shipments set a record high in 2022 as

U.S. solar panel shipments closely track domestic solar capacity additions; the difference between the two is usually because of the lag time

Get Price

US tariffs, Europe slowdown reshape global solar panels trade

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since the first round of tariffs in June.

Get Price

Understanding China''s Photovoltaic Export Tax Refund Policy in

Current Tax Refund Rate for Photovoltaic Exports As of December 1, 2024, China''s export tax refund rate for photovoltaic panels stands at 9%, marking a significant reduction from the

Get Price

U.S. Commerce Department slaps unexpectedly high tariffs on

Coalition trade lawyer says the U.S. Department of Commerce''s final tariffs on solar cells and modules from Cambodia, Malaysia, Thailand and Vietnam are among the

Get Price

Chinese module exports decline 4% MoM amid dropping

China has exported 170.24 GW of modules from January to August, up 23% YoY from 137.87 GW. As of August, the top five largest markets importing Chinese modules are, by

Get Price

US sets antidumping duties for Southeast Asian solar cells

DOC issued a list of companies it says are exporting solar cells to the US below production costs, a practice known as "price dumping".

Get Price

India''s Solar Module Surge: SBI Warns of Oversupply Amid US

India''s solar module production has surged to 100 GW, but a report by SBI Capital Markets warns of potential oversupply risks. With the US reducing incentives for solar projects,

Get Price

1H/2025 China PV Module Exports Dropped by 17,7% YoY to 120

1H/2025 China PV Module Exports Dropped by 17,7% YoY to 120 GW According to the China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME)

Get Price

Can reshoring policies hinder China''s photovoltaic module exports

China''s PV module exports are expected to experience cyclical fluctuations. The primary export market for China''s PV modules will mainly be in the EU region. Energy

Get Price

US tariffs, Europe slowdown reshape global solar

Solar panel exports from Vietnam, Malaysia, Thailand and Cambodia to the U.S. fell by 33% on an annual basis in the nine months since

Get Price

Europe remains largest importer of Chinese

The Netherlands, Brazil, and Spain were the top three markets for China''s PV module exports in 2022, accounting for 46 percent of the total

Get Price

China''s Photovoltaic Module Exports Show Strong Growth Potential

While traditional export markets remain strong, China''s PV module export base is expanding, with new emerging markets becoming increasingly important, showing a clear

Get Price

Chinese solar module exports down 12% MoM despite growth in

Most manufacturers stopped shipments by mid-December, dropping shipment volume. The duty-free import quota will be used up by the end of 2024, and a 25% tariff will be

Get Price

Can reshoring policies hinder China''s photovoltaic module

China''s PV module exports are expected to experience cyclical fluctuations. The primary export market for China''s PV modules will mainly be in the EU region. Energy

Get Price

The trend of "volume increase and price decrease" in PV module exports

Recently, China''s General Administration of Customs released the import and export data of photovoltaic modules in May 2024, which showed that the export amount of

Get Price

China to cut or cancel export tax rebates for products

China''s finance ministry said on Friday it would reduce or cancel export tax rebates for a wide range of commodities and other products,

Get Price

India''s Solar Module Surge: SBI Warns of Oversupply Amid US Export

India''s solar module production has surged to 100 GW, but a report by SBI Capital Markets warns of potential oversupply risks. With the US reducing incentives for solar projects,

Get Price

China Photovoltaic: Import and Export

Discover data on Photovoltaic: Import and Export in China. Explore expert forecasts and historical data on economic indicators across 195+ countries.

Get Price

Solar products exports decline 16% to $1.5 billion in 2024

India''s solar product exports dropped 16% to $1.5 billion in 2024 due to shipment scrutiny and concerns over Chinese components. The US remained the top destination,

Get Price

China to adjust or cancel export tax rebates for various products

Meanwhile, the export tax rebate rate for some refined oil products, photovoltaic products, batteries and certain non-metallic mineral products will be reduced from 13 percent

Get Price

5 FAQs about [Photovoltaic module exports stopped]

Are photovoltaic module shipments published?

U.S. photovoltaic module shipments by state or territory Individual data for most states are not published to protect the confidentiality of individual company data. Individual data for most states are not published to protect the confidentiality of individual company data.

How has global solar PV manufacturing capacity changed over the last decade?

Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade. China has invested over USD 50 billion in new PV supply capacity – ten times more than Europe − and created more than 300 000 manufacturing jobs across the solar PV value chain since 2011.

Do I need to report a monthly photovoltaic module shipment report?

