Energy storage in Canada: energizing the transition

The Act also sets out the circumstances under which distribution and transmission utilities can, and cannot, own energy storage—setting up the

Get Price

Top 6 EV Charger Manufacturers in Canada

Looking for the best EV charging station manufacturers in Canada, but do not know where to find? Here''s the 6 best EV companies for you. Come and have

Get Price

Energy Storage in Canada: Recent Developments in a

The energy storage market in Canada is poised for exponential growth. Increasing electricity demand to charge electric vehicles, industrial

Get Price

Futureproofing Canada''s electricity networks | EY

An EY Canada report, Next-generation Canadian electricity networks: navigating the energy transition with distribution system operators, discusses the promise of DSO

Get Price

How It Works: Electric Transmission & Distribution and

Although most power flowing on the transmission and distribution grid originates at large power generators, power is sometimes also supplied back to the grid by end users via Distributed

Get Price

A study on the energy storage market in Canada

Characterize the current energy storage market in Canada (Chapter 3) in terms of its size, near-term growth potential (next 2-3 years), characteristics of the provincial electricity markets in

Get Price

The rise of utility-scale storage in Canada

A recent white paper published by Energy Storage Canada, the nation''s leading industry organisation for all things energy storage, concluded that anywhere between 8,000

Get Price

Flexible energy storage power station with dual functions of power

The high proportion of renewable energy access and randomness of load side has resulted in several operational challenges for conventional power systems. Firstly, this paper

Get Price

Energy storage in Canada: energizing the transition

The Act also sets out the circumstances under which distribution and transmission utilities can, and cannot, own energy storage—setting up the framework for both public and private

Get Price

Energy storage

This figure illustrates the geographic distribution and diversity of energy storage projects across Canada, with a noticeable concentration in Alberta, Ontario, and Quebec.

Get Price

A snapshot of Canada''s energy storage market in 2023

Energy storage systems can level out supply in urban centres and capacity constrained areas, avoiding the cost of transmission system upgrades. Energy storage can

Get Price

Energy storage

This figure illustrates the geographic distribution and diversity of energy storage projects across Canada, with a noticeable concentration in

Get Price

Energy Storage in Canada: Recent Developments in a Fast

The energy storage market in Canada is poised for exponential growth. Increasing electricity demand to charge electric vehicles, industrial electrification, and the production of

Get Price

Market Snapshot: Energy storage in Canada may multiply by 2030

There are three main types of energy storage currently commercially available in Canada: Storage is playing an increasingly important role in the electricity system by

Get Price

List of largest power stations in Canada

Bruce Nuclear Generating Station in Bruce County, Ontario This article lists the largest electrical generating stations in Canada in terms of current installed electrical capacity. Non-renewable

Get Price

The rise of utility-scale storage in Canada

Utility-scale energy storage in Canada is undergoing a transformative shift, marked by a surge in market engagement over the past three years. In Canada, provinces wield a

Get Price

Boundary Dam Power Station

Carbon Capture and Storage (CCS) In 2014, the Boundary Dam Carbon Capture Project transformed the energy landscape. The Power Station near Estevan,

Get Price

Canadian Renewable Energy and Battery Energy Storage

As renewable energy development steadily grows in Canada, a comprehensive map of renewable energy projects captures a snapshot of Canada''s changing energy landscape while offering

Get Price

Latest News — Energy Storage Canada

Ontario Energy Association and Energy Storage Canada Support Widespread Adoption of Distributed Energy Resources (DERs) Toronto, ON – December 9, 2024 – Today the Ontario

Get Price

Electrification and Energy Storage

Electrification and energy storage projects share the common goal of addressing the challenges associated with the changing electrical demand profiles and the provision of clean, resilient,

Get Price

Top 10 BESS manufacturers in Canada

At this critical time in the energy transition, Canadian battery storage companies are playing an important role in improving the flexibility and reliability of the

Get Price

Home

We''re advancing low-carbon hydrogen, investing in energy storage technology, and modernizing our fleet of natural gas stations. The future needs clean,

