Changes To Chile''s Upcoming Power Supply Auction

The National Energy Commission (CNE) in Chile has revised the volume of new power supply for its 2023 energy tender to 5,000 GWh/year, aiming to promote renewable

Get Price

Electricity returns to most of Chile after a sweeping blackout, but

The blackout was the most significant to hit Chile since 2010, when a destructive 8.8-magnitude earthquake and tsunami cut off power and knocked out communications for

Get Price

Chile: BESS as an answer to solar curtailment, grid

The current wave of excitement around Chile''s BESS market started in October 2022, when the Chilean government passed legislation that

Get Price

Grenergy to build 1.3GW solar-plus-storage plants in

Spanish independent power producer (IPP) has unveiled two new solar-plus-storage projects, one in Central Chile and the other in Spain.

Get Price

Chile: BESS as an answer to solar curtailment, grid constraints

The current wave of excitement around Chile''s BESS market started in October 2022, when the Chilean government passed legislation that incentivised the deployment of

Get Price

Chilean Battery Energy Storage Systems Stabilize Energy Supply

Co-located batteries, like Engie S.A.''s BESS Coya, will help solar plants capture better power prices by charging the batteries during solar hours when power prices are very

Get Price

chile Archives

Utility and independent power producer (IPP) Engie has started commercial operations of its 48MW/264MWh battery energy storage system (BESS) Capricornio project in

Get Price

Changes To Chile''s Upcoming Power Supply Auction

The CNE has planned this auction to lock in electricity supply at competitive terms in the long term with a view to decarbonize its energy sector with renewable energies and

Get Price

Chilean Battery Energy Storage Systems Stabilize Energy

Co-located batteries, like Engie S.A.''s BESS Coya, will help solar plants capture better power prices by charging the batteries during solar hours when power prices are very

Get Price

Energía Abierta | Comisión Nacional de Energía – Ministerio de

This portal allows you to locate geographical information and open data of the energy sector in Chile. We also invite you to use the GeoReport where you will find information according to

Get Price

The blooming of Chilean energy storage

At present, renewable developers looking to invest in Chile face a risk posed by the fluctuations in power prices, driven by supply from solar projects that can push prices down to around zero.

Get Price

Battery Energy Storage Systems (BESS) in Chile

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged

Get Price

Chile''s $2 Billion Energy Storage Boost Challenges U.S. Supremacy

Chile is set to challenge the U.S. as the leader in the energy storage market, banking on its vast lithium reserves and new investments. The global energy storage industry

Get Price

Energy storage is a challenge and an opportunity for Chile

As renewables scale up, the need to store energy is increasing. Chile is leading the way in Latin America and has more projects in the pipeline, but hurdles remain Chilean

Get Price

Banking on batteries in Chile

A new power sufficiency regulation, which essentially operates as a capacity mechanism – a method of securing enough generation and storage assets to guarantee

Get Price

Chilean Battery Energy Storage Systems Stabilize Energy

We expect price differentials in Chile to fall as BESS-installed capacity grows and new transmission comes online adding more uncertainty to long term arbitrage revenues.

Get Price

Chile Leads Latin America with the Largest Battery Energy Storage

This achievement reinforces Chile''s position as a regional leader in energy innovation and storage solutions. The project not only supports the integration of renewable energy into the grid but

Get Price

Unleashing The Energy Storage Market in Chile

Wärtsilä is looking at ways to unleash Chile''s energy storage market and help the nation meet its energy transition goals.

Get Price

Energy storage is a challenge and an opportunity for

As renewables scale up, the need to store energy is increasing. Chile is leading the way in Latin America and has more projects in the

Get Price

Chile''s Energy Storage Price Trends: Where the Desert Meets

Chile''s energy storage prices aren''t just numbers on a spreadsheet; they''re the heartbeat of South America''s clean energy revolution. Current market data shows vanadium flow batteries

Get Price

Chile Energy Information

Through an agreement signed in 1992, Chile authorised the bidirectional use of the pipeline and the storage of oil, rendering facilities suitable for both exportation and importation.

Get Price

Battery Storage Unlocked: Lessons Learned From Emerging

Lessons Learned from Emerging Economies The Supercharging Battery Storage Initiative would like to thank all authors and organizations for their submissions to support this publication.

Get Price

Chile Energy Storage

Chile has the potential to run exclusively on renewable generation, with an estimated energy mix of 46% solar, 31% wind, 12% hydroelectric, and 8% flexible natural gas

Get Price

Chile''s $2 Billion Energy Storage Boost Challenges

Chile is capitalizing on its rich lithium resources to become a potential leader in the global energy storage market.

