Trade Statistics by Country | WITS

View Trade Statistics by Country including trade summary, exports and imports by partner and products along with tariff and development indicator.

Get Price

Qatar''s Import/Export Rules: Complete Guide to Trade

From customs documentation and prohibited items to tariff structures and free zone advantages, these regulations directly impact your bottom line and operational efficiency.

Get Price

How Trump''s tariffs could reshape Gulf aluminium exports

On the face of it, US President Donald Trump''s decision to impose a 25 percent tariff on steel and aluminium imports is bad news for GCC smelters. After all, the Gulf region

Get Price

Understanding Import and Export Regulations in

Explore the essential import and export regulations in Qatar for effective international trade operations. Understand customs procedures,

Get Price

Tariffs Imposed to the U.S. Goods and Products in Qatar

1. Understand the Tariff Structure: Firstly, it is essential for U.S. exporters to thoroughly understand the tariff structure imposed by Qatar on their specific products. This includes

Get Price

Qatar Customs Import and Export Tax and Fees

This article outlines Qatar''s import and export tax and fee policies, including a standard import tariff of 5% ad valorem and higher protective tariffs for certain goods conflicting with local

Get Price

What Are the Import Conditions and Tariffs in Qatar?

Navigate Qatar''s import duties & exemptions effectively. Discover key insights on customs regulations, tariffs, and compliance for smooth importing.

Get Price

DUBAI CUSTOMS SERVICES HS Code Search

Al-Munasiq, a groundbreaking advancement in classifying goods under the Harmonized System (HS) Code. Powered by advanced artificial intelligence, the platform delivers highly accurate

Get Price

Qatar''s Import/Export Rules: Complete Guide to Trade

Navigating Qatar''s import/export regulations can seem overwhelming when you''re expanding your business in this thriving Gulf economy. As a major global trade hub with one of the world''s

Get Price

Doing Business with Qatar

Understand Qatar''s import regulations and product standards. Determine the Harmonized System (HS) code to understand tariffs and regulations. Gather necessary export documents:

Get Price

Understanding Import and Export Regulations in Qatar: A

Explore the essential import and export regulations in Qatar for effective international trade operations. Understand customs procedures, tariffs, prohibited goods, and

Get Price

Qatar Customs

Qatar''s customs framework is structured to facilitate efficient trade through well-defined processes and duty tariffs. Central to this system is Al Nadeeb, an advanced digital platform that

Get Price

Export and Import Regulations in Qatar

Find out important information about export and import regulations in Qatar, including customs, tariffs and points of entry.

Get Price

U.S. Tariffs Threaten to Undermine the Economies of the Gulf

The most important and perhaps longest-lasting impact of tariffs on the economies of the GCC will be depressed demand for oil and, as a result, oil prices. Though oil and gas

Get Price

Tariffs and Customs Duties on Goods Manufactured in Qatar

2. Qatar, like many other countries, regularly reviews and updates its tariff and customs duty policies to align with its trade objectives and economic interests. It is advisable for businesses

Get Price

Qatar

Qatar is a member of the Gulf Cooperation Council (GCC) Customs Union which came into effect in 2003. In accordance with the GCC Customs Union, Qatar maintains a 5% tariff on a wide

Get Price

Qatar Trade Summary 2022 | WITS | Text

Merchandise Trade summary statistics for a country including imports, exports, tariffs, export and import partners, top exported products and development indicators

Get Price

Dutify | HS Lookup

Get full-length HS codes and duty rates for your product coming to Qatar with no tariff knowledge using our powerful user-friendly HS Lookup.

Get Price

U.S. Tariffs on Products and Goods Made in Qatar

In conclusion, while there are no specific tariffs on products made in Qatar at present, future developments such as changes in trade policies, geopolitical relations, and industry-specific

Get Price

Qatar Customs

Qatar''s customs framework is structured to facilitate efficient trade through well-defined processes and duty tariffs. Central to this system is Al Nadeeb, an

Get Price

JANUARY 2023

1.1 TARIFF Established rates and charges shall apply on vessel, shipment or passengers against port services and facilities as announced by Mwani Qatar.

Get Price

Tariffs Imposed to the U.S. Goods and Products in Qatar

It is important for businesses exporting goods from the U.S. to Qatar to be aware of the specific tariff rates and regulations imposed on their particular products to effectively navigate the

Get Price

Legal Insight: Why Qatar Needs a Modern Export Control

Without a modern export control regime, Qatar may struggle to qualify for concessional loans, climate bonds, or technical assistance. Aligning domestic policy with

Get Price

6 FAQs about [Qatar outdoor power supply export tariff]

How does Qatar's customs system work?

Qatar’s customs framework is structured to facilitate efficient trade through well-defined processes and duty tariffs. Central to this system is Al Nadeeb, an advanced digital platform that simplifies import and export procedures, ensuring seamless operations for businesses.

What is the new tariff system in Qatar?

The new tariff system comprises 12-digit tariff codes (previously 8 digits), so products can be classified for purposes such as determining the customs duty rate, non-tariff barriers, and statistics. There are few restrictions on bringing personal effects into Qatar.

Are there duties on exports in Qatar?

There are no duties on exports. Imports in Q3 2024 was QAR30.1 bn, mainly from Asia. Importers of goods into Qatar must sign up to the Importers’ Register and be approved by Qatar Chamber (QC). Customs duty and legalisation fees are levied on all commercial shipments, irrespective of its value.

How do I import goods into Qatar?

Importers of goods into Qatar must sign up to the Importers’ Register and be approved by Qatar Chamber (QC). Customs duty and legalisation fees are levied on all commercial shipments, irrespective of its value. All goods imported into Qatar are subject to customs duties, based on a percentage value of goods (usually 5%), or on a ‘per unit’ basis.