Get Price

Distributed generation

Centralized (left) vs distributed generation (right) Distributed generation, also distributed energy, on-site generation (OSG), [1] or district/decentralized

Get Price

Ontario System Maps

Ontario''s Electricity System This interactive illustration showcases the many components that make up Ontario''s electricity system. Each component provides different information, for

Get Price

Electric Vehicle Charging Infrastructure for Canada

Multiplying the percentages in Table 18 by the daily energy consumption figures (Figure 18) yields the distribution of energy delivered by the three charger

Get Price

Optimal Sizing of Battery Energy Storage System in a Fast EV

To determine the optimal size of an energy storage system (ESS) in a fast electric vehicle (EV) charging station, minimization of ESS cost, enhancement of EVs'' resilience, and reduction of

Get Price

6 FAQs about [Distribution of energy storage power stations in Canada]

What types of energy storage are available in Canada?

There are three main types of energy storage currently commercially available in Canada: Storage is playing an increasingly important role in the electricity system by improving grid reliability and power quality, and by complementing variable renewable energy sources (VRES) like wind and solar.

Where are energy storage projects happening in Canada?

Energy Storage Canada 2, a non-profit organization that promotes energy storage, reports that energy storage projects are operating in each of Ontario, Alberta, Saskatchewan, and PEI, with additional projects under development in these provinces as well as in New Brunswick and Nova Scotia 3.

Is utility-scale energy storage increasing in Canada?

Utility-scale storage is increasing in the rest of Canada as well, especially when considered in relative terms to the current assets online in each province. Figure 1: provincial energy storage targets.

Should energy storage be a key component of Canada's energy future?

Long-duration storage should be a key component of Canada’s energy future Additionally, while it is important we act and act quickly to deploy energy storage to meet the evolving needs of Canada’s energy system, we also need to act with an eye toward the long-term beyond 2035.

What is the largest battery energy storage facility in Canada?

Once built, the Oneida Energy Storage Project would be the largest battery energy storage facility in Canada. This project is a joint venture between NRStor Inc. and Six Nations of the Grand River Development Corporation, with funding from the Canada Infrastructure Bank and a consortium of private lenders.

What is the fastest growing energy storage technology in Canada?

BESS is the fastest growing energy storage technology in Canada and is also the dominant storage technology in terms of capacity and number of sites. All but four projects proposed to be commissioned by 2030 are battery storage, with two CAES and two PHS projects also proposed.

More related information

-

What batteries are used in large energy storage power stations

What batteries are used in large energy storage power stations

-

The price of charging and discharging energy storage power stations

The price of charging and discharging energy storage power stations

-

What are the lithium battery energy storage power stations in Bolivia

What are the lithium battery energy storage power stations in Bolivia

-

Future prices of energy storage power stations

Future prices of energy storage power stations

-

Cost of energy storage power stations in Denmark

Cost of energy storage power stations in Denmark

-

Design standards for household energy storage power stations

Design standards for household energy storage power stations

-

Zambia has grid-connected energy storage power stations

Zambia has grid-connected energy storage power stations

-

What are the cost methods of energy storage power stations

What are the cost methods of energy storage power stations

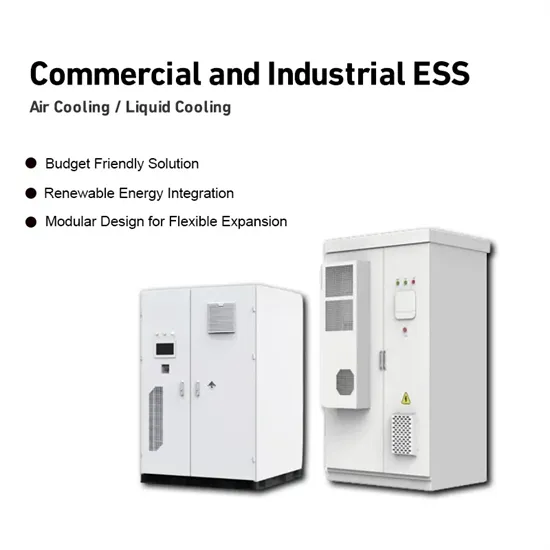

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.