What are the power delivery challenges with 5G to

The two primary power delivery challenges with 5G new radio (NR) are improving operational efficiency and maximizing sleep time. For example,

Get Price

5G Base Station Power Supply System: NextG Power''s Cutting

Discover NextG Power''s 5G micro base station power solutions! Our IP65-rated 2000W/3000W modules and 48V 20Ah/50Ah LFP batteries ensure reliable connectivity.

Get Price

Power Supply for Base Station Strategic Insights for 2025 and

The global power supply market for base stations is experiencing robust growth, driven by the widespread deployment of 5G networks and the increasing demand for higher

Get Price

Key Technologies and Solutions for 5G Base Station Power Supply

As 5G networks proliferate globally, a critical question emerges: How can we sustainably power 5G base stations that consume 3× more energy than 4G infrastructure?

Get Price

A Voltage-Level Optimization Method for DC Remote Power

Abstract: Unlike the concentrated load in urban area base stations, the strong dispersion of loads in suburban or highway base stations poses significant challenges to traditional power supply

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get Price

What are the power delivery challenges with 5G to

It''s been estimated that base station resources are generally unused 75 – 90% of the time, even on high-load networks. The base station

Get Price

What are the power delivery challenges with 5G to maximize

It''s been estimated that base station resources are generally unused 75 – 90% of the time, even on high-load networks. The base station power consumption constituents are

Get Price

5G NR Base Station Classes: Type 1-C, Type 1-H,

Learn about the different classes of 5G NR base stations (BS), including Type 1-C, Type 1-H, Type 1-O, and Type 2-O, and their specifications.

Get Price

Dynamic Power Management for 5G Small Cell Base Station

5G networks with small cell base stations are attracting significant attention, and their power consumption is a matter of significant concern. As the increase of the expectation, concern for

Get Price

5G Base Station Power Supply Market

Deployments of 5G networks are reshaping the telecommunications landscape with unprecedented demands on infrastructure performance and reliability. At the core of every 5G

Get Price

5G Base Station Power Supply Market Size & Share 2025-2030

Discover the latest trends and growth analysis in the 5G Base Station Power Supply Market. Explore insights on market size, innovations, and key industry players.

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get Price

5G Base Station Power Supply Market

With 5G base stations consuming up to 3–4 times more power than 4G systems due to higher frequency bands and denser network architectures, operators face surging electricity

Get Price

5G Communication Base Station Backup Power Supply Market:

The Global 5G Communication Base Station Backup Power Supply Market is growing rapidly due to the increasing deployment of 5G networks worldwide. This growth is expected to continue in

Get Price

5G macro base station power supply design strategy and

For macro base stations, Cheng Wentao of Infineon gave some suggestions on the optimization of primary and secondary power supplies. "In terms of primary power supply, we

Get Price

Study on Power Feeding System for 5G Network

High Voltage Direct Current (HVDC) power supply HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get Price

5G Communication Base Station Backup Power Supply Market:

The 5G communication base station backup power supply market is projected to reach USD 11.9 billion by 2032, driven by the rapid expansion of 5G networks and the increasing need for

Get Price

(PDF) Research and Prospect of 5G Power Application

This paper investigates the 5G power application status in China, and compares the mainstream communication technologies of the existing

Get Price

The State of 5G

5G wireless networks, built on a foundation of full-power, licensed spectrum, ofer the most reliable and secure wireless connectivity available, making it the ideal platform for the industries of the

