Context of renewables in Moldova''s electricity sector –

According to an analysis of technical potential for RE generation (IRENA, 2019), there is in excess of 27 GW of potential renewable generation capacity in

Get Price

THE POTENTIAL FOR WIND ENERGY DEVELOPMENT IN

Moldova possesses a promising wind regime suitable for generating electricity through wind turbines. Wind data analysis and wind resource maps reveal favorable wind speeds across

Get Price

Moldova energy profile – Analysis

The development of uncontrollable renewables, such as wind and solar, will be limited by the balancing capabilities of the Moldovan power system. Moldova has been a member of the

Get Price

Situation of the today''s Energy and Transport systems of

New nuclear small modular reactors are expected to make up for the decommissioned natural gas and wind power generation capacity providing low-carbon electricity in the Republic of Moldova.

Get Price

Moldova seeks investment for wind, solar plants with first tender

Moldova launched its first tender for wind and solar power plants on Friday as part of a push to reduce its reliance on Russian energy.

Get Price

Moldova

Moldova''s energy sector relies heavily on imports of electricity and gas. The country produces only about 20 percent of its annual electricity consumption from natural gas-fired

Get Price

Analysis of Grid-Connected Wind Turbine Generators on Power System

Since different wind turbines access grid may have different effects on the system, it is necessary to study the effect of different wind turbines access grid on the system transient

Get Price

Moldova''s Green Turn: How Crisis Sparked a Renewable Energy

Moldova''s energy grid is fragile and badly in need of modernization. If too many end users overinvest and sell energy into the network things will become unstable – a problem that

Get Price

Control of DC Link Voltage in Grid-Connected Wind Power

In the variable-speed wind energy conversion system (WECS) the wind turbine can be operated as close as possible to its optimal speed to realize maximum power point tracking for various

Get Price

Situation of the today''s Energy and Transport systems of

Geographically positioned between Romania and Ukraine, the cross-border power system of the Republic of Moldova is critical for regional energy security and regional integration with the

Get Price

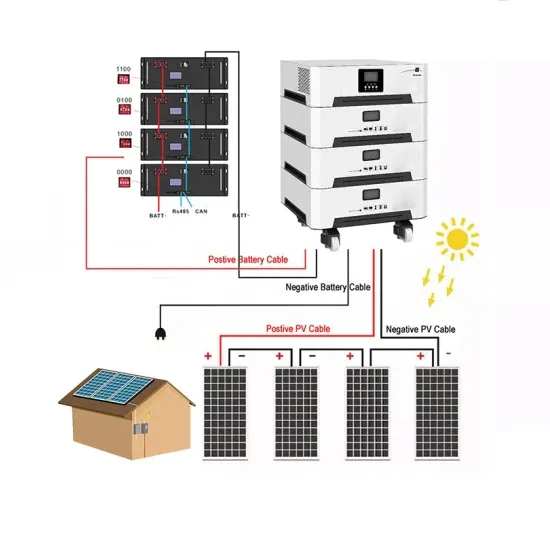

Grid-Connected Renewable Energy Systems

Currently, requirements for connecting distributed generation systems—like home renewable energy or wind systems—to the electricity grid vary widely. But all

Get Price

Grid tie solar inverter working principle Moldova

Can a grid tied inverter go back to mains? Can go back to mains. Grid-tied inverters are commonly used in applications where some DC voltage sources (such as solar panels or small

Get Price

Wind Power Generation System Using MATLAB

A comprehensive Wind Power Generation System implemented using MATLAB & Simulink. This project provides detailed modeling and simulation capabilities

Get Price

Context of renewables in Moldova''s electricity sector – System

According to an analysis of technical potential for RE generation (IRENA, 2019), there is in excess of 27 GW of potential renewable generation capacity in Moldova, including 20.9 GW and 4.6

Get Price

(PDF) Challenges and potential solutions of grid-forming

As the capacity of wind power generation increases, grid-forming (GFM) wind turbine generators are deemed as promising solutions to support the system frequency for

Get Price

Moldova seeks investment for wind, solar plants with

Moldova launched its first tender for wind and solar power plants on Friday as part of a push to reduce its reliance on Russian energy.

Get Price

Performance Analysis of PMSG Based Wind Power

Abstract The performance analysis of wind power generation systems based on Permanent Magnet Synchronous Generators (PMSGs) highlights their growing importance in renewable

Get Price

How much renewable energy is there in Moldova and how much

If we produce more green energy than it can consume, it will flow into the Romanian or Ukrainian grid either for free, or Moldova will have to pay to balance the system.

