Ethiopia: Wind farm starts to feed energy into national grid

A wind farm in Ethiopia has started feeding power into the country''s grid and is expected to increase output when all its turbines come online by the end of the year.

Get Price

Ethiopia Emerges as Africa''s Renewable Energy

Ethiopia is making remarkable progress in renewable energy, emerging as a continental leader through ambitious hydropower and wind energy initiatives.

Get Price

Scaling Up Energy Storage to Accelerate Renewables – ESMAP''s Energy

Energy storage is fundamental to stockpile renewable energy on a massive scale. The Energy Storage Program, a window of the World Bank''s Energy Sector Management

Get Price

Ethiopia Offshore Energy Storage Market (2025-2031) | Trends,

Market Forecast By Type (Lithium-Ion Batteries, Hydrogen Storage, Flywheel Energy Storage, Compressed Air Energy Storage), By Application Area (Wind Energy Storage, Offshore

Get Price

Ethiopia Power Market (2025-2031) | Trends, Outlook & Forecast

Historical Data and Forecast of Ethiopia Power Market Revenues & Volume By Energy Storage for the Period 2021 - 2029 Ethiopia Power Import Export Trade Statistics

Get Price

Ethiopia Wind Power Storage

The Techno-Economic Feasibility Analysis of Integrating Wind Power This thesis is intended to study the Techno-economic feasibility analysis of integrating Wind Power Pumped Hydro

Get Price

(PDF) The Current and Future States of Ethiopia''s Energy Sector

The Current and Future States of Ethiopia''s Energy Sector and Potential for Green Energy: A Comprehensive Study November 2017 International Journal of Engineering

Get Price

Energy in Ethiopia

Energy in Ethiopia Energy in Ethiopia includes energy and electricity production, consumption, transport, exportation, and importation in the country of Ethiopia. Ethiopia''s energy sector is

Get Price

Wind energy resource development in Ethiopia as an alternative energy

Lack of reliable wind data covering the entire country has been one of the reasons for limited application of wind energy in Ethiopia, but recently studies have shown that Ethiopia

Get Price

Unlocking wind power potential to improve energy security in

The research paper aims to examine the status, chal-lenges, and opportunities in developing, deploying, and sustaining wind power generation. This was accomplished through qualitative

Get Price

Today, the Ministry of Industry and Information Technology

Furthermore, it is proposed in the plan to deepen cooperation with emerging market countries throughout the entire industry chain in the fields of wind power, photovoltaics, energy storage,

Get Price

Ethiopia''s Wind Power Potential Faces Challenges Amid

5 days ago· Recent research published in "Sustainable Energy Research" sheds light on Ethiopia''s vast wind power potential, a resource that could significantly enhance the country''s

Get Price

Ethiopia: Wind farm starts to feed energy into national

A wind farm in Ethiopia has started feeding power into the country''s grid and is expected to increase output when all its turbines come

Get Price

Ethiopia Renewable Energy Market Analysis

With continued policy support, technological advancements, and collaboration between the public and private sectors, the Ethiopia renewable energy market is expected to play a pivotal role in

Get Price

China''s Mingyang joins Octopus for massive UK wind turbine push

1 day ago· The business of wind Recharge is the world''s leading business intelligence source for the renewable energy industries. We provide award-winning international coverage of breaking

Get Price

Geology in renewable energy development in

By leveraging its geological advantages, Ethiopia can advance its renewable energy agenda, enhance energy security, and contribute to

Get Price

Wind energy resource development in Ethiopia as an alternative

Lack of reliable wind data covering the entire country has been one of the reasons for limited application of wind energy in Ethiopia, but recently studies have shown that Ethiopia

Get Price

The Assela Wind Farm Delivers First Power to Ethiopia''s national

With the Assela wind farm, Ethiopia moves closer to universal access to modern, affordable energy and to becoming a regional power hub in Eastern Africa, eventually

Get Price

Revolutionizing Ethiopia''s Energy Landscape: A Deep Dive

Ethiopia''s commitment to renewable energy sources is at the forefront of the market. It dissects how energy storage systems are enabling the seamless integration of solar

Get Price

Ethiopia Emerges as Africa''s Renewable Energy Powerhouse

Strategic investments in clean energy infrastructure are addressing domestic electricity needs while also supporting regional energy integration and driving sustainable economic growth

Get Price

Ethiopia

Approximately 90% of the installed generation capacity is from hydropower, while the remaining 10% is from wind and thermal sources (8% and 2%, respectively).