Does Qatar impose a 5% ad valorem tariff?

In alignment with the GCC Customs Union, Qatar imposes a 5% ad valorem tariff on the value of cost, insurance and freight (CIF) invoice of general cargo goods, excluding those exempted by law provisions. The tariff may also include a fixed amount levied on each unit of the goods. The limited tariff exceptions are:

How much are customs duties in Qatar?

All goods imported into Qatar are subject to customs duties, based on a percentage value of goods (usually 5%), or on a ‘per unit’ basis. Effective from May 2021, incoming parcels and personal shipments with a cost, insurance and freight (CIF) value exceeding QAR1,000 is liable to 5% customs duties (previously QAR3,000).

More related information

-

Where can I buy outdoor power supply in Qatar

Where can I buy outdoor power supply in Qatar

-

Export outdoor power supply to North America

Export outdoor power supply to North America

-

Chad outdoor power supply sales manufacturer

Chad outdoor power supply sales manufacturer

-

The most reliable high-power outdoor power supply

The most reliable high-power outdoor power supply

-

Outdoor power supply hidden

Outdoor power supply hidden

-

Replace lithium batteries as outdoor power supply

Replace lithium batteries as outdoor power supply

-

Tanzania High Power Outdoor Telecommunication Power Supply BESS

Tanzania High Power Outdoor Telecommunication Power Supply BESS

-

Honduras emergency outdoor power supply manufacturer

Honduras emergency outdoor power supply manufacturer

Commercial & Industrial Solar Storage Market Growth

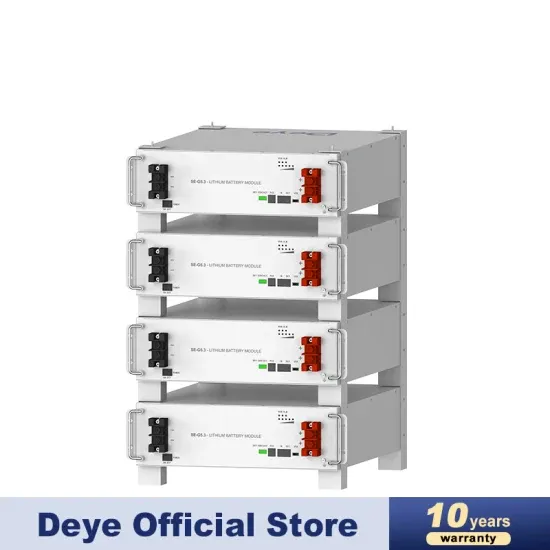

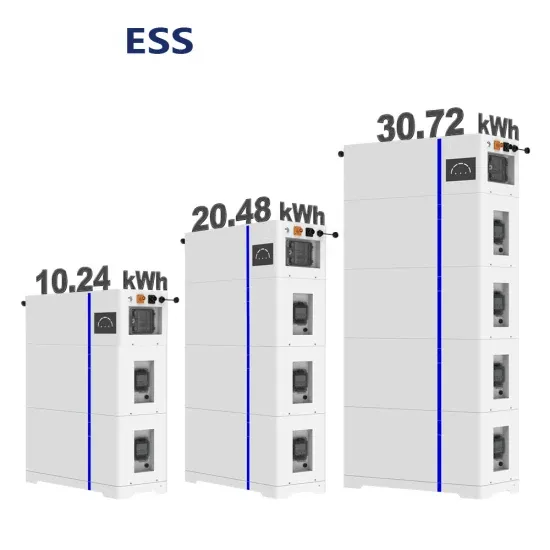

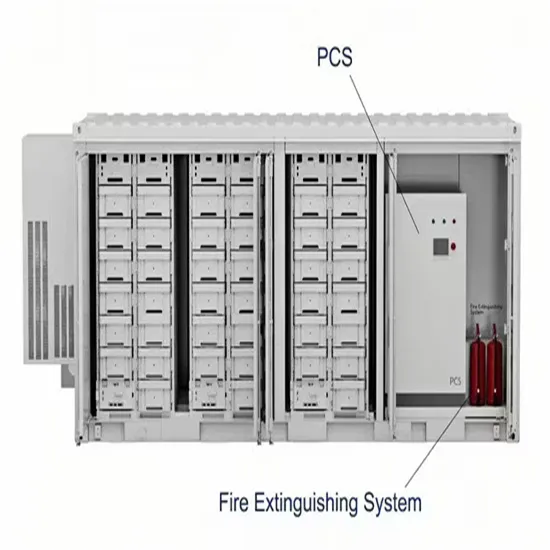

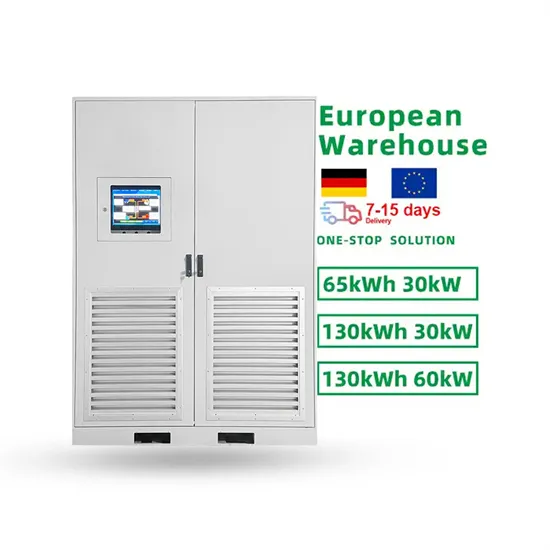

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.