Get Price

Chile Energy Storage Industry Holds Promise | EMIS

The investment is estimated at around USD 180mn and construction works will start in June 2024. The Tocopilla BESS will be capable of storing 660 MWh of energy generated by

Get Price

Chile energy profile

The IEA examines the full spectrum of energy issues including oil, gas and coal supply and demand, renewable energy technologies, electricity markets, energy eficiency, access to

Get Price

Chilean Battery Energy Storage Systems Stabilize Energy Supply

We expect price differentials in Chile to fall as BESS-installed capacity grows and new transmission comes online adding more uncertainty to long term arbitrage revenues.

Get Price

3.5GWh, BYD Energy Storage Signs Largest Energy Storage Supply

Recently, BYD Energy Storage signed an energy storage order agreement with Grenergy, a world-renowned renewable energy company, for the supply of 3.5GWh energy

Get Price

6 FAQs about [Chile emergency energy storage power supply price]

Is Chile ready for a standalone energy storage project?

This project alone nears the capacity (13GWh) the Chilean Ministry of Energy sought in a public land bidding auction for standalone energy storage projects in May of 2024. Chile has been one of the countries at the forefront of the renewable energy transition in Latin America, first with solar PV and now with BESS.

How much energy storage will Chile have in 2024?

During the Energy Storage Summit Latin America (ESS LatAm) in October 2024, Ana Lía Rojas, executive director at the Chilean renewable energy and energy storage association (ACERA), explained how the current levels of curtailment in Chile, which could end up at approximately 5TWh in 2024, could power up to 3.4GW of 4-hour duration energy storage.

Are battery energy storage systems a viable alternative for Chilean power producers?

With transmission lines at overcapacity and permitting delays slowing the development of new grid infrastructure, battery energy storage systems (BESS) have surged as a profitable alternative for Chilean power producers.

How many energy storage projects are in Chile?

According to a December 2023 publication on the InvestChile website, the country had 23 approved energy storage projects with a total of 3,000 MW of capacity. Chile is exploring a variety of solutions to keep abreast of the changing energy demand landscape ranging from BESS to innovative projects using CO2.

Where are Chile's battery energy storage facilities located?

Chile’s first battery energy storage projects were commissioned in 2009, and all but two of its 16 administrative regions have facilities in operation, under construction or in the planning stage. The greatest installed capacity is found in the northern regions of Antofagasta and Tarapacá, the country’s solar powerhouses.

Why is Chile pursuing energy storage in Antofagasta?

Chilean president Gabriel Boric (centre) at the inauguration of an energy storage plant in the northern region of Antofagasta in April 2024. Chile has strong conditions for wind and solar energy, and is pursuing storage to help overcome intermittent supply (Image: Ximena Navarro / Dirección de Prensa, Presidencia de la República de Chile)

More related information

-

Guyana Emergency Energy Storage Power Supply Price

Guyana Emergency Energy Storage Power Supply Price

-

Bulgarian energy storage emergency power supply wholesale price

Bulgarian energy storage emergency power supply wholesale price

-

Algeria emergency energy storage power supply price

Algeria emergency energy storage power supply price

-

Emergency Power Supply Energy Storage Vehicle

Emergency Power Supply Energy Storage Vehicle

-

Bahamas Photovoltaic Energy Storage Power Supply Price

Bahamas Photovoltaic Energy Storage Power Supply Price

-

Venezuela bidirectional portable energy storage emergency power supply

Venezuela bidirectional portable energy storage emergency power supply

-

Swedish outdoor energy storage power supply price

Swedish outdoor energy storage power supply price

-

Home Energy Storage Emergency Power Supply

Home Energy Storage Emergency Power Supply

Commercial & Industrial Solar Storage Market Growth

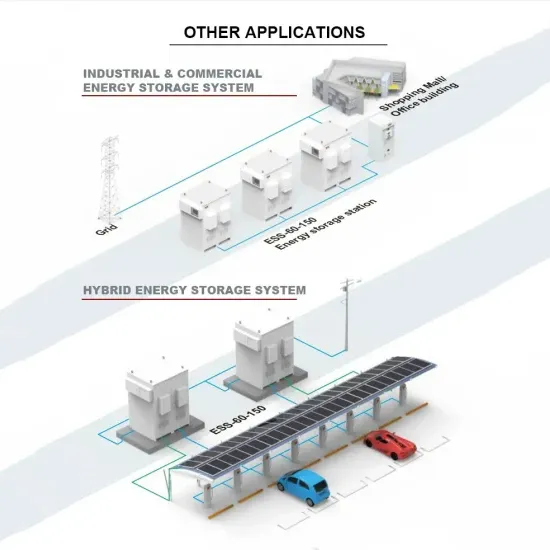

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.