A new step towards clean, renewable energy in North

Phase 2 will increase the capacity of the wind park by up to 15 MW, which is expected to produce around 50 GWh of electricity annually,

Get Price

A new step towards clean, renewable energy in North Macedonia

Phase 2 will increase the capacity of the wind park by up to 15 MW, which is expected to produce around 50 GWh of electricity annually, equivalent to the energy demand

Get Price

Alcazar Energy Partners unveils 400 MW wind power

The wind power plant will be located in the municipalities of Karbinci, Radoviš, and Štip, south of the capital city of Skopje, and is set to

Get Price

Alcazar Energy Partners launches 400 MW wind power project in North

On its path to developing the largest renewable energy platform in the Western Balkans, Alcazar Energy Partners has just made a key step. The company said it would invest

Get Price

North Macedonia

ESM owns and operates North Macedonia''s 36.5 MW wind park in the southern part of the country, and a private company completed construction of another 36 MW wind

Get Price

North Macedonia ess power system

The electric power production system in North Macedonia consists of twocoal power plants with a total installed capacity of 825 megawatts (MW),several hydro power plants with a total

Get Price

North Macedonia

North Macedonia - Countries - Online access - The Wind Power - Wind energy Market IntelligenceOnshore + offshore Year Capacity (MW) Growth (MW) Growth (%) 1997 1998

Get Price

Wind Solar Hybrid Power System for the

In conclusion, it''s more eco-friendly and economic to construct a wind solar hybrid power system for the communication base station cause

Get Price

Ane Wind Turbine Solar Generator for Mobile

ANE company started to supply wind solar hybrid power system for the communication base station in Jinchang, Jiuquan and other districts from

Get Price

Design of an off-grid hybrid PV/wind power system for

The study [4] has discussed the energy efficiency of telco base stations with renewable sources integration and the possibility of base stations

Get Price

Alcazar Energy Partners unveils 400 MW wind power project in North

The wind power plant will be located in the municipalities of Karbinci, Radoviš, and Štip, south of the capital city of Skopje, and is set to boost North Macedonia''s wind capacity by

Get Price

North Macedonia | Powertec Information Portal

A1 Macedonia, operating under the brand name A1 Makedonija, is a prominent telecommunications company in North Macedonia. It was established in 2015 through the

Get Price

ENERGY PROFILE North Macedonia

Distribution of solar potential Distribution of wind potential Annual generation per unit of installed PV capacity (MWh/kWp) Wind power density at 100m height (W/m2)

Get Price

Mobile communications of North Macedonia in 2025

Mobile connection and Internet of Northern Macedonia in 2025. The main mobile operators of Northern Macedonia. Where to buy seven in Northern Macedonia.

Get Price

Bitola power station

Bitola power station (РЕК Битола) is an operating power station of at least 699-megawatts (MW) in Novaci, North Macedonia with multiple units, some of which are not currently operating. It is

Get Price

North Macedonia Lays Foundation For Biggest Wind Farm

If plans succeed, the wind farm near the eastern city of Stip will host 55 wind turbines, generating 400 Megawatts of energy, enough to power some 100,000 out of the

Get Price

Alcazar Energy Partners launches 400 MW wind

On its path to developing the largest renewable energy platform in the Western Balkans, Alcazar Energy Partners has just made a key step. The

Get Price

Online access > Countries > North Macedonia

North Macedonia - Areas - Countries - Online access - The Wind Power Name Total power (kW) Number of wind farms Number of turbines

Get Price

North Macedonia

North Macedonia - Wind farms - Countries - Online access - The Wind Power Name Area Power (kW) Number of turbines Hub height (m) Turbine manufacturer Status Commissioning date

Get Price

North Macedonia Small Cell Power: Revolutionizing Network

With 5G adoption lagging at 23% below EU averages (ITU 2023), this Balkan nation faces critical challenges in network densification. The real question isn''t about technology availability, but