Get Price

Large-Scale Integration of Wind Power Generation in Ethiopia

LastWind aims at assessing and proposing novel solutions to the large-scale integration of WPPs into the Ethiopian grid, in order to achieve unprecedented levels of wind power penetration

Get Price

Ethiopia Emerges as Africa''s Renewable Energy

Strategic investments in clean energy infrastructure are addressing domestic electricity needs while also supporting regional energy integration and driving

Get Price

Ethiopia Energy Outlook – Analysis

Ethiopia could supply a much larger economy than today in the AC, using only twice the energy, were it to diversify its energy mix and implement

Get Price

Ethiopia Renewable Energy Market Analysis

With continued policy support, technological advancements, and collaboration between the public and private sectors, the Ethiopia renewable energy market

Get Price

6 FAQs about [Ethiopia s wind power and energy storage industry]

Does Ethiopia have wind power?

Ethiopia, a country that relies on hydroelectric plants for the bulk of its power, is now developing significant wind energy capacities.

Why is energy important in Ethiopia?

Energy is one of the most significant sectors for Ethiopia’s economic growth and development and is expected to increase significantly in the medium run. Ethiopia has abundant renewable energy resources and has the potential to generate over 60,000 megawatts (MW) of electric power from hydroelectric, wind, solar, and geothermal sources.

How many wind farms are being built in Ethiopia?

With the aim of diversifying the energy sources, the Ethiopian government is constructing a number of wind farms with total capacity of 1116 MW. It was mentioned that according to the growth and transformation plan adopted by the government for the period of 2011 to 2015, EEPCo has planned to build eight wind farms .

What is energy sector support in Ethiopia?

Energy sector support in Ethiopia aligns with Power Africa 2.0 objectives, which include advancing sustainable development through private sector led partnerships; promoting economic prosperity; and an increased focus on the enabling environment, transmission, and distribution. Technical assistance provided includes:

Is Ethiopia's power sector over dependant on hydropower?

The Ethiopian power sector is over dependant on hydropower. The country need to diversify its energy sector and keep looking for other energy sources such as wind, geothermal and solar because its extreme hydropower dependence may leave its power sector vulnerable to drought, an increasingly risky scenario due to climate change.

How much energy is available in Ethiopia?

With the addition 52 MW from wind in December 2012, the current electric energy access of the country is around 50%. The Ethiopian government is devoted to improve its energy production capacity as quickly as possible by constructing new power plants and expanding the national grid.

More related information

-

Wind solar and energy storage power station local industry

Wind solar and energy storage power station local industry

-

Uzbekistan wind power project with energy storage

Uzbekistan wind power project with energy storage

-

Green Power Wind Power UHV Energy Storage

Green Power Wind Power UHV Energy Storage

-

Energy storage configuration for Marshall Islands wind power project

Energy storage configuration for Marshall Islands wind power project

-

Liechtenstein wind power energy storage system supplier

Liechtenstein wind power energy storage system supplier

-

Wind power energy storage system

Wind power energy storage system

-

El Salvador Wind Power Plant Energy Storage Project

El Salvador Wind Power Plant Energy Storage Project

-

Suriname Wind Power Energy Storage Company

Suriname Wind Power Energy Storage Company

Commercial & Industrial Solar Storage Market Growth

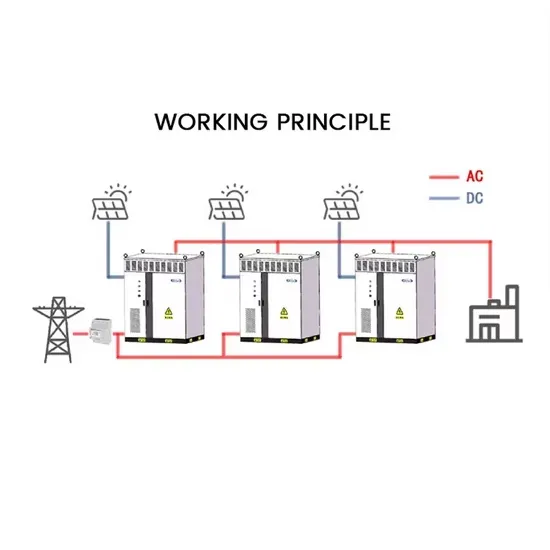

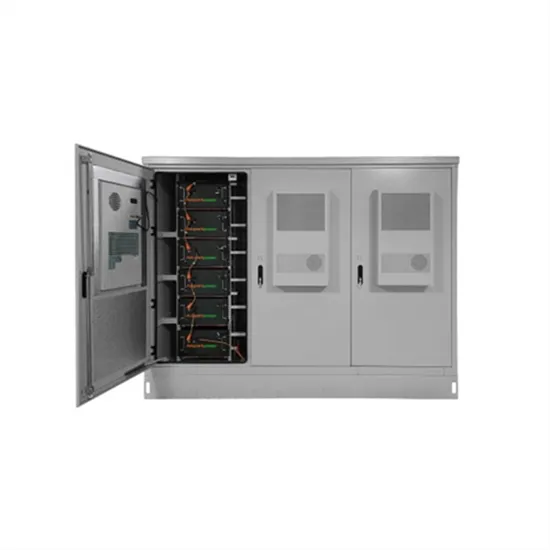

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.