Beginning in January 2017, we required some of the respondents for the annual survey Form EIA-63B, Photovoltaic Module Shipments Report, to report monthly data. The subset of respondents now must report monthly accounts for about 90% of photovoltaic (PV) activity in the United States, based on 2021 data.

Do you have to report a monthly photovoltaic account?

The subset of respondents now must report monthly accounts for about 90% of photovoltaic (PV) activity in the United States, based on 2021 data. Data collected on both the monthly and annual Form EIA-63B are protected from disclosure of individual company data. As a result of this protection, monthly data are not published in some tables.

Will demand for Modules remain strong in the medium term?

“Demand for modules is expected to remain strong in the medium term. The reimposition of Approved List of Models and Manufacturers (ALMM) from April 2024, led to reduction in imports to Rs 322 billion in FY25, a 38 per cent y-o-y decline,” SBICAPS report said.

More related information

-

Australian photovoltaic module exports

Australian photovoltaic module exports

-

The photovoltaic company with the largest module exports

The photovoltaic company with the largest module exports

-

Ghanaian solar photovoltaic module exports

Ghanaian solar photovoltaic module exports

-

Double-glass photovoltaic module power

Double-glass photovoltaic module power

-

Photovoltaic module 550Wp monocrystalline silicon installation

Photovoltaic module 550Wp monocrystalline silicon installation

-

Latest photovoltaic aluminum module prices

Latest photovoltaic aluminum module prices

-

Huawei battery photovoltaic module supplier

Huawei battery photovoltaic module supplier

-

Tonga crystalline silicon photovoltaic module price

Tonga crystalline silicon photovoltaic module price

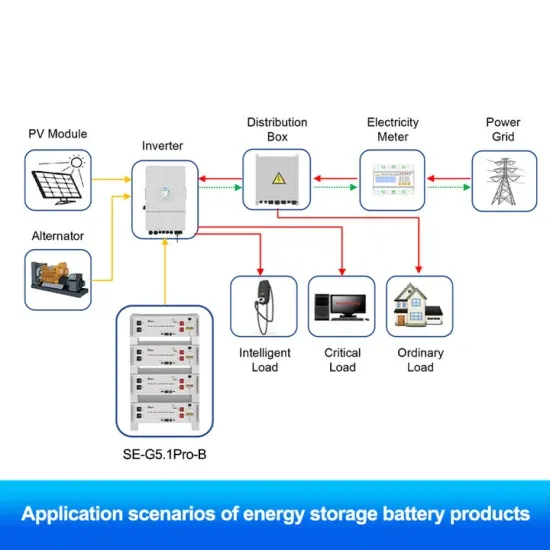

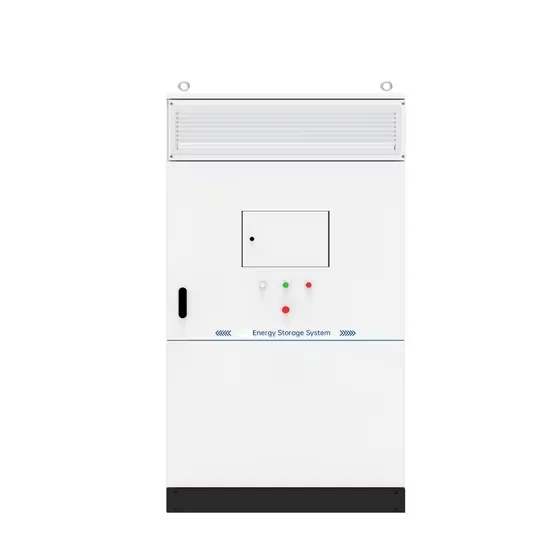

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

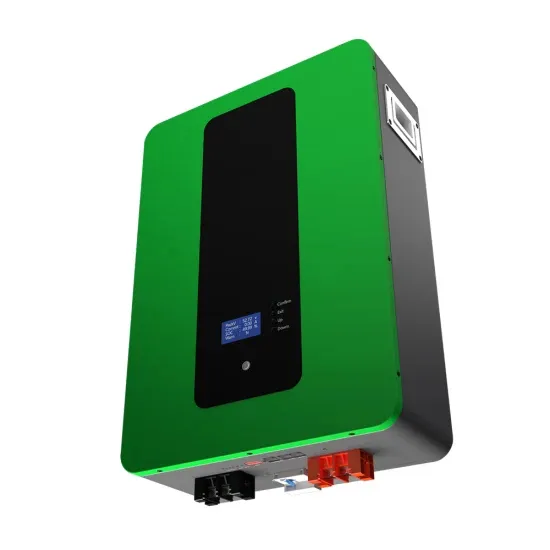

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.