Get Price

North Macedonia announces $500 million project with investors

Construction is expected to begin in early 2026. Once operational, the wind farm is scheduled to produce enough energy to power over 100,000 households annually, while

Get Price

North Macedonia''s flagship wind project enters its final phase

The investment will increase the wind park''s installed capacity by 15 MW, expected to generate an additional 46 gigawatt-hour (GWh) of electricity annually, enough to meet the

Get Price

Miravci wind farm

Miravci wind farm is a shelved wind farm in Gevgelija, North Macedonia. Project Details Table 1: Phase-level project details for Miravci wind farm

Get Price

Bogdanci Wind Park project enters final phase, affirming North

The WBIF''s investment in Phase 2 of the Bogdanci wind park, with a grant of 9 million euros, is proof of a long-term commitment and partnership — both with KfW and with

Get Price

North Macedonia: Alcazar Energy begins construction of 400 MW wind

Alcazar Energy Partners, a renewable energy investment firm based in Luxembourg, has commenced construction on a 400 MW wind farm near the city of Stip in

Get Price

Bogoslovec, first private wind farm in North

According to Erste Group, Bogoslovec is among the last wind park installations in North Macedonia that will sell its power at a feed-in tariff under

Get Price

5G Base Station Companies

5G Base Station Company List Mordor Intelligence expert advisors identify the Top 5 5G Base Station companies and the other top companies based on 2024 market position. Get access to

Get Price

6 FAQs about [North Macedonia Mobile Company Communication Base Station Wind Power]

Who owns North Macedonia's wind park?

ESM owns and operates North Macedonia’s 36.5 MW wind park in the southern part of the country, and a private company completed construction of another 36 MW wind park. ESM plans to increase capacity of the existing one by 14 MW and invest in another 50 MW in the same area.

How many power plants are there in North Macedonia?

The electric power production system in North Macedonia consists of two coal power plants with a total installed capacity of 825 megawatts (MW), several hydro power plants with a total installed capacity of 695 MW, one combined generation power plant, a heavy oil plant, solar power plants, a few biogas plants, and two wind power farms.

What changes did North Macedonia make to its energy policy?

While there were no other major energy legislative changes, North Macedonia continues to harmonize its energy sub-regulations with the EU Energy Community’s Third Energy Package (TEP).

Is North Macedonia a state-owned power company?

North Macedonia’s state-owned power company was unbundled and partially privatized in the early 2000s. Austrian utility company EVN has been responsible for electricity distribution in North Macedonia since entering the market in 2006.

Does North Macedonia still have a coal power plant?

The smaller coal power plant, “REK Oslomej,” which was dormant through 2020, was reactivated in 2021 to help North Macedonia reduce its reliance on electricity imports. ESM refurbished the “REK Bitola” coal power plant boilers in 2017, but its equipment is still largely outdated.

How much will ESM invest in North Macedonia?

The investment is estimated to be over $1 billion and will be crucial for balancing the electricity system. ESM owns and operates North Macedonia’s 36.5 MW wind park in the southern part of the country, and a private company completed construction of another 36 MW wind park.

