20% VAT scrapped for battery storage

The UK government has exempted retrofitted battery energy storage systems (BESS) from its 20% VAT, starting 1 February 2024. Since the Spring Statement in 2022,

Get Price

Zero VAT on Battery Storage Installation

Starting from 1st February 2024, retrofitted battery energy storage systems (BESS), a key component in modern energy management, will be

Get Price

Zero VAT on Battery Storage Installation

Starting from 1st February 2024, retrofitted battery energy storage systems (BESS), a key component in modern energy management, will be exempted from the standard 20%

Get Price

UK Government Removes VAT Charges for domestic battery

UK Government Removes VAT Charges for domestic battery energy storage systems, benefiting 1.2 Million Homes 04 February 2024 57 views 1 min read

Get Price

VAT Removed for Retrofitted Battery Energy Storage Systems

The UK government has eliminated the 20% VAT for retrofitted battery energy storage systems (BESS), effective from February 1, 2023. Initially, BESS enjoyed VAT

Get Price

20% VAT scrapped for battery storage

The UK government has exempted retrofitted battery energy storage systems (BESS) from its 20% VAT, starting 1 February 2024. Since

Get Price

VAT on home battery systems cut to zero

From today, VAT will no longer be charged on domestic battery energy storage systems (BESS) under any circumstance. The move,

Get Price

UK Government Removes VAT Charges for domestic battery energy storage

UK Government Removes VAT Charges for domestic battery energy storage systems, benefiting 1.2 Million Homes 04 February 2024 57 views 1 min read

Get Price

Powervault Celebrates Government Decision to Extend VAT

In a groundbreaking development, the UK government has officially granted retrofitted Battery Energy Storage Systems (BESS) an exemption from the 20% VAT, effective

Get Price

GRID-SIDE ENERGY STORAGE VAT RATE

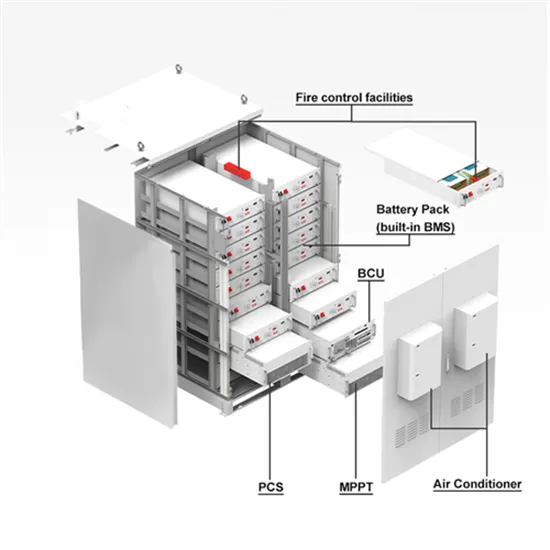

Battery energy storage system (BESS) has been applied extensively to provide grid servicessuch as frequency regulation,voltage support,energy arbitrage,etc. Advanced control and

Get Price

BATTERY ENERGY STORAGE SYSTEMS (BESS)

Aside from presenting a viable opportunity for energy storage or balancing electrical grids, BESS present significant fire and explosion risks, due to employment of Lithium-ion batteries (LIB),

Get Price

Energy storage deduction for vat

Starting from February 1, 2024, a 0% VAT rate is now applied to solar battery storage systems, also known as battery energy storage systems (BESS). VAT deductions are automatic,

Get Price

The Ultimate Guide to Battery Energy Storage Systems (BESS)

Battery Energy Storage Systems (BESS) have become a cornerstone technology in the pursuit of sustainable and efficient energy solutions. This detailed guide offers an

Get Price

BESS: Battery Energy Storage Systems

Battery energy storage systems (BESS) are a key element in the energy transition, with several fields of application and significant benefits for the economy, society, and the environment.