Get Price

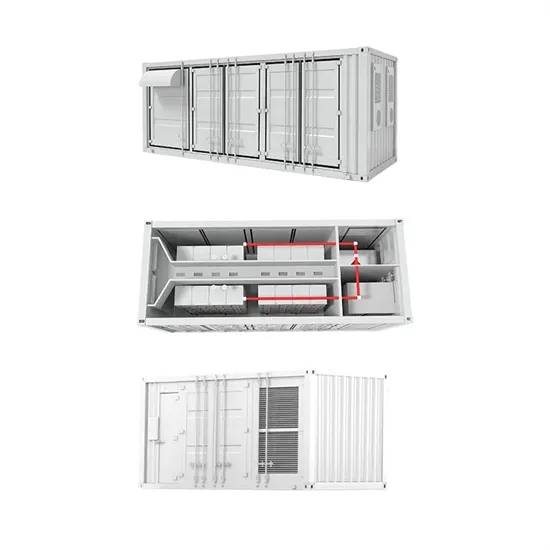

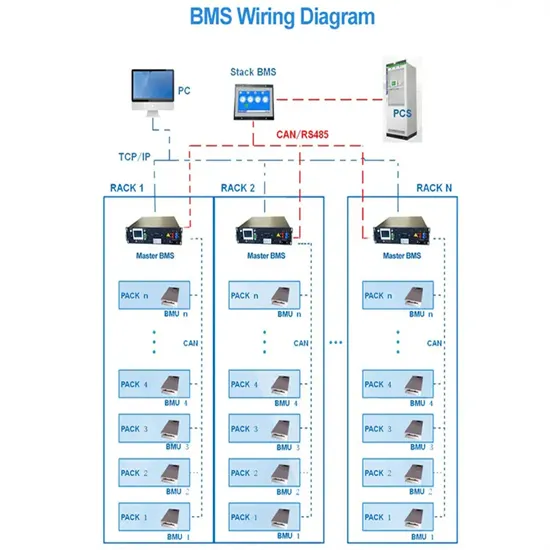

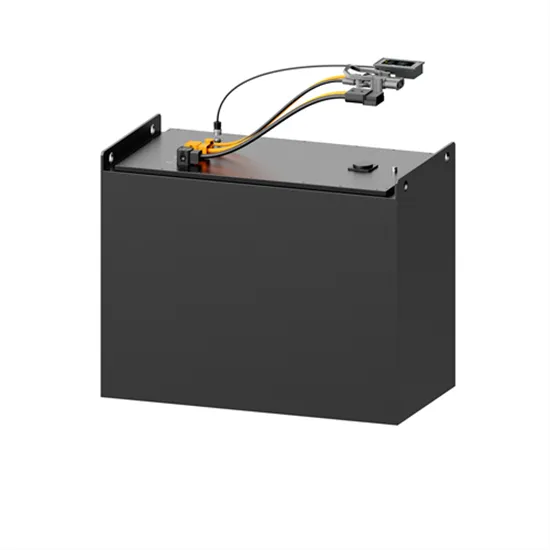

5G Base Station Power Supply with Battery & DC Distribution

5G base station power supply system This 5G base station power supply system integrates battery backup, DC power distribution, and advanced control modules to ensure reliable

Get Price

Building Better Power Supplies For 5G Base Stations

Building Better Power Supplies For 5G Base Stations by Alessandro Pevere, and Francesco Di Domenico, Infineon Technologies, Villach, Austria according to Ofcom, the UK''s telecoms

Get Price

Improved Model of Base Station Power System for the

An improved base station power system model is proposed in this paper, which takes into consideration the behavior of converters. And through

Get Price

5G Base Station Power Supply Growth Opportunities and Market

The global 5G base station power supply market is estimated to be worth USD 7203 million in 2025 and is projected to grow at a CAGR of 7.3% from 2025 to 2033. The market

Get Price

6 FAQs about [The current status of 5G base station power supply at home and abroad]

What is the global 5G base station market report?

The global 5G Base Station market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The global 5G Base Station report also provides trends by market segments, technology, and investment with a competitive landscape.

Who are 5G base stations suppliers?

Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market. China has installed around 12 times as many 5G base stations as the United States.

How much power does a 5G base station use?

Each nation has a different 5G strategy. For 5G, China uses 3.5GHz as the frequency. Then, a 5G base station resembles a 4G system, but it’s on a much larger scale. For sub-6GHz in 5G, let’s say you have a macro base station. The power levels at the antenna range from 40 watts, 80 watts or 100 watts.

Which countries dominated the 5G base station market in 2024?

Asia Pacific dominated the global 5G base station market in 2024. Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market.

How many 5G base stations are there in the world?

In addition, a total of 819,000 5G base stations have been built by these three telecom giants, accounting for 70% of the world's total. As China has played a leading role in 5G technology, its 5G development has extraordinary significance for other countries.

How far can a 5G base station go?

Each 5G base station has a range of between 800–1000 feet, or 0.15–0.19 miles. It makes up for its limited range by surpassing 4G in other key areas: data transfer speeds (bandwidth), latency, and capacity. Whereas 4G promised peak speeds of 1 Gbps, 5G’s max speed is set at 20 Gbps.

More related information

-

Armenia 5G base station power supply project base station photovoltaic

Armenia 5G base station power supply project base station photovoltaic

-

5G Communication Base Station Power Supply in Australia

5G Communication Base Station Power Supply in Australia

-

5g base station cleanup and power supply

5g base station cleanup and power supply

-

Small base station 5G communication power supply

Small base station 5G communication power supply

-

How is the power supply of 5g base station

How is the power supply of 5g base station

-

Burundi 2025 Hybrid Energy 5G Base Station Hybrid Power Supply

Burundi 2025 Hybrid Energy 5G Base Station Hybrid Power Supply

-

5G base station power supply scale

5G base station power supply scale

-

5g base station power supply and communication power supply

5g base station power supply and communication power supply

Commercial & Industrial Solar Storage Market Growth

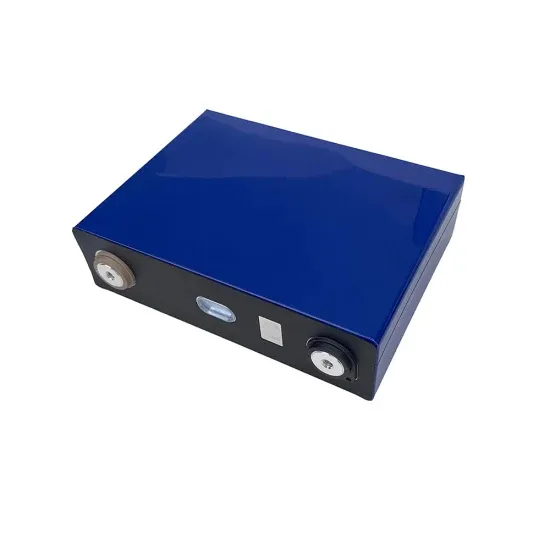

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.