More related information

-

How to use the Jamaican mobile communication wind power base station

How to use the Jamaican mobile communication wind power base station

-

Mobile integrated operator communication base station wind power

Mobile integrated operator communication base station wind power

-

Argentina outdoor wind power base station customization company

Argentina outdoor wind power base station customization company

-

Paraguay Communication Base Station Wind Power Plant

Paraguay Communication Base Station Wind Power Plant

-

Kyrgyzstan communication base station wind power products

Kyrgyzstan communication base station wind power products

-

Vanuatu Communication Wind Power Base Station Quote

Vanuatu Communication Wind Power Base Station Quote

-

Price of energy storage system for North Macedonia communication base station

Price of energy storage system for North Macedonia communication base station

-

Wind power communication small base station

Wind power communication small base station

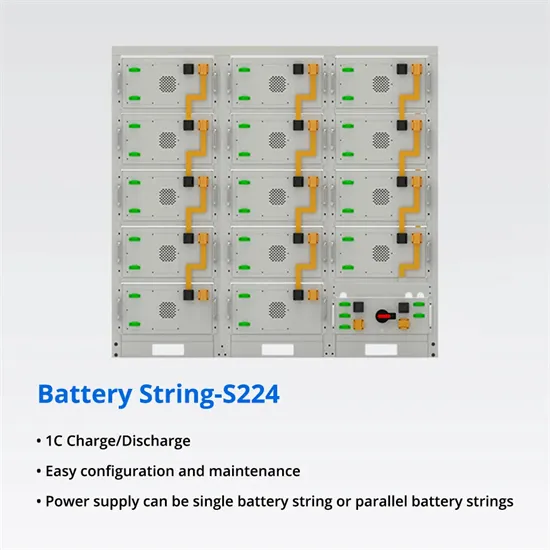

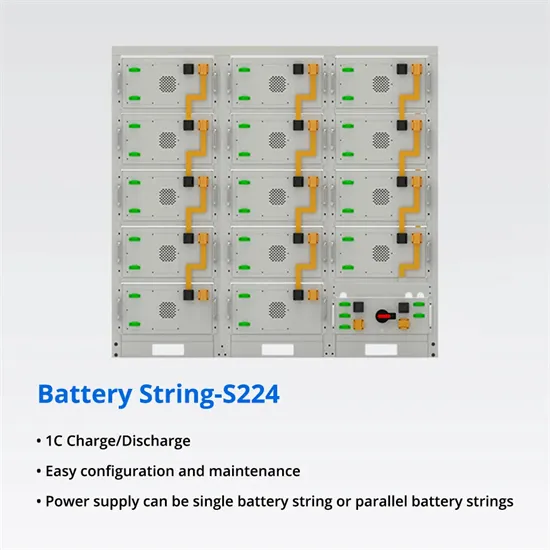

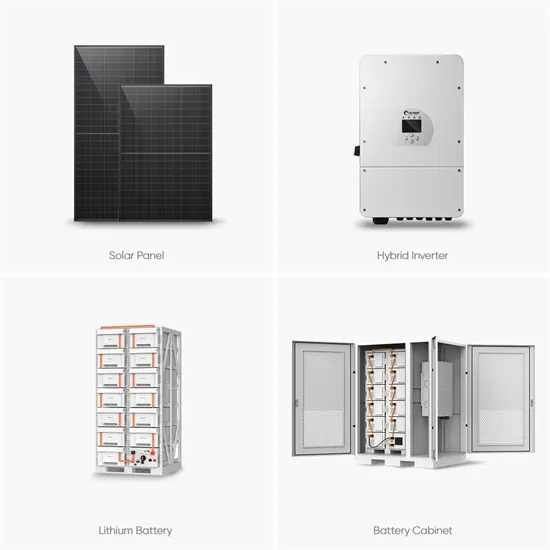

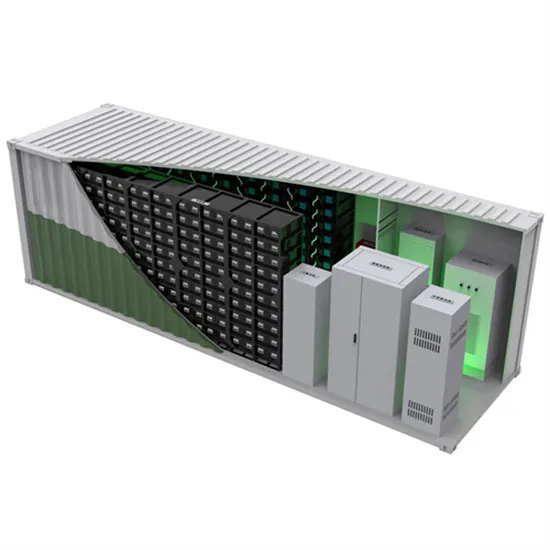

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.