Get Price

Moldova''s Renewable Energy Landscape: Trends and

The emphasis on balancing the energy system has shifted from solely relying on power plants to also managing consumer and prosumer behavior. Effective consumption

Get Price

ASSESSMENT OF THE GRID EMISSION FACTOR OF

Build Margin Clean Development Mechanism Combined Heat and Power (Cogeneration Power Plant) Combined Margin Carbon Dioxide European Network of Transmission System

Get Price

Wind Power and Its Impact on the Moldovan Electrical

An economic analysis shows payback periods for wind power investments in Moldova, the analysis also shows the sensitivity of the electricity price and discount rates. The project

Get Price

System Integration of Renwables in Moldova: A Roadmap

All power systems have inherent flexibility which allows lower shares of variable renewable energy (VRE ), namely wind and solar PV, to be integrated without any noticeable impact on the

Get Price

Review of the Analysis and Suppression for High-Frequency

High-frequency oscillation (HFO) of grid-connected wind power generation systems (WPGS) is one of the most critical issues in recent years that threaten the safe access of WPGS to the

Get Price

Grid connection permits returned to operators following new

By February 2024, Moldova''s transmission system operator (Moldelectrica) had issued grid connection permits for approximately 1,500 MW in new capacity, mainly for

Get Price

Energy in Moldova

In 2022 Moldova created JSC Energocom, initially just for renewable power supplies, before Russia attacked Ukraine electricity system that resulted in electricity imports from Ukraine

Get Price

6 FAQs about [Moldova grid-connected wind power generation system]

Why did Moldova launch its first wind and solar power plant?

CHISINAU, Aug 16 (Reuters) - Moldova launched its first tender for wind and solar power plants on Friday as part of a push to reduce its reliance on Russian energy. "Opening up for investors to develop renewables is yet another critical step towards ensuring greater energy security for Moldova," Energy Minister Victor Parlicov told Reuters.

Does Moldova have a power grid?

Moldova’s electricity grid was predominantly built in the time of the Soviet Union, making it relatively old and inefficient. It is synchronously interconnected with Ukraine’s Integrated Power System (IPS) and, in turn, Russia’s Unified Power System (UPS) in the northern and south-eastern parts of the grid.

What's going on with Moldova's energy infrastructure?

That action, he said, included connecting Moldova's grid to the European Network of Transmission System Operators (ENTSO-E), upgrading energy infrastructure to receive natural gas from diverse sources, and building electricity lines to enhance its connection with the European Union.

How important is Moldova's cross-border power system?

Geographically positioned between Romania and Ukraine, the cross-border power system of the Republic of Moldova is critical for regional energy security and regional integration with the European and Moldova-Ukraine energy markets.

What is the electricity system like in Moldova?

The electricity system in Moldova is characterised by its reliance on imports. In 2020, of its 4.4 TWh of electricity demand, 81% was supplied by imports, either from Ukraine (4%) or from the Cuciurgani-Moldavskaya GRES (MGRES) gas-fired power plant (77%) located in the breakaway region of Transnistria.

What is the main source of energy in the Republic of Moldova?

In the reference scenario, natural gas, primarily imported from the Russian Federation, remains the main component of the Republic of Moldova’s generation mix accounting for over 30% and followed by oil.

More related information

-

Jordan s grid-connected wind power generation system

Jordan s grid-connected wind power generation system

-

Xundian grid-connected wind power generation system

Xundian grid-connected wind power generation system

-

Greek communication base station grid-connected photovoltaic power generation manufacturer

Greek communication base station grid-connected photovoltaic power generation manufacturer

-

The energy storage efficiency of wind power generation and energy storage facilities is low

The energy storage efficiency of wind power generation and energy storage facilities is low

-

Microgrid system with wind power generation and energy storage

Microgrid system with wind power generation and energy storage

-

Grenada communication base station wind and solar hybrid power generation installation

Grenada communication base station wind and solar hybrid power generation installation

-

Intelligent Wind Power Generation Control System

Intelligent Wind Power Generation Control System

-

Off-grid and grid-connected photovoltaic power generation system

Off-grid and grid-connected photovoltaic power generation system

Commercial & Industrial Solar Storage Market Growth

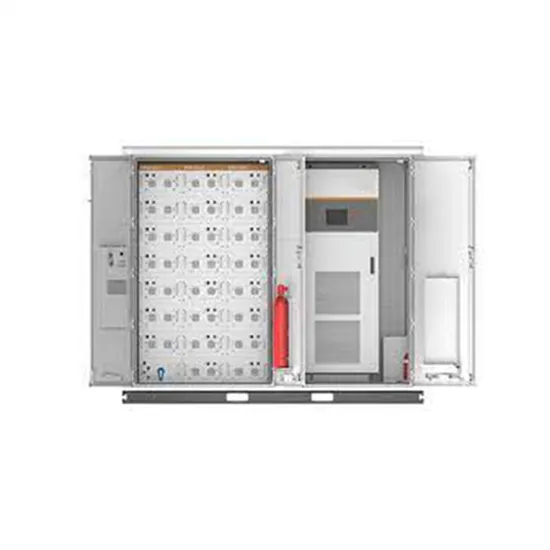

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.