US Government Finalizes Tariffs on Southeast Asian

U.S.-based manufacturers say that Chinese companies based in Cambodia, Vietnam, Thailand, and Malaysia are dumping cheap solar panels

Get Price

How Trade Policies Are Reshaping Global Solar PV

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral

Get Price

US solar tariffs and the shadow of larger trade measures

Intensified trade measures against China via higher tariffs on imported solar and battery cells are a significant policy step, but the impact is

Get Price

Tariffs on Solar Panels and Their Global Impact

Explore the impact of tariffs on solar panels in the USA and their implications for the clean energy market.

Get Price

US Finalizes Tariffs on Southeast Asian Solar Imports

The petitioner group, the American Alliance for Solar Manufacturing Trade Committee, accused big Chinese solar panel makers with factories in Malaysia, Cambodia,

Get Price

How is the foreign trade of solar energy products? | NenPower

Solar power, heralded as a revolutionary means of harnessing renewable energy, has led to increased trade in products related to this sector. Solar modules, inverters, and

Get Price

Shining a Light on Global Solar Trade for Businesses

This in-depth analysis compares solar trade policies across key global markets, helping businesses understand the impact on supply chains, project costs, and international solar

Get Price

History of U.S. tariffs and how they relate to solar – pv

Days after entering office, the Trump administration announced tariffs on key US trading partners. While Canada and Mexico negotiated a one

Get Price

US trade panel''s vote paves way for stiff tariffs on many solar

May 20 (Reuters) - The U.S. International Trade Commission determined on Tuesday that domestic solar panel makers were materially harmed or threatened by a flood of cheap

Get Price

Importing Solar Panels: A Guide to Navigating Trade Barriers in

This article focuses on importing solar panels, analyzes the international trade situation, and explains ZhongShen''s professional services in documentation and logistics,

Get Price

U.S. Commerce Department slaps unexpectedly high

In a third round of anti-dumping and anti-subsidy trade cases to counter a long high tide of U.S. solar imports from Chinese producers, the

Get Price

Final Affirmative Determinations in the Antidumping and

Information and Resources for U.S. Trade Remedy Laws and Ongoing Proceedings. Get the answers to the most commonly asked questions. View a list of our recent AD/CVD case

Get Price

Updated Solar Import Tariffs | Norton Rose Fulbright

Roughly 84% of solar cells and modules imported into the US during the fourth quarter of 2023 came from the four southeast Asian countries. Annual import volumes from the

Get Price

US trade panel''s vote paves way for stiff tariffs on

May 20 (Reuters) - The U.S. International Trade Commission determined on Tuesday that domestic solar panel makers were materially harmed or

Get Price

How Trade Policies Are Reshaping Global Solar PV Markets

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral agreements that significantly

Get Price

U.S. Commerce Department slaps unexpectedly high tariffs on solar

In a third round of anti-dumping and anti-subsidy trade cases to counter a long high tide of U.S. solar imports from Chinese producers, the U.S. domestic industry once again

Get Price

The impact of international trade on the price of solar photovoltaic

Over the past decades, the global solar photovoltaic (PV) market has experienced an unprecedented development associated with a substantial decline in solar PV module prices.

Get Price

What does it mean to have up to 3,521% US tariffs on

The trade tensions on solar imports from Southeast Asia aren''t new. After the over-300% tariff on Chinese solar products reduced US solar

Get Price

International Trade Disputes over Renewable

At the international level, renewable energy is an issue of international cooperation but also an area of high trade tensions between

Get Price

The U.S. slaps even more tariffs on Southeast Asia, as solar panels

The American Alliance for Solar Manufacturing Trade Committee also argued that Southeast Asian companies received an unfair level of subsidies, making U.S.-made solar

Get Price

Solar panels | United States International Trade Commission

We provide high-quality, leading-edge analysis of international trade issues to the President and the Congress. The Commission is a highly regarded forum for the adjudication

Get Price

Trade court orders retroactive duties on solar panels imported

This all stems from a lawsuit filed by solar panel assembler Auxin Solar asking the international trade court to review the legality of a two-year tariff pause President Joe Biden

Get Price

U.S. Commerce Department slaps unexpectedly high

Coalition trade lawyer says the U.S. Department of Commerce''s final tariffs on solar cells and modules from Cambodia, Malaysia, Thailand and

Get Price

US finalizes tariffs on Southeast Asian solar imports

The petitioner group, the American Alliance for Solar Manufacturing Trade Committee, accused big Chinese solar panel makers

Get Price

The impact of green trade barriers on China''s photovoltaic

The findings provide valuable insights for policymakers, suggesting that align with international standards, provide differentiated technical assistance and adopt transparent trade

Get Price

U.S. International Trade Commission Votes in Favor of Domestic Solar

The investigations were initiated in response to petitions filed on April 24, 2024, by the American Alliance for Solar Manufacturing Trade Committee—a coalition of U.S. solar

Get Price

Solar Energy

Transform your future with industry-leading solar training from SEI. Online courses, hands-on workshops, and professional certificate programs for clean

Get Price

6 FAQs about [Foreign trade photovoltaic solar panels]

How do international trade policies shape the global solar photovoltaic landscape?