Get Price

20% VAT scrapped for storage

The UK government has exempted retrofitted battery energy storage systems (BESS) from its 20% VAT, from 1 February 2024. From the Spring Statement in 2022, energy

Get Price

20% VAT scrapped for storage

The UK government has exempted retrofitted battery energy storage systems (BESS) from its 20% VAT, from 1 February 2024. From the

Get Price

Domestic Battery Storage Installations

The recent VAT exemption for domestic battery storage installations is a ''critical step'' for the industry and is already having a positive impact, solutions provider GivEnergy

Get Price

Powervault Celebrates Government Decision to

In a groundbreaking development, the UK government has officially granted retrofitted Battery Energy Storage Systems (BESS) an

Get Price

UK Government sparks excitement with expanded tax relief for

Effective 1 February 2024, the UK government has exempted retrofitted battery energy storage systems (BESS) from the 20% VAT. This recent and welcomed development

Get Price

Basics of BESS (Battery Energy Storage System

Why BESS? ant stress on the power distribution network. BESS can help relieve the situation by fee ing the energy to cater to the excess demand. BESS can be conveniently charged a when

Get Price

SALT and Battery: Taxes on Energy Storage | Tax Notes

Battery energy storage systems (BESS) are often referred to as the game changer when it comes to delivering clean energy. Since 2005, the emergence of renewable energy

Get Price

UK Government Unveils VAT Relief for Domestic Energy Storage

The UK government has announced plans to offer VAT relief on installing Battery Energy Storage Systems (BESS), including retrofitted BESS, which will become exempt from

Get Price

SALT and Battery: Taxes on Energy Storage

Battery energy storage systems (BESS) are often referred to as the game changer when it comes to delivering clean energy. Since 2005, the emergence of renewable energy

Get Price

UK government scraps VAT for all domestic BESS installations

As of 1 February 2024, the UK government has removed the VAT charge for domestic battery energy storage systems (BESS) under any circumstance.

Get Price

6 FAQs about [VAT rate for BESS energy storage equipment]

Are battery energy storage systems exempt from VAT?

Effective 1 February 2024, the UK government has exempted retrofitted battery energy storage systems (BESS) from the 20% VAT. This recent and welcomed development means homeowners looking to upgrade their homes with energy storage now enjoy the same tax benefits as those incorporating energy-saving materials like heat pumps and roof-mounted solar.

Will the UK offer VAT relief on battery energy storage systems?

In a significant move toward green energy efficiency, the UK government has announced plans to offer VAT relief on installing Battery Energy Storage Systems (BESS), including retrofitted BESS, which will become exempt from its 20% VAT from 1 February 2024.

When will the VAT charge be removed for battery energy storage systems?

As of 1 February 2024, the UK government has removed the VAT charge for domestic battery energy storage systems (BESS) under any circumstance. The policy change, initially announced in December 2023, followed a lengthy campaign by both Solar Energy UK and parliamentarians to include retrofitted BESS in the 20% tax exemption.

Are 1.2 million homes eligible for tax exemption for solar & Bess installations?

1.2 million homes now eligible for tax exemption for domestic solar and BESS installations. Image: Nottingham City Council As of 1 February 2024, the UK government has removed the VAT charge for domestic battery energy storage systems (BESS) under any circumstance.

Can a Bess battery be retrofitted?

However, in a recent announcement, the government has broadened the scope of VAT relief to include retrofitted BESS, irrespective of other energy-saving materials. This change allows more homeowners to enjoy the financial incentives of adopting battery storage systems.

Will the government expand VAT relief on energy-saving materials?

In the Spring Statement 2022, the government initially expanded VAT relief on energy-saving materials (ESMs). However, this expansion wasn't comprehensive enough. Responding to industry calls, the government conducted a Call for Evidence (CfE) to gather opinions on potential areas for further reform.

More related information

-

BESS energy storage equipment for Middle East office buildings

BESS energy storage equipment for Middle East office buildings

-

Saint Lucia Energy Storage Equipment BESS Enterprise

Saint Lucia Energy Storage Equipment BESS Enterprise

-

Mobile Energy Storage Equipment BESS

Mobile Energy Storage Equipment BESS

-

250kw energy storage equipment price

250kw energy storage equipment price

-

Ess energy storage equipment

Ess energy storage equipment

-

Photovoltaic energy storage power supply equipment

Photovoltaic energy storage power supply equipment

-

Introduction to Energy Storage Equipment

Introduction to Energy Storage Equipment

-

How much does the Cyprus communication base station energy storage system equipment cost

How much does the Cyprus communication base station energy storage system equipment cost

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.