International trade policies shape the global solar photovoltaic (PV) landscape through complex networks of tariffs, regulations, and bilateral agreements that significantly impact market dynamics and industry growth.

How does international trade affect solar PV?

International trade policies significantly influence manufacturing costs and investment returns throughout the solar PV supply chain. Tariffs and trade barriers can increase component prices by 10-30%, directly impacting module costs and project viability.

Are solar panels harmed by cheap imports from Southeast Asian countries?

May 20 (Reuters) - The U.S. International Trade Commission determined on Tuesday that domestic solar panel makers were materially harmed or threatened by a flood of cheap imports from four Southeast Asian nations, bringing the United States a step closer to imposing stiff duties on those goods.

How is the solar PV industry adapting to changing trade policies?

The solar PV industry demonstrates remarkable resilience in adapting to evolving trade policies through strategic diversification and innovation. Companies are increasingly establishing regional manufacturing hubs to mitigate tariff impacts and reduce supply chain vulnerabilities.

Will US tariffs affect solar panels imported from Southeast Asia?

The USA Leaders 23 April 2025 Washington, DC – In a sweeping move that’s sending ripples through global energy markets, the United States has announced significant tariffs on solar panels imported from Southeast Asia.

How do regional trade agreements shape the global solar PV market?

Regional trade agreements significantly shape the global solar PV market through preferential tariffs and standardized regulations. The European Union’s Solar Alliance and the Asia-Pacific Economic Cooperation (APEC) Renewable Energy Partnership stand out as influential frameworks that facilitate cross-border solar technology trade.

More related information

-

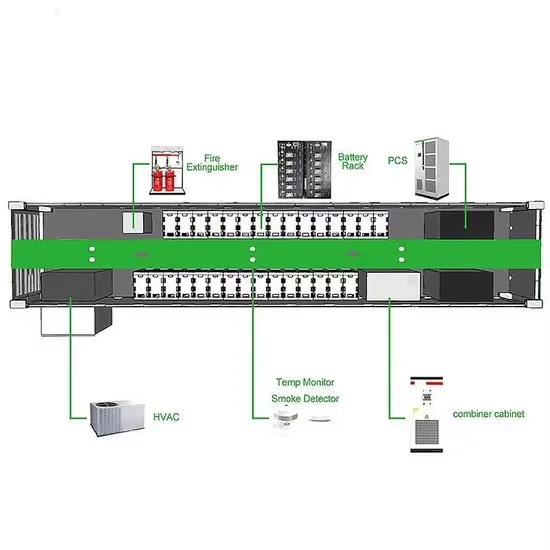

Somalia container photovoltaic energy storage lithium battery foreign trade

Somalia container photovoltaic energy storage lithium battery foreign trade

-

Morocco s new solar photovoltaic panels

Morocco s new solar photovoltaic panels

-

Cuban monocrystalline solar photovoltaic panels

Cuban monocrystalline solar photovoltaic panels

-

Photovoltaic enterprise double-sided solar panels

Photovoltaic enterprise double-sided solar panels

-

Huawei base station solar photovoltaic panels

Huawei base station solar photovoltaic panels

-

Solar Photovoltaic Panels Huijue

Solar Photovoltaic Panels Huijue

-

Morocco-specific solar photovoltaic panels

Morocco-specific solar photovoltaic panels

-

Huawei Bulgaria photovoltaic conductive solar panels

Huawei Bulgaria photovoltaic conductive solar panels

Commercial & Industrial Solar Storage Market Growth

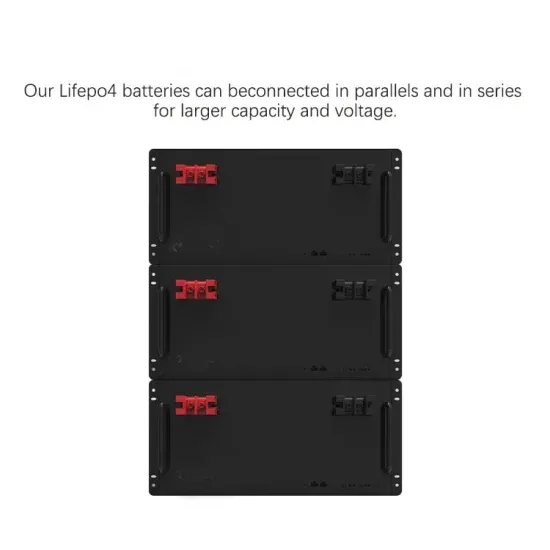

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.